I like to put in my 2 cents , this pair GBPNZD is very volatile which is good for someone who wants to get in and get out quick but not a scalper. However i don’t trade this one because the cost is to high for me to take.Right now my broker is asking 10 pips to get in the trade, that is tooo much.

I have my resistance line marked at around 1291, it may pose some traffic for your price to move up further… Anyway my support line is also drawn differently from yours, mine is at 1242, but I do see that your support at 1278 is also valid.

Hi folks. Question:

Is this bullish bar at support considered a swing low to trade? (bar hasn’t closed and i’m not trading it). Thanks G

This area around 0,92 has acted as a support and resistance zone multiple times, so it is a good area to trade off+the recent momentum is up. Also to me it looks like a swing low, two bar reversal on H4 or a pinbar on H8. I personaly will be looking to go long as soon as it closes. My resistance is at 0,9477

Hello Matko. Thanks for your comments. I am thinking along similar lines.

Big BUEB has formed on the 4H but i think ol’ trigger happy is gonna wait this one out as i see i’d be trading into a fair bit of congestion/traffic? Not sure i’d get a good enough RR as it stands. Any comments y’all?

I can’t find a decent looking trade so just gonna watch tv and nurse a hangover instead lol. I had a great week last week I don’t want to ruin it by over trading this week.

G. I have a question for you, just looking at the below chart would you say the trend is up or down ?

Hello everyone!

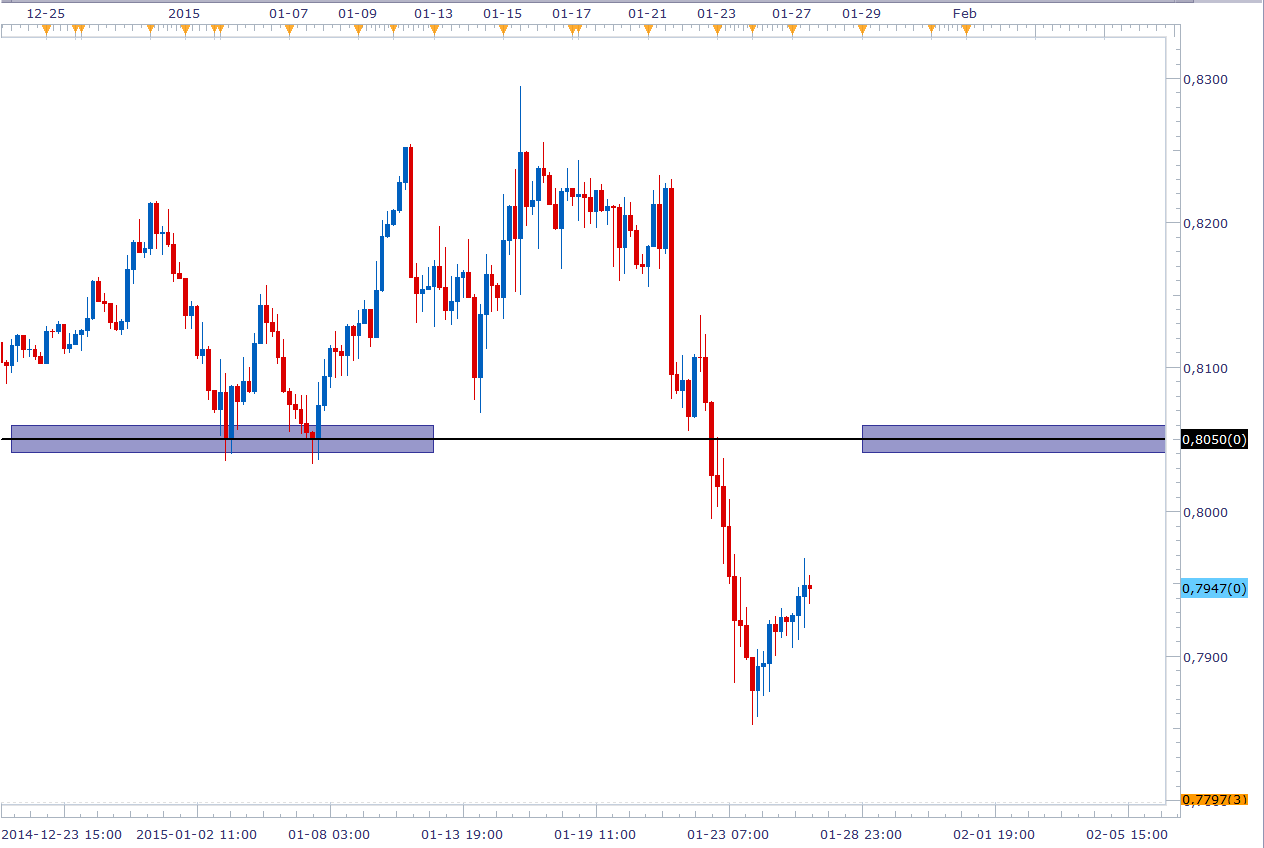

I decided to chime in with this AUD/USD 4hr chart:

Thoughts? Going to be looking for bearish PA at around the .8050 level - hopefully we get some nice PA in the form of a big PB or BEEB (I’m not much of a 2-bar-guy)!

And thank you gforce for the welcome! Good to be here!

EDIT:

Also looking at this GBP/AUD daily chart:

I’m watching plenty of other pairs as well, but I decided to post up the cleanest & nicest charts I have so far.  Hope you find them interesting!

Hope you find them interesting!

Hi Johnathon,

I am learning the Forex for the past eight months and recently moved to live account after completion of Demo… I learned the Price Action in James16 thread in Forex Factory…

I found Your thread also teach the same concept with bit different … I love one thing in your post is, the way you present the first page was awesome… It clearly give picture of where we want to go…

Few days before i started to read your post…I eager to add more strength to my entry with help of you…

Adhav

Why did you take this trade against the trend and also after a move down where all the buyers were waiting?

Gforce,

I’m not here to intrude, but are you sure you’re not over-trading? Someone asked you the same question a few posts back and I don’t know if you saw it or not, but I really think you should take a step back and review your charts. I’m not saying your charts are bad, because they’re not. I’m just pointing out a flaw in your decisions - you’re taking trades right into traffic, you’re taking short trades with no regard for the absence of a swing high etc. etc. - the point is, all these factors are indicating that you’re more or less chasing trades. Once again, I’m not here to intrude, but my opinion is; take the rest of the week off. When the weekend comes, try to find some time to go over your charts and analyze them with a clear mind. Are you trading with the trend? Are you taking trades from key levels? Are you waiting for big price action - big BEEB/BUEB’s, big pin bars, big 2-bar reversal patterns? Are you waiting for price to make a swing high before going short/to make a swing low before going long?

I’m just here to try to help. You don’t have to listen to me, if your way of trading makes your account balance consistently rise then by all means, continue as you do.

Then again, I’m a newbie, so what do I know?

Nikz

GBP/AUD BEEB. Looking for 3RR. Taking all the setups that i think look good for now on demo. Learning through doing. Thanks for all the comments. Good trading, G

EDIT: Counter trend! Oops. Will wait for pullback to a KHL and look for long PA.

Hi Pip dream. Thanks for your comments. I have posted the daily chart GBP/NZD. For me, the Daily chart looked to be in a downtrend the last few weeks with price pulling back, ready to resume downtrend at a KHL. Price looked like it would/will reverse at level it is currently at. This was/is my thinking. Thanks, G.

My D1 GBPAUD has already achieved a BEEB…so, with circumstances like this, do we still have to wait for today’s candle to close? I guess if we look at the 4hr & 1hr they already have confirmed BEEB (like gforce has jumped on), so am I being to reserved?

Hi gforce, see Nikz post above, he has also noticed that things don’t seem to be quite right with your trading. As he pointed out, we are not being critical, rather we are trying to help you.

Regarding the GBP/NZD trade, you need to draw your lines on daily chart but manage your trades on the timeframe upon which you take them. On the 1H and 4H charts we are looking for short term price action from the D1 S/R levels.

You said above that you thought the long term trend on the D1 is down, that seems like a fair call, but if you want to enter a trade based on that observation then you need to enter a trade once a reversal forms on that TF.

If you flip down to the 1H TF then you need to look at the 1H trend and trade with it. If price on the 1H is not at a D1 level then wait until it reaches one.

Please see the links below from page 1 of this thread.

> Importance of marking levels from Daily timeframe (even for lower timeframe trades) #1

> Importance of marking levels from Daily timeframe (even for lower timeframe trades) #2

> Importance of marking levels from Daily timeframe (even for lower timeframe trades) #3

> Mark S/Rs on Daily but manage trades on the timeframe you found the setup on #1

> Mark S/Rs on Daily but manage trades on the timeframe you found the setup on #2

> We need to trade AWAY from key areas, not INTO them

> Why we need to enter at correct value (swing) areas

> We are only concerned with the short-term momentum ( the 1-2-3 pattern )

> Waiting for price to move to your key levels

> Brief explananation on the 1-2-3 pattern

Kind Regards

Hello to all ! I would agree that Gforce is overtrading but its a learning curve . I did the same thing when I first started with FSO and in time I have learned that the A++ trades are not easy to come by. From overtrading I turned to picking much lesser trades to trade overtime.

Anyways , I found this to be a pretty nice setup on USD/CAD with that BEEB on swing high . I guess its Sell when high , buy when low  lol

lol

Hi Baojie

I am going to assume this isnt an A++ setup though as it is against the trend? Hope it comes good for you though.

Regards, James