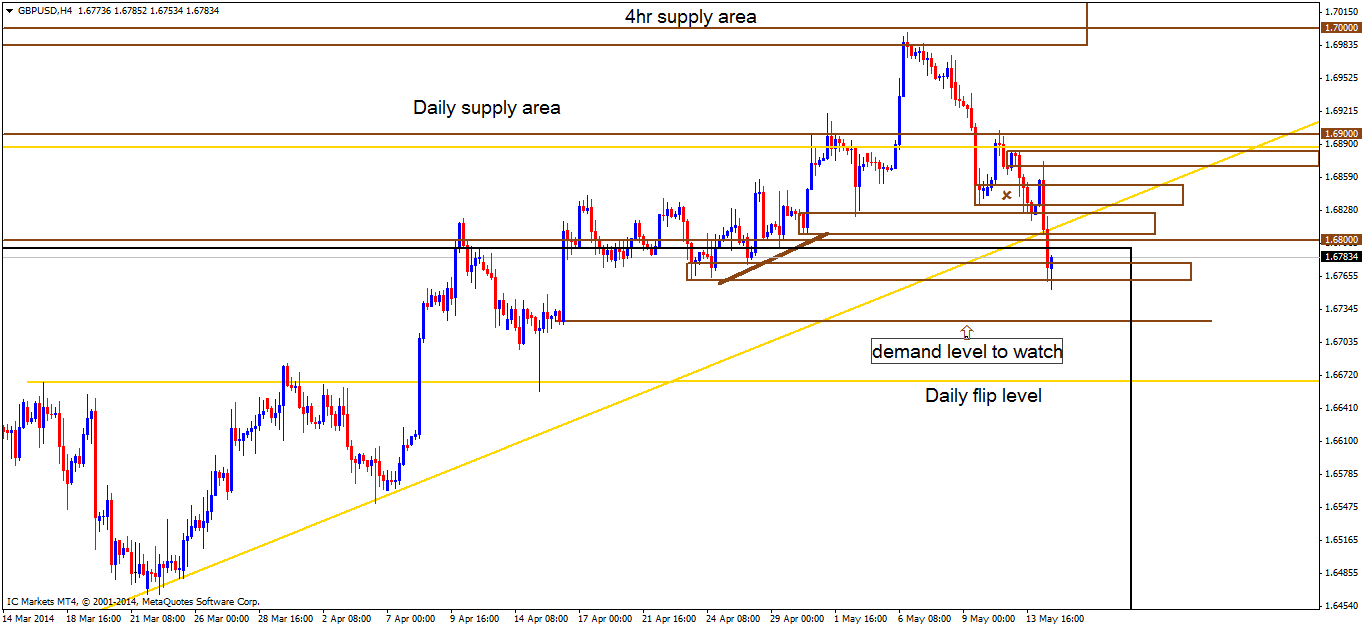

GBP/USD

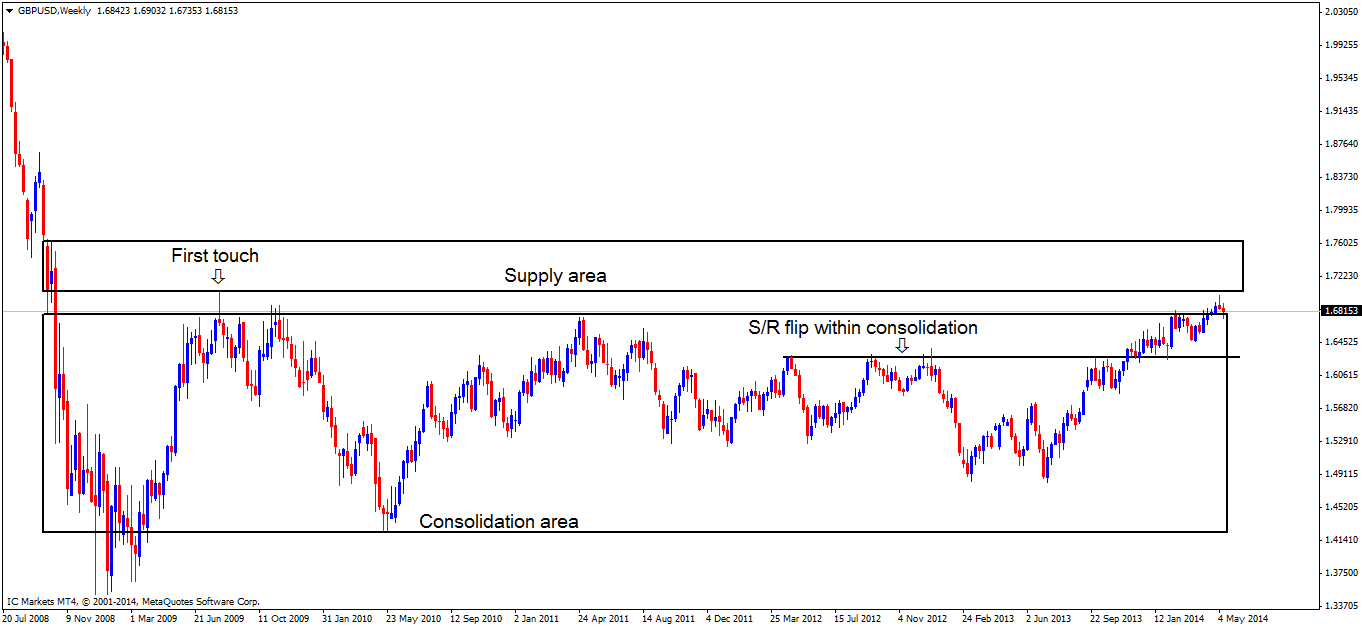

Weekly TF.

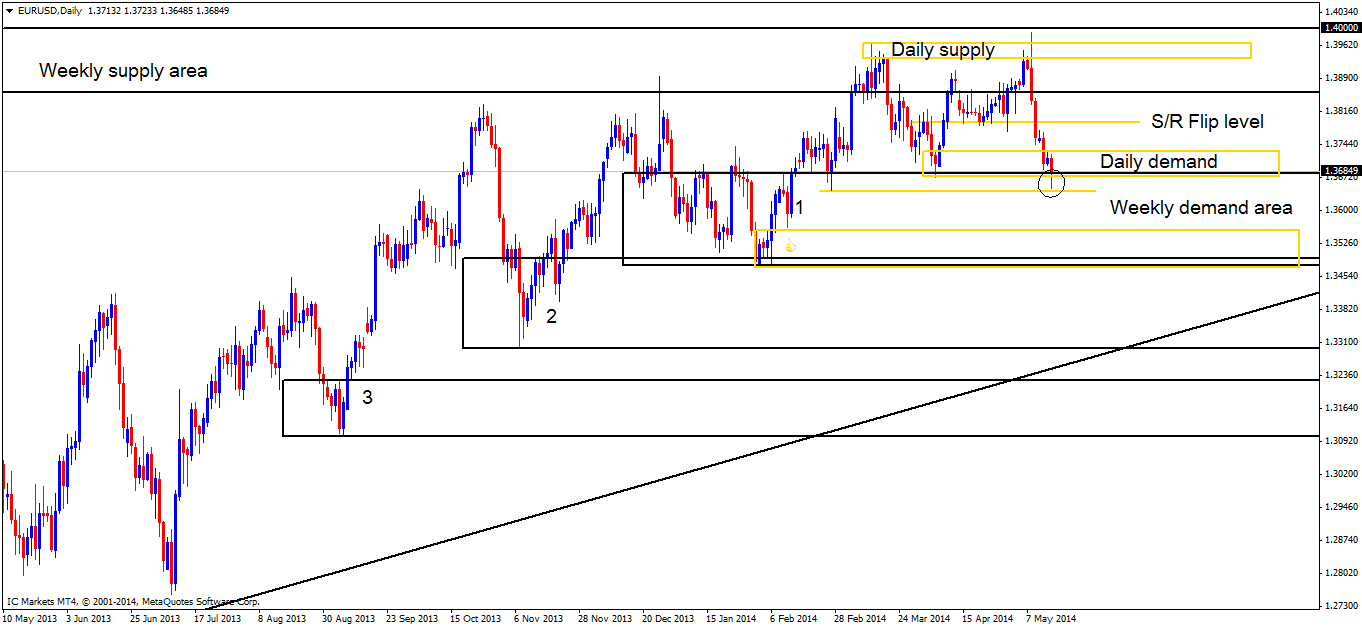

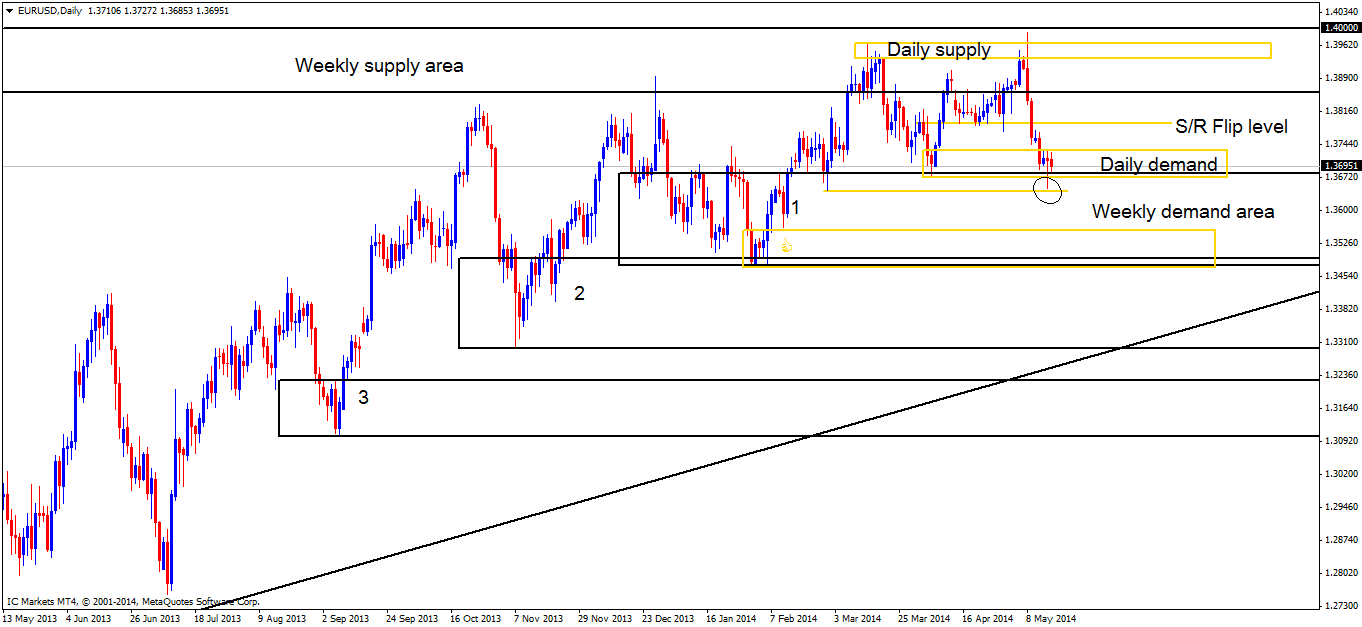

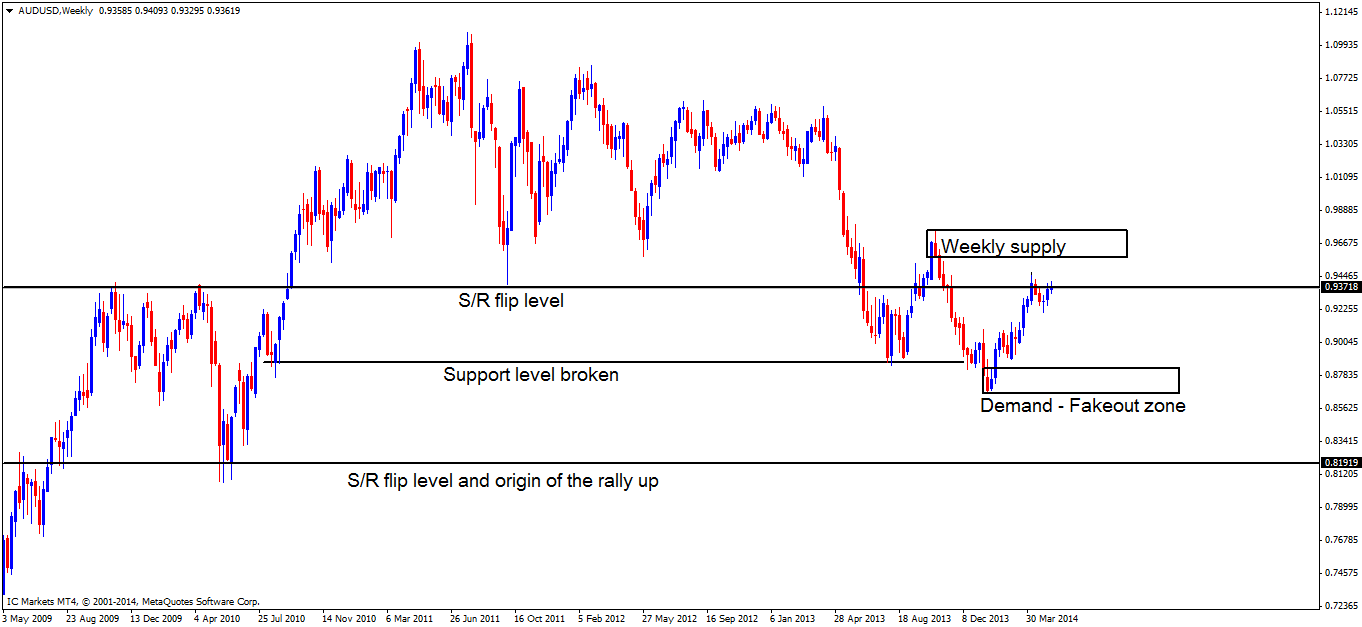

Considering the bearish reaction seen two weeks ago with buyers failing to reach the weekly supply area at 1.76290 – 1.70490, more bearish price action was seen with last week’s candle closing below the previous week’s close at 1.68153. Price is now seen trading at support which was prior long-term resistance to the weekly consolidation zone (1.67980 – 1.42273). Over the next coming weeks, it will become more apparent as to whether current price action is merely a fakeout above the consolidation area (levels above) similar to back in 2009 (first touch) or a continuation move higher.

Lower-timeframe analysis may provide more details.

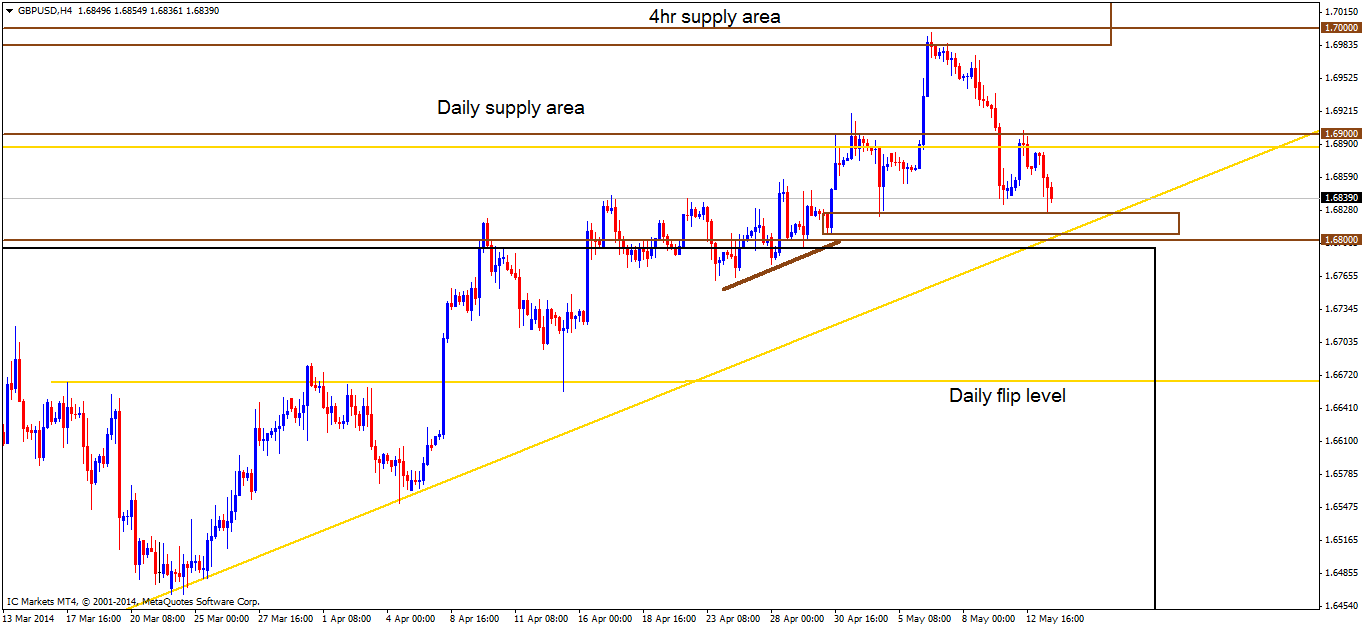

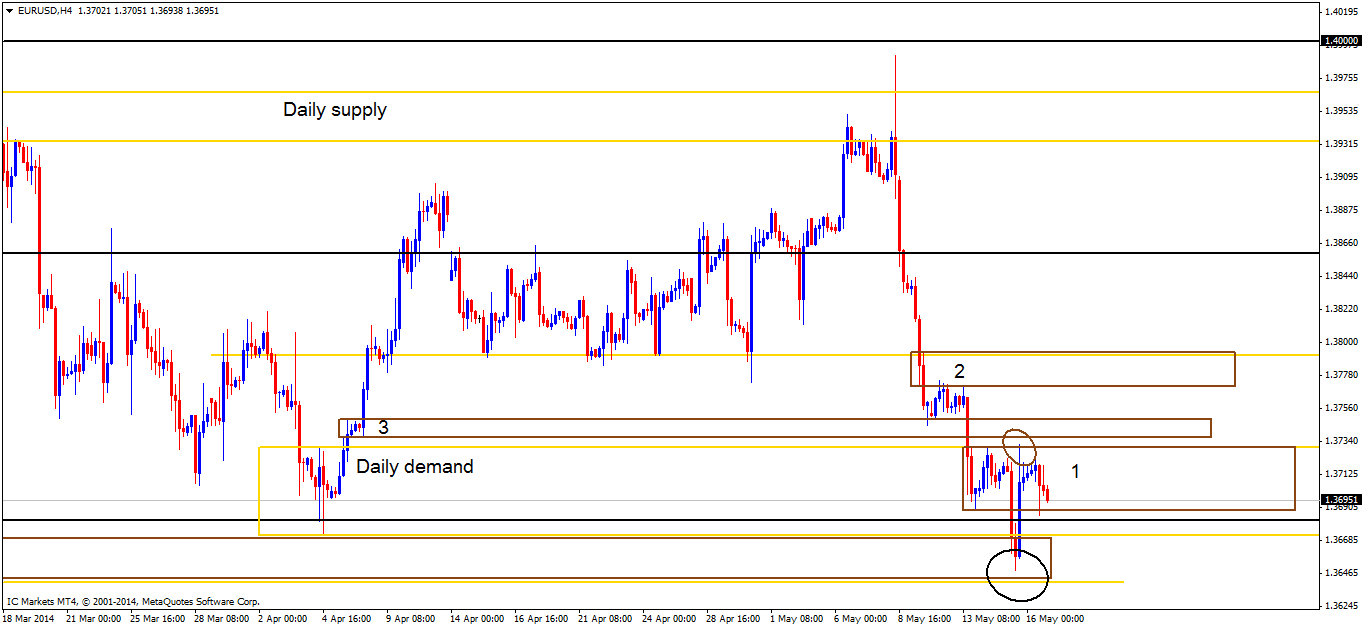

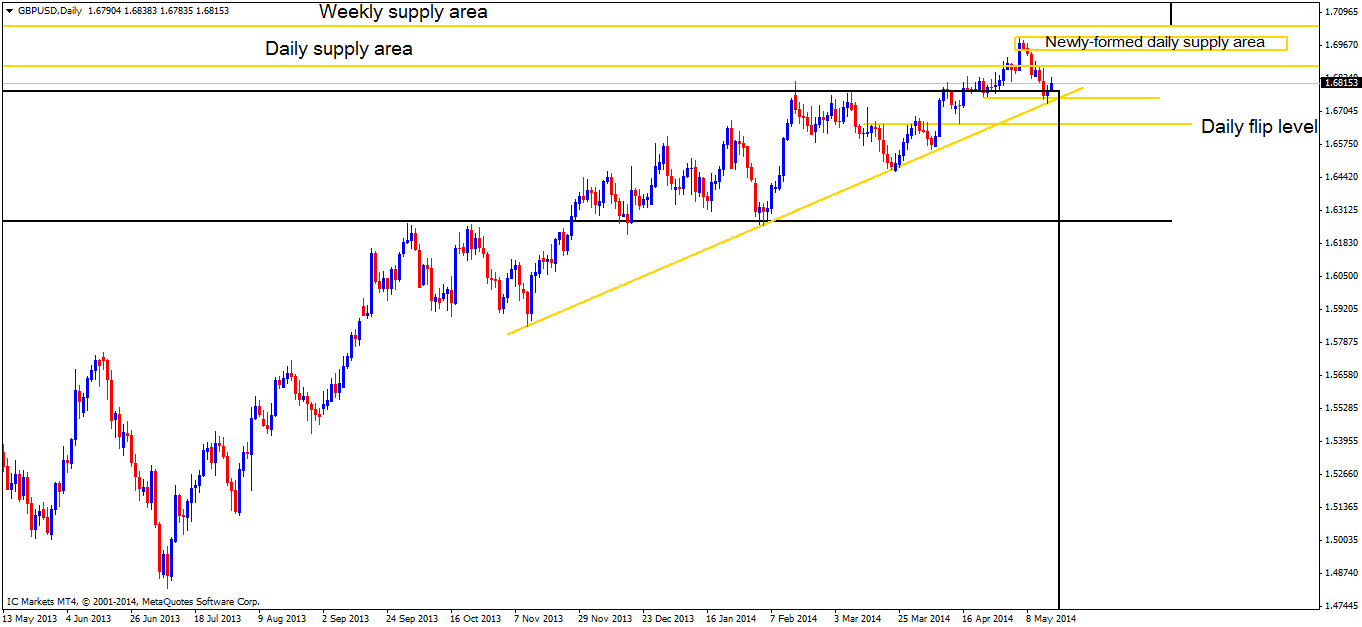

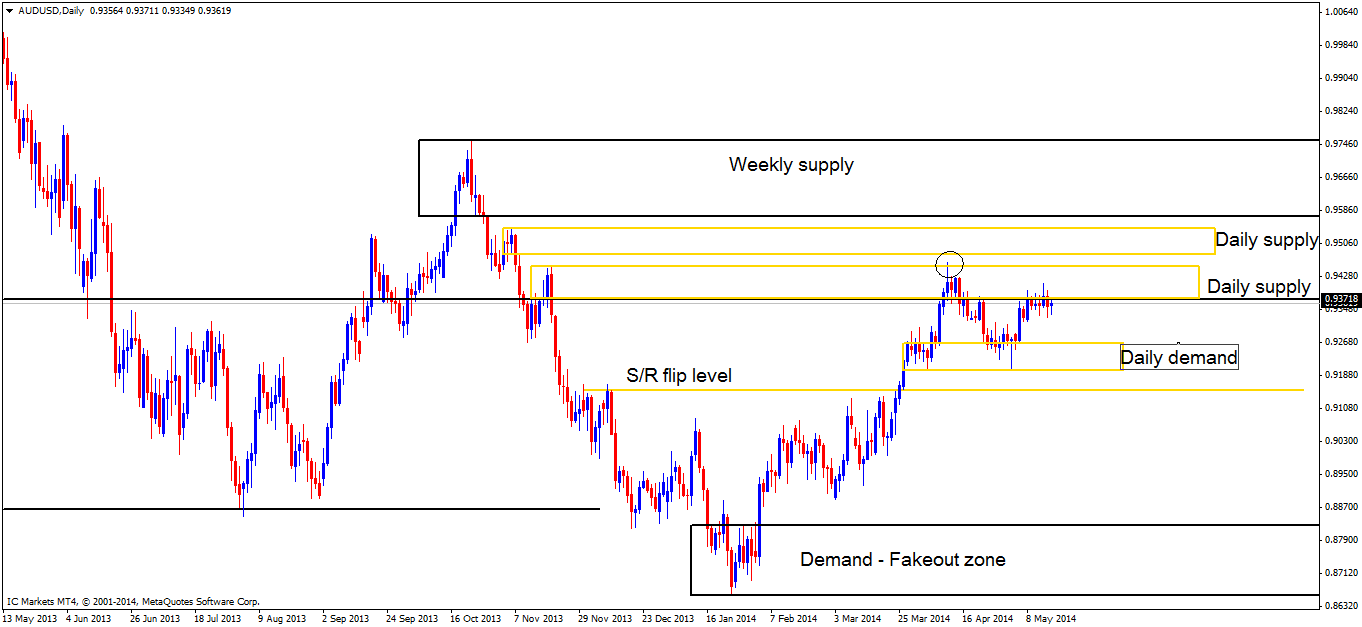

Daily TF.

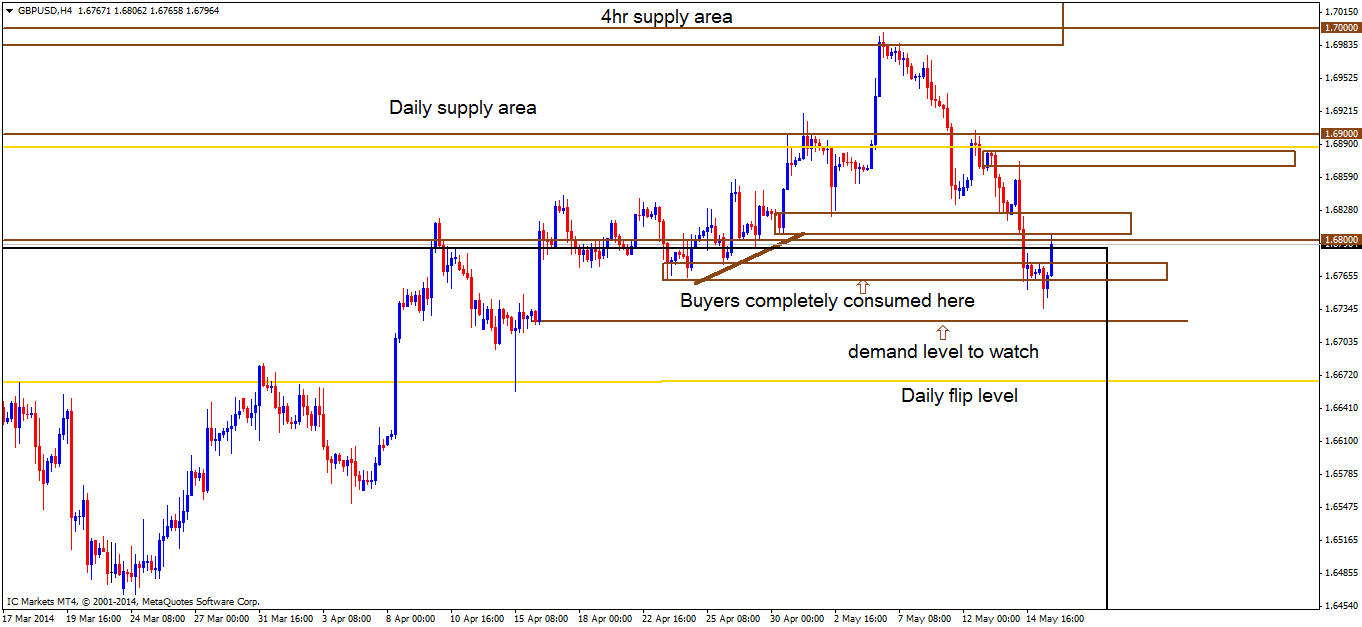

This timeframe shows price dropped from a daily supply area at 1.70410 – 1.68880 and has seen a ‘standard’ reaction thus far. The low 1.67622 provided support to the market along with daily trendline confluence. A newly-formed supply area at 1.69963 – 1.69514 has been spotted within current daily supply (levels above).

The low just mentioned (1.67622) has cleared out the majority of buyers around this area with a sneaky spike down. A per this timeframe, price may rally up to the newly-formed supply area (levels above) to collect liquidity for a further push down to the S/R flip level at 1.66630.

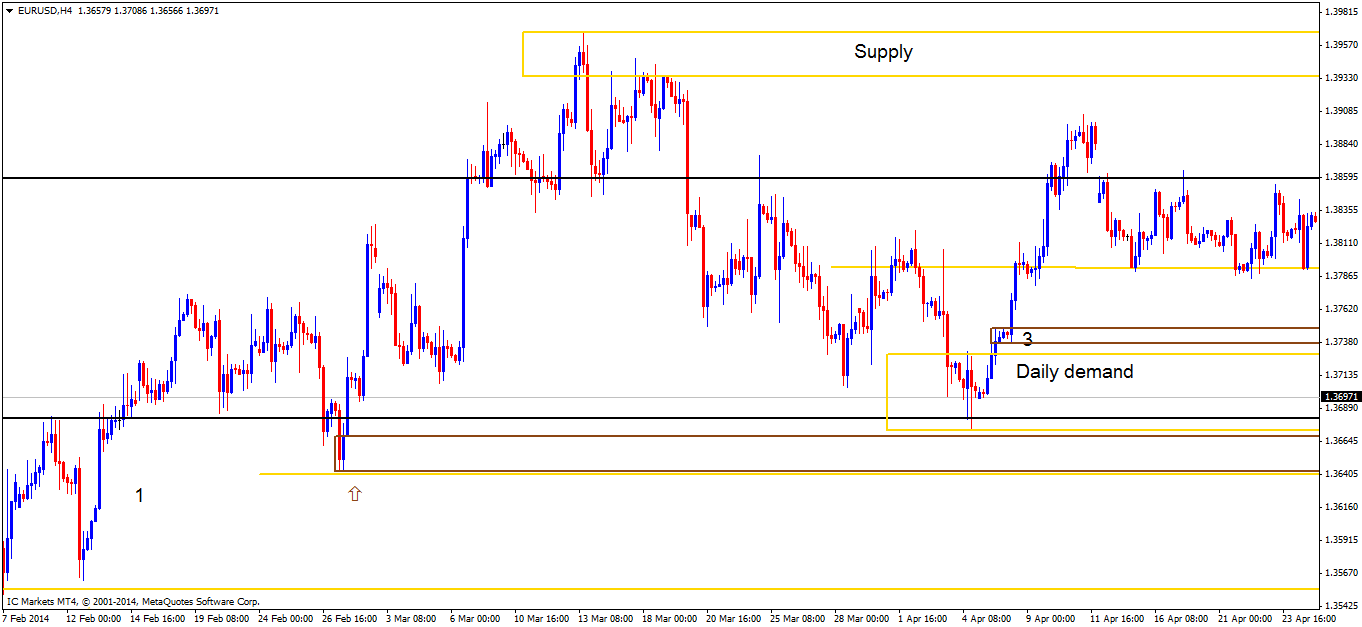

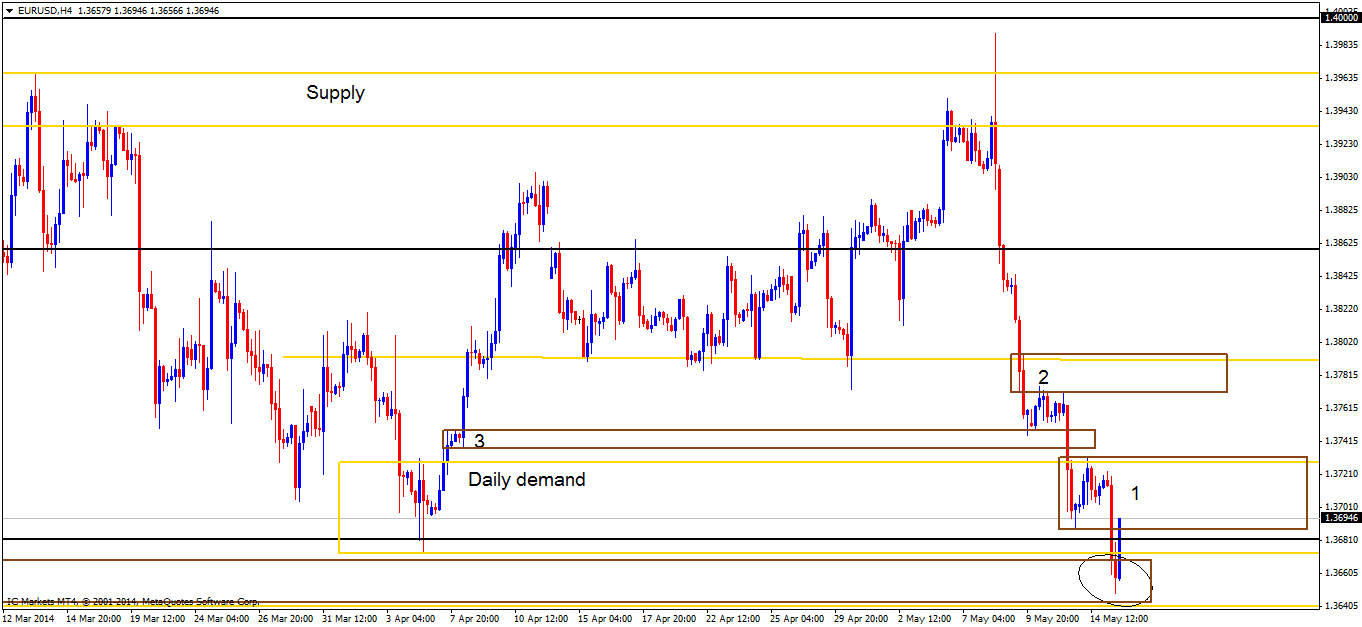

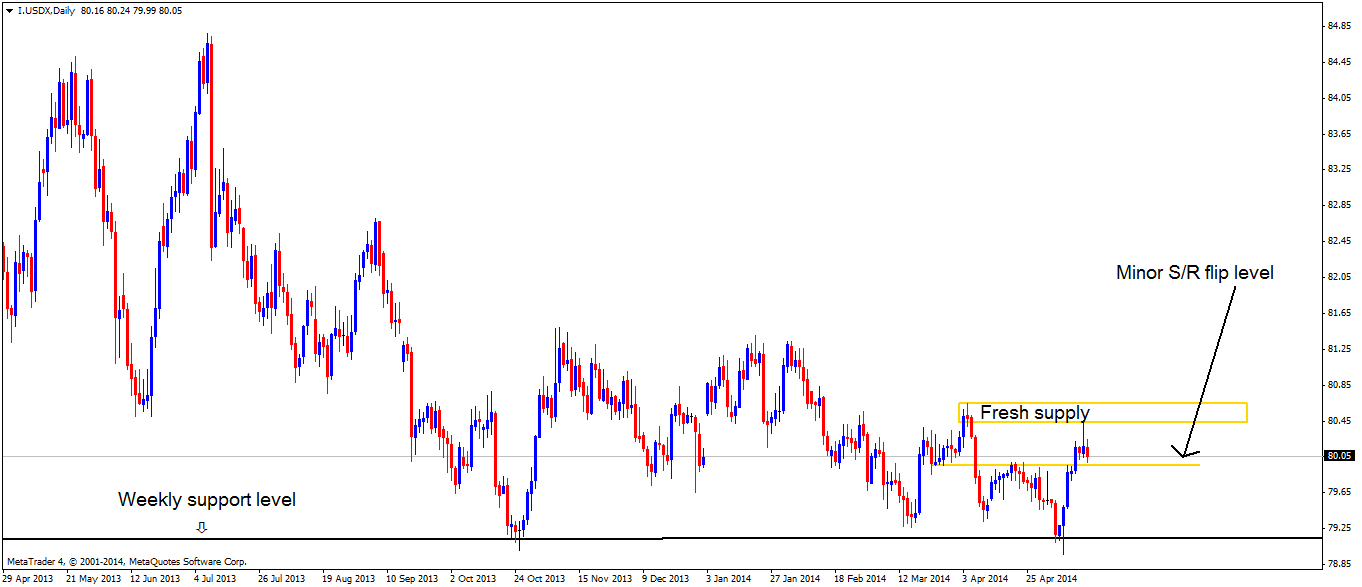

Very similar to the Euro, the Pound has reacted at a recent demand area B[/B] whilst the USDX reacted to a recent supply area at 80.65 – 80.49. For added confidence with your trading, look for the Pound to be in some sort of demand area and the USD to be in a supply zone.

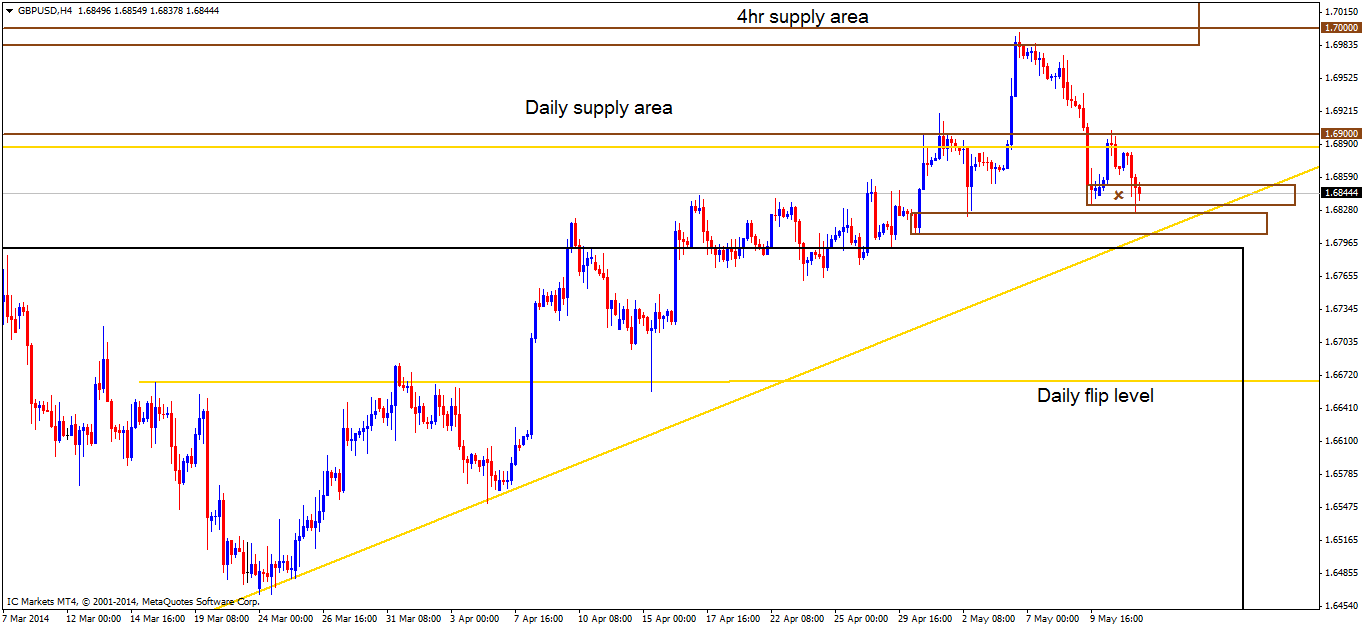

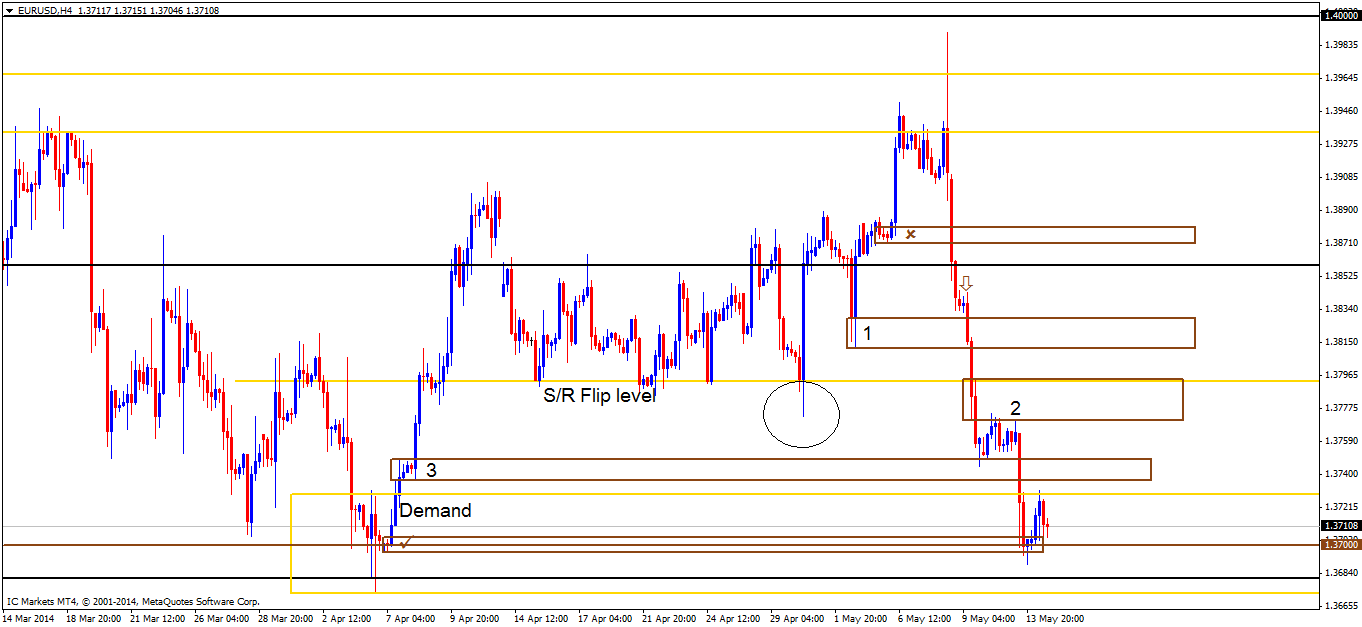

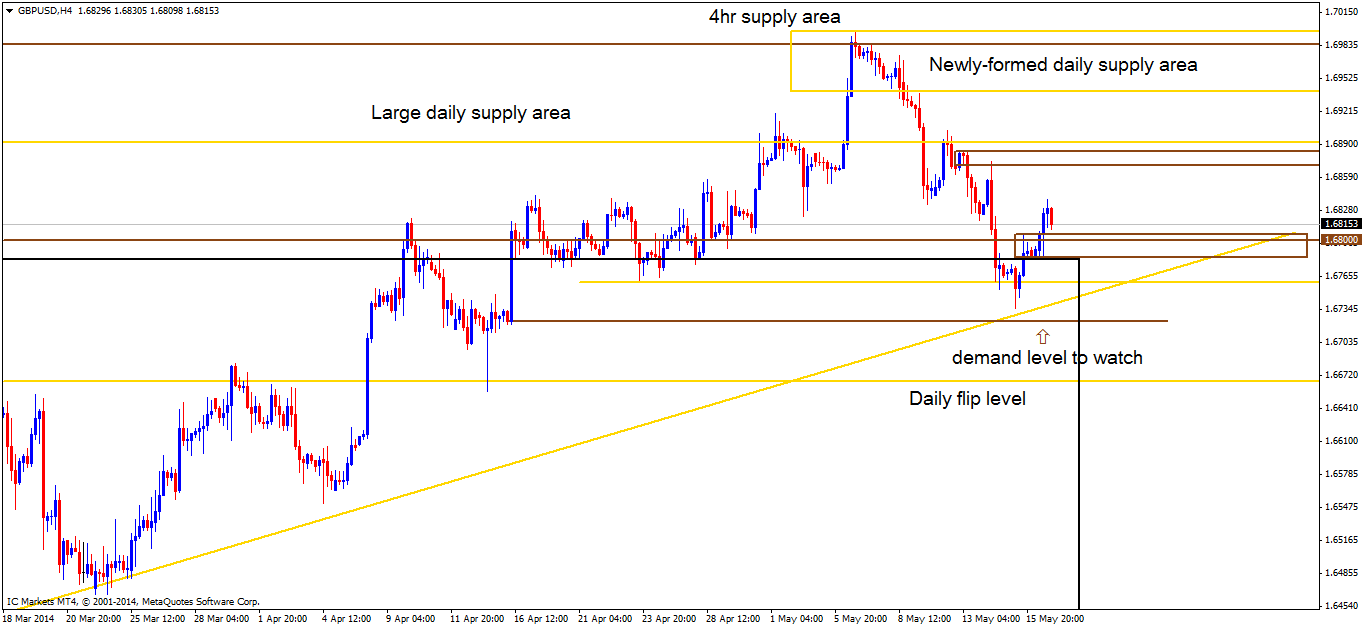

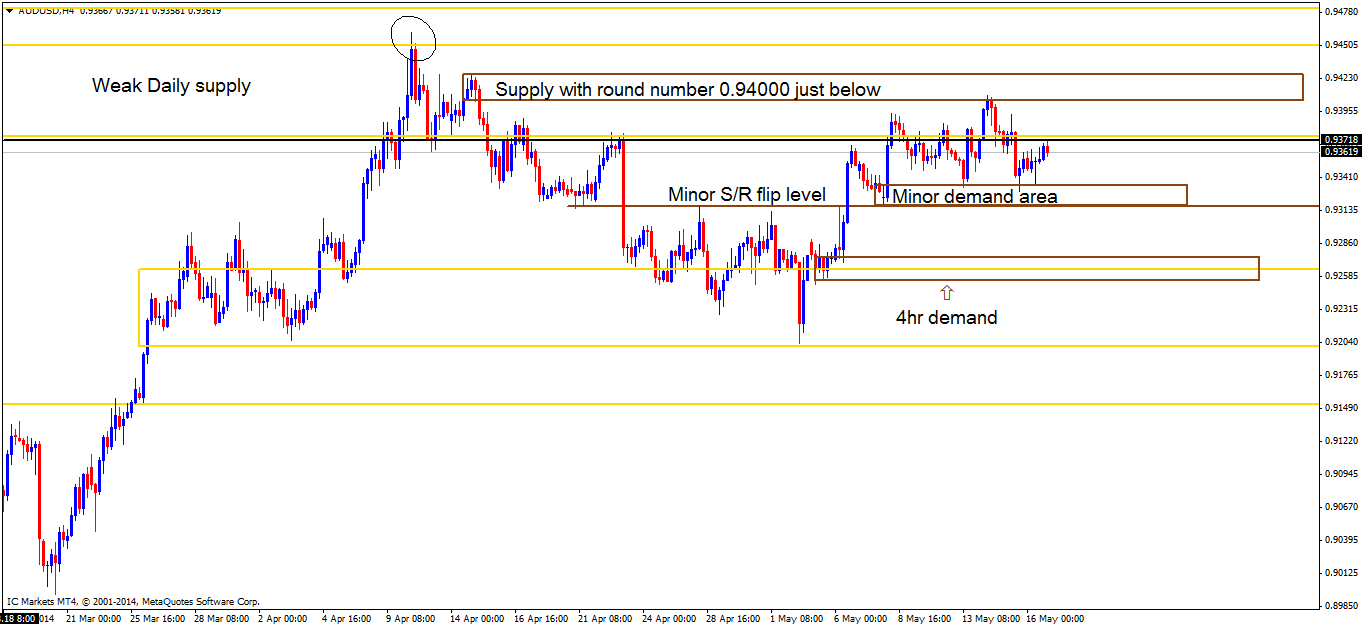

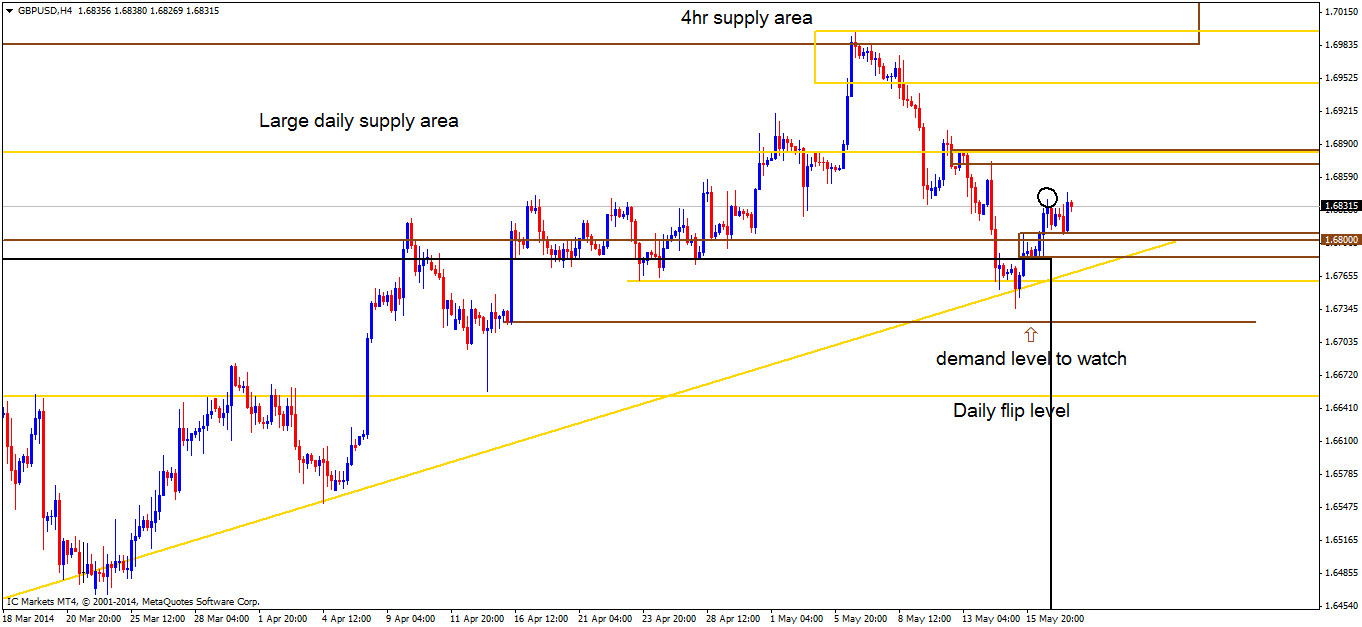

4hr TF.

Price completely consumed the demand/supply flip area at 1.68260 – 1.68072 shown in the chart below.

From price consuming this supply area mentioned above, a new demand area has been created at 1.67835 – 1.68062 incorporating the round number 1.68000 within as shown on the chart below. It is doubtful this area will carry much weight, as momentum from the base was very weak. Near-term supply remains at 1.68824 – 1.68714, and is a zone which may be weak due to a spike consuming sellers was seen recently.

[ul]

[li]Areas to watch for buy orders: 1.67835 – 1.68062, 1.68000.

[/li][li]Areas to watch for sell orders: 1.68824 – 1.68714.

[/li][li]Most likely scenario: A quick recap is in order – The weekly timeframe has seen a break above long-term consolidation

(1.67980 – 1.42273) and we are now seeing a retest. The daily timeframe shows support in the market around the low of 1.67622 with trendline confluence. Fresh supply is seen above at

1.69963 – 1.69514. The 4hr timeframe shows a minor demand area at

1.67835 – 1.68062 with a logical-fresh demand area below at 1.67236, near-term supply is seen at

1.68824 – 1.68714 which has seen a touch already so it’s not a fresh zone.

[/li][/ul]

Taking all of this into consideration, we are likely to see higher prices this week, however do not discount the possibility of a retrace before this happens. Today’s action will likely not be too volatile due to weak data, so price will likely trade between supply at 1.68824 – 1.68714 and demand at 1.67835 – 1.68062.