[B]DAILY USD/JPY TECHNICAL OUTLOOK[/B]

[B]DAILY USD/JPY TECHNICAL OUTLOOK[/B]

Last Update At [B]01 Apr 2014[/B] [I]01:54GMT[/I]

[B]Trend Daily Chart[/B]

Sideways

[B]Daily Indicators[/B]

Rising

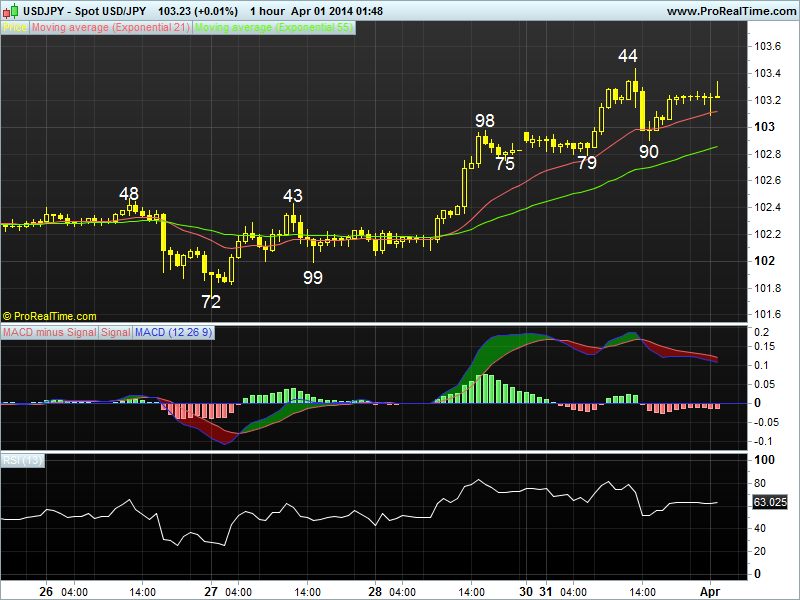

[B]21 HR EMA [/B]

103.11

[B]55 HR EMA[/B]

102.84

[B]Trend Hourly Chart [/B]

Sideways

[B]Hourly Indicators [/B]

Turning down

[B]13 HR RSI [/B]

63

[B]14 HR DMI[/B]

+ve

[B]Daily Analysis[/B]

Consolidation b4 upmove resumes

[B]Resistance [/B]

104.22 - Equality proj. of 100.76-103.77 fm 101.21

103.77 - Mar’s high (07)

103.44 - Y’day’s high

[B]Support[/B]

102.90 - Y’day’s NY low

102.69 - Mar 19 high, now sup

102.43 - Mar 27 high, now sup

. [B]USD/JPY - 103.25[/B]… Although dlr penetrated abv last Fri’s high of 102.98 shortly after European open y’day n rose to 103.44 in NY morning, dovish remarks fm Fed Chair Yellen triggered broad-based selling in greenback n knocked price down to 102.90 b4 staging a rebound to 103.27 in Australia this morning.

. Looking at the hourly chart, y’day’s breach of 102.98 to 103.44 suggests a re-test of upper lvl of recent broad range of 100.76-103.77 wud be forthcoming soon but a daily close abv said res is needed to indicate an ‘upside break’ has occurred n bring further gain to 104.22, being the equality projection of 100.76-103.77 measured fm 101.21, however, as ‘bearish diverging signals’ have appear on hourly oscillators, sharp gain fm there is not likely n price shud falter below 104.55, this is 80.9% r of fall fm 105.45 to 100.76, n yield retreat later this week. Looking ahead, only abv 104.55 wud suggest correction fm 105.45 (2013 5-year peak in Dec) is over n bring further headway twd 105.45.

. Today, as long as sup at 102.69 (prev. res, now sup) holds, trading dlr

fm long side in anticipation for a re-test of 103.77 is favoured n only a daily

close below 102.69 indicates temporary top is made, risks weakness twd 101.99.