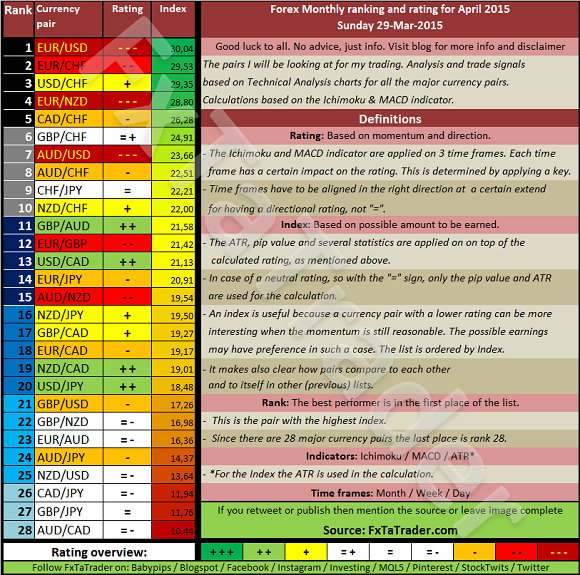

When looking at the Top 15 in the Monthly Ranking and Rating list provided here we can see that for the coming month the following stronger currencies are well represented for going long: USD(4X), NZD(3x) and the GBP(2X). The EUR(3x) is clearly the weaker currency followed by the AUD(2x) and the CAD(2X).

A nice combination for the coming month(s) may be e.g.:

[ul]

[li]EUR/USD with the GBP/AUD[/li][li]EUR/NZD with the USD/CAD[/li][li]AUD/USD with the EUR/GBP[/li][li]EUR/USD with the AUD/NZD[/li][/ul]

These are just a few examples and there are many other combinations possible. The mentioned pair combinations can be traded at the same time according to the rules of the FxTaTrader strategy because these are all different currencies. By not trading the same currency in the same direction more than once you may have better chances with lower risk.

Because of the high volatility in the CHF pairs they are also high in the ranking and rating list. However, when looking at the rating it is clear to see that most of the pairs are not in a strong trend. Reason for the high volatilty is that the EUR/CHF was taken away.

FxTaTrader Forex monthly ranking and rating April / Sunday 29-March-2015

Analysis based on TA charts for all the major currency pairs. Good luck to all. No advice, just info. Every month the Forex ranking rating list will be prepared. All the relevant Time Frames will be analyzed and the ATR and Pip value will be set.There will be no more than 21 trading days between each update in case of a period with maximum 3 weeks in between. This is a reasonable period when considering that the smallest time frame used is the daily, meaning 21 price bars/candlesticks.

The monthly articles will be published outside the weekend. When the 1st or the 16th of the month is on Monday, Tuseday or Wednesday the weekend before will be used for creating the models. Otherwise the weekend after will be used. Reason for creating the information in the weekend is because the Weekly close is more important than the daily close.

The Ranking ans Rating list will be published on Monday around the 1st and 16th of the month and the Currency Score on Thursday around the 1st of the month. Reason for this is that on Tuesday and Wednesday there are Weekly updates.

The review on the strategy will be published once a month in the week that there are no other monthly articles. This is most of the times week 2 or 4 of the month.

This longer term strategy does not differ much from the weekly strategy. There are 3 important differences:

[ul]

[li]The decisions are based on the monthly chart instead of the weekly chart and the timing is based on the weekly chart instead of the daily chart. There is no context chart.[/li][li]There is also more emphasis on taking carry trades because positions will be held longer.[/li][li]The profit target is based on the ATR of the monthly chart instead of the weekly chart.[/li][/ul]

A new evaluation account has been opened for this purpose. For more information you can check the Evaluation account on FxTaTrader.com. Check the article FxTaTrader Plans for 2015 also for more information. The longer term strategy uses the monthly chart for decision making and the Monthly ATR to calculate the profit target. The results are satisfactory up to now. One of the reasons for using a longer term strategy is the higher profit target. However the stop loss is also higher so the strategy will work in a similar way to the Weekly strategy except that less trades will be made and they will be held longer. The advantage of this is also that some pairs that cannot be traded Intra Week may very well be traded Intra Month and vice versa. The Monthly Ranking and Rating list, see here below, has been fine-tuned for this purpose and it is still under evaluation.

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for ‘Forex Trading Journal’ purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you.