EURUSD

The Euro continued to march higher in January to trade at $1.0867, the highest level since April last year, and benefitting from a softer dollar, as investors expect the Fed to slow the pace of rate increases after the US CPI report pointed to another slowdown in inflationary pressures. In Europe meanwhile, preliminary estimates showed price pressures eased more than expected, with the annual inflation rate in the Eurozone hitting a four-month low.

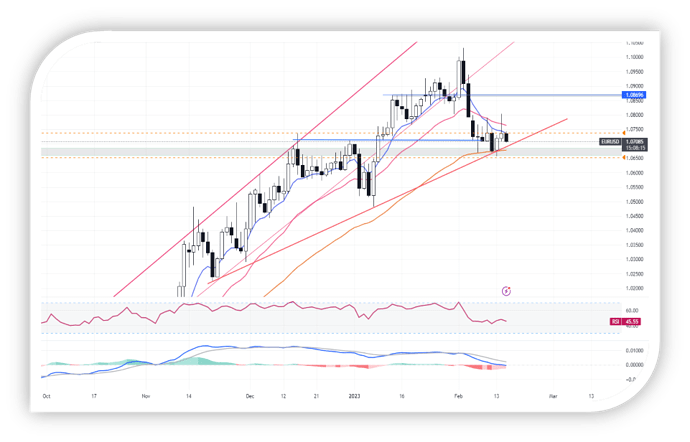

Technically, the pair made an upward breakout yesterday with a strong positive bar. If it stays above 1.08 levels, it could move towards the 1.0910/15 region, which also coincides with the ceiling of the ascending channel. On the downside, the 1.0800 level is as seen support. If it breaks downward, the strong support level is at 1.0630 (21-DMA).

Support: 1.0800 – 1.0735 – 1.0630

Resistance: 1.0890 – 1.0910 – 1.0930

EURUSD

The Euro is trading at a higher level than it has in the past several months, and the US dollar has been weakening. The European Central Bank’s chief economist, Philip Lane, stated in an interview with the Financial Times that the bank needs to continue to increase interest rates to a point that starts to curb economic growth, but it remains uncertain at what level the peak in the interest rate cycle will occur. German CPI data will be followed by investors today.

From a technical analysis point of view, the pair has made an upward breakout last week with a strong positive bar. If it stays above 1.0800 levels, it could move towards the 1.0910/15 region, which also coincides with the upper boundary of the ascending channel. On the downside, the 1.0800 level is considered as support. If it breaks downward, the strong support level is at 1.0675 (21-day moving average).

Support : 1.0800 – 1.0735 – 1.0675

Resistance: 1.0890 – 1.0910 – 1.0930

EURUSD

The annual inflation rate in the Eurozone has hit a four-month low and is expected to ease further. However, inflation excluding energy remains at record levels. The ECB survey of consumer expectations has also shown that inflation prospects for the next 12 months have decreased for the first time since May 2022. Despite this, the ECB is expected to continue with its current monetary policy and another increase in borrowing costs is expected next month.

The currency pair has dropped beneath the 1.0800 thresholds and is currently fluctuating near the 8-day moving average. If this average is broken, there is a possibility that the price may find support at 1.0725. However, if the decline persists, the next level of support to watch for would be the 21-day moving average at 1.0675. To see an upward trend resuming, the pair needs daily closes above 1.0865.

Support: 1.0760 – 1.0725 – 1.0675

Resistance: 1.0865 – 1.0910 – 1.0930

EURUSD

The Federal Reserve’s expectation of a 25 basis points interest rate increase compared to the European Central Bank’s expectation of a 50 basis points increase is a result of the different monetary policy approaches of the two central banks. This could indicate that the Euro may continue to gain strength against the US dollar. Investors are optimistic that the flash S&P global surveys on Tuesday will show that the EU economy is strong. The EU manufacturing PMI is expected to increase to 48.5 in early January from 47.8, and services to 50.2 from 49.8, partly due to lower gas prices and the mild winter so far.

Technically, the Euro was unable to reach its highest point of 1.0927 but did find support at 1.0850. The EUR/USD pair may aim for the upper boundary of the ascending channel. The Euro has recently reached its highest level in the past 9 months and appears to have a bullish trend. The 1.0927 resistance level should be closely watched. On the downside, the support level is at 1.0865, and in case of further decline, the next support level to pay attention to would be the 21-day moving average at 1.0720.

Support : 1.0845 – 1.0740 – 1.0650

Resistance: 1.0930 – 1.0970 – 1.1020

EURUSD

Christine Lagarde, the head of the European Central Bank, stated that it is important for interest rates to increase at a consistent rate in order to prevent inflation from becoming a long-term problem. In the past six months, the ECB has raised its key policy rates by the fastest pace in its history, 2.5 percentage points. Lagarde also stated that the goal is to bring inflation down and they will deliver on this goal. Based on the statement, it is expected that the ECB policymakers will raise rates at their meetings in February and March.

The EUR/USD currency pair is currently trending upward, with the 8-day moving average supporting the trend. It may continue to rise and reach the upper boundary of the ascending channel. The Euro has recently hit its highest point in the last 9 months and appears to be in a bullish trend. The key resistance level to watch is 1.0930. In the event of a pullback, the support level is at 1.0845 (8-day moving average), and further declines could see support at the 21-day moving average at 1.0740.

Support : 1.0845 – 1.0740 – 1.0650

Resistance: 1.0930 – 1.0970 – 1.1020

EURUSD

The European Central Bank is expected to raise interest rates by 50 basis points consecutively, as they continue to combat inflation. They predict that the deposit rate will be maintained at 3.25% for approximately a year before a decline in economic conditions prompts a series of quarter-point reductions, starting in June 2024.

The currency pair had a pause in its upward trend after six consecutive days of gains. The pair is currently trying to maintain its position above the 8-day moving average and is seeking support at the current levels. The 1.0850 level is identified as a support level, and if it is breached to the downside, the next support level is at 1.0765. For the upward trend to continue, the pair must break above the 1.0930 level.

Support : 1.0850 – 1.0765 – 1.0650

Resistance: 1.0930 – 1.0970 – 1.1040

EURUSD

The euro rose over 1.10 on Wednesday, near its highest level since April of the previous year, due to a weaker dollar and the Federal Reserve’s expected reduction in the size of its interest rate increases, which appeared to indicate a more accommodative stance. At the same time, investors anticipate that the European Central Bank will maintain a more aggressive stance and raise interest rates by 0.50 basis points. However, the focus is mainly on the ECB’s plans for its March meeting, with markets predicting another 0.50% hike. The Eurozone inflation rate slowed more than expected to 8.5% in January, the lowest since May, while the core rate remained at an all-time high of 5.2%.

Technically, the pair reached its highest point in 9 months, boosted by the Federal Reserve’s interest rate decision and Fed Chair Powell’s statements. The support levels are around 1.0985 and 1.0925, and resistance is seen at 1.1050.

Support : 1.0985 – 1.0925 – 1.0855

Resistance: 1.1050 – 1.1120 – 1.1180

EURUSD

The parity remained steady on Monday, due to worries about increasing interest rates and escalating tensions between the US and China, triggered by the shooting down of a suspected Chinese spy balloon by the US. Investors will be closely monitoring a speech by the President of the European Central Bank, Christine Lagarde. Investors will closely follow the retail sales data in the European region as an important economic indicator. If the data is positive, it may contribute to a slight improvement in the exchange rate.

From a technical perspective, the currency pair has broken below its 8-day and 21-day moving averages, and it appears to have shifted from an upward to a downward trend. These two developments have a negative impact on the pair. However, the 1.0750 level can be monitored as a potential support level, while the 1.0840 level can be watched as a nearby resistance level.

Support : 1.0750 – 1.0700 – 1.0660

Resistance: 1.0840 – 1.0880 – 1.0925

EURUSD

The European Central Bank made changes to the rate limit for government deposits within the Eurosystem. This step is aimed at kickstarting their return to the market in a controlled manner and avoiding potential disruptions as the bank adjusts its monetary policy. The update to the rate ceiling is a part of the ECB’s strategy to ensure a smooth transition and maintain stability in financial markets.

Technically, the pair under consideration found support from its 50-day moving average and currently appears to have reversed its trend. After reaching a low of 1.0669 yesterday, the pair has the potential to advance toward the resistance level set by the 8-day moving average at 1.0795.

Support : 1.0695 – 1.0670 – 1.0595

Resistance: 1.0795 – 1.0835 – 1.0925

EURUSD

Fundamental Outlook: The release of the University of Michigan Consumer Sentiment Index for February in the United States is expected to have an impact on the EUR/USD exchange rate. This index measures consumers’ outlook and expectations, taking into account their perceptions of their own financial situation, the near-term economic outlook, and their long-term economic outlook. This data will be closely monitored, as recent indications suggest a slowdown in inflation, which could boost consumer confidence.

Technical Analysis : Yesterday, the EUR/USD pair was supported by its 50-day moving average. The 8-day moving average currently stands at 1.0765. The pair attempted to surpass this level but was unsuccessful. Market participants will closely monitor the 1.0705 support level in case of a potential downside move.

Support : 1.0705 – 1.0670 – 1.0595

Resistance: 1.0765 – 1.0835 – 1.0925

EURUSD

Fundamental Outlook: According to the European Commission, the eurozone is expected to avoid a recession this year as inflation is easing and gas prices continue to be low. The latest Eurostat data indicates that the 19 countries in the eurozone recorded a combined economic growth rate of 0.1 percent in Q4 2022 as compared to the previous quarter.

Technical Analysis : The pair is currently falling toward the 50-day moving average, which could signal a potential bearish trend in the market. If the pair falls below this level, it may increase the selling pressure and indicate a further decline. On the downside, two key support levels to monitor are 1.0685 and 1.0650. On the upside, the 1.0735 level is an important resistance level to watch for potential bullish movements.

Support : 1.0685 – 1.0650 – 1.0585

Resistance: 1.0735 – 1.0765 – 1.0800

EURUSD

Fundamental Outlook: Last week, two prominent policymakers indicated that interest rates set by the European Central Bank (ECB) still have room to increase, leading to a rise in the market’s estimation of the highest potential interest rate. This development helped to counteract overly optimistic predictions that arose after the previous policy meeting. Isabel Schnabel, a member of the ECB board, and Francois Villeroy de Galhau, who leads the French central bank and is one of the most influential voices on the ECB’s 26-member Governing Council, expressed concerns about persistent inflation and disagreed with market predictions of interest rates.

Technical Analysis : Last Friday, the parity has a significant volatility, and it has found support at 1.0610. However, the pair is expected to face resistance at the 1.0715 level. On the other hand, it’s crucial to monitor the 1.0675 and 1.0655 levels as potential support areas. In addition, the blue MACD line is currently situated in the negative zone of the histogram, and it must cross into the positive zone for an upward trend to emerge. Therefore, traders should pay close attention to the MACD and RSI indicators to identify potential opportunities for the pair.

Support: 1.0675 - 1.0655 – 1.0615 Resistance: 1.0715 – 1.0735 – 1.0760

EURUSD

Fundamental Outlook: Today, the data coming from Germany, one of the powerful economies of the European Region, will be followed closely. German PMI will indicate the performance of the economy. The risk of recession is still on the table and the ECB needs good macroeconomic data to fight inflation. The ECB is expected to increase by 50 bps in March. In addition, the ZEW sentiment data for the Euro and Germany, which will be released today, will provide important indications regarding the measurement of economic performance.

Technical Analysis : Last Friday, the parity has a significant volatility, and it has found support at 1.0610. However, the pair is expected to face resistance at the 1.0690 level. On the other hand, it’s crucial to monitor the 1.0660 and 1.0640 levels as potential support areas. In addition, the blue MACD line is currently situated in the negative zone of the histogram, and it must cross into the positive zone for an upward trend to emerge. Therefore, traders should pay close attention to the MACD and RSI indicators to identify potential opportunities for the pair.

EURUSD

Fundamental Outlook: The euro has been relatively insulated from the recent recovery in the US dollar exchange rates, partly due to the European Central Bank’s (ECB) hawkish stance and evolving outlook on interest rates in the eurozone. This week, market movements are expected to be influenced by several economic indicators from both Europe and the US. Among these figures, the German Consumer Price Index (CPI) will be closely monitored. CPI is a key measure of inflation, and any significant deviation from market expectations could have an impact on market sentiment and trading activity. As a result, traders and investors will be keeping a close eye on the release of the German CPI data to gauge the outlook for the eurozone economy and the potential implications for the ECB’s monetary policy stance.

Technical Analysis : The currency pair is currently trading below its moving averages, suggesting a bearish outlook. As long as the pair remains below the 1.0700 level, we may anticipate further selling pressure. However, should the pair find support at 1.0675, we may see a temporary halt in the downtrend. On the other hand, if the pair manages to break above the 1.0700 resistance level, it may indicate a bullish trend reversal, and we should monitor for potential buying opportunities.

Support: 1.0675 - 1.0655 – 1.0615

Resistance: 1.0700 – 1.0730 – 1.0760

EURUSD

Fundamental Outlook: Today, investors who focus on parity will monitor the release of German PMI (Purchasing Managers’ Index) data and inflation data. ECB officials have made comments suggesting the possibility of an interest rate increase of 50 basis points. It is anticipated that German inflation figures will show a decrease from 8.7% to 8.5%.

Technical Analysis : Yesterday, the currency pair trended upward, reaching the 8-day exponential moving average. However, the daily closing price failed to hold above this average. Today, there will be another attempt to maintain the price above this level. Given the high volume of economic data expected today, there is a possibility of volatile price movements as the data is analyzed. Traders should watch the support level at 1.0575 and the resistance level at 1.0620.

Support: 1.0575 - 1.0540 – 1.0480

Resistance: 1.0620 – 1.0670 – 1.0710

EURUSD

Fundamental Outlook: To counterbalance the surging demand and prevent a possible inflationary cycle caused by rising consumer prices leading to higher wages, the European Central Bank (ECB) plans to increase interest rates by the highest margin in the past forty years. The ECB’s reasoning behind this move is to tame the demand and mitigate the risk of inflationary pressure on the economy.

Technical Analysis : Based on technical analysis, the pair has exhibited a strong upward momentum, crossing above the 8-day exponential moving average. The appreciation of the US dollar index, triggered by concerns about inflation and high-interest rates, has resulted in a decline in the euro. In the near term, the 1.0625 level can be considered as a support level, with the next support level being 1.0555. On the upside, the 1.0675 level can be viewed as a support level for the pair.

Support: 1.0625 - 1.0555 – 1.0535

Resistance: 1.0675 – 1.0700 – 1.0730

EURUSD

Fundamental Outlook: Data released on Thursday showed that Eurozone inflation eased slightly to 8.5% last month from 8.6% in January. However, the decline was mainly driven by lower energy costs. Prices for most other items, such as food, services, and durable goods, continued to surge, reinforcing the concerns of some policymakers at the ECB. In summary, while Eurozone inflation eased a bit in February, the drop was primarily due to lower energy prices. The prices for most other goods continued to rise, including food, services, and durable goods, which raised concerns among some ECB policymakers.

Technical Analysis : Over the past five days, a pattern of rising bottoms has emerged in the currency pair, indicating an ascending channel. As the price continues to rise, it is likely to encounter resistance at the 1.0675 level. However, on the downside, the 1.0575 level may serve as a support for any declines.

Support: 1.0575 - 1.0555 – 1.0525

Resistance: 1.0675 – 1.0700 – 1.0730

EURUSD

Fundamental Outlook: The European statistics agency reported on Tuesday that the eurozone economy did not experience any growth in the last quarter of 2022 compared to the previous quarter. Both GDP and employment growth figures were slightly revised downwards, but employment growth remained strong. According to Eurostat, economic growth in the eurozone was 0.0% in Q4 compared to Q3 and 1.8% YoY. The previously released flash estimates were 0.1% and 1.9% respectively, on February 14.

Technical Analysis : The pair is currently seeking support at the 200-day moving average level and attempting to maintain its position at this level over the past few days. Traders should pay attention to the 1.0570 level, which is likely to act as resistance for the Euro in the near future. On the downside, if the pair drops further, the 1.0520 level may serve as a potential support level.

Support: 1.0520 - 1.0485 – 1.0400

Resistance: 1.0570 – 1.0600 – 1.0640

The United states is many trillions in debt, the interest payments make recovery impossible.

EURUSD

Fundamental Outlook: The European Central Bank is expected to announce another interest rate hike on Thursday, but the recent turmoil in global bank stocks has made the outlook less certain. In February, there was an unexpected increase in underlying inflation, which caused policymakers to worry that inflationary pressures might persist. However, the uncertainty in the U.S. banking sector has created concerns about potential contagion in Europe. As a result, confidence in a significant 50 basis point interest rate hike has diminished.

Technical Analysis: After three consecutive days of strong uptrend, the pair faced a barrier at 1.0750 and pulled back. However, the formation of a double bottom pattern suggests a target of 1.0800. To achieve this, the pair needs to break through the 1.0750 resistance level first. The current pullback may continue until the double bottom resistance is broken, where a retest is possible. If the decline persists, the support level to watch is at 1.0650.

Support: 1.0650 - 1.0600 – 1.0525

Resistance: 1.0750 – 1.0780 – 1.0835