I heard my name called.

Welcome to this forum, HappilyNorth.

Regarding your question —

For your Daily opening time, use the time-of-day when your trading platform closes each daily candle, and opens the next daily candle. Ideally, this time will be 5 pm New York time (for reasons explained below).

It’s difficult to do daily chart studies on charts that define a “day” as something different from what you define a day to be. So, follow the pattern established by your broker’s platform.

If your broker’s platform deviates too far from the preferred 5 pm New York pattern, you might want to consider doing your studies on a different platform (an Oanda demo account, for example).

Your Weekly opening should be the first daily opening on, or after, Sunday. If your platform follows the

5 pm New York pattern, then your weekly opening would be 5 pm New York time on Sunday.

Your Monthly opening should be the first daily opening on, or after, the first day of the new month. For example, looking ahead to August of this year, the calendar month will begin on Saturday, August 1, at which time (obviously) the retail forex market will be closed. So, if your platform closes/opens daily candles at 5 pm New York time, your August opening will be 5 pm Sunday, August 2.

Your Yearly opening should be the first daily opening on, or after, January 1. Brokers that follow the

5 pm New York pattern typically close retail trading for the New Year holiday at 5 pm on New Year’s Eve, and re-open at 5 pm on January 1. So, unless January 1 falls on Friday or Saturday, your Yearly opening would be 5 pm on January 1. If January 1 falls on Friday, your Yearly opening would be 5 pm on Sunday, January 3.

Regarding 5 pm New York time as the preferred Daily close / Daily open —

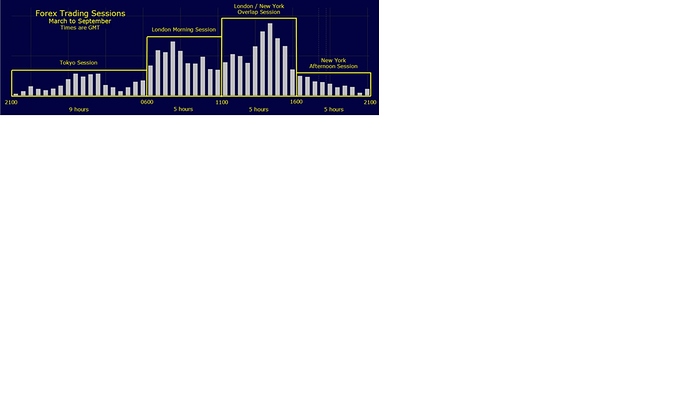

Trading everywhere in the world, and in every currency pair, experiences a lull in the hour following the

5 pm close of the New York market, making that time of day the closest thing we have to an actual, physical market close.

During that 5-6 pm hour, the normal business day has ended in the three major forex markets – Asia, Europe, and North America – and only New Zealand and Australia are open.

Forex trading is normally subdued in Wellington and Sydney, until the Japanese business day ramps up (at 7 pm EST, or 8 pm EDT, in New York), at which time traders in Tokyo take the lead, and Wellington and Sydney basically follow along. Then, an hour later, Singapore and Hong Kong open, bringing massive volume into the market.

Tokyo is still the nominal “heart” of the Asian market, but Singapore and Hong Kong are both larger than Tokyo in terms of forex market volume. And those three markets combined absolutely dwarf Wellington and Sydney.

The lull in the market which I have described can be seen clearly on any tick-volume chart.