thanks for the spreadsheet and yep i messed up when i did the original amounts…but it should be like 2% a day profit provided I dont make stupid mistakes LOL

Could you elaborate on to why you believe this?

If he has a plan tha tinvolves 10 trades a day, in order for his expectancy of 80% accuracy to play a role… I think it’s just good…

I’m only scalping 15-25 pips a trade, thats not too difficult. Due to my work schedule I have 5 days a week to trade one or all of 3 sessions. I’ve been trading the morning NY/London overlap from about 8am till noon, the Asia session off and on from about 7pm -10pm and the some of the London open.

I’ll never know if I can pull it off unless I try, worst case scenario I blow up my meager little account. But, I think with proper money management like not risking more than 3% of my entire account value on a single trade , Discipline - following the specific rules for entering and exiting trades and a solid strategy, I shouldn’t have a problem. If I do you can always say “I told ya so”

The Trades:

I will only be trading the trend pullbacks on the 5 min chart of the majors.

Depending on your interpretation of the “trades”, the first time I read it it seemed to me to be counter trend scalping, which is like trying to catch a falling knife. Now that I have read it again, it could also be interpreted as waiting for a pull back and then trading in the direction of the trend (this is a good thing).

There are many ways to make money in FX trading, scalping… swing trading etc…etc… For a new trader, scalping is the fastest way to get to margin call because you are over exposing your account. Think of it this way, 10 trades a day @ 2% risk… On a bad day, its possible to lose all 10 trades, that would equate to approximately 20% loss of capital in a single day. Say it happens again the next day and the next… you can see where I’m going with this. Even with this strat, on a good day say you collect 200 pips but again, at what risk? We already know ~20%… if you trade longer time frames it is reasonable to expect higher pip returns, so it is very possible to collect 200 pips in a single trade @ 2% risk…

So I ask you which is better:

200 pips at 20% risk

or

200 pips at 2% risk

I would suggest that traders, especially new traders follow the daily and 4 hour chart, and try to make your entries off the 15 min chart. Trade in the direction of the trend. A trade may last from a couple of hours to days, weeks, months…

Cheers

Overtrading is known to be one of the many things that gets traders into serious trouble. What happens is that they sometimes start looking for opportunities that just are not there. I believe that is what Cdawg was just pointing out as a word of caution.

I would second this. Personally I trade the daily and weekly TF with a suitably small risk, where a trade will typically last 5-10 (trading) days and net anywhere from 100-400 pips. In addition I would suggest its easier to select 1-3 RR and greater trades on the longer TF’s.

For that wouldn’t he need a completely different system?

how did you do today Gimmie?

I guess it wasnt really as clear as I thought. I’m trading the pullbacks in the direction of the trend. Jumping in at the end of the pullback and riding it up to the next one or my profit target which is usually the same as the distance from my entry to the previous swing high or low depending on which way the trend is going. there are very specific entry rules to avoid fakeouts, failing to follow any one of them exactly will cause a loss, ask me how i know :31:

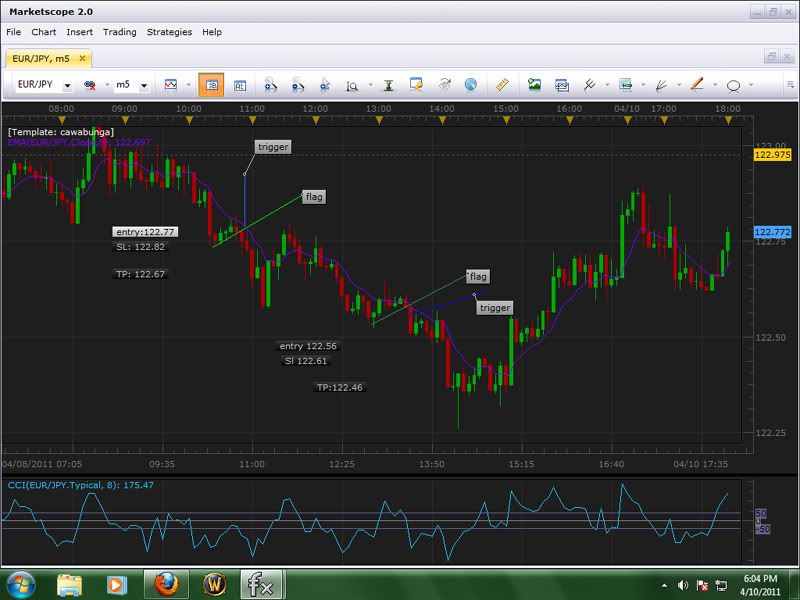

heres a visual , it’ll probably make more sense. Of course this is a downtrend so i’m catching the pullbacks just as price drops and taking shorts ( I didnt actually trade these, it’s just a chart as an example)

anyway , did ok today…I had things I had to do so I only took 4 trades so far, lost one due to not paying attention as to where price was in the grand scheme of things GBP/USD was just heading for a double top and I tried to catch the last trend up, got a few pips and turned south, up 41 pips so far today though, so overall not bad. I have somewhere to be in a little while so I’ll probably hit the asia session and the london open later.

**** beginners, don’t follow me on this, I’m still pretty new to trading FX and learning more and more everyday. If you decide to try this method, learn it on a demo or find a mentor who has plenty of experience with it

Yes, he would… trading the 1 minute and 5 min charts can be done but I wouldn’t recommend it. To each thier own I suppose… I have been trading now almost 5 years and started out with a simular idea and have watched alot of other traders do something simular, start by trying to scalp for small profits often and I am pretty sure myself included that that particular way of trading didn’t work out so well for just about everyone. Over time and the pain of losing money, my trading styled changed till I have what I do now as well as many other traders I have seen come through here.

So my small piece of advise and hopefully it can spare others some grief, is to start trading the higher time frames from the beginning. Most new traders will struggle with this, because it really can be quite boring and new traders really just want to trade… dreaming of the pips they will be making. I can wait days or even weeks to put a trade on, cause I wait for what I figure is the right price. Patience and good MM are the key to making money in FX.

Cheers

According to Brett Steenbarger (I think he’s the author who said this), everyone has a style that will fit their personality just right. For me, I started with the medium timeframes, mostly the 240 minute. After some success, I was still never satisfied with the consistency. Now I study the shorter timeframes and it honestly feels much more natural to me. I think the only way to find out what works is to try them all and see where you get burned.

Oh I agree, every trader will develop a style that suites thier personality. I also believe that traders change thier style as they learn or get the “feel” of the market. Trading is an evolution. But untill a new trader goes through the growing pains, I would recommend to stay away from the lower time frames.

Cheers

[B]Cdawg[/B] You join a handful of likeminded traders on BP… were an exclusive club…LOL. Expect to see you still posting a long while.

The 666’th post is obviously a clue… ‘the number of the beast’? Sold my soul to ‘mammon’ long ago.

EDIT: Just kidding on the 666 thing… not wishing to upset anyone (weekend silly posts, its a tradition… ‘Fractal Rock’ was the high point in my opinion) … may your God go with you… heck I’m married to a Catholic! LOL.

my only thoughts are along the lines of what cdawg says.

Where you begin your journey is definitely not where you will end it. So I say go for it. If trading the 5m charts works for you and it is in line with your personality than why not. A lot of professional traders prefer 4h and daily charts. I look at the 4h but I prefer to trade 15m chart myself.

I personally hate swing trading. its to much like work to me. I’d rather earn my 2% in 20-25 pips than to earn 2% in 100-400 pips like R carter suggests. But that is just me. I just always found it easier to pull 25-50 pips out of the market than to try for more.

So my best advice is do what works for you and by all means stay disciplined. Don’t move stops back to give your trade “breathing room” And only take the best trades that fit you model.

Thanks for all the advice, I have a plan laid out and I revise it as I go along. I have a pretty good handle on risk/reward (1:2 or 1:3 would be nice but it really isnt going to fly in real short time frames) and on money management, thanks to advice from some fellow traders who have been doing it for a living full time for years.

I’ve changed up my plan just a little and i’ll be looking for a few less trades per day, 3-5 is what i’m aiming for right now, If i can get more, great. I’m using Shr1k’s spreadsheet doc as a guide for my weekly goals.

Just to give you a little background, I’m not totally new to trading, I’ve been trading stocks off and on for years, mainly swing trading but it’s done in my 401k which is a self directed brokerage account. I started in forex about 2 months ago, My big hurdle was getting used to trading live charts, it still gets me sometimes but for the most part i have it down pretty well. I trade the 15m or the 5m, i’m sure I could use the same strategy on any time frame, i just prefer the shorter times.

Also, this isnt about money really, it’s about becoming consistent in my strategy, setting a goal and hitting that goal in a regular basis with minimal losses and developing my discipline so that when I am trading standard lots I can relax and just trade without hesitation.

My ultimate goal, like many others, is to trade full time. I have been in the same job, commercial aviation, for 18yrs. You know when you reach a point in your life where you just need to make a change? well i’m past that point, I go to my job because I’m stuck there. I’m maxed out on my hourly pay and theres nowhere else to go. The industry gets worse by the day and i’m just ready to move on with my life. Maybe I’ll make it to my goal, maybe I wont but at least I’m going to try as hard as I can to find out.

This sounds crazy but I was actually inspired by, of all things a fortune cookie. it read “You can not change the way you’ll die but you can change the way you’ll live”.

That kind of stuck with me and really made me think about what I want out of my life and how to give my family the things they deserve.

“You can not change the way you’ll die but you can change the way you’ll live”.

Read more: 301 Moved Permanently

nice quote its like Nikin Minaj’s everybody dies but not everybody lives

I don’t suggest its the way to go for everyone, there’s no right or wrong way to trade. A caveat to that is of course… if its consistantly profitable? I too many years ago started off looking to the quick in and out trades. I figured the less exposure to the market the better. But I liken this to driving. When your young its ‘pedal to the metal’ mentality. When your older and wiser you know its more a case of the ‘hare and the tortiose’. LOL.

Just for clarification, I don’t swing trade… more trading the high/ low across the weekly tunnel. It works for me and free’s up a whole lot of screentime. Admittedly it takes a good while to see a trade through (5-10 days typically) but I’m old and patient… only looking for an average 250 pips a week at 0.1% of bal risk per trade or 2.5% week on week increase on my account. Most weeks its better than that. Since Sunday 04/04 i’m up over 1100 pips (my month on month spread sheet) or 11% on my trading capital. That said, I’m more than happy with 10% a month as its compounding that builds the account not individual trades.

I just noticed this thread. It’s the same as the flag thread on the FF forum. Things I like about it, small stop losses, high win rate, only an ok risk reward ratio of 1:1 but a high win rate makes up for that. I’m thinking of going for a higher reward like 1:1.5 or 1:2 or close half move stop to break even and leave the other half open. It has two other things going for it, direction and momentum.

I’m going to try it for a while and see how it goes.

I would internalize this article before moving any further with your trading. Best of luck

Capitalization | Risk Management | Learn Forex Trading

edit:

and the $50,000-$100,000 figure quoted is implied to be those seeking to trade fulltime and live off their earnings. It doesn’t mention covering a year’s worth of living expenses too, but I would advise adding that into it as well.

alternatively you can work a job and save up while compounding a smaller account, but this can be like having 2 jobs and you really got to be motivated to execute that effectively (and not lose your job in the meantime!)

tell me what you think anyways, I hope it’s a wakeup call for what you’re trying to do in the markets with $150.

Hey Talon, yes the Flag thread on FF is where I learned the method, I make my fair share of mistakes and I dont have it mastered like divergence does but I’m working on it. I like the method, it’s simple, reliable and just works. The only thing I do differently is that I added an additional longer term sma for extra verification of the trend direction.

I practice a lot and I have the rules laid out in front of me when i trade, bad things happen when i dont follow them exactly. I got lucky the other day, I had what I thought was a legit entry but didnt notice i was looking at the wrong cci bar, instead of it being +50 it was 0…i entered on that bar, luckily the next candle was the legit one and I managed to pick up a 21 pip gain.

akeakamai, yes I completely understand what you’re saying. I’m not trying to turn $150 into a million, far from it. hell, I’ll be happy just to make gains and not blow up my account , lol.

I’m using the small amount of capital and a micro account to develop my skills and consistency. When i was talking about getting out of my job I didnt mean I was going to grow my account to $1000 , quit my job and try to be a full time professional trader. If I have 6mo-1yr of living expenses and a decent sized trading account I would consider it but that is in the future. Right now it’s all about learning ,growing my account by making consistent profits and increasing funds as I am able to.

Before this method I originally funded my account with $300, I made $65 in gains on the first day out of sheer luck, caught the bottom of the USD/JPY intervention. That type of gain on day 1 for a total forex noob was a bad thing, it led to overconfidence and not long after it I drew my account down to $100 while learning, trying different methods like just trading the ma cross and making big mistakes.

Anyway, as of right now I’m going to continue aiming for 10% weekly gains and see how things go. I’ll either do well of i’ll go down in flames, lol

I started the thread for my own personal journal I guess, not really trying to prove anything but I like seeing all of your different opinions.