The Currency Score analysis is one of the parameters used for the Ranking and Rating list which was published earlier this weekend. Besides this analysis and the corresponding chart I also provide the Forex ranking and rating list.

It is recommended to read the page Currency score explained and Models in practice for a better understanding of the article. This article will provide my analysis on the 8 major currencies based on the technical analysis charts using the MACD and Ichimoku indicator on 4 time frames: the monthly, weekly, daily and 4 hours.

Last 3 months currency classification

The last 3 months currency classification from a longer term perspective are provided for reference purposes. There are some changes and the new classification is provided here with the necessary charts which can be found at the bottom of this article. The currencies are classified for the coming weeks as follows:

[ul]

[li]Strong: GBP / USD. The preferred range is from 7 to 8.[/li][li]Average: CAD / NZD / JPY. The preferred range is from 4 to 6.[/li][li]Weak: AUD / CHF / EUR. The preferred range is from 1 to 3.[/li][/ul]

The EUR and CHF were an average currency but they are very weak lately and are now classified as weak currencies.

The CAD was a weak currency but is very strong lately and is now classified as an average currency.

For now the average and weak classification categories contain 3 currencies while the strong classification has only 2 currencies.

Currency Score

For analyzing the best pairs to trade the last 3 months currency classification is the first issue. When looking at the most recent score that is used for the coming period we can see in the screenshot below the deviations and we can come to certain conclusions. These are explained below the screenshot.

In essence it boils down to the 3 following lines of text:

[ol]

[li]A strong currency can be traded long against all the other currencies except on a pullback(deviation) then it seems best to trade it only against a weak currency.[/li][li]A weak currency can be traded short against all the other currencies except on a pullback(deviation) then it seems best to trade it only against a strong currency.[/li][li]When an average currency is outside the range(deviation) it is best not to trade it against it’s own currencies in the average range and the currencies in the range it is at.[/li][/ol]

Because the text above is quite abstract you can read below a more detailed description.

According to the Ranking and Rating list already published this weekend the following pair combinations look interesting:

[ul]

[li]GBP/CHF with the USD/CAD[/li][li]USD/CHF with the GBP/CAD[/li][li]EUR/USD with the GBP/NZD[/li][li]EUR/GBP with the NZD/USD[/li][li]CHF/JPY with the GBP/CAD[/li][li]EUR/JPY with the NZD/USD[/li][/ul]

We will fit each pair if possible in the right group here below and within each group also add the following abbrevations for the pair combinations:

A. -> SA = Strong Average

B. -> SW = Strong Weak

C. -> AW = Average Weak

Strong currencies

[ul]

[li]There are no deviations meaning that the strong currencies seem best for trading, depending on the opportunities coming around,.in the following ways:[/li][LIST]

[li]A. going long against the average currencies (SA). The pairs selected from the Ranking and Rating list are the USD/CAD, GBP/CAD, GBP/NZD and the NZD/USD.[/li][/ul]

[ul]

[li]B. going long against the weak currencies (SW). The pairs selected from the Ranking and Rating list are the GBP/CHF, USD/CHF, EUR/USD and the EUR/GBP.[/li][/ul]

[/LIST]

Average currencies

[ul]

[li]There is a deviation for the NZD with a score of 3. This is an average currency and it should have by preference a score from 4 to 6.[/li][li]There is a decrease of momentum for the NZD which is getting weaker.[/li][li]A. The NZD has a score at the moment of a weak currency and it seems best for trading going short against the strong currencies (SA). The pairs selected from the Ranking and Rating list are the GBP/NZD and the NZD/USD.[/li][li]There are no other deviations meaning that the other average currencies (CAD and JPY) seem best for trading, depending on the opportunities coming around, in the following ways:[/li][LIST]

[li]A. going short against the strong currencies (SA). The pairs selected from the Ranking and Rating list are the USD/CADand the GBP/CAD.[/li][li]C. going long against the weak currencies (AW). The pairs selected from the Ranking and Rating list are the CHF/JPY and the EUR/JPY.[/li][/ul]

[/LIST]

Weak currencies

[ul]

[li]There is a deviation for the AUD with a score of 5. This is a weak currency and it should have by preference a score from 1 to 3.[/li][li]There is most probably a pullback for the AUD when looking at the market as a whole, the downtrend has lost momentum.[/li][li]B. The AUD has a score at the moment of an average currency and it seems best for trading going short against the strong currencies (SW). The are no pairs in the Ranking and Rating list.[/li][li]There are no other deviations meaning that the other weak currencies (CHF and EUR) seem best for trading, depending on the opportunities coming around, in the following ways:[/li][LIST]

[li]B. going short against the strong currencies (SW). The pairs selected from the Ranking and Rating list are the GBP/CHF, USD/CHF, EUR/USD and the EUR/GBP.[/li][/ul]

[ul]

[li]C. going short against the average currencies (AW). The pairs selected from the Ranking and Rating list are the CHF/JPY and the EUR/JPY.[/li][/ul]

[/LIST]

Summary:

[ul]

[li]The weak currencies against the NZD are most probably ranging and there are most probably no opportunities in the Top 10 of this week “Ranking and Rating list”.[/li][li]The AUD may offer a good opportunity to step in. However, it is important to determine if a specific pair indeed is in a pullback. For that reason it is good to see the momentum returning in that pair, check the “Ranking and Rating list”. If there is momentum then also check the"Currency score difference" table.[/li][li]All the other pairs may be in a trend when complying to the “Currency score difference” table which can be seen here below. There are most probably opportunities in the Top 10 of this week “Ranking and Rating list”.[/li][li]The pairs from the Ranking and Rating list that fit well in the group above are theUSD/CAD, GBP/CAD, GBP/NZD, NZD/USD, GBP/CHF, USD/CHF, EUR/USD,EUR/GBP, CHF/JPY and the EUR/JPY[/li][li]By using the (1)“Ranking and Rating list” with the (2)above Weekly Currency Score analysis and the (3)“Currency score difference” table with the (4)Bollinger Band analysis provided here below a good foundation is provided for looking at the Weekly and Daily Technical analysis chart of a specific pair.[/li][li]The analyses are complementary where:[/li][LIST]

[li]the “Ranking and Rating list” takes strength, direction and volatility into account.[/li][li]the “Currency score” looks for the strong trends and pullbacks with a possible disadvantage of being overbought/oversold.[/li][li]the “Currency score difference” adds granularity to the “Currency score” by using the score difference for determining potential trends.[/li][li]the “Bollinger Band” confirms that a potential trend found is not being overbought/oversold.[/li][li]With the “Currency score difference” and the “Bollinger Band” the disadvantage mentioned for the Currency score will be overcome.[/li][/ul]

[/LIST]

Currency Score difference

According to the Ranking and Rating list already published this weekend the following pair combinations look interesting:

[ul]

[li]GBP/CHF with the USD/CAD[/li][li]USD/CHF with the GBP/CAD[/li][li]EUR/USD with the GBP/NZD[/li][li]EUR/GBP with the NZD/USD[/li][li]CHF/JPY with the GBP/CAD[/li][li]EUR/JPY with the NZD/USD[/li][/ul]

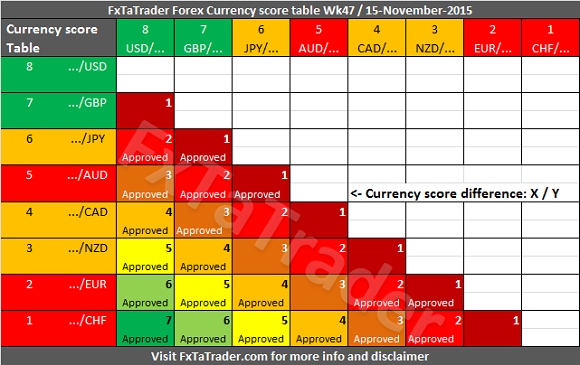

When looking at the Currency Score Table here below for this week we can see the currency score differences. The interesting pairs should have by preference a score difference of 4 or higher when they are similarly classified. Or the better classified pair should have a higher score than the counterpart. All the pairs mentioned above comply for trading in the coming week. The Currencies are colored Green, Orange and Red resp. by the classification they have. This way it is easier to see what currencies should have a certain score difference.

The technical analysis is the most important issue to consider before taking positions. The Weekly Chart is analyzed. I prefer the Bollinger Band for defining where a pair is in the chart. Once a pair is outside a Bollinger Band it is in a strong trend which can cause a strong pullback. Although this may be a good opportunity for other analysts I avoid taking positions because of the possible unexpected strong pullback. Positions are only opened inside the Bollinger Band and this may be at the start of a possible trend or on a good pullback in an existing trend.

[ul]

[li]The GBP/CHF is in an uptrend and within the Bollinger Band.[/li][li]The USD/CAD is in an uptrend and within the Bollinger Band.[/li][li]The USD/CHF is in an uptrend and just ourside the Bollinger Band. Most probably it will be inside when trading starts again.[/li][li]The GBP/CAD is in an uptrend and within the Bollinger Band.[/li][li]The EUR/USD is in a downtrend and at the Bollinger Band.[/li][li]The GBP/NZD is in an uptrend and within the Bollinger Band.[/li][li]The EUR/GBP is in a downtrend and within the Bollinger Band.[/li][li]The NZD/USD is in a downtrend and within the Bollinger Band.[/li][li]The CHF/JPY is in a downtrend and at the Bollinger Band.[/li][li]The EUR/JPY is in a downtrend and at the Bollinger Band.[/li][/ul]

When trading according to the FxTaTrader Strategy some rules are in place. For more information see the page on my blog FxTaTrader Strategy. Depending on the opportunities that may come up the decision to trade a currency may become more obvious at that moment. If you would like to use this article then mention the source by providing the URL [FxTaTrader.com](file:///C:/Users/portiz/Dropbox/TIS/Dropbox/Forex/_SocialMedia/Blog/2015/W05/FxTaTrader.com) or the direct link to this article. Good luck in the coming week.

Last 3 months currency classification charts

Here below are the charts providing the Currency classifications for reference purposes. There are three charts showing resp. the stronger, average and weaker currencies.

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for ‘Forex Trading Journal’ purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you.