Japanese Equities Dip: Nikkei 225 Hits Two-Week Low in Volatile Trade

Solid ECN – In Thursday’s post-holiday trading session, the Nikkei 225 Index experienced a significant drop, initially plunging by 2.3% and finally closing 0.53% lower at 33,288. This marked a two-week low point for the index, as it aligned with the global market trend of substantial losses. The beginning of the new year brought with it a cautious approach from investors. Many opted to secure their gains and reduce their expectations regarding the magnitude of interest rate reductions by major central banks within the current year.

Japan faced additional internal turmoil. The country was struck by a devastating earthquake, resulting in the tragic loss of at least 65 lives. Further adding to the chaos was an incident at Tokyo’s Haneda airport, involving a collision with Japan Airlines. This series of events put additional pressure on the stock market.

Technology sectors bore the brunt of the downturn, with notable companies like Tokyo Electron, SoftBank Group, Disco Corp, Lasertec, and Advantest witnessing steep declines in their stock values. These companies saw their shares fall by 5%, 3.9%, 3.9%, 5.3%, and 3.8% respectively. Other prominent companies in the index, such as Fast Retailing, Sony Group, and Shin-Etsu Chemical, also experienced notable drops in their share prices.

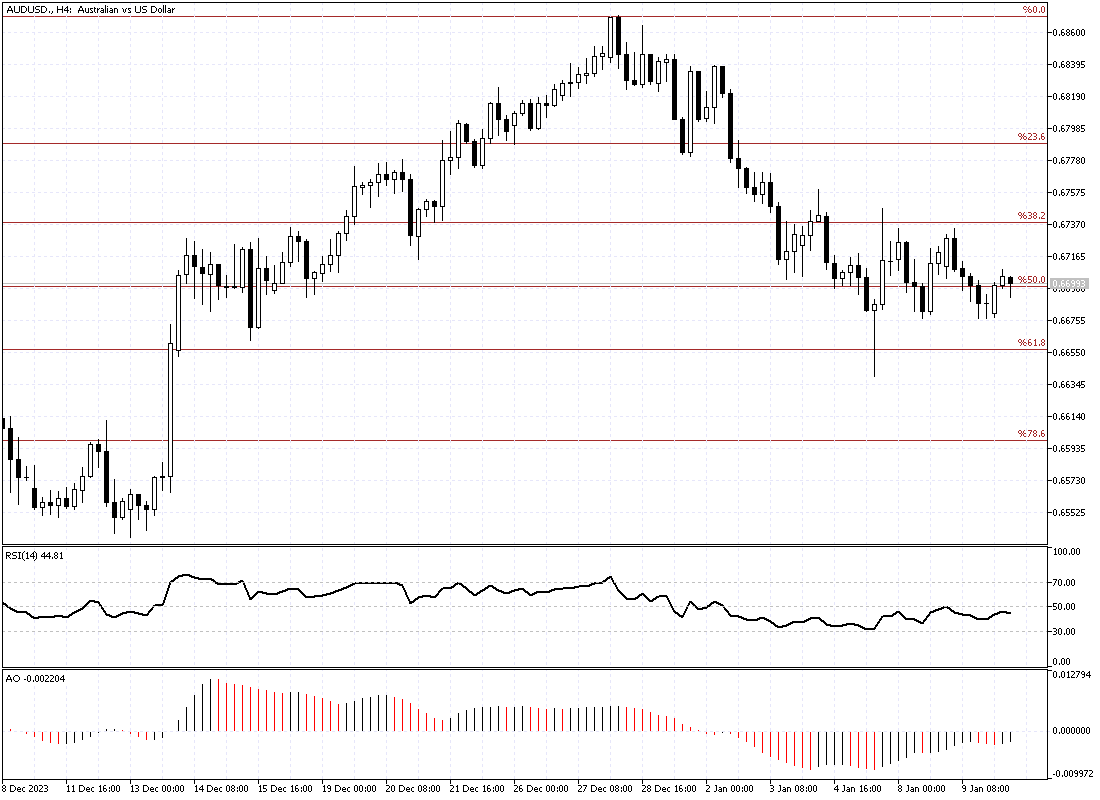

Technical Analysis

The JP225 Index, also known as the Nikkei, has recently experienced a rebound from the 32,689 mark. This particular point is in close proximity to the 38.2% Fibonacci retracement level.

At present, the index is undergoing a test of the lower band of what was previously a bullish flag pattern. The pivot point in this scenario is at the 33,423 mark. For the continuation of the bullish bias, it is imperative that buyers achieve a close above this pivot point. Should there be a failure to surpass the pivot, it would likely result in a decline in the index’s price.

Under such circumstances, the initial target would be set at the 38.2% Fibonacci retracement level. Following this, the next level of support would be at the 50% Fibonacci retracement level.