What broker ?

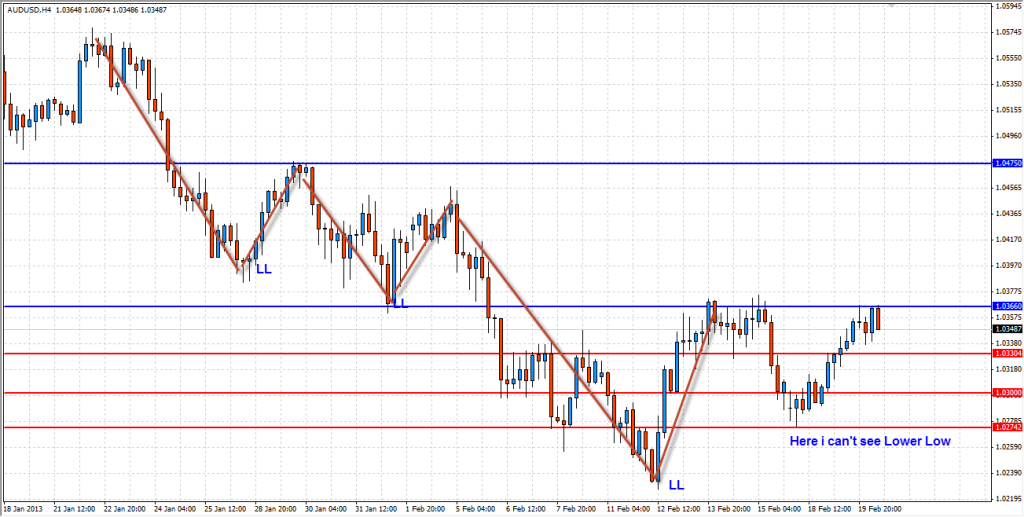

In Pepperstone Pinbar is too small . Now trend isn’t clearly

Fxcm

Daily trend clearly down

The pin bar does look smaller if you look at the 4 hour over a bigger period.

KR RMc

Hopes are made of this…

-

GBPUSD D1: approaching key historical zone around 1.5400. Any CT PA?

-

USCAD D1: any pullback to RN 1.0100 + bullish PA?

-

SPI200 (Aussie futures): any pullback to VBRN 5000 (in strong uptrend!) + bullish PA?

Cheers

I would wait at least for the next week to go long on GBPUSD IF historical support holds. It dropped 100 pips so fast…

What do you think of it?

So because it is dropping you are looking to go long?

Would it not be better to look for any strength and price rotating higher to get short with the all the current momentum there is for bears?

What you need to do is first only every enter trades you are confident about and that you hold no doubts about. When you enter trades that you are doubting, when they go into drawdown you will be looking for any excuse to get out.

The other thing you need to do is before entering any trades work out exactly how you are going to manage the trade and write it down. You should not be trying to work out what to do on the fly. You should have levels marked and no exactly what you are going to do when price gets there.

Johnathon

Well done to those that took the 2 day NZDUSD Pin Bar or daily BEEB. I know a few posted it and would not be cleaning up so well done to those traders.

NZDUSD 2 DAY CHART

I was looking at the support on weekly chart.

If it rotate higher wouldn’t we be going against 1.53000?

Or do you mean a higher rotation to give us more free room to go short?

Looking at this daily chart the trend is both super strong and obvious. i would much prefer shorting with it than go against it. Don’t get me wrong I am not saying I would not go long if the chance presents but to short with the obvious trend is always first choice.

Any rotations higher and I will look to short on 4hr/8hr and daily charts.

GBPUSD DAILY CHART

Anyone else in eurgbp long based on bullish engulf on d1? or maybe even previous pb–?

I understand your point. I was considering long if a BUEB on next week show up. That’s why I said to wait. I know it’s much more difficult to happen.

Which one? Chart?

This was one of the trades that I had no doubts that it’s good. With strong trend, swing low, big BUEB, from support.

I was surprised that the price went down, no up. My plan is this: I won’t get out until I will lose all the money I planned to lose for this trade or until the price reaches break even.

Did you take the trade? If not, what was the reason you did not take it?

I took this trade and when it moved to FSA area I adjusted my trade to BE level . So I am in now but Risk Free

Okay fair enough. I guess I am confused because you said:

[U]“I took this trade but now that is seems it doesn’t work too well I’m thinking maybe I shouldn’t have taken.”[/U]

You really don’t sound sure about it, which can lead to second guessing trades and them making dud decisions because of the doubt.

And then are wondering if you should cut the trade or not:

[U]“If I take a trade I should wait until my stop loss will be reached, or I can close my trade at break even or with a small loss?”[/U]

What trade was it? I did not look at the trade, just replied to what you had written which sounded full of doubt. It also struck me that you did not have any set idea of how you were planning to manage the trade. I understand what you mean about letting it go until your stop is hit, but what I was talking about was targets. You need to have your targets and exactly how you will manage the trade written down before you enter. Things seem different when money on the line and you will make far better decisions when don’t have money on the line. it is then just a matter of following what you have written and it a lot easier than guessing whilst under pressure of drawdown.

To answer your last question, i am not sure how you place your stops, but where I put mine, I put them there for a reason. Cutting a trade after it has gone into a little bit of drawdown would make the placement of the stop useless. As we know price does not move in straight lines and trades need room to move. You have your stop there for a reason. Let price do it’s thing and don’t over manage your trades.

Did your trade work out in the end?

I have seen this setup after the close of the 8hr candle of a pinbar and on for hour a BEEB. Is this an A + trade your opinion is highly appreciated.

I had no doubts before I entered the trade, in fact I waited for a long time for a pullback and PA signal on JPY pairs, the doubts appeared only on Tuesday when I saw price moving down instead of up.

My first TP target was 147.76.

On the broker that I placed the trade the BUEB closed above the open of the previous candle.

I put my stop at the low of the BUEB.