Yen Rebounds Amid Intervention Fears

Solid ECN—The Japanese yen strengthened past 161 per dollar, recovering slightly from its 38-year lows. This improvement came mainly due to a weaker dollar after soft US economic data boosted expectations that the Federal Reserve might cut interest rates as soon as September.

Additionally, fears of another government intervention supported the yen. Japanese authorities had spent nearly 10 trillion yen from late April to late May to bolster the yen after it fell below 160 per dollar.

Significant interest rate differences between Japan and other major economies had pressured the yen, leading investors to borrow and invest in higher-yielded currencies.

Furthermore, the Bank of Japan’s slow approach to changing monetary policy weighed the yen. However, there is increasing speculation that the BOJ might raise rates at its next policy meeting in late July. Moreover, the BOJ announced it would release a plan to wind down its bond-buying program this month.

EUR/USD Forecast: Bulls Eye 1.0844

Solid ECN—EUR/USD tests the immediate resistance at 1.082. The technical indicators give mixed signals, with the Awesome Oscillator (AO) and stochastic oscillator being bearish. On the other hand, the RSI and Heiken Ashi suggest the bullish market will resume.

From a technical perspective, the ascending trendline and the 23.6% Fibonacci retracement level at 1.080 play critical roles as support. The bull market remains intact as long as the pair trades above it. In this scenario, if the price exceeds the immediate resistance at 1.082, the next bullish target will be the July 8 high at 1.0844.

Conversely, if the EUR/USD price dips below the key support level at 1.080, the bull market should be invalidated, and the bears (sellers) will likely push the price down to the 38.2% Fibonacci retracement level at 1.077.

AUD/USD Uptrend Resumes above 0.675

[/url]

Solid ECN—The Australian dollar bounced from an ascending trendline against the U.S. Dollar from the immediate resistance at 0.675. The technical indicators provide mixed signals, mostly because all technical tools are lagging. That said, from a technical perspective, the AUD/USD is in a bull market because the currency pair trades in a bullish channel.

If the immediate resistance holds, the next bullish target will be testing the key resistance level at 0.679.

Conversely, if the price dips below 0.675, the next support area will be 0.672, a supply zone backed by the Ichimoku Cloud.

Gold Technical Analysis - 12-July-2024

Solid ECN—XAU/USD dips from $2,424 as expected since the RSI 14 and the Stochastic oscillator were in oversold territory. With the bullish primary trend, the consolidation phase can provide new opportunities for traders and investors to find a decent bid to join the bull market.

The $2,392 and $2,387 levels offer new entry points. That said, traders should monitor these supply zones for bullish candlestick patterns, such as a hammer or a bullish engulfing pattern.

Please note that if the bears close below $2,387, the consolidation phase could extend to $2,370, a support area backed by the Ichimoku Cloud.

AUD/USD Analysis: AO Signals Twin Peaks

Solid ECN—The AUD/USD pair is in an uptrend, trading above the $0.6761 immediate resistance and the ascending trendline. The immediate resistance is at 0.6767, Friday’s peak. Interestingly, the awesome oscillator signals twin peaks, which is a bullish signal if the bar turns green again.

From a technical standpoint, if the bulls close above the 0.6767 immediate resistance, the uptrend will likely resume, and the next bullish target will be at 0.6792, followed by July’s all-time high at 0.6801.

Conversely, a dip below the immediate resistance at 0.6761 could extend to 0.6752. Furthermore, if the selling pressure exceeds 0.6752, the bullish scenario should be invalidated, and the trend should be considered reversed from a bull market to a bear market.

USD/JPY Analysis: Bears Face Key Resistance

Solid ECN—The USD/JPY currency pair tested the 157.6 resistance level, as shown in the daily chart. The technical indicators are bearish, but if the bulls (buyers) can hold the price above the key resistance level at 157.6, the uptrend will likely resume and initially target 160.3.

Conversely, if the price dips below the key resistance, the bearish momentum could target the next support level at 155.6.

USD/CHF Update: Bears Eyeing Key Resistance Levels

Solid ECN—The USD/CHF pair trades within a bearish flag pattern and is aligned with the 50-period simple moving average, highlighting a pronounced downtrend. Despite the Awesome Oscillator bars turning green, they remain below the signal line, indicating a weakening of the bearish trend.

From a technical perspective, the primary trend remains bearish as long as the pair stays below the descending trendline. In this scenario, sellers will likely test the 0.891 resistance level again. Should the selling pressure surpass 0.891, the next resistance area would be at 0.888.

On the other hand, if buyers manage to close and stabilize the price above the descending trendline, the bearish trend would be invalidated. This would signify a reversal from a bear market to a bull market.

Unpredictable Market Keeps Silver Prices in Limbo

Solid ECN—Silver trades between the $30.5 immediate support and the $30.9 immediate resistance. The technical indicators give mixed signals, which adds to the uncertainty in the market direction in the short term. That said, the price has crossed the 50-period moving average several times, which could confuse retail traders.

In such a situation, traders and investors should wait patiently for the market to break out from one of the immediate barriers. The primary trend should be considered bullish since the silver price is still above the 38.2% Fibonacci. In this scenario, if the bulls close and stabilize the price above $30.98, the bull market will likely resume, and the initial target could be retesting the $31.48 resistance.

Conversely, if the price dips below the immediate support at $30.5, the value of silver could drop to the next supply zone at the 50% Fibonacci level, marked at $30.1, which is backed by the 100-period simple moving average.

DAX 30 Index Tests Key Fibonacci Level

Solid ECN—The DAX 30 Index experienced a decline during today’s trading session, reaching the 38.2% Fibonacci retracement level at $18,429. Technical indicators suggest a bearish market trend, with potential signs of being oversold.

From a technical perspective, entering short positions in an oversold market is inadvisable. Consequently, traders and investors are encouraged to await a correction near the 61.8% Fibonacci retracement level. At this point, a bearish engulfing pattern should be observed before considering joining the bear market.

Alternatively, should the price stabilize above the 61.8% Fibonacci retracement level, an upward movement towards the 78.6% Fibonacci retracement level at $18,661 is anticipated.

WTI Crude Oil Nears Crucial Resistance at $80.6

Solid ECN—WTI Crude Oil is currently oversold, testing a critical resistance level at $80.1. The Awesome Oscillator indicates a prevailing bear market; however, the RSI 14 and Stochastic Oscillator signal an oversold market, suggesting a consolidation phase may be imminent.

Traders and investors are advised to wait for the oil price to recover some of its recent losses, as shorting a market with intense selling pressure is not advisable.

Nonetheless, the oil price may rebound to test the immediate resistance at the 23.6% Fibonacci level of $80.6, a level reinforced by the low on July 15. It is essential to monitor the $80.6 demand area for bearish candlestick signals.

Please note that if the bulls (buyers) close and stabilize the price above the 23.6% Fibonacci level, the next key resistance will be $81.

EUR/USD Consolidation and Bearish Signals

Solid ECN—The EUR/USD currency pair shows signs of consolidation after the price peaked at 1.092 and formed a shooting star candlestick pattern on the 4-hour chart.

Moreover, the Awesome Oscillator and the momentum indicators also show signs of a short-term bearish trend that might result in the price testing the 1.086 resistance level, followed by the 38.2% Fibonacci at 1.082. These levels could provide a decent bid price for retail traders to join the bull market.

If the bears (sellers) push the price below the ascending trendline, the bull market will be invalidated.

USD/JPY Analysis: Bearish Target Set at 155.6

Solid ECN—The USD/JPY price has fallen below the ascending trendline and the 157.6 resistance level, currently trading around 157.0 in today’s session.

Technical indicators on the daily chart suggest that the downtrend will likely resume following this breakout. From a technical standpoint, the immediate resistance is at 158.8. With the price remaining below this level, the next bearish target is anticipated at the 155.6 resistance.

However, should the USD/JPY price rise above the immediate resistance, the bearish scenario will be invalidated, potentially paving the way for a bullish advance toward the 160.3 resistance.

Ethereum Tests 61.8% Fibonacci Level

Solid ECN—Ethereum trades in a bullish flag pattern, testing the 61.8% Fibonacci level. The momentum indicators suggest the ETH/USD market is overbought. Therefore, we expect the price to consolidate near the lower line of the ascending trendline.

If the price dips to near the middle line of the Donchian channel, at approximately $3,345, retail traders can find new, low-risk opportunities to join the bull market. Consequently, we suggest waiting patiently for the market to consolidate and monitor the key support levels for bullish signals.

However, the bull market should be invalidated if the price dips below the ascending trendline.

XRP/USD Overbought: Is a Dip to $0.56 Ahead?

Solid ECN—Ripple is in an uptrend, trading at approximately $0.62 in today’s session. The recent bullish trajectory has driven the XRP/USD pair into overbought status, as both the RSI and Stochastic oscillator hover above 70 and 80, respectively.

If the bars turn red, the Awesome Oscillator could form a twin peak signal. If this happens, the Ripple price could dip to $0.56, providing a low-risk and decent bid to join the bull market.

Traders and investors should note that trading in an overbought market is not advisable. Furthermore, the bullish scenario will be invalidated if Ripple dips below the key resistance level at $0.56 and the ascending trendline.

Gold Price Dips: Will Bulls Hold $2,439?

Solid ECN—Gold prices dipped from $2,483, while the stochastic oscillator warned of an overbought market. The current bearish momentum should be considered a consolidation phase, which could extend to testing the July 15 low at $2,439. Consequently, for the uptrend to resume, the bulls must maintain the XAU/USD price above the immediate resistance at $2,439.

Traders should note that the immediate resistance is in conjunction with the 25-period simple moving average, a supply level that could offer a decent bid price for the bull market.

Furthermore, if the gold price falls below the immediate resistance, the consolidation phase can extend to $2,420, followed by $2,392, a supply zone backed by the Ichimoku cloud.

Bearish Momentum in EUR/USD Gains Strength

Solid ECN—The EUR/USD currency pair is in an overbought state, trading at about 1.093 and testing the immediate resistance at 1.0922. The stochastic oscillator is above 80 and declining, indicating that bearish momentum is gaining strength.

It is likely for the bears to dip the price to test the ascending trendline before the uptrend resumes. If the price dips below the trendline, the next support level will be 1.0870.

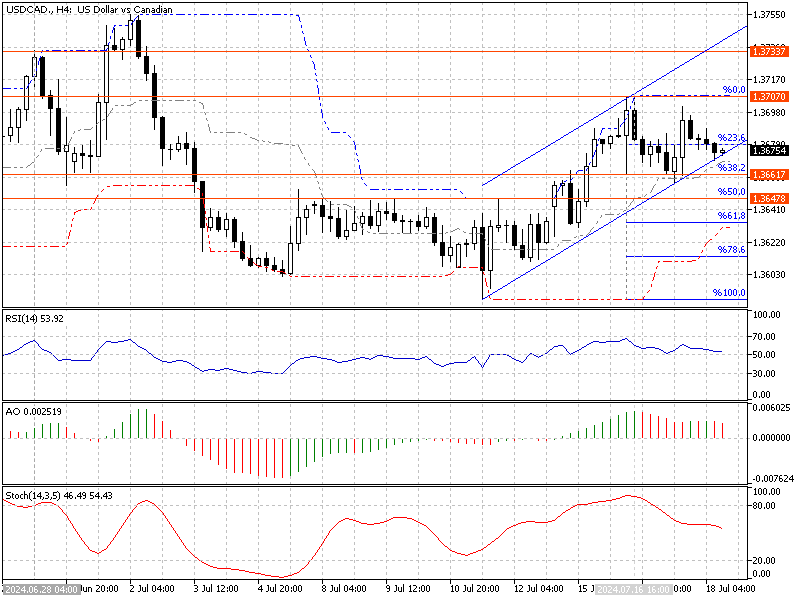

USD/CAD Tests Key Trendline at 1.367

Solid ECN—The USD/CAD currency pair tests the ascending trendline at approximately 1.367, with the technical indicators in the 4-hour chart suggesting the bearish momentum might extend to the lower resistance level.

The primary trend is bullish, with the price above the 38.2% Fibonacci level. If the USD/CAD price holds above the 1.366 mark, the uptrend will likely resume to retest the 1.370.

Conversely, if the price dips below 1.366, the bullish outlook will be invalidated. In this scenario, the next support level will be at the 50% Fibonacci retracement level at 1.364.

Silver’s Bearish Trend: Key Levels to Watch

Solid ECN—Silver’s short-term trend direction is bearish, trading in a bearish flag, slightly above the 100-period simple moving average. The XAG/USD pair is testing the 38.2% Fibonacci at $30.5 in the current session, with technical indicators suggesting the downtrend should resume.

The immediate resistance is at $30.5. The downtrend will likely resume if the price remains below this barrier. In this scenario, the sellers could initially target the lower line of the bearish flag.

On the flip side, if the bulls (buyers) close and stabilize the price above the immediate resistance, the pullback that began from the 50% Fibonacci could result in the Silver price surging and targeting the 23.6% Fibonacci at $30.9.