The accumulation schematic shown below tells us that, there’s some substantial demand coming into the market - let’s get ready for a potential change in the downtrend.

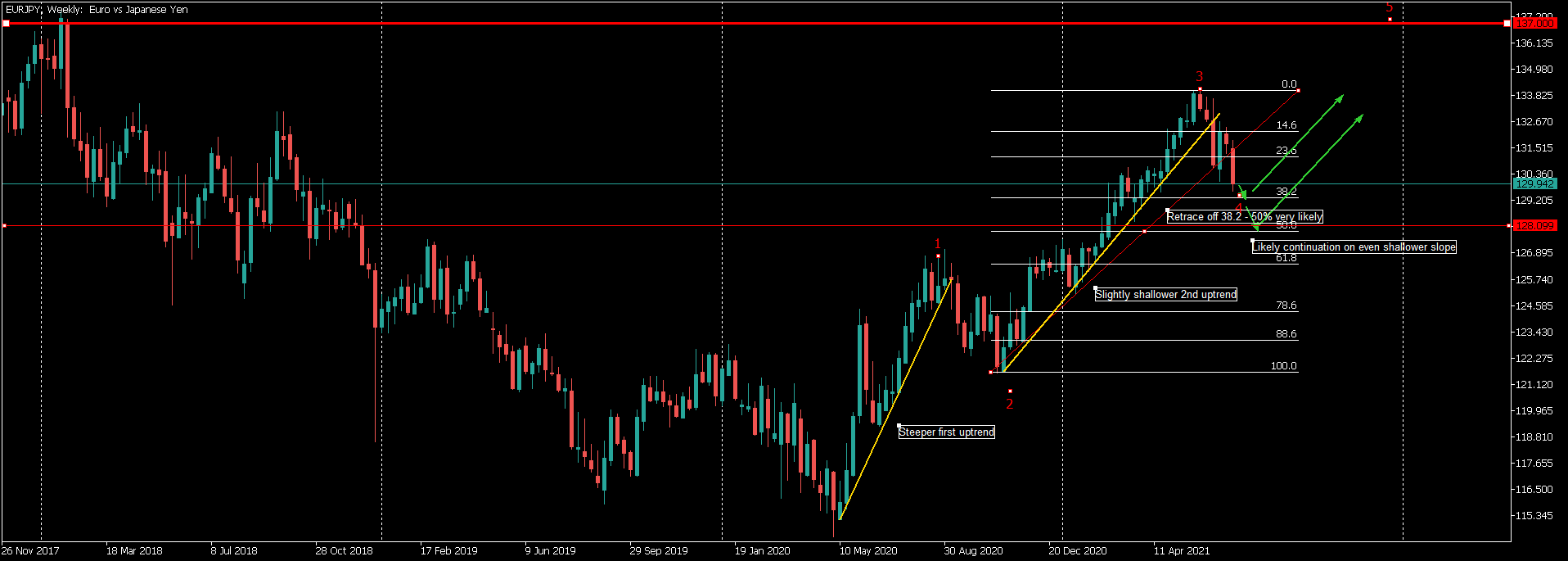

Accumulation Schematic diagram on EURJPY

This is how Wyckoff would label the supply and demand forces in the relatively equilibrium price range, our job is to find high quality entries in areas of such potential.

The important levels I would take note of in the labelled charts are; the springboard and sos (sign of strength). My entry was based on the spring.

A question would be, how do you know it’s a spring especially since the formation looks something close to a continued downtrend until the candle closes? Which would be an excellent question.

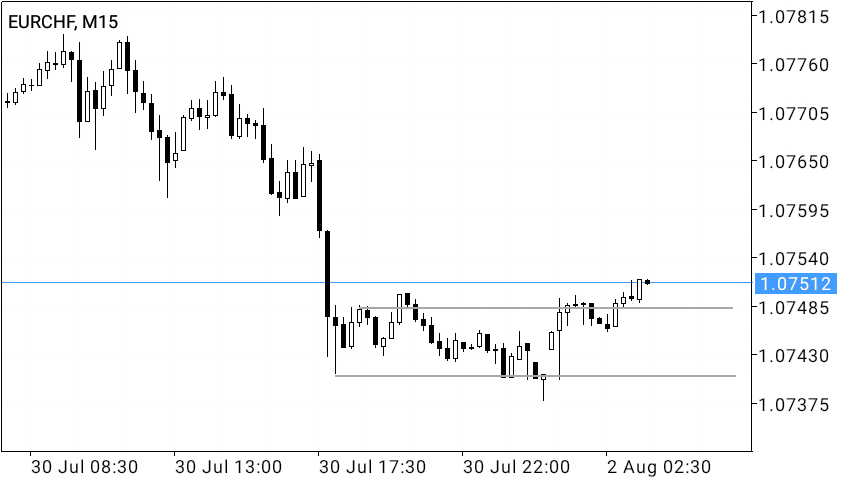

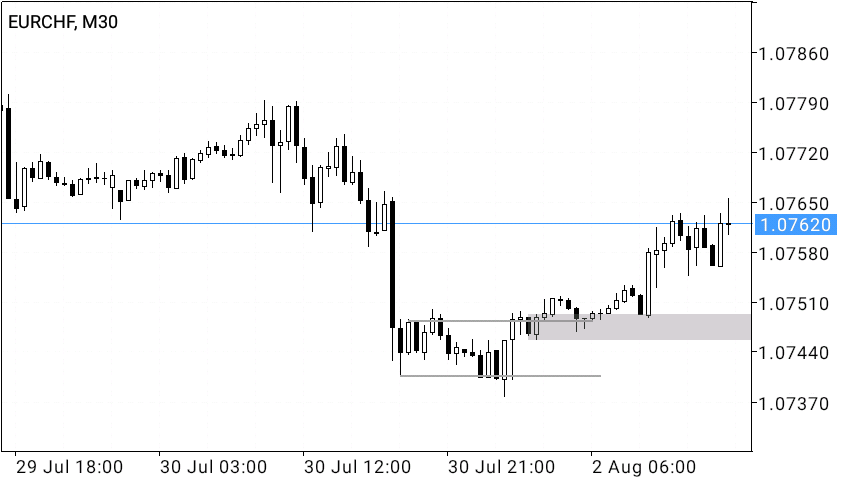

Lower time periods assist with understanding if in fact there is a shortening of the downward thrust. (1) Wicks coming from the bottom are a great sign selling is met with strong demand absorbing their every effort. (2) Failure for price to follow through after attempting a continued downtrend also means that a spring is forming. Typically, this looks like a “stop hunt” then contracts back into the range.

Entry is established when price expands to the springboard (stop hunting), once the candle closes - you place a protective stop below the candle.

As price contracts into the range, you’ll watch for demand control over price in order to be sure that this battle is close to being won by buyers. A good signal is price breaking the upper bound of the trading range as a sign of strength (sos).

We already know that when we have a breakout, there’s high chances of a retest of this break (resistance becoming support). This would be our lps - last point of support, where we can establish a second position long.

I am not sure if this covers your question, but I’m glad I was able to write it up for anyone who’s lurking and might find useful.

Basically, this is how I executed the above shared; GBPJPY, GBPUSD from the recent turning point (see the weekly/daily chart), CADJPY and EURJPY (this very trade)