In this technical blog, we are going to take a look at the past chart’s performance of Nikkei an index from Japan. But before looking into the Charts, we need to understand the market nature first. The market always fights between the two sides i.e Buying or Selling. We at Elliott Wave Forecast understand the Market Nature and always recommend trading the Elliott wave hedging or no enemy areas. Those areas are reflected as the blue box areas on our charts. They usually give us the reaction in favor of market direction in 3 swings at least. Now, let us take a quick look at the Nikkei 1 Hour Charts and structure below:

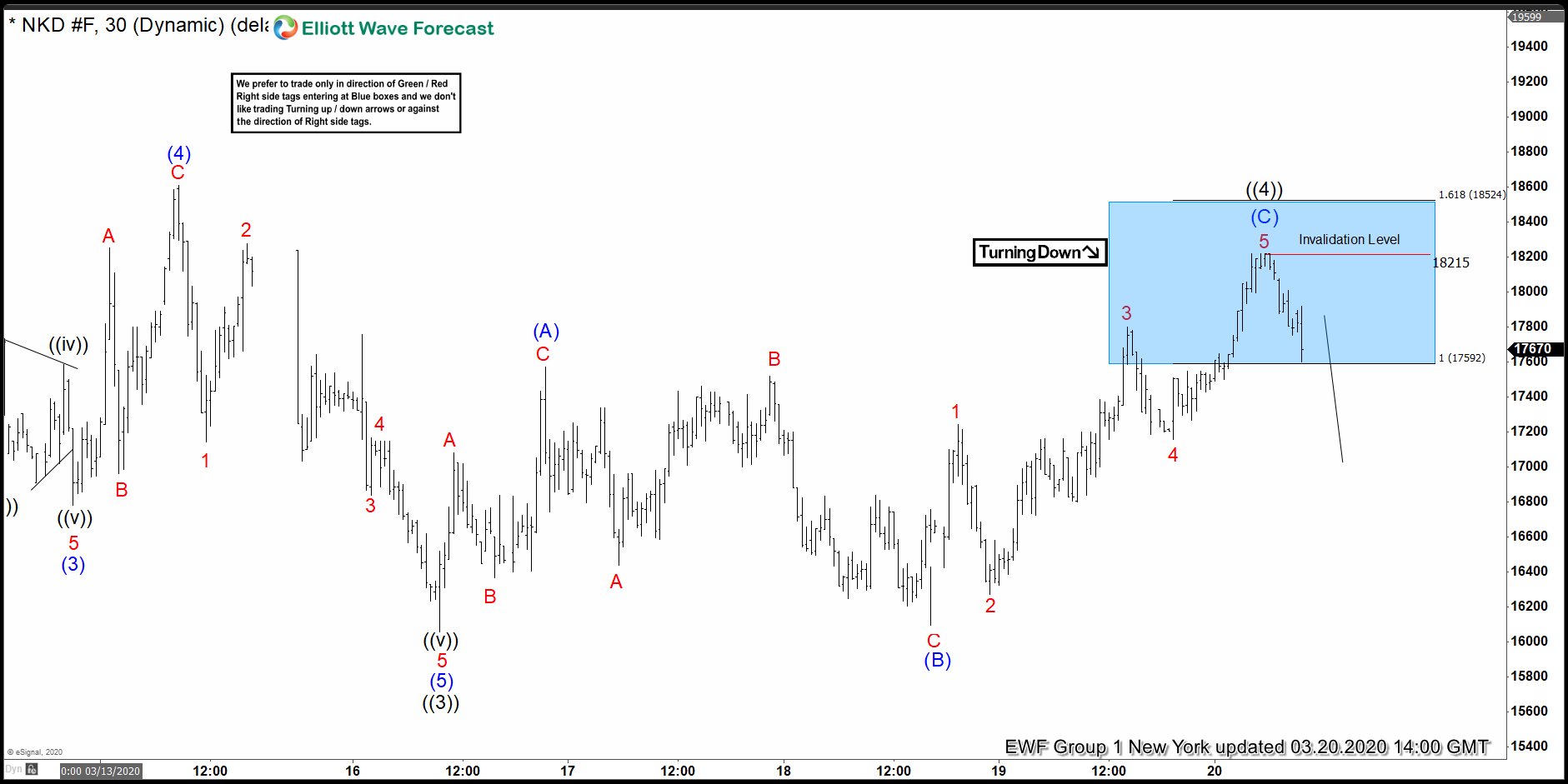

Nikkei 1 Hour Elliott Wave Chart From 3.20.2020

Nikkei 1 Hour Elliott Wave Chart from 3/20/2020 NY update. In which, the decline from December 2019 peak unfolded in 5 waves impulse structure. While the index ended wave ((3)) in a lesser degree 5 waves impulse sequence at 16060 low. Up from there, the index made a 3 wave bounce in wave ((4)). The internals of that bounce unfolded as a flat structure where wave (A) ended in 3 swings at 17570. Wave (B) ended at 16205 low and wave © ended in 5 waves structure at 18215. After seeing sellers at the blue box area i.e 17592-18524 100%-161.8% Fibonacci extension area of (A)-(B). From there, the index was expected to resume the downside or to do a 3 wave reaction lower at least.

Nikkei 1 Hour Elliott Wave Chart From 3.23.2020

Here’s the 1 Hour Elliott Wave Chart of Nikkei from 3/23/2020 London update. In which, the index is showing the reaction lower taking place from the blue box area. And end up making new low below the previous low & bounced higher again. However, it’s important to note that based on cycles & the distribution. We downgraded the degree & labeled the last decline as a part of ((3)) still.