That’s exactly it… they need a reason to be there… and now they have it… Whats good for the Saudi’s is good for America and Iran is a persistent PIA to both…

Are you expecting this to end up as a full-blown war? Or just brinkmanship to see who stands back first? Why do you think they are looking for a reason to be there?

I’m no historian… I’d say just Brinkmanship… The Iranians would be annoyed at having the US in their backyard breathing down their necks and are more than likely to do something stupid… allowing the US (and the coalition of the willing) to pounce… we’ll have to wait and see…

It’s possibly another “Weapons of Mass Destruction” moment… a real regime changer as previously seen… Like all street fights… you don’t want to be seen throwing the first punch…

This may not even be a Trump play… The Clinton’s are the ones with all the Saudi email addresses…

I agree with you there - and it seems that is also how the oil markets are seeing it - a threat, but shouldn’t escalate into anything too serious!

Well, that is a different angle on the issue!

Maybe, but somehow, knowing how closely Mr Trump watches his rivals and antagonists, I doubt it would have escaped his notice?

IN the meantime, it is just carry on scratching ticks from the short side. But we are into breakeven territories for many producers and even Russia had said a while back that it was happy with prices at “these” levels.

If it wasn’t that the oil (energy) industry interests me anyway, apart from trading, I would be feeling quite bitter that I hadn’t been trading GBP instead - but all markets have their moments and I’m sure oil will soon be trending again. The main aim now is not to give up profits while we are going nowhere! Small bites on idling revs for now!

I was just reading one article that offers some kind of credible reasoning why Iran would be carrying out such attacks - and why the oil markets are not overly affected by them.

Following on from the US withdrawal from the Iran agreement and the re-introduction of severe sanctions, the Iranian economy has been driven substantially downhill. The internal pressures this must be creating in Iran can only be imagined. But outright war with the US surely cannot be a serious option at this stage.

But we know that Mr Trump is first a businessman and only second a politician, and he has already stated a willingness to negotiate with Iran - as he did with N. Korea, too. But we also know his negotiating tactics only too well - prior to negotiating, show your own strength and weaken your opponent until they are a pulp and then talk - then their only hope is to emerge with the best from a series of bad options (from their point of view).

So if Iran is looking to negotiate, then they need to strengthen their own hand by showing what they are potentially capable of doing to the international oil trade. There is a real risk of military escalation but their options are few and it is a reasonable assumption that Mr Trump would avoid war in his preference for a business deal.

Thus demonstrating its capability, range and scale of destabilising activities, such as threats over shipping in the Hormuz Straits and also increasing production of enriched uranium (which they can also sell as well as use), they are strengthening their negotiating hand by having something to surrender in exchange for the reduction or removal of sanctions - as it has done in previous negotiations.

If that is so, then it does offer a credible explanation for the current events, the lack of direct admission of responsibility and the fact that oil markets are not concerned with the US/Iran negotiations any more than they have been previously. I.e. the prospect of global recession is still the only real game in town.

But also, if this is true, then what a dangerous game to be playing… but then so is also assuming that a country with an ancient, deep, and proud cultural and religious heritage would always think and (re)act in the same track as a typical western country

And 8 hours after our discussion, up they go… over 3% and still running in the US Session alone…

Both USOIL and UKOIL started “twitching” 4 hours prior to the New York open…

Most consensus was a downward move… It’s why they took it up… so not in this unfortunately…

Yes, all I’ve found so far is a comment that:

“Oil prices turned positive in early morning trade Tuesday after Saudi Arabia reportedly increased the pressure on fellow OPEC members and allies to extend their agreement on output restraint.”

As usual, it is not the content itself so much as the timing of the comment. And I think OPEC does that well!

As I mentioned earlier, it is, or at least was, a time for small bites. But this small is really quite depressing! I had a “gut feel” all morning (here) that we were struggling to go down further so I quit with a pittance, quite embarrassing really! But better a small gain than a bigger loss!

But I didn’t go long, it was a bit too fast for me. But for anyone watching, say, 1-15 min charts it was/is a great move!

But is this short-covering or a strategic change in direction remains to be seen…

Seems the sudden burst of short-covering/buying was initiated by Mr Trump stating today that he will be meeting Chinese President Xi Jinping at the G20 meeting and will be discussing the ongoing trade dispute - and that their respective teams will begin talks prior to the meeting.

So we have OPEC adding more strength to the belief that production cuts will continue to the end of the year and Mr Trump suggesting that the trade war may soon be witnessing some more positive changes.

Not surprising that the market “surged” and “soared”, as they say, upwards!

Only a few days back we were talking about the dominant factor affecting oil prices and concluded that:

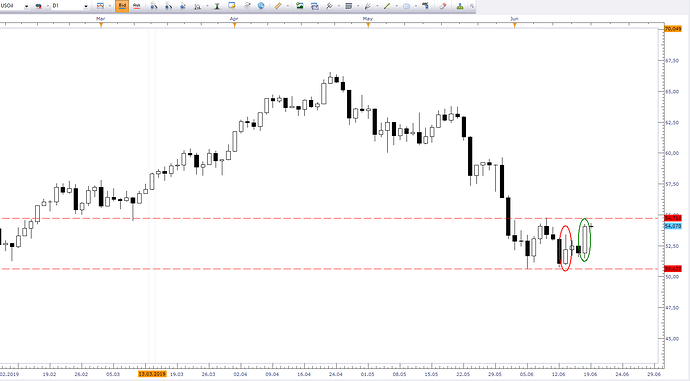

And that certainly seemed to appear true in yesterday’s move following Mr Trump’s announcement of “extensive talks” with Chinese President XI Jinping at the G20 meeting next week. Looking at the daily chart, the red ring is last week’s tanker attack and the green ring is yesterday’s announcement.We can see which carries more impact!

But this chart also offers a word of caution in that it shows we have only reached the top of the recent range and, apart from the announcement of this meeting, nothing in the world has changed yet - or has it???

As we have said earlier, Mr Trump is a businessman. And for him timing is the essence in all negotiations (almost like a chapter out of Zen Tzu). So what do we have here:

-

Mr Trump started his presidential campaign yesterday - good time for some good news on the economic future

-

Chinese Huawei’s founder and CEO just confirmed how hard the trade war is hitting them - evidence of a weakening opponent who is ready to compromise

-

OPEC+ is about to consider their terms for an extension of their production cuts which are designed to support oil prices (which Mr Trump does not want) - news of a possible trade war solution weakens the need and resolve for deeper or longer cuts ans so a milder outcome from the meetings than otherwise might be the case - especially from Russia whose oil chiefs wish to cease these production cuts.

-

THe US-Iran issue is still “hot” and heating up further with the European nuclear agreement parties urging Iran not to increase their enriched uranium stockpiles other wise, as Mrs Merkel said, “there will be consequences”.

We also said recently that:

What more can one say!

Normally, I would be urging caution on myself not to get swept up in this new wave of euphoria since a one-day move does not a trend make - but in this case I am stuck to find a reason why oil would crash back down again (until/unless the Trump/Jinping meeting fails to produce) - sometimes a turnaround can be that vicious - is this one of those occasions?

Morning.

Yeh. I was just telling somebody else this morning: they interviewed a veteran trader (decades at it) yesterday on Bloomberg. When asked about market direction etc he said that he’s never seen markets behaving like this in decades and in all of his years in this business. But one example cited were indeed these Tweets that can move markets sharply one way or the other. Basically he was saying well how is it possible to trade under these conditions i.e. market norms and fundamentals mean nothing.

You trade a new product - “Trumps”

Weak USD, low interest rates, low oil prices, low taxes, strong stock market, strong exports/ intl trade balance. Whatever is working against those objectives will be “tweeted” back into line ----- when the timing is right!

Seems to me that there are three types of trading environments that one can consider in this light - two of which are probably doing just fine - and a third which is struggling.

Long term traders. Mr Trump’s tweets do not appear so contradictory on longer term moves. E.g. the SP500 and Crude Oil have seen some very long and steady moves over the past 9 months and have only recently gone into a neutral stance.

Short term traders. The 1m-15m TF traders probably do well on these moves like we saw yesterday. These TFs are not based on fundamentals anyway, just on an ability to jump in (and out) fast. Their problem is avoiding whipsaws - which is nothing new on this scale.

Then there are the medium term swing-type traders. Maybe this group is the most likely to be in trades whenever the surprise tweets occur, and probably mostly with only a relatively small open gain at the time. These also have relatively nearby stops which are within the range of reactions to such tweets. For this group there are neither fundamental nor technical models to predict the timings of these events. Also, the psychological uncertainty over what might happen “today” is far greater than for long term and very short term traders.

But I do not think Mr Trump is erratic in his objectives at all. It is only the likely timings that maybe we should focus on more. For example, it was obvious that the US/China trade war was not going to continue indefinitely without further negotiations. It was all about when these would restart not if.

We just have to adjust and get smart in a different kind of way!

Rather a strange day today with oil prices. Most of the day was soggy even with an EIA inventories reporting a draw of 3.1 mill barrels for the week to June 14. It also reported a draw in gasoline inventories of 1.7 mill barrels. True, these figures did spike prices up, but they quickly slid back again and remained lethargic until late in the day, when they started climbing slowly but steadily back to make a new high from yesterday.

So we are coming to a good close, confirming the anticipated upward bias, but with the cautionary note that we are still below the highs of early last week around 53.80 WTI.

That is a scary read, @Trendswithbenefits! And what scares me most is that it again raises the question, what happened to the US government machinery? Has Congress been fired? Or on permanent holiday? President Trump and a few close colleagues seem to have succeeded in locking the entire congress machinery into an understairs cupboard and are freely playing the world according to their own rules and whims.

We are all aware of Mr Trump’s characteristics of impulsiveness and unpredictability, but I am sure he, himself, is not a warmonger, he just wants the publicity as the big, tough, successful deal-maker. He is not a military man and the thought that he could be manoeuvred into a large-scale war, just at the start of his re-election campaign as well as in the midst of his Chinese “chess match” is surely as horrendous for him as it is for anyone else!  So where is Congress?

So where is Congress?

Oil finally broke through last week’s high in early trading this morning, creating a spurt to the upper end of $55 range. 55.50 was my TP and I really didn’t expect to see it so soon and I really don’t know what to do now.

I have seen no other news yet why we have broken upwards except for the technical break of last week’s range. If that is all we are seeing then I will consider re-entering on a pullback towards that previous high from last week, i.e. somewhere in the range 53,80 - 54.00. So I’ll come back when I have something more concrete to add!

For the record, the upcoming OPEC+ meetings have been moved from next week to 1-2 July, i.e. after the G-20 meeting - shrewd move!!!

Also, just for the record, I do not wish to discuss oil prices in the event that any kind of war does break out. People who know me here from earlier times, know how much I am disgusted by retail speculating on how to make a few bucks from other people’s tragedies and catastrophies. Of course, the world has to carry on and the professionals all still have a job to do - but that is not the retail market at all. So if we do get to that point, I will not be commenting here on it at all.

So now there is news now of a US drone being shot down by Iranian surface-to-air missile in international airspace over the Strait of Hormuz. That would explain it!

Don’t mind me butting in here with my lack of understanding and insights i.e. with just ye olde boring technical trading stuff. But that jump in Oil is (was) a perfectly good Fractal trade long (three bar Fractals). Whether it now is going to trend up I have no clue at all of course. Be interesting to see what ADX(14) says (not at my PC at the moment).

To be honest, Dale, I think we are moving out of a normal market situation at present where TA of any kind would have a relevance.

Afterall, we have a G20 event on the doorstep including teams from the US and China meeting prior to the big Trump/Jinping meet. The results of that are not likely to be anything concrete now but the tone and comments will almost certainly flavour the optimism (or pessimism) for an end to the trade war. And this comes at a time when many analysts are anticipating a recession next year - adn a collapse in oil prices to even $40.

That is followed by the OPEC+ meetings where the terms of a production cut continuation will be decided and with a target of around current price levels

Then we have a potential war in the middle east involving a highly complex situation involving far more than just the visible US v. Iran conflict. And if we see an escalation to a state of war in the Hormuz Strait, that passes 30% of global seaborne crude oil, then any seizure of merchant shipping there will send oil soaring in spite of the global excesses in oil inventories.

The fact that all three of these events and scenarios are more or less simultaneous, and beyond the normal day-to-day “business as usual”, surely means any TA based on “yesterday” cannot hope to be predictive of “tomorrow”?

This won’t be a war… The US will just surgically remove Iran’s military presence and its ability to conduct operations in the Hormuz Straits… and after Iran says It will breach its nuclear deal… maybe take out a few atomic research sites saving Israel the hassle… the old 2 birds with one stone sort of thing…

This is all about allowing seaborne crude to continue to flow… The only escalation will come if Russia decides to take a stance… Iran’s middle eastern allied nations are all on their knees… Syria, Lebanon… maybe Iraq… This will be why the jump in Gold and Oil are going hand in hand…

Who knows who’s telling the truth… but right on cue… the Iranians start giving them excuses…

Not to be left out the Saudis are joining in… Excited by seeing the competition possibly take a fall…

I should’ve held strong on my long oils, The analyst above missed the retracement but it certainly broke 55!

At the risk of sounding naive, I seriously ask if it’s simply “creating excuses” to “justify” driving the price higher.

I also wonder if there has ever been a profit and loss statement for the private companies, their employees and investors that have benefitted from an affilliation with America’s longest war? I am sure it would be shocking.

KC