What is the matter with you? I have not criticised any of your trades or strategies. I simply questioned why you are running more than one strategy - perhaps you have a very good reason.

I just want to clarify that I don’t use multiple strategies — most of my trades are based on price action. If I occasionally post an analysis in a different format, it’s because it comes from very professional analysts whose work I have access to. These analyses are part of expensive annual subscriptions, but I have the right to share them, so I post them here for others to benefit from. That’s all.

![]() Daily Gold Spot Analysis

Daily Gold Spot Analysis

Gold broke above 3363, forming a new short-term bullish continuation ![]() . Momentum remains positive, but a confirmed trend requires a breakout above 3433–3450

. Momentum remains positive, but a confirmed trend requires a breakout above 3433–3450 ![]() .

.

![]() Main Targets:

Main Targets:

First 3395 (previous futures high), then 3433–3450.

If you’re in from near current levels, consider reducing at 3395. Lower entry positions can aim higher ![]() .

.

![]() Short-term consolidation formed between 3371–3385.

Short-term consolidation formed between 3371–3385.

Chasing above 3385 is risky;

Aggressive entry: near 3377 (15-min mid-band).

Conservative entry: only if 3371 holds.

If price breaks below 3371, bullish momentum may fade. 3351 is key to holding neutral structure ![]() .

.

![]() Key Levels:

Key Levels:

Resistance: 3395 / 3405 / 3417 / 3433–3450

Support: 3371 / 3363 / 3351 / 3339 / 3331

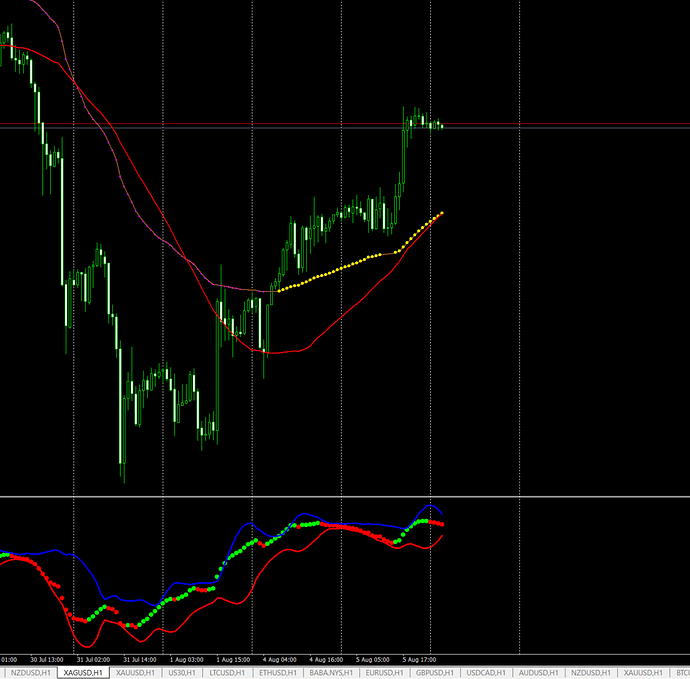

![]() Analyst Insights XAGUSD:

Analyst Insights XAGUSD:

① Bruce Powers believes that silver issued a bullish reversal signal on Monday.

Since reaching the recent high of $39.53, this is the first time silver has formed a “higher high” and “higher low” ![]()

![]() — a classic sign of a potential uptrend.

— a classic sign of a potential uptrend.

This move may signal the start of a bullish reversal, with expectations for the price to at least test the 20-day moving average at $37.90 ![]() .

.