EUR/USD briefly dipped below 1.15 before rebounding as recovery risk builds into the November open. Battle lines drawn on the Euro short-term charts.

By : Michael Boutros, Sr. Technical Strategist

Euro Technical Outlook: EUR/USD Short-term Trade Levels

- EUR/USD briefly broke below 1.15 before rebounding, weekly range breakout to offer guidance

- Immediate focus is on a possible recovery attempt within the multi-month downtrend

- Resistance 1.1537/42, 1.1601 (key), 1.1641/46- Support 1.15, 1.1469 (key), 1.1387/92

Euro is attempting to recover after a brief break below the 1.15 handle, with EUR/USD carving the weekly opening range just below the November open. The move highlights potential downside exhaustion within the broader downtrend, with the focus now on whether a near-term recovery can develop from this zone. A breakout of the weekly opening range may offer clarity on direction in the days ahead. Battle lines are drawn on the Euro short-term technical charts.

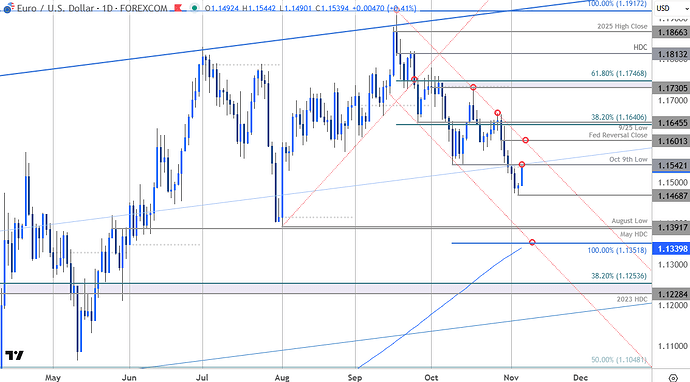

Euro Price Chart – EUR/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Technical Outlook: In last month’s Euro Short-term Technical Outlook we noted that EUR/USD was in consolidation within the October range heading into the Fed rate decision and, “the immediate focus is on a breakout of the 1.1582-1.1686 range for guidance with the outlook still weighted to the downside while within this formation.” The range broke lower post-FOMC with a five-day decline plunging more than 1.7% off the recent highs. A brief stint below 1.15 into the start of the month has been erased with the weekly opening-range now set just below the October 9th swing low at 1.1542. Looking for a breakout in the days ahead for guidance here.

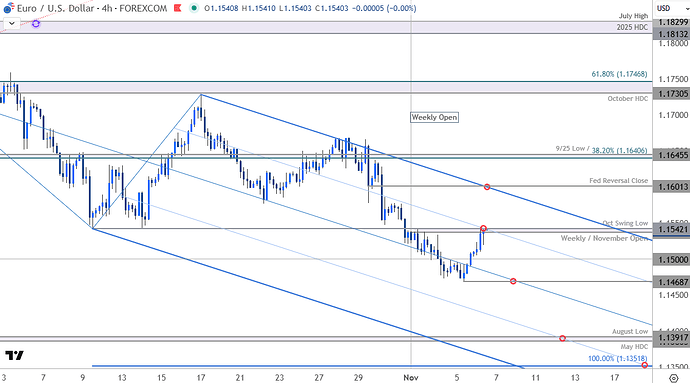

Euro Price Chart – EUR/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Notes: A closer look at Euro price action shows EUR/USD continuing to trade within the confines of the descending pitchfork extending off the yearly high. A two-day rally is now testing confluent resistance near the 75% parallel at 1.1537/42- a region defined by the objective monthly / weekly open and the mid-October swing lows. A rally surpassing this pivot zone would expose a stretch towards the Fed reversal close at 1.1601. Note that this level converges on the upper parallel tomorrow (near-term bearish invalidation). Ultimately, a breach / close above the 38.2% retracement of the September decline and the September 25 swing low at 1.1641/46 would be needed to suggest a more significant low is in place / a larger reversal is underway. Subsequent resistance eyed at the October high-day close (HDC) / 61.8% retracement at 1.1731/47.

Initial support rests at the 1.15-handle and is backed closely by the weekly range low at 1.1469. A break / close below the median-line is needed to mark resumption of the September downtrend with subsequent support objectives seen at the May HDC / August low at 1.1387/92 and 200-day moving average / 100% extension of the September decline at 1.1340/52. Both regions represent areas of interest for possible downside exhaustion / price exhaustion IF reached.

Click the website link below to Check Out Our FREE “How to Trade EUR/USD” Guide

https://www.cityindex.com/en-uk/whitepapers/

Bottom line: EUR/USD is threatening downside exhaustion here and the risk remains for a larger recovery within the multi-month downtrend. From a trading standpoint, the immediate focus is on a breakout of the weekly opening-range for guidance. Rallies should be limited to 1.16 IF price is heading lower on this stretch with a close below the weekly low needed to fuel the next leg of this decline.

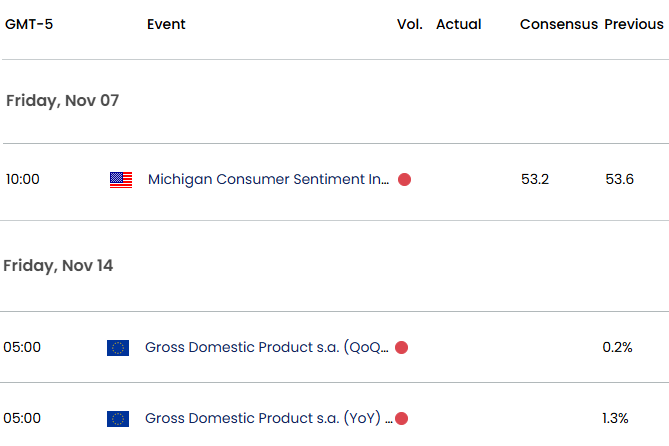

Note that economic data remains limited next week amid the ongoing government shutdown. Stay nimble into the November opening-range and watch the weekly closes here for guidance. Review my latest Euro Weekly Technical Forecast for a closer look at the longer-term EUR/USD trade levels.

Key EUR/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

— Written by Michael Boutros, Sr Technical Strategist

Follow Michael on Twitter @MBForex

StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it.

No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For further details see our full non-independent research disclaimer and quarterly summary.