Below are the CFD holiday trading hours for June. Forex trading hours remain unchanged, and you can view the holiday rollover interest schedule here: bit.ly/14Wwoso

What currency strategist Christopher Vecchio noted on DailyFX.com last Friday, but is absolutely worth reiterating now, is the notion of risk management with respect to the EUR-crosses. It may be deemed best risk management practice for traders to reduce position size and leverage in EUR-crosses for the foreseeable future.

While the potential outcome for Greece is unknown - the absolute magnitude of the fallout around a positive or negative outcome will be enough to have a significant impact on prices over the coming week at a minimum.

Data Source: Bloomberg, Wall Street Journal. Prepared by David Rodriguez, Quantitative Strategist for DailyFX.com

What’s the Most Important Date on the Calendar?

In concrete terms, the single most significant deadline on the calendar is likely the European Central Bank bond repayment due on July, 19—assuming that the Greek Government remains solvent up until that point.

Any surprises could force substantial market moves, and traders should limit trading leverage—particularly in EUR pairs—ahead of the key dates. Caution is advised until we see a true breakthrough in negotiations.

Hi Jason,

In trading station, I can see the 6th candle for Sunday. But this is not in MT4. Why we have this extra Sunday candles in Trading Station. Also how can I make sure I’m using NDD(I discussed with your representative. He told it is NDD. Still is there any way can we double check on this).

Hi Ramkirshnavarma,

Make sure your Marketscope charts are set to hide weekend data. Go to File > Options > General Options > Weekend data > Hide.

Our live customer support team is available to you 24 hours a day, 7 days a week, so you can call us anytime to verify the execution type of your account.

Below are the CFD holiday trading hours for July. Forex trading hours remain unchanged, and you can view the holiday rollover interest schedule here: bit.ly/14Wwoso

Times below are in GMT

According to the latest readings from our Speculative Sentiment Index (SSI), the ratio of long to short positions in the EUR/USD stands at -1.68. That means there are 1.68 short positions among FXCM’s retail client base for each long position.

In other words, only 37% of traders are long, while 63% are short. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the EUR/USD may continue higher.

_

For years, FXCM clients have been able to get SSI updates on DailyFXplus.com, but now you can also get real-time SSI data for up to 19 symbols directly on your charts.

The SSI Snapshots indicator updates every second, so you have the most up-to-date info on the marketplace. And with convenient docking, you can position the indicator on any chart so it never gets in the way.

Hello jason, can i know if there is some issues with withdraw in fxcm? Because i have request from last year yet still its not success. Thank you.

Hi Amirah,

There are no issues on our end that would prevent you from making a withdrawal. Our MyFXCM.com website allows clients to make withdrawal requests online anytime 24 hours a day.

You mentioned that you tried making this withdrawal request last year. We typically process withdrawal requests in 1 to 2 business days.

Please email our Operations department at <[email protected]> to follow up on your request and make sure that the @fxcm.com email domain is not being blocked by your email spam filter. It’s possible that our Operations department contacted you last year about your request, but you didn’t see their email.

Welcome to BabyPips!

Below are the CFD holiday trading hours for September. Forex trading hours remain unchanged.

Times below are in GMT

Note that there will be 4 days of rollover interest earned or paid on all currency trades open today at 5pm New York Time (21:00 GMT).

You can view the complete holiday rollover interest schedule here: bit.ly/14Wwoso

Hey Jason, why did the gold disappear from the FXCM’s symbols?

I downloaded the MT4 demo several times, and it contained the gold chart next to the currencies. Last time I downloaded it, and now it is only currencies, nothing else. Was it moved to somewhere else, is there a CFD platform I have to download?

Thanks

Hi Darastonius,

FXCM still offers gold trading

It sounds like you might have signed up for a US demo, and CFTC regulations only allow us to offer forex to US traders, not CFDs for gold, stock indices or energy products.

Your forum profile says you live in Hungary. That means you can trade through FXCM UK which does offer CFD trading. Here’s a link for a UK demo: MT4 Forex Trading Demo - FXCM UK

Hello Jason,

I received an e.mail notifying me that my account will be moved over to a new ‘mini’ account, which is tailored to smaller-size trading…In reading here [URL=] Trade Forex Now - FXCM UK

about the new account, I noticed that the number of Forex pairs available will be eighteen, rather than forty.

Could you tell us which pairs these are?

Also, will I still be able to trade equities and commodities?

Thank you

Just click on the links within the pricing & execution section (example below) & it’ll show you the available products/pairs to execute in the various account options.

Hi PMH, you can trade 18 of the most popular currency pairs as shown in the link that Wyntac posted.

Yes, you can trade all the stock indices and commodities listed here: Index Trading - Trade Major Indices - FXCM UK

Thank you wyntac, and Jason!

I actually opted out in the end because the mini account was a ‘Dealing Desk’ and I could not trade GBP/NZD on it - and, I would never find a reason to use up to 400:1 leverage.

Thanks Jason and FXCM for being transparent and giving me the full facts to allow me to make an informed decision.

It’s our pleasure, PMH

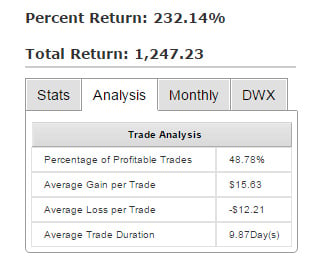

All FXCM clients now have access to our new online app Trading Analytics.

They offer a simple but powerful way to:

[ul]

[li]Visually find mistakes in your trading

[/li][li]Recognize your best trading habits

[/li][li]Improve your trading performance

[/li][/ul]

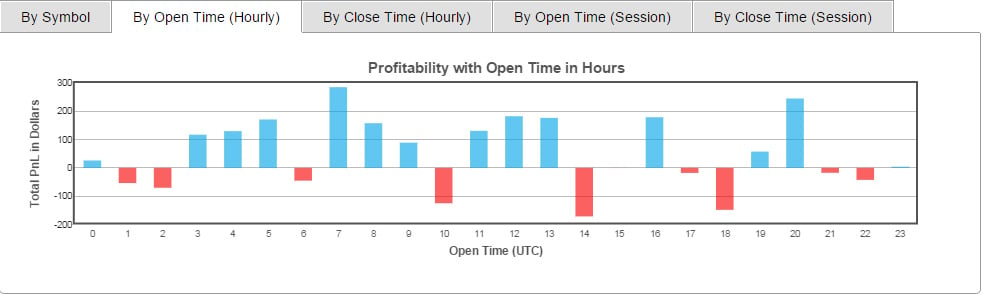

Use them to see what time of day you are most successful:

And the risk/reward profile of your current strategies:

Hi Jason,

I asked customer services about opting out and I got this reply:

Thank you for contacting FXCM. That is correct, if you opt out of the mini account, then you will remain on the NDD execution. However, if your account does not meet the 2,000 account minimum for the standard account, then your account is subject to a 10 GBP monthly fee. This fee is purely an account maintenance fee to keep the account open as a standard account when the balance is under the account minimum.

I’ve no reason to think they’re lying, but I just wanted to double check this is right? I don’t want a DD account, but I don’t have £2000 in my account, and I wont be topping it up, and certainly wont be paying £10 a month.

Hi PipMeHappy, just thought I’d let you know (which you may already do) that, as you can see on my previous post, if you opt out you have to pay £10 a month if you have under £2000 in your account. Obviously this may not effect you, just thought I’d point it out in case it did