Nice one, Emerald…

Left you a short (aheam) comment under the YouTube video…

Thank you so much for your time. I look forward to the Live Room in August.

I look forward to seeing you all there.

Step by Step live Trade on h1 Cable. Note we trade to 1.5680. Uploading the principles of volume always pays off.

Hey all my free webinar starts in an hour and a half so sign up here http://tradersclub.london/live-event

Thanks all.

Thanks to all who made it to the webinar. It was a great turn out. Look forward to seeing you guys in my live trading room. We do make money in there and have a few hundred thousands at play so we can’t make it free but we do have a free day on monday. So check out our website at tradersclub.london

I enjoyed the live trading room, this morning, and if nobody has experienced it, you should: a great place to exchange comments on live price action, in a friendly atmosphere… Keep up the good work, Emerald!

Is this live trading room continous, or it is going on only during the webinars? Also does it have a membership price, or is it free?

Thanks Pipme.

Glad you enjoyed it. Despite us on the day decimating 500 Euros but that is trading… We really wanted guys to understand what trading is like rather than what people have others believe but on the other hand we know it is possible to do well.

We look forward to Thursday when we have another free session but we will be a little careful, it was the first day so everyone was nervous on systems and integration but now we have had a chance to fix any integration issues for a smoother experience.

The live room is not free but Thursday will be and I am attaching the link here if you wish to register.

We where overwhelmed by the amount who came in, we even struggled with the feed but we have made some upgrades so I look forward to seeing you guys there. More info is on my webpage at Home - Traders Club

It looks really good! thanks for the info!

Thanks guys again. It was an amazing trading room last week. To all who made it, thanks again.

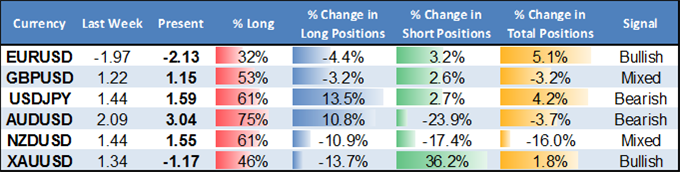

Retail FX traders continue buying aggressively into Australian Dollar weakness, and a contrarian view of crowd sentiment leaves us in favor of selling into AUD declines. The majority of traders last turned net-long the AUD as it traded below $0.80 in May.

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

Until we see a marked swing in the opposite direction we see little reason to change our long-standing bearish trading bias, and indeed any rallies are likely to be capped by significant volume-based resistance at $0.7400.

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Directional Real Volume indicator

The Australian Dollar briefly broke to fresh lows versus the US Dollar before bouncing sharply, and the AUD/USD now trades at major volume-based resistance levels near $0.7400. Failure to close above would nonetheless leave focus on recent lows near $0.7250. A break above $0.7400 would instead target the bottom of a major volume-based congestion range near $0.7600.

[I]Talking Points[/I]

[ul]

[li]EUR/USD pushes to two-month high

[/li][li]USD/JPY breaks 123.00

[/li][/ul]

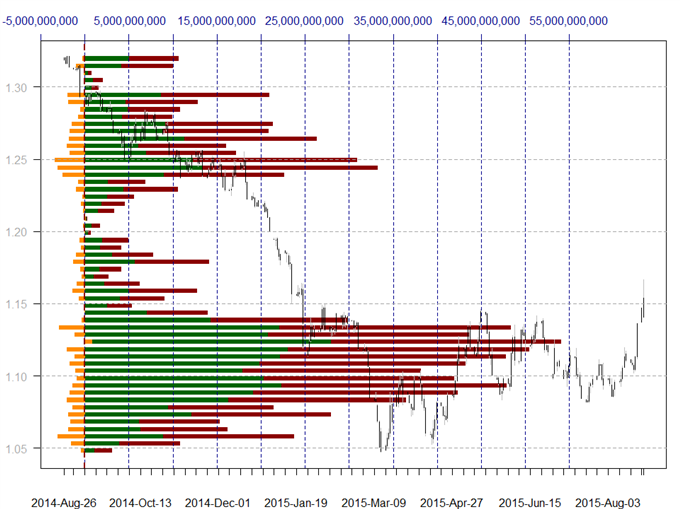

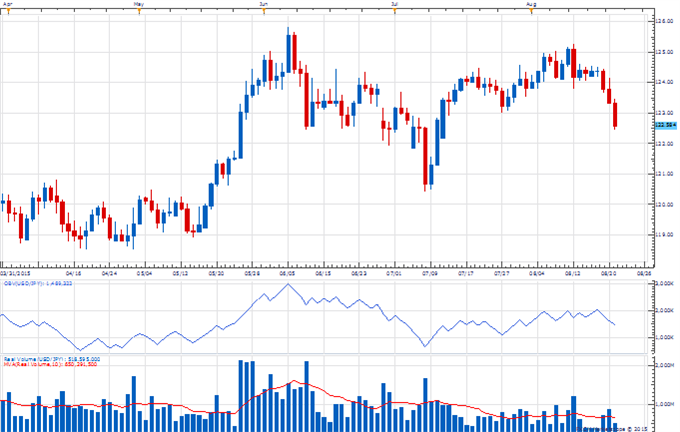

[B]Daily Volume Chart: EUR/USD[/B]

[I]Real Volume charts created using Marketscope – Prepared by Kristian Kerr[/I]

[ul]

[li][B]EUR/USD[/B] continued higher this week to trade at its highest level in almost two months

[/li][li]Volume has failed to pick up materially on the latest advance which is a warning sign that the recovery may only be corrective

[/li][li]The failure in daily OBV to get above last week’s high is also concerning

[/li][li]However, A close below 1.1000 on above average volume is needed to turn the outlook negative again on the euro

[/li][/ul]

[B]Daily Volume Chart: USD/JPY[/B]

[I]Real Volume charts created using Marketscope – Prepared by Kristian Kerr[/I]

[ul]

[li][B]USD/JPY[/B] fell to its lowest levels in over a month this week

[/li][li]Volume, however, remains very low and unsupportive of the decline

[/li][li]The downtick in daily OBV is negative, but a break under the late July low is needed to excite about potential further downside

[/li][li]A close back over 124.30 on above average volume would turn us positive on the pair

[/li][/ul]

The US Dollar has tumbled through significant support versus the Euro, Japanese Yen, and other majors. What levels are worth watching next?

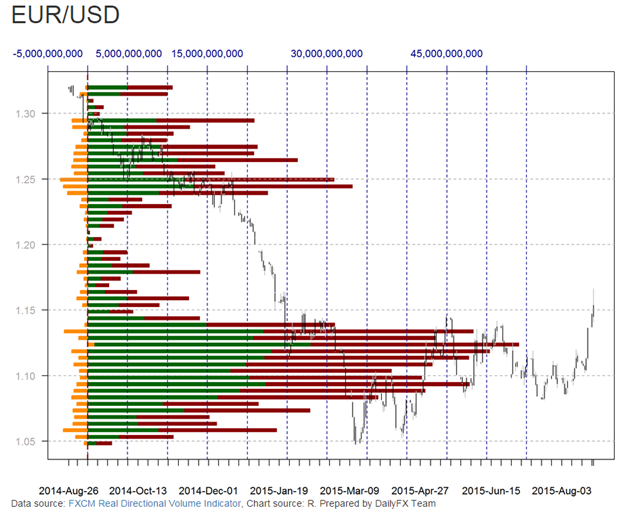

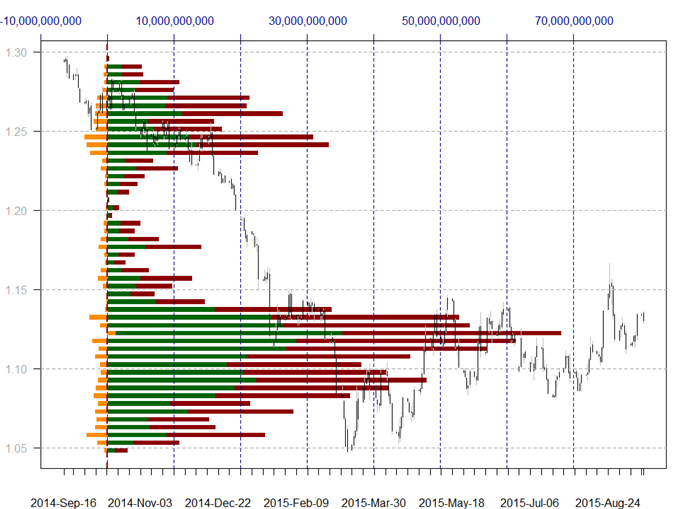

EUR/USD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: Prepared by David Rodriguez

The Euro surged beyond key resistance as it briefly broke to $1.17 versus the US Dollar, and the relative lack of further major resistance suggests risks remain for further advances. Support now starts at considerable volume-based congestion support near $1.14 and extends through $1.12. Resistance remains recent spike-highs at $1.17.

On Friday, before the market shakedown, EUR/USD broke above the 200-day moving average for the first time since summer of 2014.

And it did so on high volume. This type of move favors follow-through.

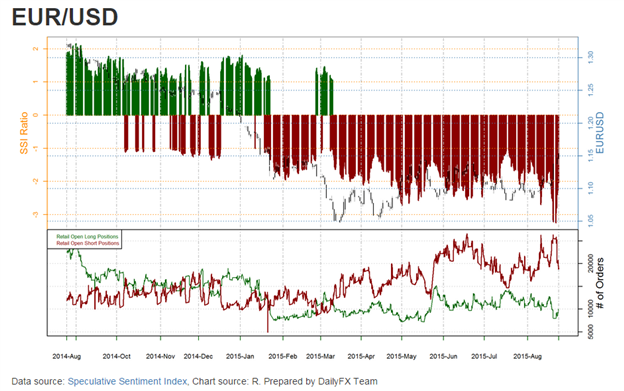

From a pure sentiment perspective, where we look for aggregate retail positioning as a contrarian indicator, EURUSD has been flashing by signals from the 1.0808 bounce.

In the chart above, you can see the red bars showing retail open short positions largely outweigh retail open long positions, which favors further upside.

The US Dollar remains in control versus the Euro and Japanese Yen. In his Weekly Volume at Price Report on DailyFX.com, quantitative strategist David Rodriguez discusses the key levels he is watching.

EUR/USD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator

The Euro trades below key congestion levels at $1.12, and risks remain to the downside unless we see a significant move above the important price level. The psychologically significant $1.10 level remains the next logical target, while notable price and volume-based congestion near $1.09 offers subsequent support.

_

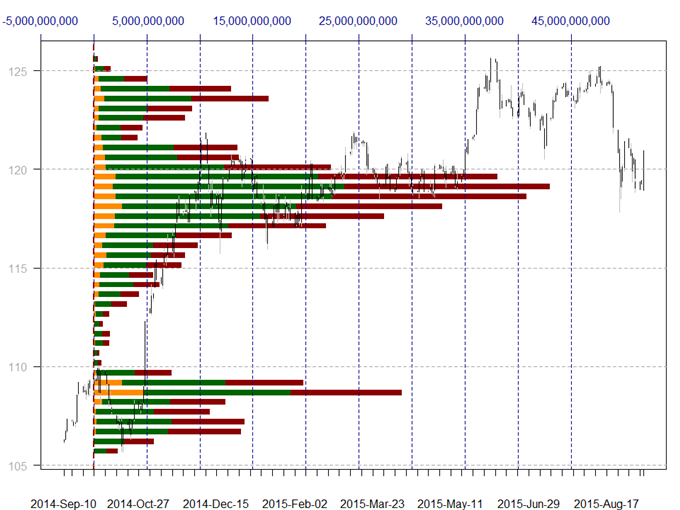

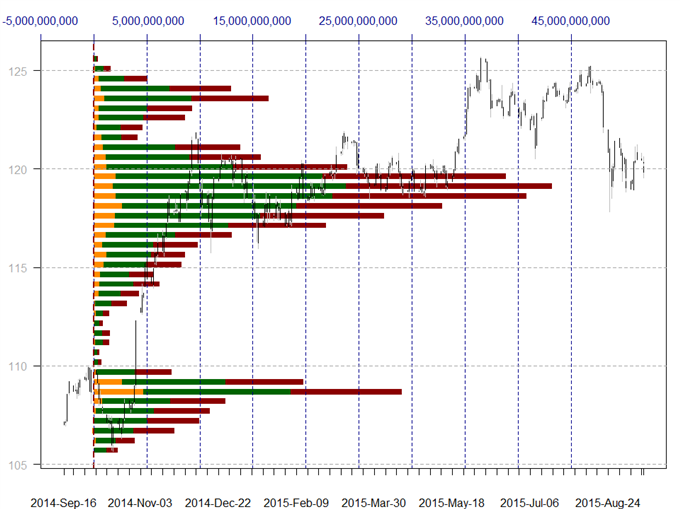

USD/JPY

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator

The US Dollar continues to hold substantial volume-based support versus the Japanese Yen near the ¥119 mark, and trading above keeps focus on near-term technical resistance at the recent reaction high of ¥121.60. A break above sees little in the way of substantial resistance until considerable volume-based congestion near ¥123.50.

Below are the key price levels for the Euro and Yen identified by DailyFX quantitative strategist David Rodriguez in his Weekly Volume at Price report.

_

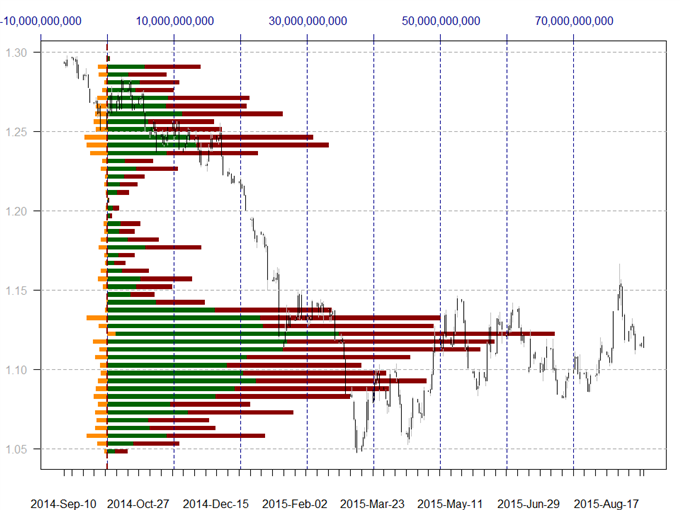

EUR/USD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

The Euro trades above key price and volume-based congestion levels at $1.12, and a hold above said level leaves near-term focus on a comparable price ceiling near $1.14. Extraordinarily choppy market conditions have nonetheless made it difficult to sustain a meaningful trading bias. We’ll watch for any major breakouts in either direction given the near-guarantee of major FX market moves in the days ahead.

_

USD/JPY

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

The US Dollar continues to hold substantial volume-based support versus the Japanese Yen near the ¥119 mark, and indeed traders seem content to keep it in a narrow trading range ahead of the highly-anticipated US Federal Reserve interest rate decision on September 17. Near-term resistance remains the recent reaction high of ¥121.60. A break above sees little in the way of substantial resistance until considerable volume-based congestion near ¥123.50.

Thanks guys for keeping this alive. I have been so buys with the Trading room which has fast become a Prop room. So that is amazing. Beyond that I am well and kicking.

I will try and get a few chart post on here. Just time is not easy to come by these days.

Hi Jason, I notice you didn’t cover cable… Interesting on Dollar Yen, weirdly I prefer to be on the short side of this long-term. I do think as we are in an intermediate term balance a test of the high isn’t impossible. That said, traders are better going short with stops over 125 and just hold through the storm. I would prefer better trade location to be honest, hence I have stayed well clear.

Nice work Jason.

On Friday October 23, 2015, GBP/JPY traded 2.3 yards which is the highest daily volume in over 5 years.

Friday ended up as a daily close higher, but the high price of the day may kick off an aggressive Elliott Wave 3 lower. Jeremy Wagner discusses the implications in his article on DailyFX.com.