Hello fellow traders. In today blog, we will have a look at Chevron Corporation (CVX) which is an American energy corporation based in San Ramon, California. It is one of the worlds largest oil companies. We will explain why CVX is important for commodities like Oil and how it may affect the next move it Oil.

In the chart below you can see the Elliott Wave View of CVX in the weekly chart. We can see that the instrument has a right side tag against 69.65 low. Up from there, it ended red wave I at $133.76 peak in a 5 wave Elliott Wave structure. Below from there, it managed to reach the equal legs of black ((A))-((B)) at 105.01-88.83 areas. Which were the first areas for buyers to appear. We can see nicely that CVX reached the areas and rallied in an impulsive manner, making red wave II pullback complete at its December 2018 low (100.21).

Up from its December 2018 low, it ended black wave ((1)) at 127.20 peak and also the proposed black wave ((2)) pullback at 113.80 low. Above from there, it is close to taking the black wave ((1)) peak. Key will be CVX breaking that peak because than it will show an incomplete sequence to the upside from its December 2018 low making it bullish. The possible target can be the equal legs of black ((1))-((2)) which will come at around 140.50 area.

CVX 07.02.2019 weekly Hour Chart Elliott Wave Analysis

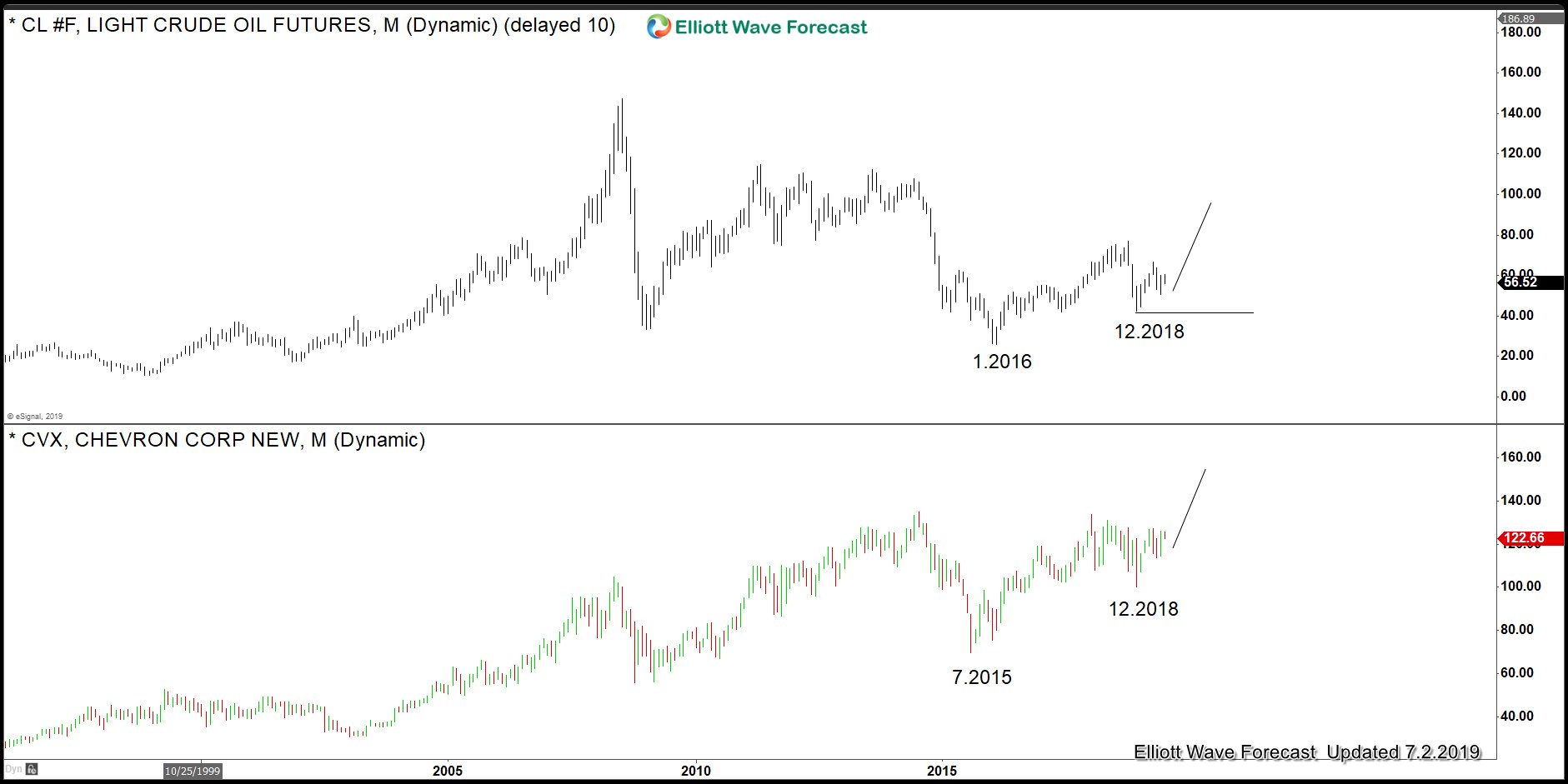

This will have huge effects on other commodities or better said Oil-related stocks. If CVX takes the black wave ((1)) peak then Oil will be supported after all. In the chart below you can see an overlay of the Oil chart and the Chevron stock. We can observe that both are correlated to each other. And if CVX takes the key level of 127.20 then Oil could trade into its equal legs area from January 2016 low. That implies Oil trading at around 93.70-105.80 areas in the future. We did also a blog about the GCC index which is also at a very interesting long-term buying area.

Chevron 07.02.2019 weekly Hour Chart Elliott Wave Analysis

If you are a long term investor your trade should be for several months or years then this can be a good opportunity. It is simple how to operate in this market but sometimes traders lack and make things too complicated. We hope you enjoyed this blog. We wish you all good trades.