Believe in yourself, and you can achieve anything!

im glad you did this, and i really hope we can all stick together now

I am ready to be apart of this, and offer my insights where possible. I plan on being involved in the discussion of how to best implement all of the tools and discuss where people are having the most success.

GLGT

Thanks for starting this AK. I really hope to find time to participate more frequently.

looking forward to participating in this thread. in fact, so much so i’ll bring up an interesting topic ICT only touched on briefly: the news.

basically, the way i’ve been trying to trade news is:

-

go to forexfactory.com before sunday’s start. so generally i do this on a loverly sunday afternoon.

-

set the news to show weekly rather than daily.

-

filter the events so only the red-marked ones show up. these indicate the story with the highest potential for “impact”

-

see if any of these news stories line up with kill zones.

-

set an alarm on the iPhone or whatever you have for all the stories that happen within kill zones. i generally set them for 15 minutes before the marked time.

-

when the alarm goes off open up your metatrader terminal and analyze, analyze, analyze.

-

watch price as the news breaks. notice any patterns or OTE’s forming? if so, participate in the market!

does this seem like a reasonable use of the news calendar to any of the more experienced students of ICT?

keep it up, akeakami!

LTPP checking in.

My mission is 2 fold:

- to continue my journey to a wildly successful trading career.

- develop mentoring capabilities to help other achieve the same. “My wish for you” is to achieve what you everything you want.

I will be a regular contributor of analysis and mentoring.

Team. We are a man down. However, we are snipers. And we will accomplish the mission.

We are top shots.

We wait for our shot.

We will achieve the mission of identifying smart money moves and riding their coattails.

Ready up.

Good luck and good trading.

Well done AK, this was absolutely necessary. It would be heart breaking to watch the community disband aswell.

Ok guys, where were we??

Good luck everyone. Although Michael cannot be here to mentor us so closely as before, we have all the tools and knowledge we will ever need to be successful at this. Lets keep at it and success will only be a matter of time and commitment.

Good stuff, lets keep this going.

I’ll be here lurking in the shadows :21:

Nice first page! Looking forward to following this thread, just starting to demo trade myself and I’m sure I’ll benefit from the discussions here.

GLGT everyone.

By all means, use me as your mentee guinea pig!

Akeakamai, well done. I’m way in. I’ve worked too hard over the last year studying and taking notes (and the lost hours of sleep  )to give up. Any particular manner you want to organize this thread?

)to give up. Any particular manner you want to organize this thread?

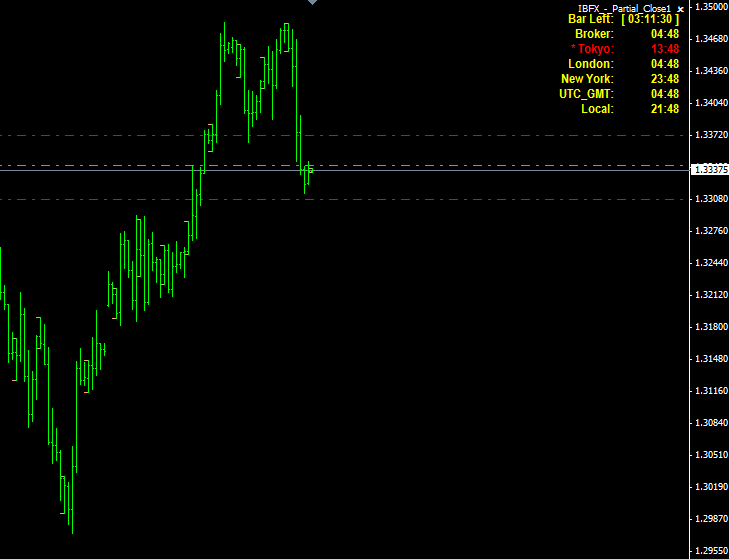

Ok, folks. We have the cable / fiber both at important S/R levels right now:

Cable tested this year’s high and as you can see formed a nice hammer at that level. Price wasn’t able to keep up the bull move and closed below the high made in Feb.

Fiber also testing this years high. Wasn’t able to close below the high made in Feb.

What we thinking folks?

Good idea on the new thread AK. I’m here for the long haul…glad to be part of the “pack.”

Matty

Good move AK im in will not let what michael gave be destroyed by anyone. Lets all work together to keep his teachings alive.

The best way to honour him is to give back to others what he gave to us.

Tony

Great stuff AK. Nice to see familiar names again, feels like home already.

Lets go!

Just my thoughts:

I think the high that was set up Tuesday/Wednesday was the high for the week.

The fibre has daily, 4hr and 1hr market flow down (the last time I checked).

I’ll be hunting for a short on fibre.

I’m open to ideas.

Crazysac…

My thoughts on tomorrow/tonights trading:

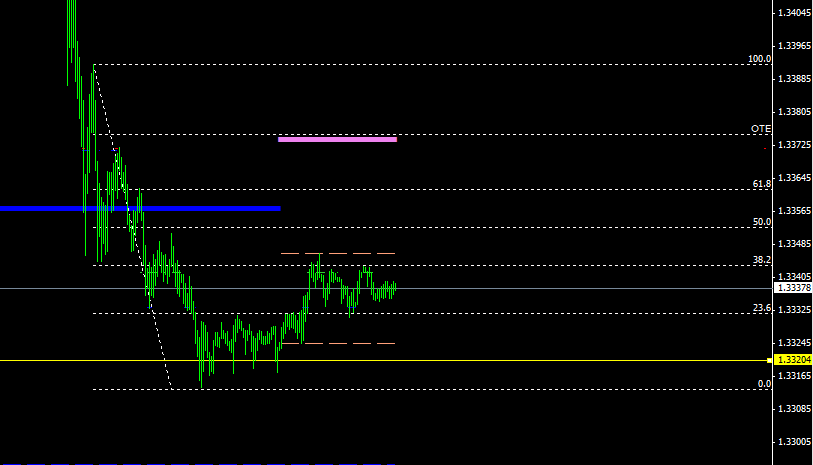

Double top formed on the Euro and 4 hr MF has finally turned down for the first time in the last ~12 days.

I’m looking for shorts tomorrow. Eye’s on the 1.3370-80 level. Would love to see a judas up to the CPP to retest Tuesday’s low/friday AR, 79% OTE level from fib pulled on the 5m charts.

Just what I’m looking at for tomorrow.

If price moves there, we’d still be in the ‘no man’s land’ of the TT, but at the upper boundary. BTW, I recall a video where ICT discussed how to trade in this area of the TT…anyone recall the tips he gave regarding this? Thanks.

Matty

I’m looking short too (as I just posted), but just FYI, daily MF is still up on the Fiber and will be til we break below 1.2973 level (on my feed).

Matty