Bro, go back a few pages. I’ve given two.

That’s because stops are too tight and we can’t give our trade time to work. Also during low volatility the markets “generally” bounces within a narrow range. Commonly know as a flat market. Flat markets are the enemy of trend traders. But there’s simply no way of knowing when a flat market will turn into a trending market. Just as there’s no way of telling when a trend will end. All we can do is obey our rules.

Now for some pretty pictures. Take what you will from them. But they demonstrate average long term volatility of some major pairs. Note where the EURUSD, GBPUSD n USDJPY sit. Then compare where EURGBP, AUSUSD n USDCAD sit.

Remember, we speculating, we’ve got to get in and get out. It’s statistically against us to expect a 100 pip move in the US session if the price has all ready moved 100 during the Europe.

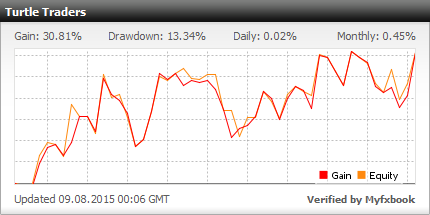

Now for a weekly report. Another good week for the bots. Tempted to turn them off for the rest of the week but that’s not what testing is about

![]()

https://www.myfxbook.com/portfolio/turtle-traders/1279152

Two weeks don’t make a system but. Anyway we’re not interested in $$$'s. What concerns us is that the results of back testing can be replicated in a demo environment. Which they are. Also getting some data now. 45 trade win rate of 49%. Our back tests suggest should average a win rate at 39% so we’ve started on a high. Expect some losses soon. To back that up expectancy is sitting at 3%. Again back test suggest 2.7% so a run of losses will bring that down a bit. Finally our reward to risk ratio is running at 2.28 where as tests suggest an average of 1.7 as the norm. So make money while we can cause a run of losses is getting closer every trade. Who knows what the market will do.

Plenty of other data open for discussion. I’ve found it hard not to interfere and close out trades. Watched lots of pips being given up. Think if I went live with this I would let the bot open the trades but manually trail and close them. Buts that’s just me and that’s just my process I go through during development.

Oh $hit , yeah u did. I forgot about that.

Gday lads.

Absolutely fantastic gap opened up this weeks trading which the bots caught. Manually closed them out but. Wasn’t going to let all those pips go to waste. With the knowledge of hindsight probably a good move. Now with that said remember it is a demo account so price gets filled without slippage. Might not of been such a good deal in real account.

Also I have added the EURJPY and GBPJPY to the test account on the one hour charts. Setting for EURJPY are the 24 period break, 12 trailing. ATR period 18 and a multiple factor of 3 Trading from 01 GMT to 20 GMT. On the GBPJPY trading the 33 period break with a trailing period of 12. ATR again is 18 and a multiple factor of 3. Trading from 0 GMT to 21 GMT

So far the bots are proving very good to enter trades. However manually managing the trades is looking like the better option. Might be time to go live soon.

EURJPY

GBPJPYLooks really good, bob…

I had some nice profits in live acc with those gaps …i was already short on almost all EUR pairs last week…

Very nice bro. Proof that the only thing that matters is price. Highs and lows. Trade when the market forms new highs and lows and it’s hard to go wrong on any time frame.

Exactly…why trying to predict the future when it’s much easier to just follow price where it goes…

Im popping onto this thread as suggested by Bob. I’ve been reluctant to explain the donchan strategy im using as im certain its dismissed by everyone else for being so simple (I am still a noob). However in the interests of trying here goes;

Daily - find a strong trending pair

4hour / 2Hour DNC on 20 setting look for breaks in top / bottom / middle.

Break in line must have candle close over the line

Trade must be in direction of trend identified before

Then confirm with slow Stochastic on 12,2,2

SS should be moving in the direction of the trend

I am getting some good hits on s demo account however due to work commitments im missing too many trades that’s why I am trying to learn MQL4 of which i am discovering it is the hardest thing in the world!!!

Welcome bro. first learning to code is a *****. I spent a couple of years using compilers before progressing to learn mql. But its trail and error and a subject for a different thread.

Welcome to donchian channel hosted by our good friend forexmike. Like your take. It’s slightly different to what we all do. Be keen to help you work with this. And remember simple is best

I feel your pain with the code. Try this site out its free and u dont need to know code. u can do indicators as well as EA.

eabulider.com

But heres where Im at. After finally getting the code that was written by the program to compile with no errors.

For some reason the indicator I built using doch isnt opening and closing at the channels. So its back to frustration, but give it a go man it might be good for u.

good luck hope it helps.

Welcome to the thread!

Nobody gets dismissed here…every version of donchian channel trading brings something new and interesting…in this case i think i’ll have a look at stochastics in combination with DCs…we never stop learning…

In trading simple is nothing bad…the more complex a system is, the more parts can fail…just my point of view…

Yes stoch sounds interesting. but I just got the code right for the channels after almost a week.

Now trying to incorporate the ATR with that should take another week lol.

My wife wants to know why I dont pay someone to code for me. SHE JUST DONT GET IT.

So if I read it right and forgive me , my mind is mush right about now.

There r entries at center line not just top/bottom.

JUST GRRRRRRRRRRRRRRRRRRRRRRRRRRRRRR

venting

sorry

Just keep it simple , nothing wrong with that, especially when your making $$$

Well, week 3 results are in.Overall we made a small profit. After capturing the gaps on Monday (which because we’re trading a demo we know weren’t affected by slippage) the bots pretty much bummed out. Had to be expected but considering whats going on. And it still keeps constant the results we saw in backtesting.

https://www.myfxbook.com/portfolio/turtle-traders/1279152

Trading five pairs now, EURUSD, EURJPY, GBPUSD, GBPJPY and USDJPY on both the 1 and 4 hour charts. I also might start becoming more actively involved in managing the bots now. Watching many pips being given up. Often said the secret to using a bot is simply knowing when to switch them off.

Chilling to Foo Fighters 1995 Oz Tour edition

The watching pips go bad is still the 1 issue i jave trading doch. Sometimes i stubbornly wait for the 1xatr or 2xatr to be hit but just see the loss of pips.

Vert interesting results bob.

Hi guys

the last days i was thinking about a new idea…

i want to reduce the trades that give back profits and turn losers at the end…so, i went through the thread again and again and some of you also are aware of this “problem”…

bob uses TPs in some of his bots, so i came up with this idea…

i downloaded historical data to simulate DCs in spreadsheets and calculate the average profit of every pair after a DC 20 breakout (or how many pips it went negative after a breakout => for SL, alternatively one could use ATR as SL)…the positive pips would be the TP…pending orders would be set at upper and lower DC 20 as now…

I think the win% should increase (although its not so important)…but most important, winners wouldn’t give back profits…the TP/SL would be calculated dynamically, as you only have to add the new prices into the spreadsheet…

I am aware that this idea leaves a bit the idea of trend following…sorry adrian

Thoughts appreciated

I was trying to code a bot but it was just to much. I paid a programmer to do it for me.

Its obviously based on doch channels.

You can change the variables of,

doch periods

ATR periods

ATR entry

MA periods

SL multiple of ATR

TP multiple of ATR

volume

trailing stop trigger

trailing stop amount

conformation of bars.

I did it so maybe I/ we can change all the variables and see what works best.

The reason why I didnt just link it is that it is for ctraders calgo. It can be downloaded for free. And easy to use once u install it there. if u are intrested in playing with the bot. I know most of u use mt4 but I really like ctrader

It is OK to let those pips go. Trade just the channel(s) you have selected and don’t change mid-trade. Human biological bias is such that we tend to focus on recent episodes of out-performance or under-performance. The solution is system diversification.

-Adrian