[B]FxGrow Daily Technical Analysis – 26th May, 2016[/B]

[I]By FxGrow Research & Analysis Team[/I]

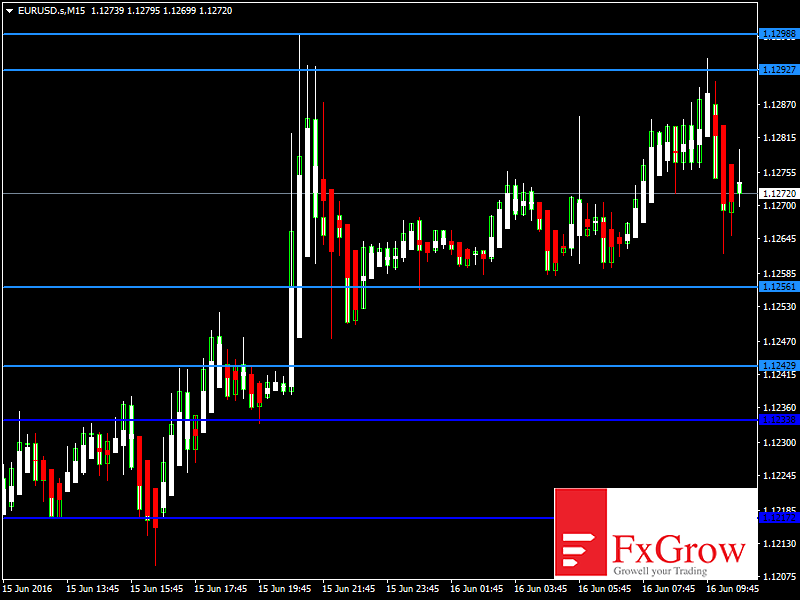

[B]The Euro gains on softer US Dollars ahead of US durable goods data[/B]

The EURUSD found support as the dollar eased awaiting further US data today and Yellen’s speech due on Friday that will give an outlook of whether the Fed will hike rate sooner or later this year. The Euro also found support as Euro group ministers agreed on Greece bailout funds. The EURUSD will continue surging higher on weak US durable goods data and breaking 1.1195 will open an upward wave toward 1.1215 and 1.1255 respectively.

[B][I]To read this Full in depth Analysis please visit FxGrow.[/I][/B]

[I][B]Note:[/B] This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.[/I]