… no it doesn’t. I don’t understand what you’re saying.

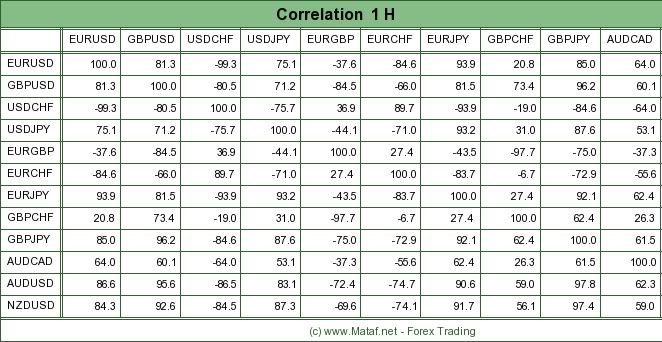

i would agree with the above in only trading one currency pair at a time as most pairs correlate.

Most pairs correlate SOME of the time, with varying degree. I am suggesting that spreading your risk to two separate instruments, might increase your profit. Consider:

If you trade $500 in ONE instrument, we have two possibilities:

1- you can loose $500

2- you can make a profit (what it is will depend on your take-profit policy)

If you trade $250 across TWO instruments, we have the same possibilites:

1 - both trades loose -$500 total loss

2 - both trades win (again, how much depends on your system, but will be the average of both systems)

BUT, if you trade two instruments, you have a NEW possibility:

3 - one trade could loose while the other wins, effectively canceling each other out.

This has the effect of lowering your draw-downs. By how much depends on to what extent the instruments are correlated. If they are 100% correlated, then there is no effect on draw-downs. If they are 0% correlated, then you should expect your draw-downs to be reduced by half.

I further suggest that the level of correlation can be deduced by performing a back-test of two separate instruments and recording each draw-down.

Another back-test, this time trading both instruments together, will give us an objective comparison. Say each instrument separately returns a 30% draw-down, and together they return a 15%, they are not correlated over that segment of time. If they return a 30% draw-down together, they are 100% correlated.

This is what I meant by “the proof is in the pudding”, or, as George Carlin pointed out, “the proof IS the pudding.”