The Currency Score analysis is one of the parameters used for the Ranking and Rating list which was published earlier.

It is recommended to read the page Currency score explained and Models in practice for a better understanding of the article. This article will provide my analysis on the 8 major currencies based on the technical analysis charts using the MACD and Ichimoku indicator on 3 time frames, the monthly, weekly and daily. The result of the technical analysis are the 2 screenshots in this article showing the Currency Score and the Currency Score Difference.

Last 12 months currency classification

The last 12 months currency classification from a longer term perspective are provided for reference purposes. See for more information the article: Monthly Currency Score for Jan. where the charts are available. There are no changes since January and the currencies are classified for the coming months as follows:

[ul]

[li]Strong: USD / NZD / GBP[/li][li]Average: CHF /CAD[/li][li]Weak: JPY / AUD / EUR[/li][/ul]

[B]Currency Score

[/B]

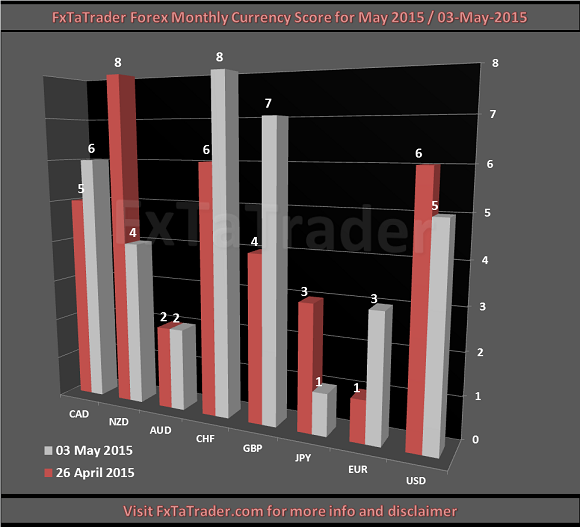

For analyzing the best pairs to trade this classification is the first issue. When looking at the most recent score that is used for the coming period we can see in the screenshot below the following deviations:

[ul]

[li]The USD has a score of 5 and the NZD a score of 4. These are a strong currencies and they should have by preference a score of 6 or higher. They have a score at the moment of an average currency.[/li][li]The CAD has a score of 6 and the CHF a score of 8. These are average currencies and they should have by preference a score from 4 to 5. They have a score at the moment of a strong currency.[/li][/ul]

The conclusion is:

[ul]

[li]Half of the currencies are at the right level when looking at the last 12 months currency classification except for the USD, NZD, CAD and CHF.[/li][li]There is a slight pullback at the moment for the USD and the NZD when looking at the market as a whole.[/li][li]There is an increase of momentum for the CAD and CHF which are getting stronger.[/li][li]The pairs that we may look at are all most probably trending except for the pairs containing the USD and the NZD which are most probably ranging.[/li][/ul]

Currency Score difference

According to the Ranking and Rating list already published this month the following pair combinations look interesting.

[ul]

[li]CHF/JPY with the GBP/AUD[/li][li]AUD/CHF with the GBP/JPY[/li][li]EUR/CHF with the GBP/AUD[/li][li]EUR/CHF with the GBP/JPY[/li][/ul]

When looking at the Currency Score Table here below for this month we can see the currency score differences. The interesting pairs should have by preference a score difference of 4 or higher when they are similarly classified. Or the better classified pair should have a higher score than the counterpart. All the pairs mentioned above comply for trading in the coming month. The Currencies are colored Green, Orange and Red resp. by the classification they have. This way it is easier to see what currencies should have a certain score difference.

The technical analysis is the most important issue to consider before taking positions. The Monthly Chart is being analyzed. I prefer the Bollinger Band for defining where a pair is in the chart. Once a pair is outside a Bollinger Band it is in a strong trend which can cause a strong pullback. Although this may be a good opportunity for other analysts I avoid taking positions because of the possible unexpected strong pullback. Positions are only opened inside the Bollinger Band and this may be at the start of a possible trend or on a good pullback in an existing trend.

[ul]

[li]The CHF/JPY is in an uptrend and within the Bollinger Band.[/li][li]The GBP/AUD is in an uptrend and within the Bollinger Band.[/li][li]The AUD/CHF is in a downtrend and within the Bollinger Band.[/li][li]The GBP/JPY is in an uptrend and within the Bollinger Band.[/li][li]The EUR/CHF is in a downtrend and within the Bollinger Band.[/li][/ul]

So all the pairs mentioned here are interesting for the coming month. The Monthly Currency Score and Currency Score Difference are is still in the evaluation phase. The review on the strategy will not be published for the time being because of further testing of the system and lack of time. You can follow the Weekly strategy to stay informed on the progress and development of the strategy.

If you would like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming month and don’t forget to check my weekly Forex “Strategy Review” and the “Currency Score”.

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for ‘Forex Trading Journal’ purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you.