XAU/USD (GOLD)

[B]Daily TF.[/B]

Price is still seen trading in and around daily supply at 1318.12-1331.08. However something interesting has been spotted, take a quick look at the small dashed line, this likely resembles pro money activity in that they are thinking ahead of time here, the tails/spikes possible show pro money consuming minor pockets of demand which is likely clearing the path south for sellers, so is a drop lower still on the cards, or will price positively close above daily supply?

[B]4hr TF.[/B]

Technically, not a lot has changed on this pair as no break of either 4hr demand at 1304.77-1308.55 or 4hr supply above at 1342.30-1335.74.

Again, much the same as the last analysis:

[I]Price spiking above daily supply (levels above) nearly hit a great-looking 4hr supply area at 1342.30-1335.74. Now, if this is indeed a fakeout above daily supply (levels above), price may yet rally prices further into the aforementioned 4hr supply area to consume all the sellers’ stops lurking above daily supply (levels above).[/I]

[I]If price positively closes below 4hr demand at 1304.77-1308.55 we can be quite confident it was indeed a fakeout without the need for price to rally higher in the 4hr supply area (levels above). If, however price consumes the 4hr supply area above (1342.30-1335.74), we can be pretty sure it is a continuation move. Only time will tell, but we definitely favor a fakeout

[/I]

[B]Pending/P.A confirmation orders:[/B]

[ul]

[li][B]No pending buy orders[/B] (Green line) are seen in the current market environment.[/li][li][B]P.A confirmation buy orders [/B](Red line) are seen just above the S/D flip area (1284.77-1280.53) at 1285.71. We have set a P.A confirmation buy order here simply because we could not find a logical area for the stop-loss order, so to avoid any deep spikes; we have decided to wait for confirmation.[/li][li][B]P.A confirmation buy orders [/B](Red line) are seen just above demand (1304.77-1308.55) at 1309.75. We did not think a pending buy order was wise here due to the amount of spikes/tails seen already to this area, hence the need to wait for confirmation.[/li][li][B]Pending sell orders [/B](Green line) are seen just below supply (1342.30-1335.74) at 1334.17. A pending sell order is set here because this is the likely area pro money will push prices to if indeed a fakeout of daily supply (1318.12-1331.08) is happening, thus a pending sell order is valid.[/li][li][B]No P.A confirmation sell orders[/B] (Red line) are seen in the current market environment.[/li][/ul]

[B]Quick Recap:[/B]

Exactly the same as the last analysis!

[I]The daily timeframe shows price is still trading around daily supply at 1318.12-1331.08. It is very difficult to see if the wick/spike above the aforementioned daily supply area was a genuine continuation move or a fakeout. The 4hr timeframe shows price is currently trading in between 4hr demand at 1304.77-1308.55 and 4hr supply at 1342.30-1335.74 with a break yet to be seen either side, however do watch these areas just mentioned as a break of either could very well answer our questions as to whether a fakeout of daily supply (1318.12-1331) is occurring.[/I]

[ul]

[li][B]Areas to watch for buy orders:[/B] [B]P.O:[/B] There are currently no pending buy orders seen in the current market environment. [B]P.A.C:[/B] 1285.71 (SL: (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed) 1309.75 (SL likely to be set at 1303.11 TP: Dependent on approaching price action after the level has been confirmed).[/li][li][B]Areas to watch for sell orders[/B]: [B]P.O: [/B]1334.17 SL: 1343.78 TP: Dependent on approaching price action) [B]P.A.C:[/B] There are currently no P.A confirmation sell orders seen in the current market environment.[/li][/ul]

EUR/USD:

[B]4hr TF.[/B]

The higher picture resembles the following:

[ul]

[li]Buyers and sellers still remain trading within weekly demand at 1.34760-1.36314.[/li][li]Trading remains capped between daily supply at 1.37297-1.36879 and daily demand below at 1.34760-1.35265.[/li][/ul]

On the 4hr timeframe the sellers pushed a little deeper into the support (which was a prior decision point level) at 1.36076 nearly touching base with the round number directly below at 1.36000.

An advance up to the decision point (supply) at 1.36632-1.36485 has recently been seen as reported may happen in the last analysis if indeed the buyers did confirm the aforementioned support. The reaction seen at the decision point supply area (levels above) was nearly to-the-pip with the sellers showing little sign of stopping just yet, as they are hammering price back down to the support level mentioned above.

A deeper test of the round number 1.36000 below is likely to be seen, how deep this test is, is very hard to determine at the moment. Take a quick look at the red-dashed uptrend line; this possibly resembles consumed demand here, so effectively a deep test could be seen all the way down to the low 1.35746.

Price now remains capped between the decision point supply area (levels above) and the low 1.35746. A break of either one of these areas will likely give us potential setups to consider. If price however would have positively broken the aforementioned decision point supply area, likely buys would be around support at 1.36076/1.36000 area.

[B]Pending/P.A confirmation orders:[/B]

[ul]

[li][B]No pending buy orders [/B](Green line) are seen in the current market environment.[/li][li][B]P.A confirmation buy orders [/B](Red line) are seen just above demand (1.35018-1.35375) at 1.35417. The reason behind us placing a P.A confirmation buy order here, rather than a pending buy order is because the aforementioned demand area appears weak as deep spikes have been seen recently (marked with two arrows).[/li][li][B]No pending sell orders [/B](Green line) are seen in the current market environment.[/li][li][B]P.A confirmation sell orders [/B](Red line) are seen just below supply (1.37224-1.37028) at 1.36894. A P.A.C order was selected here due to the reaction seen at the aforementioned supply area proving its validity. However, pro money may well decide to push price higher into this supply area if/when price returns to it, thus making it a risky trade for a stop above the high 1.36995 which could be very easily be stopped out if a pending sell order was set, hence the need to wait for confirmation.[/li][/ul]

[B]Quick Recap:[/B]

The decision point supply area at 1.36632-1.36485 has seen a to-the-pip touch as was reported may happen in the previous analysis if buyers proved support at 1.36076. A deeper test of the round number 1.36000 is expected soon, however how deep is very hard to determine, but our overall bias still remains long.

[ul]

[li][B]Areas to watch for buy orders:[/B] [B]P.O:[/B] No pending buy orders are seen in the current market environment. [B]P.A.C: [/B]1.35417 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).[/li][li][B]Areas to watch for sell orders[/B]: [B]P.O:[/B] No pending sell orders are seen in the current market environment. [B]P.A.C:[/B] 1.36894 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed)[/li][/ul]

GBP/USD:

[B]4hr TF.[/B]

The higher picture resembles the following:

[ul]

[li]Buyers are still seen deep within weekly supply territory at 1.76297-1.67702, with a little interest being shown by the sellers at the moment.[/li][li]The daily timeframe still shows price is currently trading in no man’s land between daily supply above at 1.76297-1.73024 and daily S/R flip level seen below at 1.69712.[/li][/ul]

The minor 4hr supply area seen circled at 1.71371 has been well and truly consumed. Notice how easy price sliced through the ‘wicky’ action to the left on the rally up, this was because there was very little supply left there.

If the round number 1.71000 did not appear weak (buyers are possibly consumed here due to the tail marked fakeout) we would have definitely considered entering long here as price could very well rally hard to the round number above at 1.72000.

Still, we are staying with our original hypothesis in the last analysis: ‘[I]The round number 1.71000 appears to be consumed already, meaning there are not likely very many buyers left there, so a deeper test may be in order down to the 4hr S/R flip area at 1.70617-1.70459 before a rally higher is seen’.[/I] The reason being is pro money will likely require liquidity in the form of sell orders to buy into, and with little buyers currently seen here (1.71000), pro money will likely have to trade deeper to allow breakout sellers to follow suit thus once pro money does decide to buy then have the sellers’ orders to use whether these sell orders will be enough to fill their massive quota is anyone’s guess!

[B]Pending/P.A confirmation orders:[/B]

[ul]

[li][B]No pending buy orders [/B](Green line) are seen in the current market environment.[/li][li][B]P.A confirmation buy orders [/B](Red line) are seen just above demand (1.70617-1.70459) at 1.70662. A reaction north is likely to be seen here as there is no doubt unfilled buy orders left around this area when pro money made the ‘decision’ to push higher. However deep spikes can occur around flip areas (levels above) such as these, hence the need to wait for confirmation.[/li][li][B]No pending sell orders [/B](Green line) are seen in the current market environment.[/li][li][B]P.A confirmation sell orders [/B](Red line) are seen just below the round number 1.72000 at 1.71943. We have placed a P.A confirmation sell order here simply because these psychological levels are prone to deep tests/spikes, so sometimes it is better to wait for that all important confirmation.[/li][/ul]

[B]Quick Recap:[/B]

The minor 4hr supply area (circled) at 1.71371 has been consumed. Meaning the path to the upside should be relatively clear to around the round number 1.72000. Before this happens though we must expect a deep test of the round number 1.71000 possibly hitting the 4hr S/D flip area below at 1.70617-1.70459 which in turn will trigger our P.A confirmation buy order set at 1.70662 before higher prices are seen.

[ul]

[li][B]Areas to watch for buy orders:[/B] [B]P.O:[/B] No pending buy orders seen in the current market environment. [B]P.A.C:[/B] 1.70662 (likely to be set at 1.70423 TP: Dependent on approaching price action after the level has been confirmed).[/li][li][B]Areas to watch for sell orders[/B]: [B]P.O: [/B]No pending sell orders seen in the current market environment. [B]P.A.C: [/B]1.71943 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).[/li][/ul]

AUD/USD:

[B]Daily TF.[/B]

In the last analysis it was reported a bearish pin bar pattern WAS forming, once the candle closed it resembled no similarity whatsoever to a bearish pin bar! Price however nearly touched daily supply (30 pips or so) at 0.95425-0.94852 before dropping like a rock!

[B]4hr TF.[/B]

What a beautiful site that is! Look at the way price reacted to our 4hr decision point level at 0.94408. Clearly pro money pushed price hard north, but not without stopping out a ton of buyers in the process, look at the tail marked with an arrow. These are the situations where one enters into a trade, price stops you out, and then shoots off to your designated target(s), and I am sure we all know how frustrating that is!

Once price hit the aforementioned decision point level, the sellers took control with buyers beginning to show interest around the 0.93671 area. A small retracement may well be seen from here, but overall we believe price still has a little way to drop first to at least the 4hr demand area at 0.93208-0.93417, so anyone who is short, don’t go bailing just yet!

[B]Pending/P.A confirmation orders:[/B]

[ul]

[li][B]No pending buy orders [/B](Green line) are seen in the current market environment.[/li][li][B]P.A confirmation buy orders [/B](Red line) are seen just above the decision point level (0.92566-0.92736) at 0.92775. The reason for placing a P.A confirmation buy order here rather than pending buy order is simply because we were trading just above a daily demand ‘buy zone’ at 0.92046-0.92354, meaning pro money could very well just ignore this level completely and trade deeper into the aforementioned daily demand area, so, confirmation is the order of the day![/li][li][B]Pending sell orders [/B](Green line) are seen just below supply (0.95425-0.95096) at 0.95052. A pending sell order is placed here due to this being an area where pro money was interested in before; see how close price came to the supply area? (Levels above), this indicates possible strong supply (selling pressure), so the next time price visits we can expect some sort of reaction.[/li][li][B]The pending sell order [/B](Green line) set just below the decision point level (0.94408) at 0.94382 [B]is now active. Our first take-profit target has been hit at 0.93678, so do keep an eye on our second target seen within 4hr demand below (0.93208-0.93417) at 0.93360.[/B][/li][li][B]The P.A confirmation sell order [/B](Red line) set just below the round number 094000 at 0.93959[B]has been cancelled, price rallied too far away from the entry level to remain valid.[/B][/li][/ul]

[B]Quick Recap:[/B]

The sellers are well and truly in control on the daily timeframe just missing daily supply at 0.95425-0.94852 in the process. Our pending sell order set just below a decision point level (0.94408) at 0.94382 has been filled with our first take profit level being hit shortly after at 0.93678. Buying interest is being seen where our first take profit level was, this is no need for panic as it is totally expected! Price will likely continue south until at least hitting 4hr demand area below at 0.93208-0.93417 where a bigger bullish reaction is likely to be seen.

[ul]

[li][B]Areas to watch for buy orders:[/B] [B]P.O: [/B]No pending buy orders seen in the current market environment. [B]P.A.C:[/B] 0.92775 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).[/li][li][B]Areas to watch for sell orders[/B]: [B]P.O:[/B] 0.95052 (SL: 0.95467 TP: Depending on price approach) 0.94382 [B](Active-1[SUP]st[/SUP] target hit)[/B] (SL: 0.94677 TP: [1] [B]0.93678[/B] [2] 0.93360 [3] 0.93000. [B]P.A.C:[/B] No P.A confirmation sell orders seen in the current market environment.[/li][/ul]

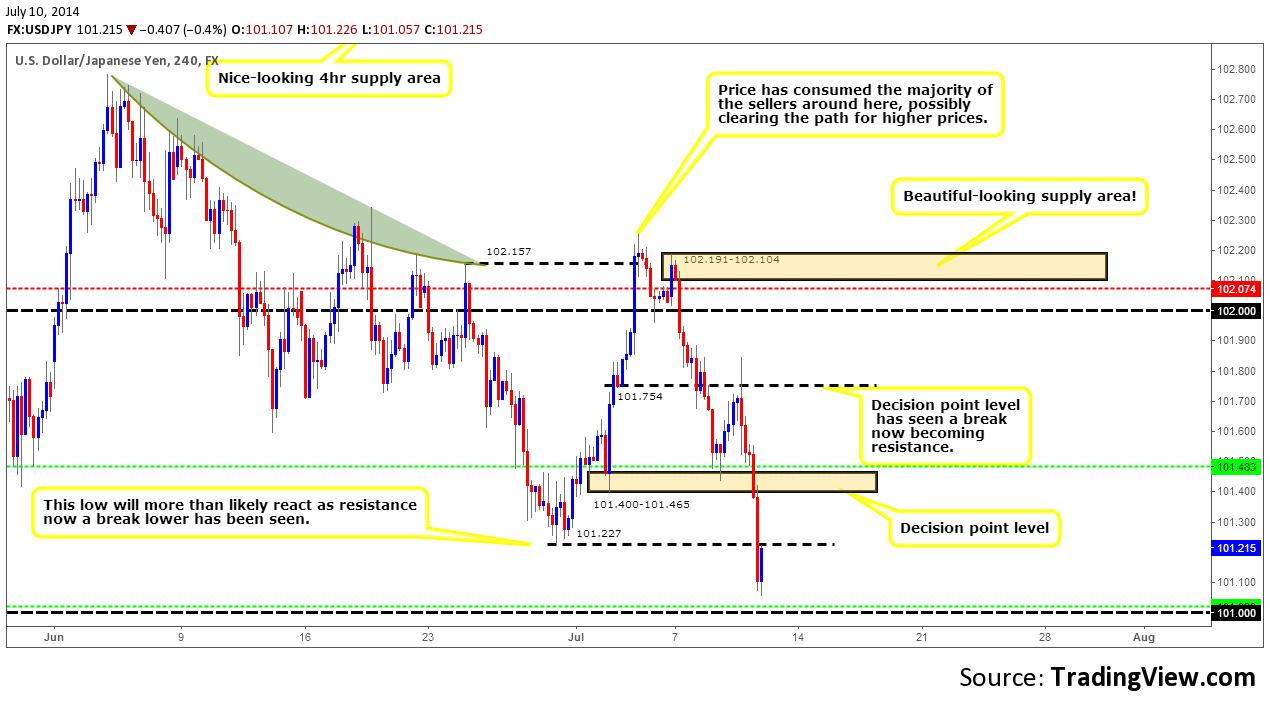

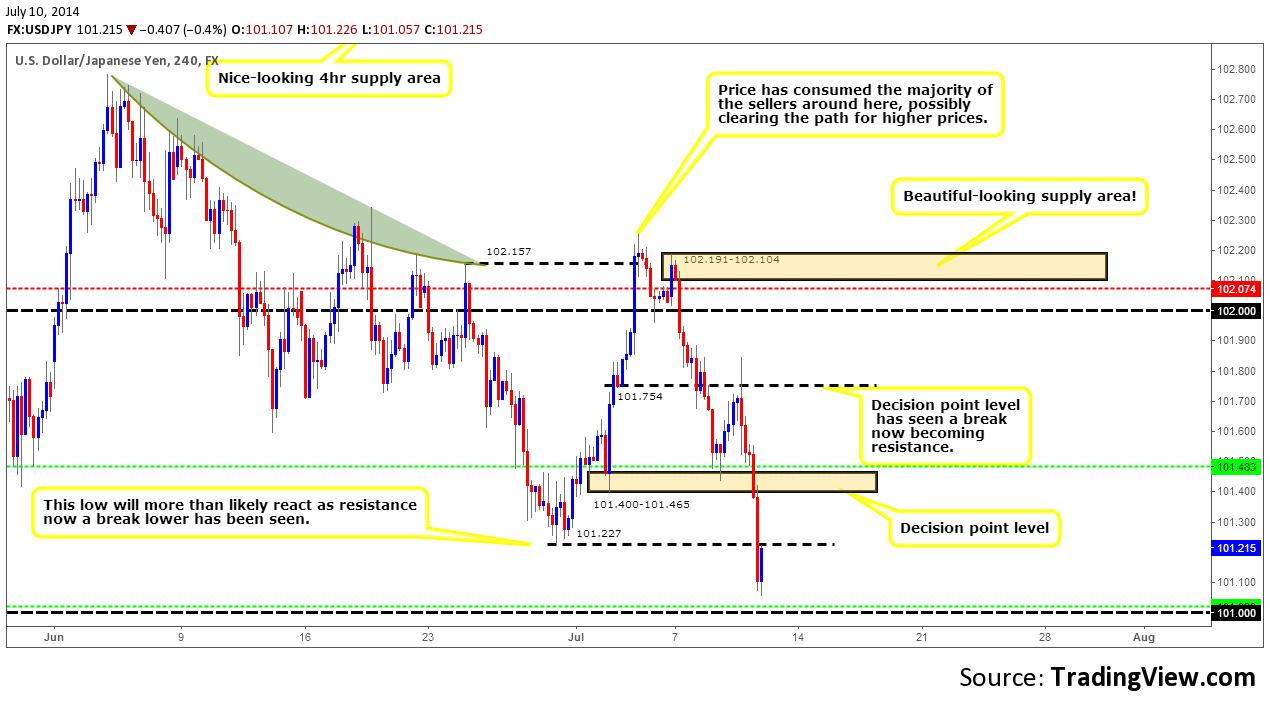

USD/JPY:

[B]4hr TF.[/B]

The higher picture resembles the following:

[ul]

[li]The weekly timeframe shows price is trading around a long-term S/R flip level support at 101.206 with a positive close below yet to be seen.[/li][li]Buyers and sellers on the daily timeframe are currently trading within a range with resistance being seen above at 102.713 and daily demand seen below at 100.747-100.967.[/li][/ul]

On the 4hr timeframe, a mean-looking wick is seen above the 101.754 resistance level indicating the buyers could not overcome the sellers around this area. The sellers have remained control ever since with some serious selling being recently seen! However do not forget, on the weekly timeframe, all this represents is the sellers have sold into higher-timeframe support at 101.206.

A positive close below the low 101.227 has been seen, price is now relatively clear all the way down to the round number below at 101.000 where the buyers are likely to make an appearance soon, as if you remember we are not only now trading at only weekly demand (levels above), we are also entering a daily demand buy zone at 100.747-100.967 so higher prices are still naturally expected from around the round number 101.000 area.

[B]Pending/P.A confirmation orders:[/B]

[ul]

[li][B]The pending buy order [/B](Green line) set just above the decision-point level (101.400-101.465) at[B]101.483 is now closed in profit as the first take profit target was hit at 101.754.[/B][/li][li][B]New pending buy orders [/B](Green line) are seen just above the round number 101.000 at 101.020. The reason for setting a pending buy order here is because we are currently trading around weekly and Daily demand areas (101.206…100.747-100.967). We would not normally set a pending order around psychological levels such as these, but since we are in a great higher –timeframe location it is worth the risk (Weekly: 101.206 Daily demand: 100.747-100.967).[/li][li][B]No P.A confirmation buy orders[/B] (Red line) are seen in the current market environment.[/li][li][B]Pending sell orders [/B](Green line) are seen just below supply (103.294-102.983) at 102.953. A pending sell order was set here due to this being an area where likely unfilled sell orders are.[/li][li][B]P.A confirmation sell orders[/B] (Red line) are seen just below supply (102-191-102.104) at 102.074. A P.A confirmation order was used here purely for the simple fact we are trading around a higher-timeframe weekly support level at 102.206 meaning we may see a small reaction, but nothing to write home about, hence the need for confirmation![/li][/ul]

[B]Quick Recap:[/B]

Our pending buy order set just above the 4hr decision point level (101.400-101.465) at 101.483 hit its first target at 101.754 then dropped like a rock. Price now remains trading between the round number 101.000 and the prior support at 101.227 which is now resistance. A spike down through the aforementioned round number will likely be seen before we see a break of the resistance level above at 101.227 which will also see our pending buy order set at 101.020 filled in the process.

[ul]

[li][B]Areas to watch for buy orders:[/B] [B]P.O: 101.483 (Closed in profit)[/B] (SL: 101.375 TP: [1] 101.754 [2] 102.000) 101.020 (SL: 100.786 TP: Dependent on price approach).[B]P.A.C:[/B] No P.A confirmation buy orders are seen in the current market environment.[/li][li][B]Areas to watch for sell orders[/B]: [B]P.O:[/B] 102.953 (SL: 103.317 TP: Dependent on price approach).[B]P.A.C:[/B]102.074 (SL: 102.214 TP: Dependent on approaching price action after the level has been confirmed).[/li][/ul]

EUR/GBP:

[B]Daily TF.[/B]

Price is currently seen reacting to a minor S/R flip level at 0.79581 where, at the time of writing a bearish pin bar is currently being seen, but as we all know this could very well change by the time the daily candle closes.

[B]4hr TF.[/B]

It was reported in the last analysis that we should be prepared for price to retrace a little to the 4hr minor demand (circled) at around the 0.79388 area before a break above temporary 4hr resistance at 0.79586-0.79534 is seen.

Price broke above the aforementioned temporary resistance area straight into our S/R flip level at 0.79679 where a strong bearish reaction followed. At the moment the sellers are steaming south, however they may find a little buying interest around the minor circled demand area mentioned above. If we see a break below, price could very well drop straight to the low 0.79139. The reason price could drop that far is because of the tail marked with an arrow, this tail was likely used to collect orders for the original advance, but in the meantime, it consumed buyers, thus clearing the path for sellers.

[B]Pending/P.A confirmation orders:[/B]

[ul]

[li][B]Pending buy orders[/B] (Green line) are seen just above demand (0.78862-0.79048) at 0.79076. A pending buy order is placed here due to the aforementioned 4hr demand area’s location in the higher timeframes (Within the compressed green arc from weekly demand: 0.76931-0.78623… Seen on Monday 7[SUP]th[/SUP] July analysis), and daily demand at 0.78862-0.79206.[/li][li][B]No P.A confirmation buy orders[/B] (Red line) are seen in the current market environment.[/li][li][B]The pending sell order[/B] (Green line) set just below the S/R flip level (0.79679) at 0.79641 [B]is now active. Our first target has been hit at 0.79388, so do keep an eye on our second target below at 0.79139.[/B][/li][li][B]No P.A confirmation sell orders[/B] (Red line) are seen in the current market environment.[/li][/ul]

[B]Quick Recap:[/B]

The daily timeframe is showing weakness around the daily S/R flip level at 0.79581 where, at the time of writing a bearish pin bar is currently being seen. Our pending sell order set just below the 4hr S/R flip level (0.79679) at 0.79641 has now been filled with our first take profit level being hit shortly after at 0.79388. . If we see a break below this price could very well drop straight to the low below at 0.79139 which is our second and final target level.

[ul]

[li][B]Areas to watch for buy orders: P.O: [/B]0.79076 (SL: 0.78846 TP: Dependent on price approach)[B]P.A.C: [/B]No P.A confirmation buy orders are seen in the current market environment.[/li][li][B]Areas to watch for sell orders[/B]: [B]P.O:[/B] [B]0.79641 (Active)[/B] (SL: 0.79747 TP: [1[B]] 0.79388[/B] [2] 0.79139).[B]P.A.C:[/B] No P.A confirmation sell orders are seen in the current market environment.[/li][/ul]

USD/CAD:

[B]4hr TF.[/B]

The higher picture resembles the following:

[ul]

[li]Price is currently seen trading quite deep within weekly demand at 1.05715-1.07008.[/li][li]Much like the weekly timeframe above, the daily timeframe shows price is currently trading within daily demand at 1.05874-1.06680.[/li][/ul]

Considering the higher-timeframe picture (see above), higher prices was and still is expected to be seen. A break south of the minor S/R flip level at 1.06660 happened recently with the sellers nearly once again hitting 4hr demand below at 1.06041-1.06312 as reported may happen in the last analysis.

As already mentioned above higher prices are expected soon, it is very likely we will now visit at least the round number above at 1.07000 sometime soon. However as most already know, pro money love to play tricks, so they may push price deeper into the aforementioned 4hr demand area stopping out a lot of traders who were long, then loading up the boat once more for a nice rally higher.

[B]Pending/P.A confirmation orders:[/B]

[ul]

[li][B]Pending buy orders [/B](Green line) are seen within demand (1.06041-1.06312) at 1.06229. Price will likely see a retracement into this demand area, and a bullish reaction will likely follow, as we are currently in higher timeframe demand (Weekly demand: 1.05715-1.07008 Daily demand: 1.05874-1.06680).[/li][li][B]The pending buy order [/B](Green line) set just above demand (1.06041-1.06312) at 1.06462 [B]is now active, so do keep an eye on our first target set at the round number 1.07000.[/B][/li][li][B]No P.A confirmation buy orders[/B] (Red line) are seen in the current market environment.[/li][li][B]Pending sell orders [/B](Green line) are seen just below a small supply area (1.07508-1.07434) at 1.07386. A pending sell order has been set here since a bounce from this area will likely be seen if/when price reaches here, as the momentum from this area was quite strong, indicating unfilled sell orders may still be set there.[/li][li][B]No P.A confirmation sell orders[/B] (Red line) are seen in the current market environment.[/li][/ul]

[B]Quick Recap:[/B]

With the higher timeframes indicating buy positions (Weekly demand: 1.05715-1.07008 Daily demand: 1.05874-1.06680) higher prices are naturally to be expected. A decline in value was seen on the 4hr timeframe right into our first pending buy order set just above 4hr demand (1.06041-1.06312) at 1.06462. It would be great to say price will rocket straight to our first target at 1.07000, however we have to prepared for a retracement back into the 4hr demand area (levels above) before higher prices are more, shall we say, expected.

[ul]

[li][B]Areas to watch for buy orders:[/B] [B]P.O: [/B]1.06229 SL: 1.05951 TP: Dependent on price approach)[B]1.06462[/B] B[/B] (SL: 1.05951 TP: [1] 1.07000 [2]1.07386 [May be subject to change]) [B]P.A.C:[/B] There are no P.A confirmation buy orders seen within the current market environment.[/li][li][B]Areas to watch for sell orders[/B]: [B]P.O:[/B]1.07386 (SL: 1.07541 TP: Dependent on price approach)[B]P.A.C:[/B] There are no P.A confirmation sell orders seen within the current market environment.[/li][/ul]

USD/CHF:

[B]4hr TF.[/B]

The higher picture resembles the following:

[ul]

[li]The weekly timeframe is showing price consolidating just above weekly demand at 0.85664-0.88124[/li][li]Daily supply at 0.90372-0.90042 has seen a lot of action over the past few weeks with no break north seen yet. Price is currently capped between the daily supply level just mentioned above and the daily S/R flip level below at 0.88608.[/li][/ul]

A strong break below the low 0.89245 has recently been seen just missing the round number at 0.89000 by a couple of pips! The buyers then took over, a small reaction at the resistance which was prior support (low – levels above) was seen, but at the time of writing, the sellers seem too weak for the buying onslaught currently taking place.

Take a quick a look at the small purple trend line, this is not to resemble a trend as such, it is more to show how pro money have likely consumed supply/sellers as price was dropping possibly clearing the path for a nice advance back up to the high 0.89557.

However, we must expect the unexpected in these markets, right? A retracement could possibly be seen back down to the 0.89042 area where price initially decided to rally from before we could expect price to reach the aforementioned highs at 0.89557.

[B]Pending/P.A confirmation orders:[/B]

[ul]

[li][B]New pending buy orders [/B](Green line) are seen just above the round number 0.89000 at 0.89042. The reasoning behind placing a pending buy order and not a P.A confirmation buy order here is simply because we expect this area to see a reaction, as a decision was clearly made to rally prices in the first place. Agreed, it is not ideal, as on this timeframe there is not really any logical area for a stop loss order, well a tight one anyways.[/li][li][B]P.A confirmation buy orders [/B](Red line) are seen just above the low 0.88546 at 0.88586. The reason that a P.A confirmation buy order was set here rather than a pending buy order was simply because there is no logical area for a stop loss, and the low (level above) will be likely prone to deep tests, or worse, a positive break below, hence the need to wait for confirmation.[/li][li][B]New pending sell orders [/B](Green line) are seen just below the highs 0.89557 at 0.89514. The reasoning behind setting a pending sell order here is simply because the sellers proved to us that this level is worthy by consuming the buyers around the low 0.89245, thus permitting us to set this type of order.[/li][li][B]No P.A confirmation sell orders [/B](Red line) are seen in the current market environment.[/li][/ul]

[B]Quick Recap:[/B]

A positive break below the low 0.89245 has recently been seen; price did nearly as expected as price just missed the round number below at 0.89000. A likely retracement will probably happen from here back down to the aforementioned round number before higher prices are seen.

[ul]

[li][B]Areas to watch for buy orders[/B]: P.O: 0.89042 (SL: 0.88886 TP: Dependent on price approach).[B]P.A.C:[/B] 0.88586 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).[/li][li][B]Areas to watch for sell orders[/B]: [B]P.O:[/B] 0.89514 (SL 0.89624 TP: Dependent on price approach).[B]P.A.C [/B]There are currently no P.A confirmation sell orders seen in the current market environment.[/li][/ul]

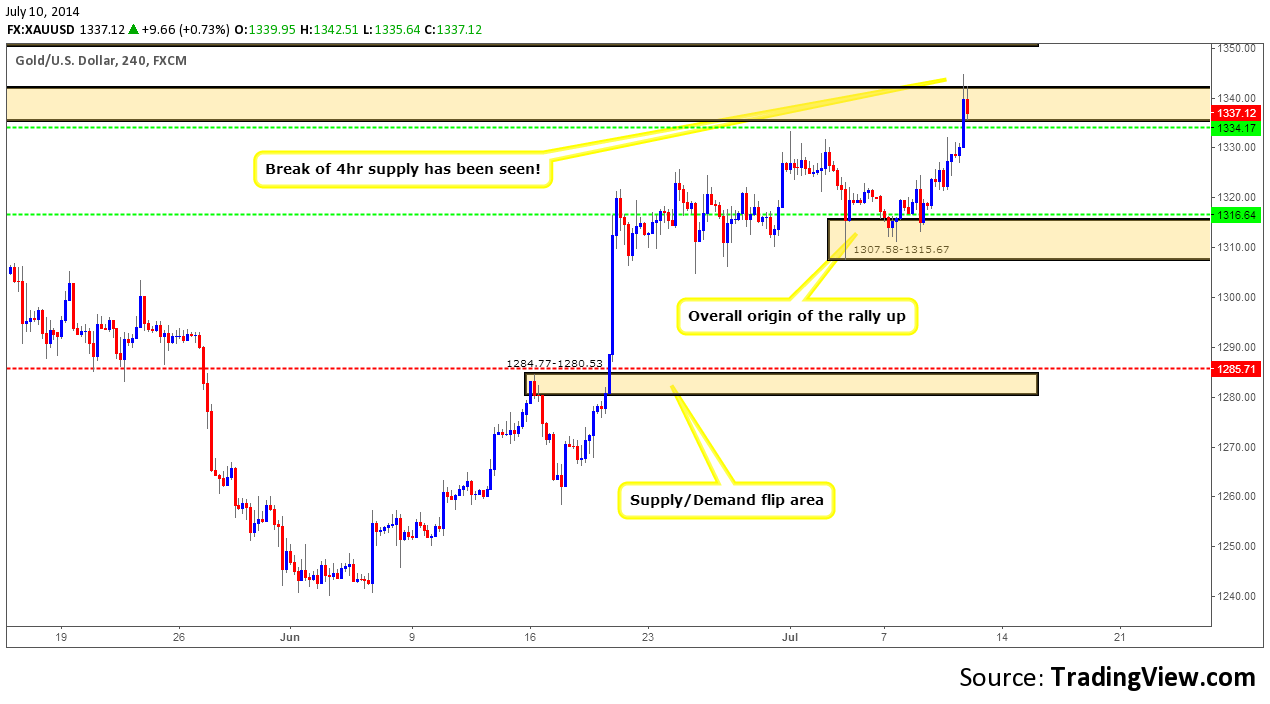

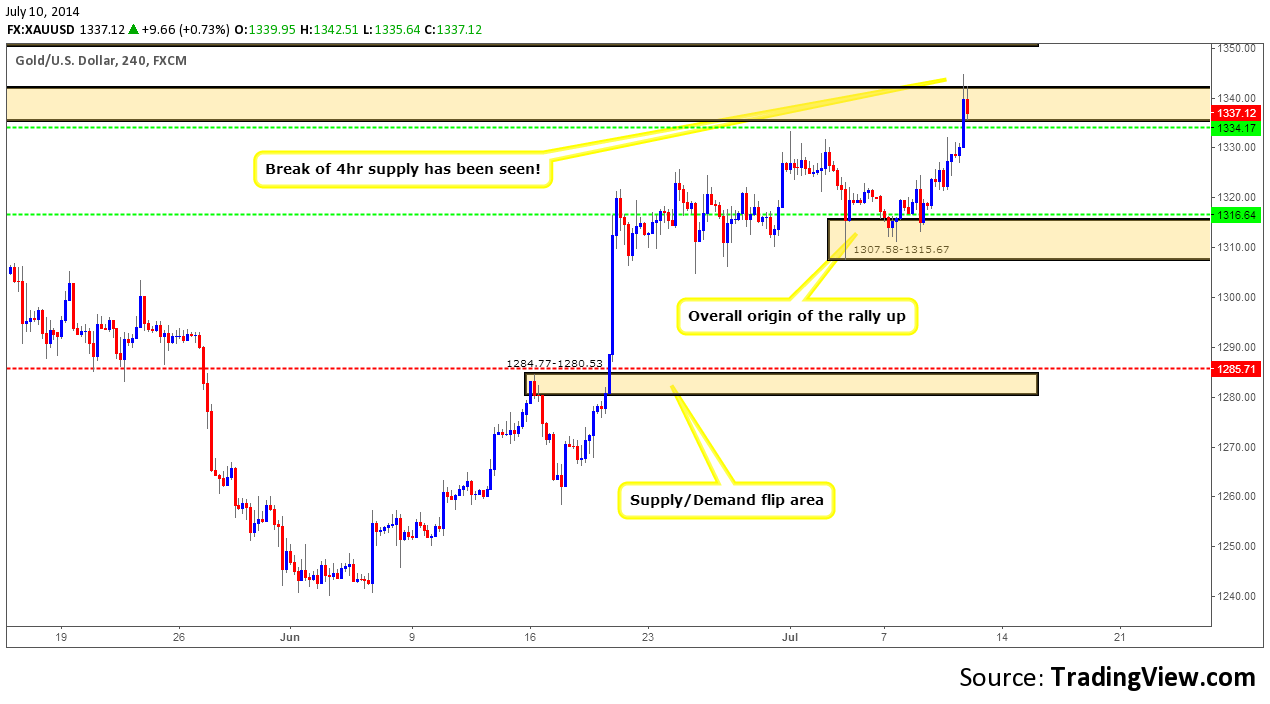

XAU/USD (GOLD)

[B]Daily TF.[/B]

A strong push above daily supply at 1318.12-1331.08 has been seen, price is now free to rally all the way up to major daily supply above at 1391.97-1366.80.

[B]4hr TF.[/B]

Price has seen a strong advance possibly consuming the majority of the sellers in and around 4hr supply at 1342.30-1335.74. Logically speaking, price is now free to hit the above 4hr supply at 1363.99-1350.62, however before it does that, price could very well drop to 4hr demand below at 1307.58-1315.67.

[B]Pending/P.A confirmation orders:[/B]

[ul]

[li][B]New pending buy orders[/B] (Green line) are seen just above demand (1307.58-1315.67) at 1316.64. A pending buy order was set here purely because of the fact this was the origin of the rally up into supply at 1342.30-1335.74, and when price returns to the origin a reaction is normally seen.[/li][li][B]P.A confirmation buy orders [/B](Red line) are seen just above the S/D flip area (1284.77-1280.53) at 1285.71. We have set a P.A confirmation buy order here simply because we could not find a logical area for the stop-loss order, so to avoid any deep spikes; we have decided to wait for confirmation.[/li][li][B]The pending sell order [/B](Green line) set just below supply (1342.30-1335.74) at 1334.17 has been stopped out.[/li][li][B]No P.A confirmation sell orders[/B] (Red line) are seen in the current market environment.[/li][/ul]

[B]Quick Recap:[/B]

The buyers have pushed above daily supply at 1318.12-1331.08 opening the possibility to higher s prices up to oncoming daily supply at 1391.97-1366.80. Likewise the 4hr timeframe has seen a break above 4hr supply at 1342.30-1335.74 opening the possibly to higher prices up to oncoming 4hr supply at 1363.99-1350.62. However do remain aware a retracement could very well be seen on the 4hr timeframe right down to 4hr demand at 1307.58-1315.67 before we hit the upper 4hr supply area just mentioned.

[ul]

[li][B]Areas to watch for buy orders:[/B] [B]P.O:[/B] 1316.64 (SL: 1306.01 TP: Dependent on price action approach). [B]P.A.C:[/B] 1285.71 (SL: (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).[/li][li][B]Areas to watch for sell orders[/B]: [B]P.O: [/B]There are currently no pending sell orders seen in the current market environment. [B]P.A.C:[/B] There are currently no P.A confirmation sell orders seen in the current market environment.[/li][/ul]