FxGrow Daily Technical Analysis – 02nd Sept, 2016

By FxGrow Research & Analysis Team

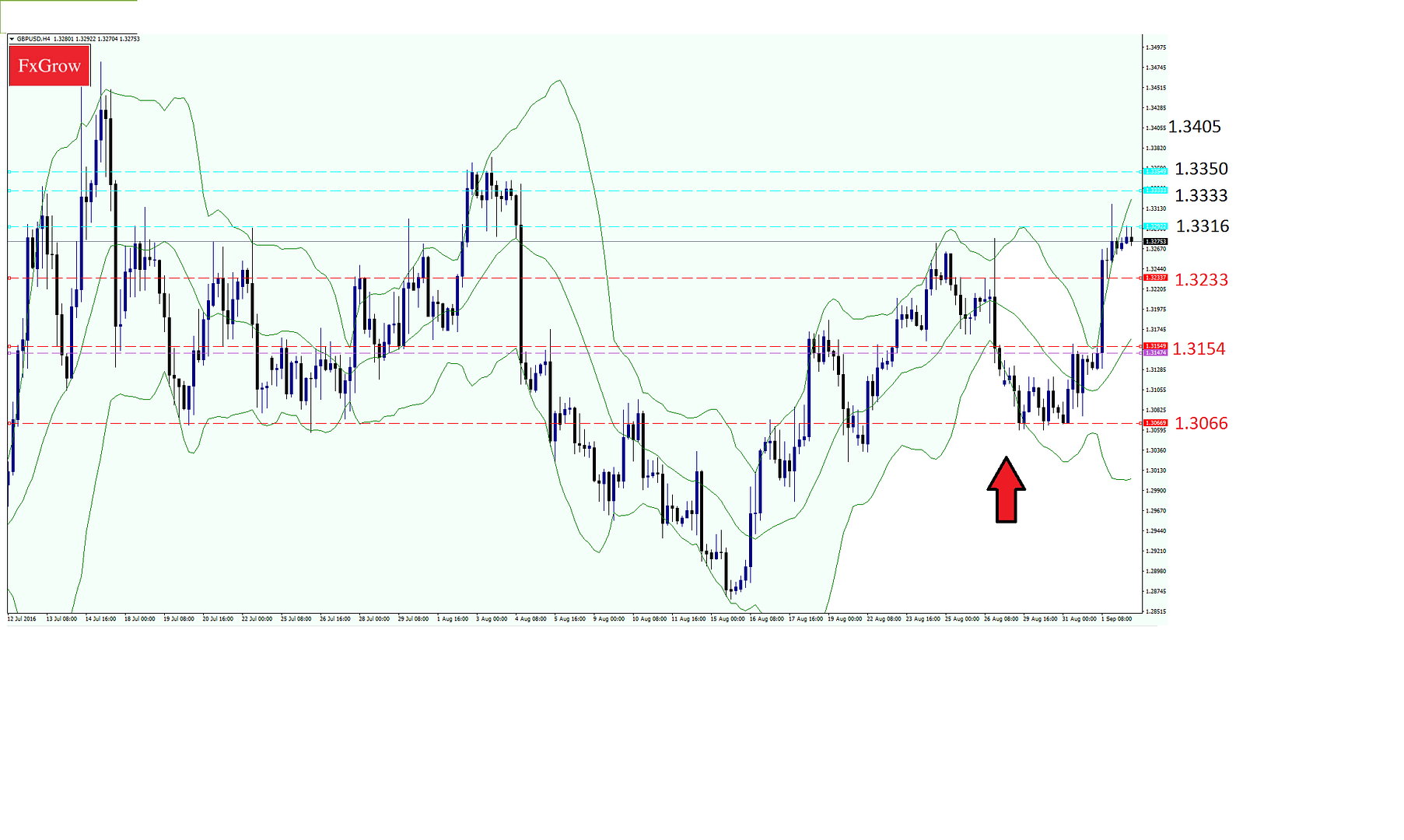

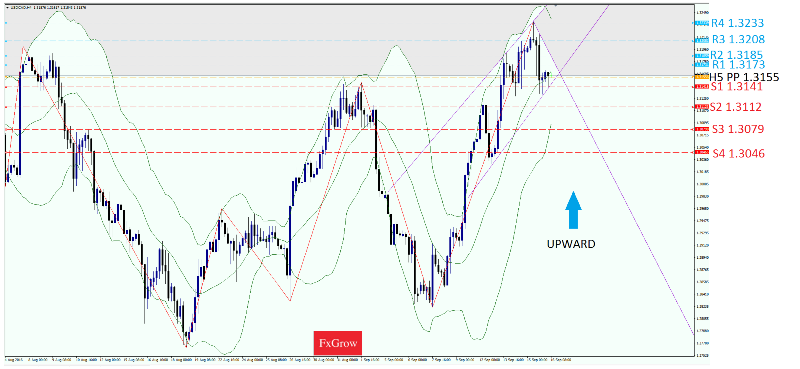

The British pound surged higher after strong manufacturing PMI

GBPUSD received a positive shock yesterday at 9:30 GMT that created a bullish rise to break 1.3300 zone.

The British manufacturing PMI yesterday came above expectation scoring 53.3 where forecast was expected to be at 49.1. This caused a positive shock in the market creating a bullish rise reaching 1.3317.

Then made a short drop as the rebound clear its way and trading near 1.3270 at these moments. It is expected the GBP will trade between 1.3233 & 1.3316.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 05th Sept, 2016

By FxGrow Research & Analysis Team

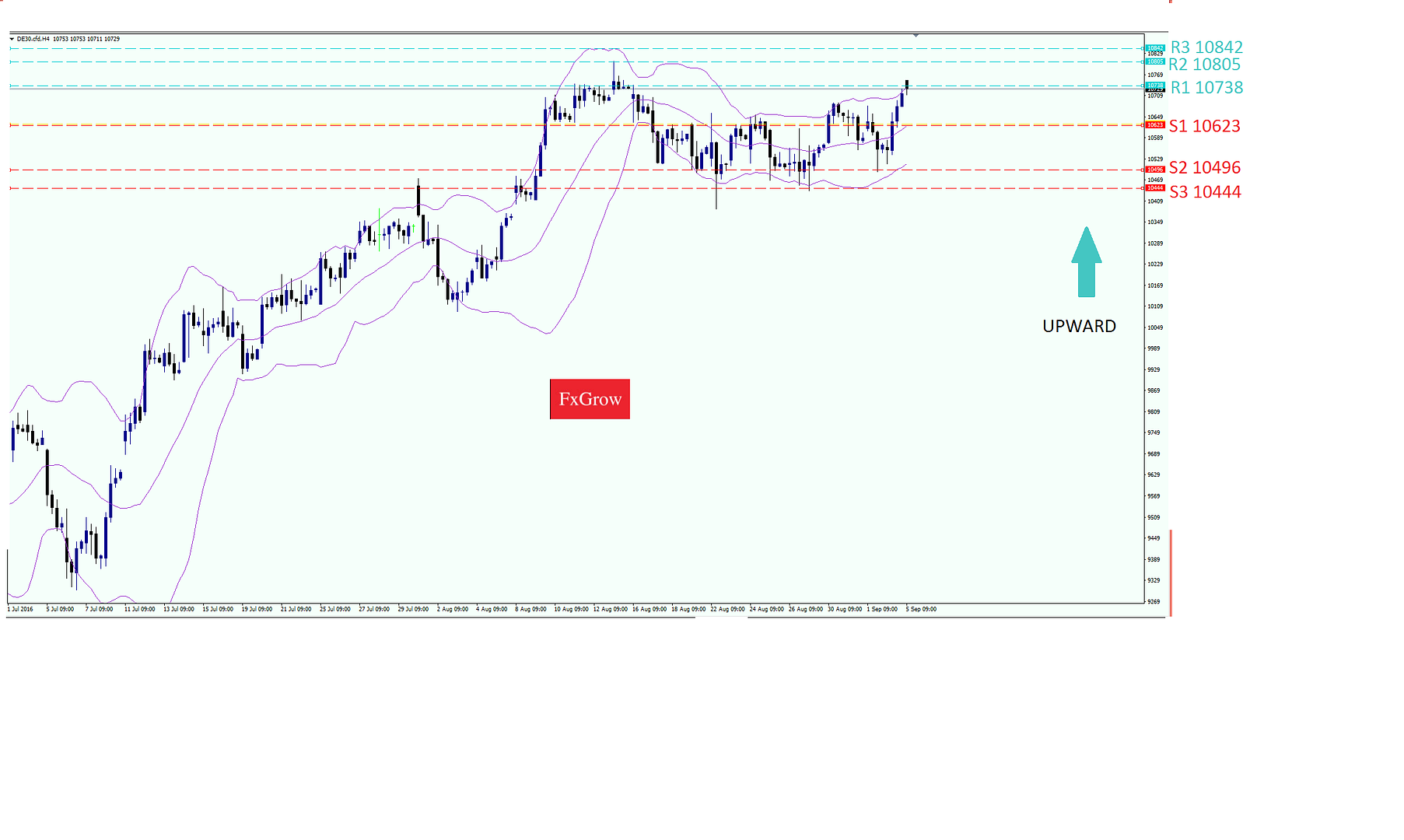

German index Dax

Dax Weekly pivot : 10627

The German Index Dax opened this morning at low 10700 and made a high of 10753.

Right now, the spot price is trading at 9am GMT 10720. The trend is upward, with resistance levels R1 at 10738, and R2 10805, if the Dax exceeded R2, the spot might trigger third resistance R3 10842.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 06th Sept, 2016

By FxGrow Research & Analysis Team

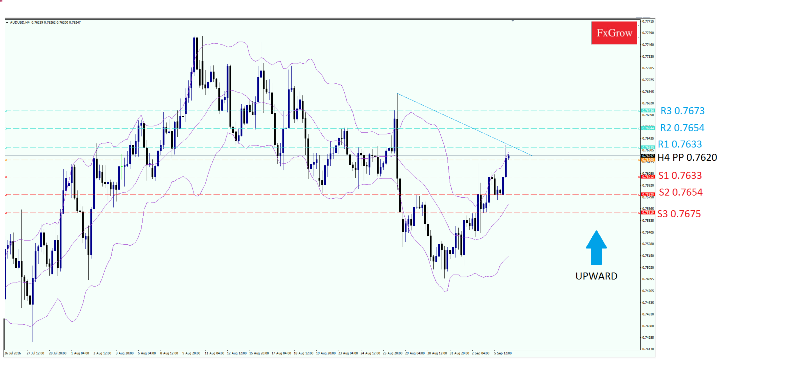

AUDUSD NOURISHED THIS MORNING AFTER THE PRESS RELEASE BY THE RESERVE BANK OF AUSTRALIA

AT 5:30 AM GMT, Glenn Stevens, Governor of Monetary Policy, decided to leave cash rate unchanged at 1.5%. The RBA rate statement was more hawkish than expected leaving the AUD in a continuous bullish rise since then. The AUDUSD started climbing from 0.7580 and still at the moment 7 AM GMT at 0.7628.

H4 Pivot 0.7620

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 06th Sept, 2016

By FxGrow Research & Analysis Team

The Japanese yen loses ground after kuroda comments

The yen was near one month low against the dollar and the USDJPY is now steadied around 103.55 as Kuroda acknowledges to expand stimulus. The USDJPY gained traction after Kuroda’s speech on Monday signaling that the BOJ is going to expand the massive stimulus programme at its next meeting on September 20, and breaking 103.75 will pave its way toward 104.05 and 104.55.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 06th Sept, 2016

By FxGrow Research & Analysis Team

Gold is till struggling on Tuesday but continues to rise in a poor range

Gold is till struggling on Tuesday but continues to rise in a poor range. Gold Friday’s high was 1330.01, today’s highest was 1329.77 10 AM GMT, which gives a hint of continuous rise today till 3 PM GMT where there are crucial news on USD. The Institute for Supply Management PMI will set a new course for gold trend. Right now the expected scenario for gold is to trade between 1328.30 and first resistance R1 1333.27, above that the price will trigger to the R2 at 1336.34, and constantly R3 1341.16.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 07th Sept, 2016

By FxGrow Research & Analysis Team

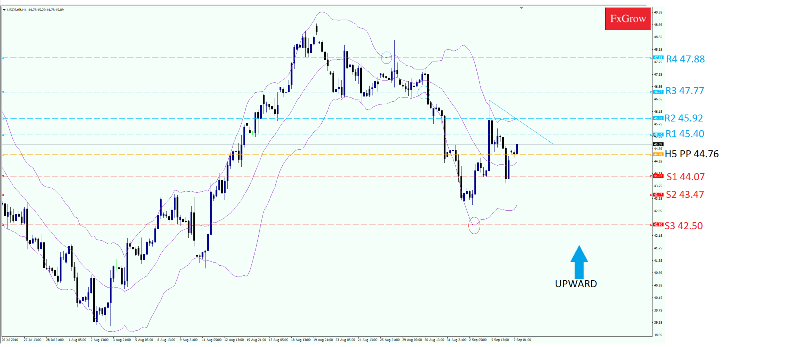

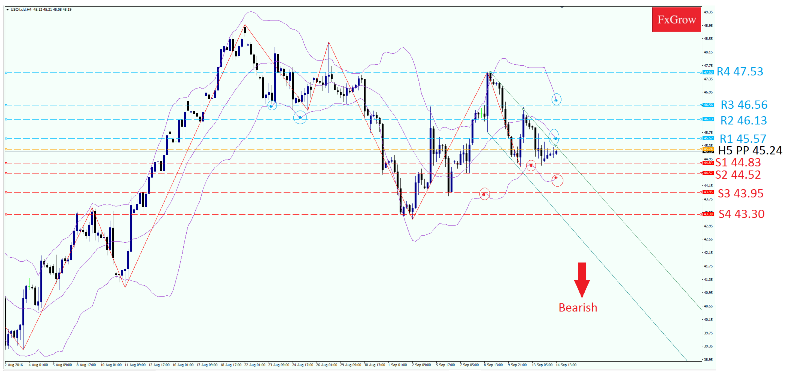

OIL IS RISING, U.S ECONOMY IS NOT PLAYING UP TO EXPECTATIONS

Yesterday, crude oil shifted opposite into an upward trend when The U.S FED were put in a tough position yesterday releasing a press release summarized by this conclusion: The U.S economy is not playing up to expectations. At 3 PM GMT, oil rallied from 43.97 reaching a high 45.20 and expected to climb the ladder later today.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 07th Sept, 2016

By FxGrow Research & Analysis Team

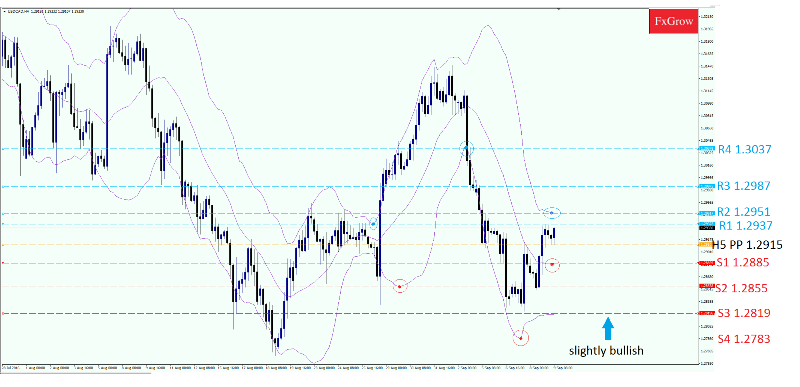

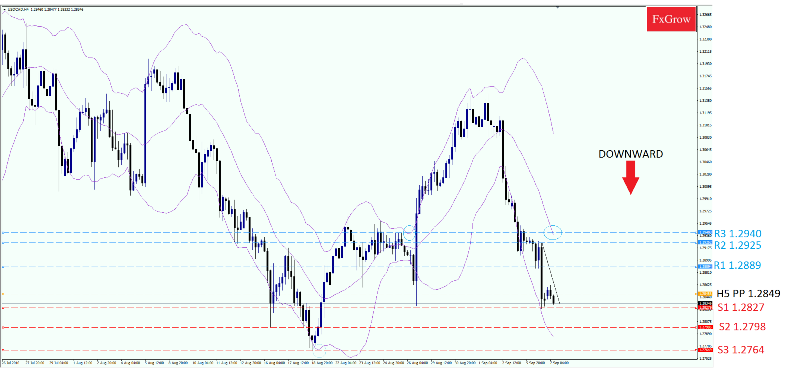

USDCAD DROPPING FOR A THIRD CONSECUTIVE DAY

For the third consecutive day, USDCAD still dropping reaching it’s lowest price since 12 days 1.2833 which suggest a downward trend this day according to charts and numbers. The focus today is at the BOC Rate Statement meeting press release, then Friday’s meeting on Canadian Employment reports. In general, the Canadian trend is in the vague until the press release which will set a new course either more down and opposite shift upward.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 08th Sept, 2016

By FxGrow Research & Analysis Team

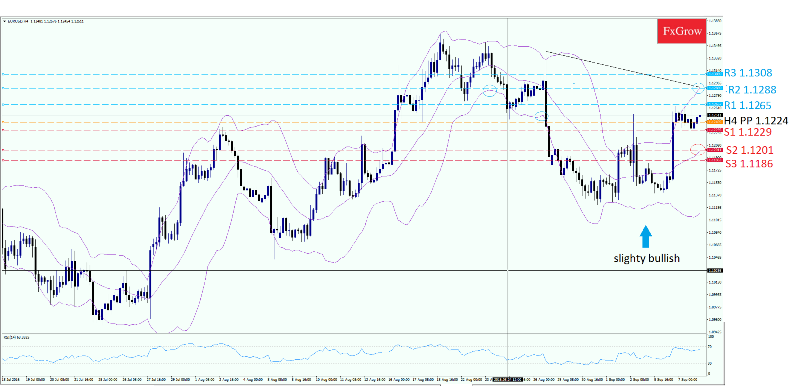

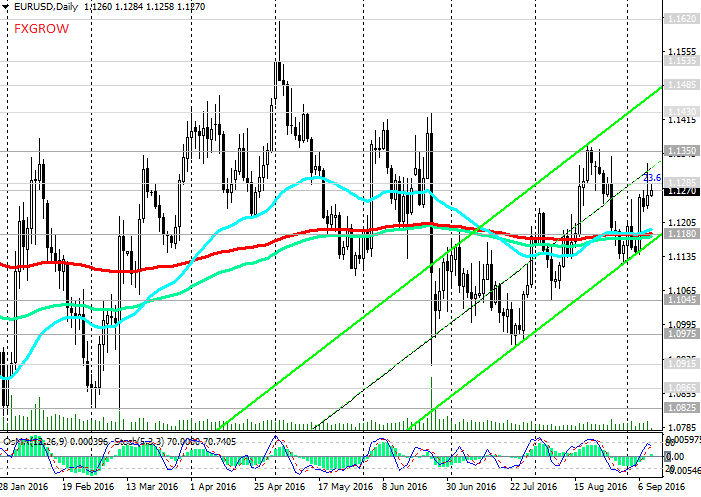

Fibo level index is moving slightly bullish ahead of Draghi ECB press release

Fibo level index is moving slightly bullish ahead of the Draghi ECB announcement today. EURUSD clocked intraday highs around 1.1257 which is the highest since 29th of August 1.1206 allowing the EURUSD to catch a breath and it’s expected to rise later on today.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 08th Sept, 2016

By FxGrow Research & Analysis Team

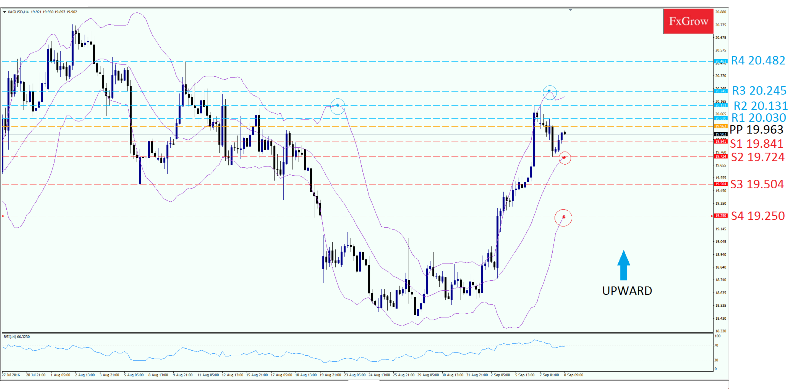

Silver is still climbing for the 11th consecutive day breaking all expectations

XAGUSD is still climbing for the 11th consecutive day since 22th August and clocked 20.131 yesterday. Numbers and charts suggest a continuous bullish rise since 1 AM GMT this morning. Right now, silver is trading at 19.90 and expected to reach the first resistance R1 at 20.03.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 09th Sept, 2016

By FxGrow Research & Analysis Team

The Canadian Dollar started a bullish trend since yesterday at 10:00 AM GMT

The Canadian Dollar started a bullish trend yesterday at 10:00 AM GMT and clocked a high 1.293 ( R1) since 6th of August a high of 1.2933. Although the two numbers seem to be close but the indication is different. Since the first resistance is at 1.2937, the behavior of the trend is expected to continue in an uprise trend.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 09th Sept, 2016

By FxGrow Research & Analysis Team

The euro edged up on Draghi’s comments

The euro increased against the dollar and break the 1:1300 zone trading around 1.1320 as the European Central Bank kept interest rate unchanged.

The EURUSD is now trading a range between 1.1235-1.1285 as Draghi claimed that expanding its asset purchase program is improbable right now and the EURUSD needs to break 1.1305 again in order to pave its way toward near-term resistance levels 1.1340 and 1.1375.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 12th Sept, 2016

By FxGrow Research & Analysis Team

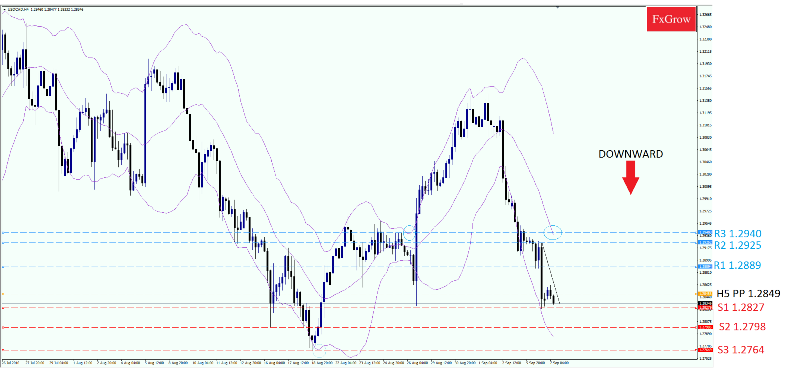

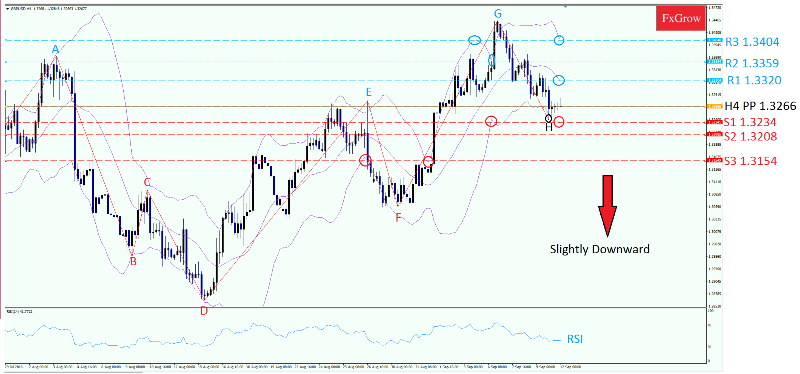

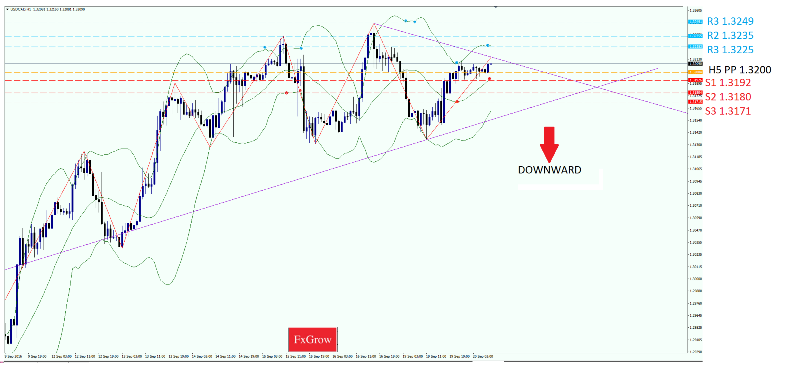

GBP/USD STRUGGLING AGAIN - The FED MONETARY POLICY SPECULATIONS TO TRADE AT SPOT

Postive comments from FOMC member Eric Rosengren on Friday 9th Sep energized expectations of an eventual Fed-hike action and helped the greenboogie to move in in strong positions facing major currencies. On the 9th of Sep, at 1 PM GMT, the GBP started a bearish mood dropping from 1.3325 to 1.3237 at 3 PM GMT as shown in the chart ( from G to H point ) which suggests a more drop in the coming hours and in the absence of major press news this monday on economic calendar.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 14th Sept, 2016

By FxGrow Research & Analysis Team

GBP/USD VULNERABLE TO DROP FURTHER MORE : UK JOBS REPORT INTO FOCUS

Dovish comments by Fed Governor Lael Brainard on Monday 12th of Sep where he suggested that the possibility of an action on Fed this month are as thin as ice. As a result, the USD was moving in strong positions against major pairs and commodities. Today, UK Job data will be the elemental key player that may set a new course for the GBP. Both scenarios are possible depending on the result of this Report. Yesterday the GBP/USD was bearish, but since 2 AM this morning, it took an opposite trend moving in bullish candle charts due to the high demand of traders buying GBP, taking a leap of faith on the British Currency.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 14th Sept, 2016

By FxGrow Research & Analysis Team

OIL BOUNCES IN ASIA, STABILIZED TODAY AFTER FALLING 3% YESTERDAY AND ALL EYES ON EIA REPORTS TODAY

Oil prices changed course and attempted a recovery in the Asian trades, after having slumped 3% on bearish monthly reports from both the IEA and OPEC.

On Tuesday, oil prices rallied 3% after both the EIA and OPEC made downgrade revisions to their global demand forecasts, while also pointed out that the global crude oversupply could persist for much longer than expected. EIA advised that increasing supply along with a sharp reduction in demand will create a saturation of oil in the market. at least until June 2017 which is in noticed contrast to last’s month where the agency noted that supply would fall by the end of the year. Mr. Eugen Weinberg, head of commodities strategy commented " It seems that the situation deteriorated strongly or significantly in the eyes of OPEC, as well as the EIA.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 15th Sept, 2016

By FxGrow Research & Analysis Team

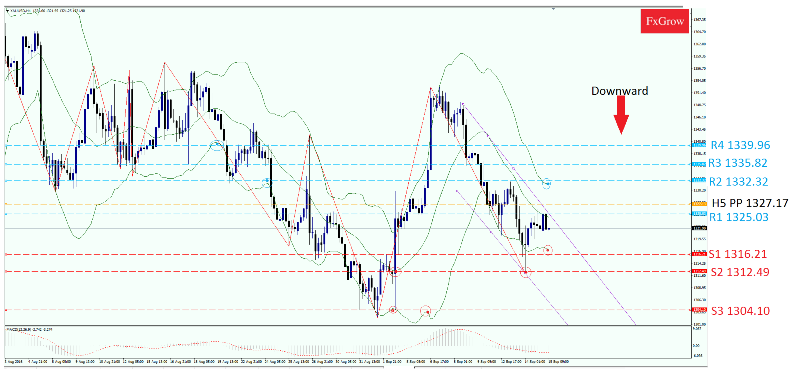

GOLD IS UNDER PRESSURE YET AGAIN FOR THE SECOND TIME SEP: EYES ON ECONOMIC CALENDAR

Once again this month, for the second week, gold today, is subject to a new test against the dollar. The question is, Will it pass and make a correction towards towards the 1350 zone or the greenback moves stronger creating a pressure on XAUUSD again to drop into the 1300 zone or even less. On the 2nd of Sep, Gold clocked a low 1302.31 but then rallied up again on the 6th of Sep reaching 1352.35 which is the climax score for Sep, then gradually started dropping, yet still.

Trend: Bearish Downward

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 15th Sept, 2016

By FxGrow Research & Analysis Team

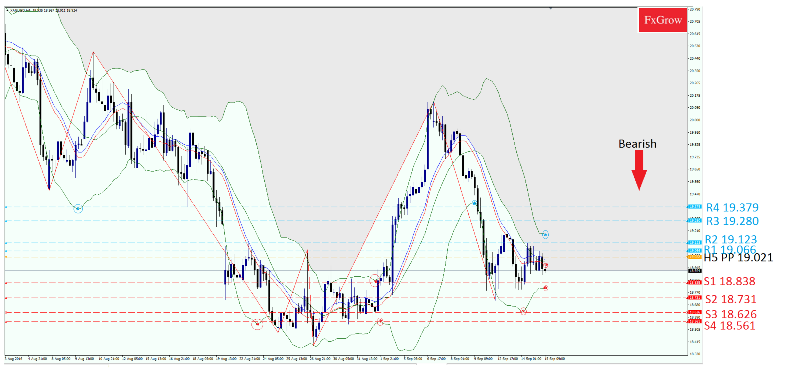

SILVER, STILL IN BEARISH MOOD FOR THE THE 7TH DAY, EYES ON U.S NEWS TODAY

What to expect from XAGUSD today? Silver rallied up on the 2nd of Sep till 6th clocking 20.129 Intraday, but then dropped, trading at the moment 18.912.

Trend: downward H5 PP 19.021

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 16th Sept, 2016

By FxGrow Research & Analysis Team

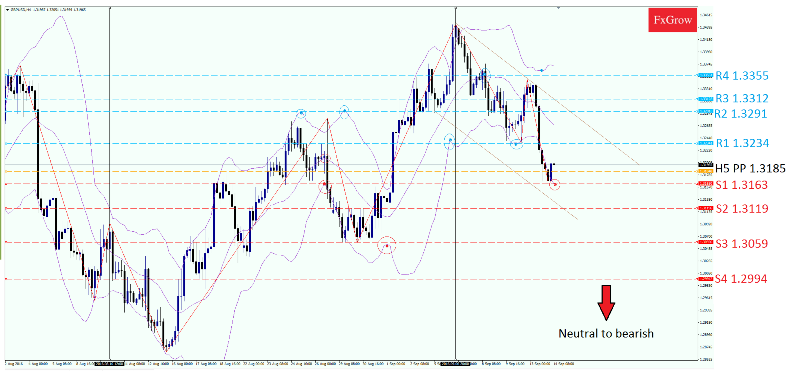

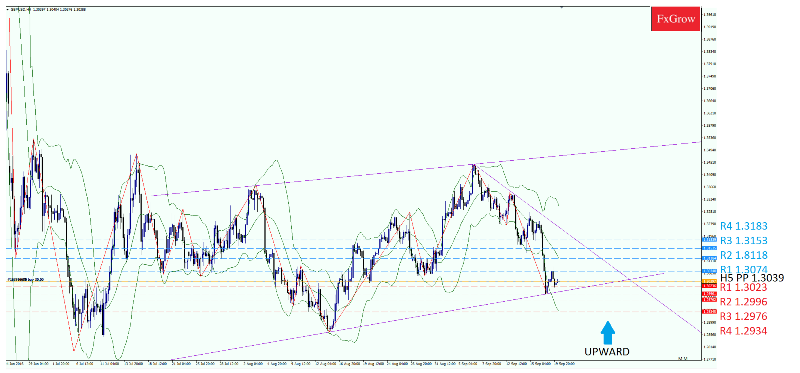

USD/CAD INTRADAY 1.3160 TRADING ZONE, AHEAD OF U.S CPI AND CANADIAN MANUFACTURING SALES REPORTS.

After clocking a high 1.3233 yesterday, reaching its highest through Sept, the USD/CAD dropped later on to 1.3132 the USD is still moving strong in the market against major currencies and commodities. The USD/CAD rallied up again in bullish trend since early this morning and expected to move more upward later today till 1:30 PM GMT when U.S CPI and Canadian Manufacturing Sales reports are released constantly. This will draw a better picture on how things will go after that.

Right now the USD/CAD is trading at 1.3165, and expected to continue moving upward.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 19th Sept, 2016

By FxGrow Research & Analysis Team

AUD/USD NOURISHING, IMPACT OF RBA AND AND MONETARY POLICY

The AUD/USD opened this morning in bullish candle charts climbing from 0.7475, rallied to 0.7544. The AUD/USD was moving strong against the greenback since beginning of Sep until the 8th of Sep where roles took a **** and the AUD dove in a bearish trend clocking its lowest during Sep 0.7442.

The Australian Monetary Policy and Governor of Reserve Bank meeting on 19th of Sep meeting objectives and goals were focused on the transparency and accountability in their relationship. This had the positive impact on AUD/USD and why it went upward.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 20th Sept, 2016

By FxGrow Research & Analysis Team

GBPUSD STARTS WITH THE SAME SCENARIO AS YESTERDAY, AFTER INVERTED HAMMER FORMATION

Just like yesterday, The GBP/USD started wit bullish trend, after dropping to 1.2998, the GBPUSD rallied again to 1.3046. Although there was buying pressure during previous sessions, the bulls were not able to sustain thee pressure and prices closed well off of their highs. Just like yesterday. Roles are mixed between GBP and USD, whose moving stronger facing each others.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 20th Sept, 2016

By FxGrow Research & Analysis Team

USD/CAD COMATOSE WITH BEARISH HAMMER CANDLES, WITH ABSENCE OF NEWS

USD/CAD is still moving neutral to bearish, taking a deep sleep ( comatose ) is trading movement in absence of crucial news that has major effect on the Canadian Dollar. CAD is still fighting trying to move stronger than USD, but with the absence of trust and faith in Canadian Dollar, the bearish movement is slight. Today, Poloz, governor bannk of Canada, will draw a better picture of how the Canadian will move facing USD and other pairs.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.