FxGrow Daily Technical Analysis – 20th July, 2016

By FxGrow Research & Analysis Team

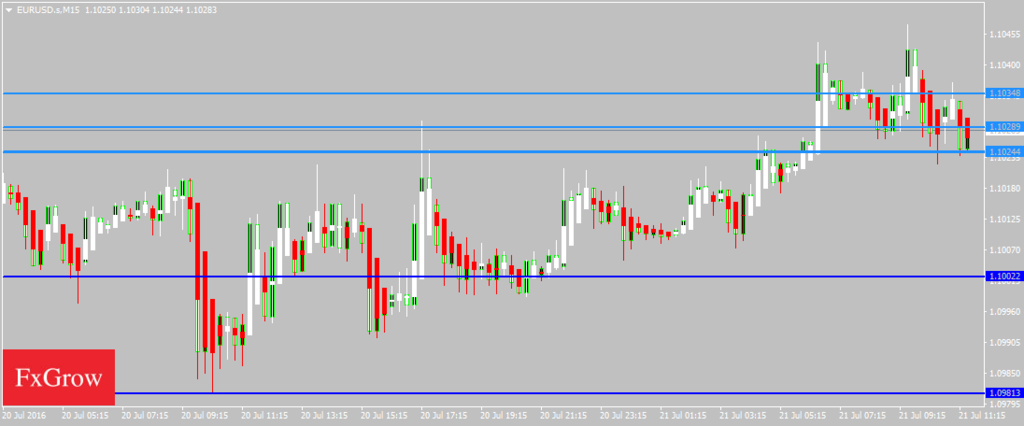

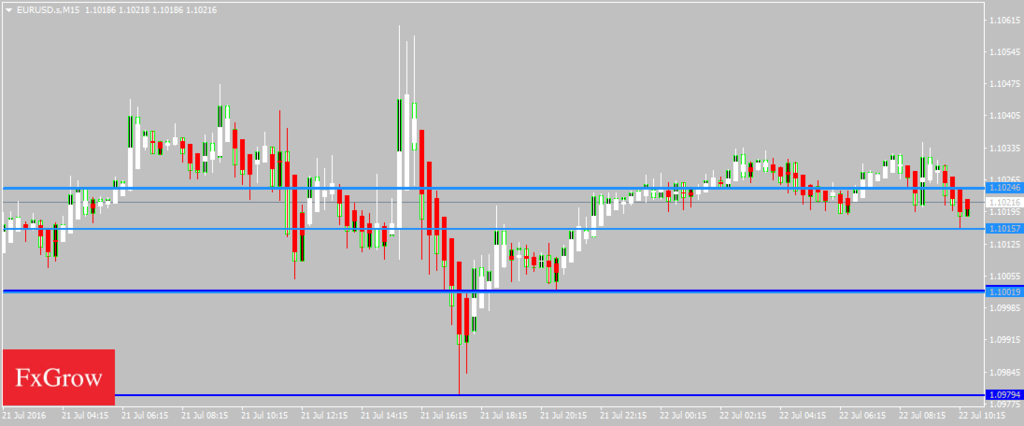

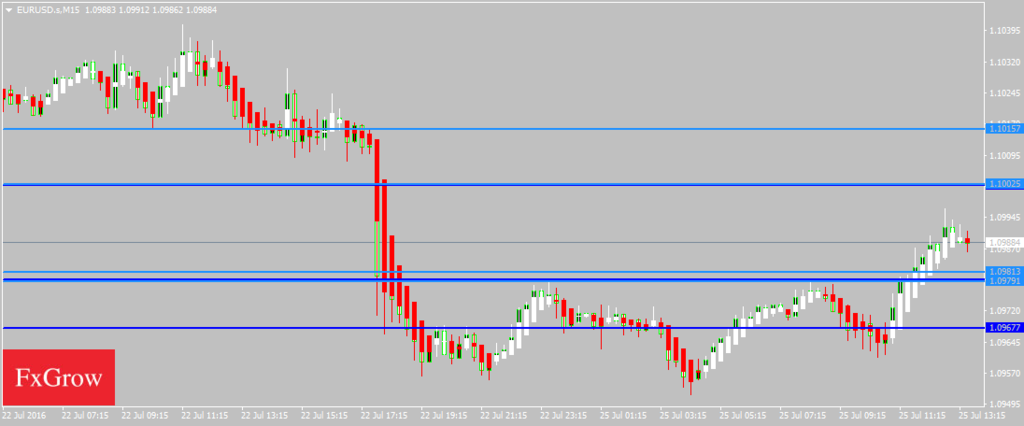

EURUSD

EURUSD was bearish yesterday as it came down below the 1.1050 handle and remained weak towards the end of the trading session. The pair is trading below its 100 day SMA of 1.1070 and some pullback correction is expected but the overall outlook remains bearish. The near term bias is Neutral to Bullish with targets of 1.1060

STOCH (9, 6), Ultimate Oscillator indicate a BUY; ADX (14), CCI (14) are Neutral; STOCHRSI (14) is Overbought; while Average True Range (14) indicates High Volatility.

Support is at 1.0981 while Resistance is at 1.1015 and 1.1024

20th July 2016 – 09:42AM (UTC)

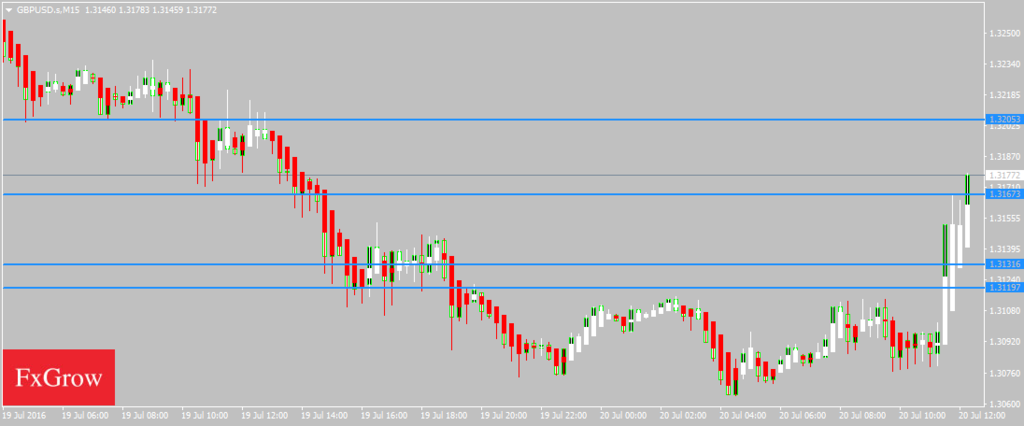

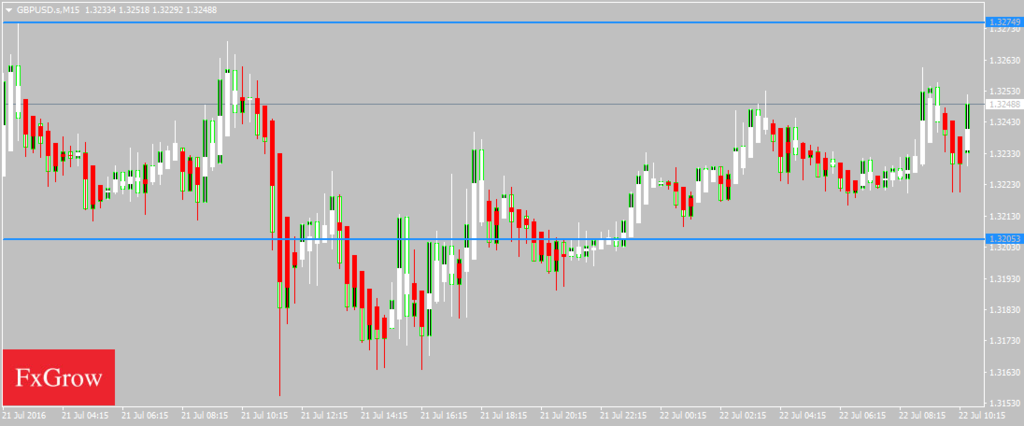

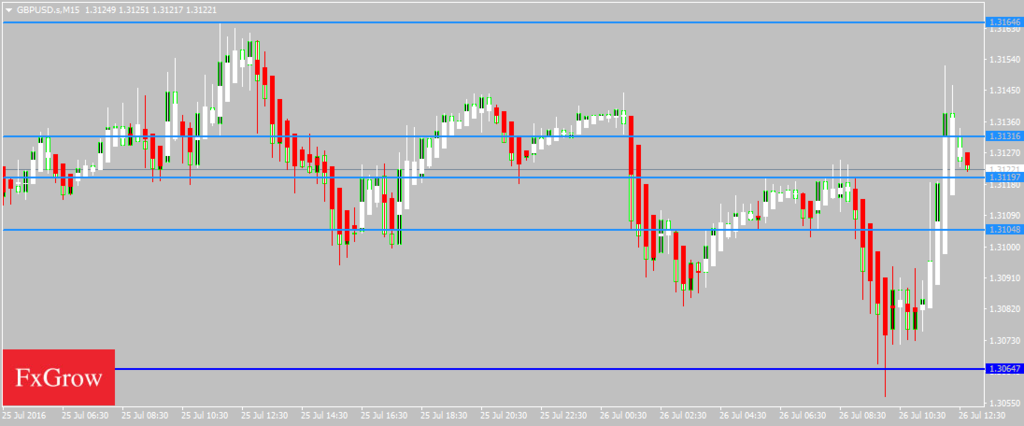

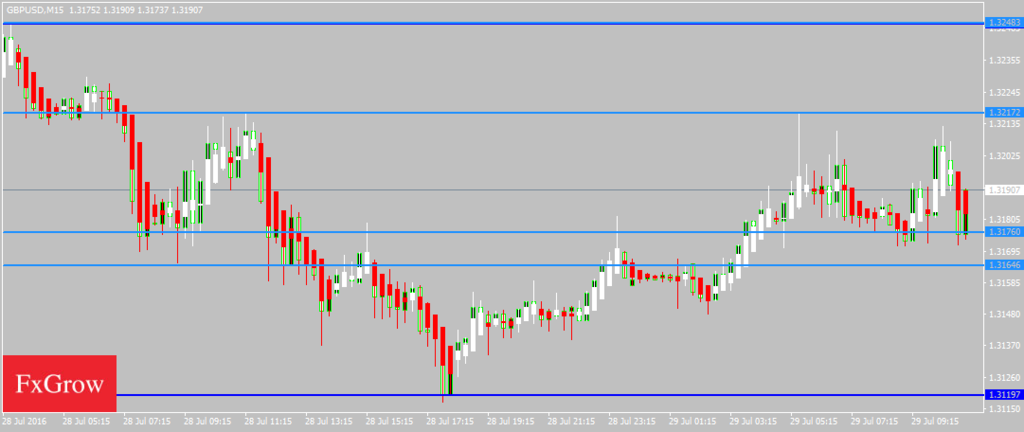

GBPUSD

GBPUSD was bearish yesterday as it broke below 1.3150 handle and remained weak towards the end of the trading session. Cable has made bullish correction today and is trading above 1.3170 now though the long term view remains bearish towards 1.3000 levels. GBPUSD is trading below its 100day SMA of 1.3238 in the European trading session. The near term bias is Neutral to Bullish with targets of 1.3200 to 1.3250

RSI (14), ADX (14), Ultimate Oscillator, ROC indicate a BUY; STOCHRSI (14), CCI (14) are Overbought; STOCH (9, 6) is Neutral; while Average True Range (14) indicates Less Volatility.

Support is at 1.3046 while Resistance is at 1.3218 and 1.3270

20th July 2016 – 09:40AM (UTC)

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.