Hello guys,

I finally have some time on my hands, so i’ve decided to make a little contribution as a lot of people have been asking how i trade and what tools i use.

This is a complex of 3 Trading Systems. It is not a hybrid, i individually apply the each system to gauge the trend and price movement.

Before starting out i recommend you introduce yourself to the following material courtesy of Incredible Charts: Stock Trading Guide - Stocks and Shares

Bull markets[ul]

[li]Bull markets commence with reviving confidence as business conditions improve.[/li][li]Prices rise as the market responds to improved earnings[/li][li]Rampant speculation dominates the market and price advances are based on hopes and expectations rather than actual results.[/ul]Bear markets[ul][/li][li]Bear markets start with abandonment of the hopes and expectations that sustained inflated prices.[/li][li]Prices decline in response to disappointing earnings.[/li][li]Distress selling follows as speculators attempt to close out their positions and securities are sold without regard to their true value.[/ul]Ranging Markets[/li][ul]

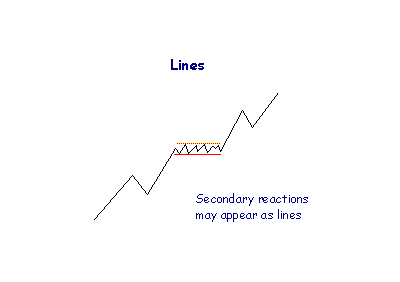

[li]A secondary reaction may take the form of a �line� which may endure for several weeks. Price fluctuates within a narrow range of about five per cent.Breakouts from a range can occur in either direction. [/li]Breakouts from a range can occur in either direction.

[/ul][ul]

[li]Advances above the upper limit of the line signal accumulation and higher prices;[/li][li]Declines below the lower limit indicate distribution and lower prices;[/ul] Trends[/li]

Bull Trends

A bull trend is identified by a series of rallies where each rally exceeds the highest point of the previous rally. The decline, between rallies, ends above the lowest point of the previous decline.

[I]Successive higher highs and higher lows.

[/I] [B]

[/B]The start of an up trend is signaled when price makes a higher low (trough), followed by a rally above the previous high (peak):

Start = higher Low + break above previous High.

The end is signaled by a lower high (peak), followed by a decline below the previous low (trough):

End = lower High + break below previous Low.

What if the series of higher Highs and higher Lows is first broken by a lower Low? There are two possible interpretations - see [Large Corrections](http://www.incrediblecharts.com/technical/dow_theory_trends.htm#Large+Corrections).

Bear Trends

Each successive rally fails to penetrate the high point of the previous rally. Each decline terminates at a lower point than the preceding decline.

Successive lower highs and lower lows.

A bear trend starts at the end of a bull trend: when a rally ends with a lower peak and then retreats below the previous low. The end of a bear trend is identical to the start of a bull trend.

What if the series of lower Highs and lower Lows is first broken by a higher High? This is a gray area - see [Large Corrections](http://www.incrediblecharts.com/technical/dow_theory_trends.htm#Large+Corrections).