AUD/USD is trading just below major resistance with May opening-range preserved on the heels of the RBA. Battle lines drawn on the Aussie weekly technical chart.

By : Michael Boutros, Sr. Technical Strategist

Australian Technical Forecast: AUD/USD Weekly Trade Levels

- AUD/USD rally halted at resistance of a fifth-consecutive week

- Aussie May opening-range preserved post-RBA rate cut- breakout pending

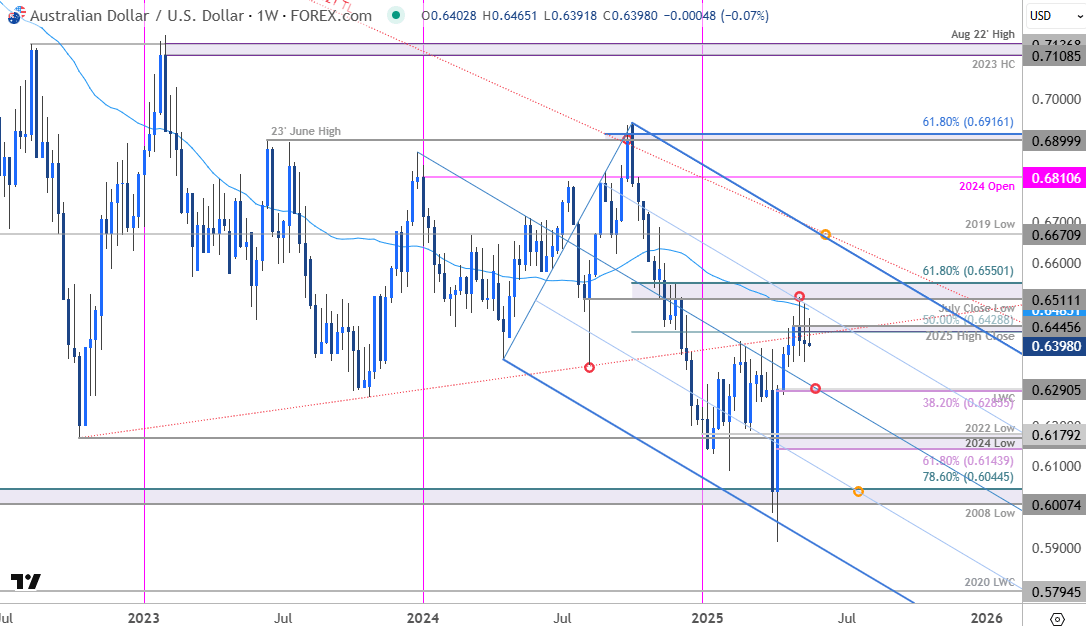

- Resistance 6429/45 (key), 6485, 6511/50- Support 6286/91 (key), 6144/79, 6007/45

The Australian Dollar is trading just below major resistance with AUD/USD holding a within a contractionary range for the past five weeks. The May opening-range is preserved on the heels today’s RBA rate cut and the focus remains on a breakout for guidance with the April rally still vulnerable while below the yearly moving average. Battle lines drawn on the AUD/USD weekly technical chart.

Australian Dollar Price Chart – AUD/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In my last Australian Dollar Forecast we noted that AUD/USD had, “rallied into confluent resistance at the September downtrend- risk for possible topside exhaustion / price inflection into this threshold. From a trading standpoint, a good zone to reduce long-exposure / raise protective stops- losses should be limited to 6179 IF price is heading higher on this stretch with a close above 6429 needed to suggest a more significant low is in place.” Aussie has held below resistance for nearly five-weeks now with multiple breakout attempts failing at the 52-week moving average.

Weekly resistance now stands with the 2025 high-close / 50% retracement of the September decline at 6429/45 and is backed again by the yearly moving average, currently near ~6485. Critical resistance is eyed with the July close low / 61.8% retracement at 6511/50 and a breach / close above this threshold is needed to fuel the next leg of the advance towards the 2019 low at 6671.

Weekly support rests with the 38.2% retracement of the yearly range / 2025 low-week close at 6286/91. Note that the median-line converges on this zone over the next few weeks and a weekly close below would be needed to suggest a more significant high is in place. Subsequent support seen at 6143/79- a region defined by the 61.8% retracement and the 2024/2022 swing lows.

Click the website link below to read our exclusive Guide to AUD/USD trading in Q2 2025

https://www.cityindex.com/en-au/market-outlooks-2025/q2-aud-usd-outlook/

Bottom line: The Australian Dollar rally has been halted at resistance and the focus is on a breakout of this multi-week range just below. From a trading standpoint, losses would need to be limited to 6285 IF price is heading higher on this stretch with a close above the 52-week moving average needed to fuel the next leg of the advance. Review I’ll publish an updated Australian Dollar Short-term Outlook once we have further clarity on the near-term AUD/USD technical trade levels.

Australia / US Economic Calendar

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- British Pound (GBP/USD)

- Japanese Yen (USD/JPY)

- Canadian Dollar (USD/CAD)

- Gold (XAU/USD)

- US Dollar Index (DXY)

- Euro (EUR/USD)

- S&P 500, Nasdaq, Dow

- Swiss Franc (USD/CHF)

- Crude Oil (WTI)

— Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.