What’s the position size?

You are starting in the past. Can I borrow your time machine?!? I’m guessing risk management is out the door, Following with interest still.

Please issue a big post linking to this one when you get to trade # 200. Anything less has no meaning whatsoever.

Omg I missed that lol

Thanks, corrected the typo.

You can’t borrow my time machine, I busted it while time traveling to the 90s.

The lot sizing is going to be aggressive, especially at the start. Hence, the entries are going to be critical.

I saw that Silver still dipped this morning, which meant that the entry isn’t great, but there was no way I could be awake at that time, so…

The key idea here is to kind of do a Jesse Livermore. Only with such a system, can every single person benefit from forex trading.

Previously I tried attempted this with an EA: 10% a day? SGD 1,000 to SGD 100,000 in 50 days? - #10 by KovanTrader. I got to around $13,000 before it collapsed. I am now a firm believer that machines still need to be guided by humans.

Trade update: I’m a little disappointed we have yet to recover 25.000 and hit TP. However, as I see DXY softening at the moment, we could be making a run later in London session. Guess patience is needed here.

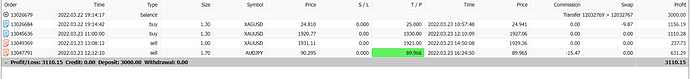

First trade closed. Profit of $1,146.32 (paid $9.87 swap). Gain of 38.21%.

I stopped before the TP, which was a mistake because as soon as I closed, within the next minute it hit TP.

I’m switching over to XAU/USD buys at 1921 because I think it is the next big mover.

In addition, Powell speaks in 4 hours time and there will be home sales data (which was previously bad). Target profit for this trade is $415. I am leaving TP open because if there is one thing I learnt, the market is dynamic and I want to see how it catches up with Silver.

Second trade done! Gain of 28.77%.

EDIT: Looks like once again I closed the trade early, but oh well…

I think yen pairs might be reaching resistance.

Next trade should target $526.

EJ and GJ are flirting at red daily candles while AJ is still bullish. For those looking for a swing trade, selling AJ could be profitable.

Both XAU/USD and XAG/USD are trending towards a lower low and lower high. XAU/USD might revisit 1919 support during the US session while XAG/USD might revisit 24.800 levels.

Trade 3 done, captured a profit of $237.73, for 4.5%.

I decided to switch it out for another trade based on the following rationale:

- I believe the move will be greater

- The margin requirements are lesser.

Next trade target profit is $550.

Trade 4 done for $616 profit for 11.2%.

As mentioned, yen pairs are pushing towards resistance.

Next trade target profit is $612.

Why does Gold and Silver looks like the same bull trap yesterday? Could possibly have a huge dump when US equities open.

Half the gains wiped out in first 3 mins…

EDIT: This is in reply to the post above…

Current balance is at $6,110; an increase of 100% in Day 1. However, US session wasn’t good, I could had taken profit but did not as I expected more profits and now I can’t. Guess will have to pay triple swap and see where we land tomorrow.

Hopefully when I am awake tomorrow my TPs are hit…that would make me extremely happy, although chances are, it would not.

I’m also glad I exited my AJ shorts as they are now totally OTM.

kovan, I need someone to train me please help. nate

Still have a lot od trades to go! The fact that youve already doubled though, pretty good!

Any hints about your strategy? What markets do you watch/don’t watch?

Any crypto in this or strictly forex?

Excellent job so far.

Wow. Nice job.

What does this mean?

Curious to see what happened here after that flying start! Post an update when you can!