For daily analysis

5 important events this week will bring us

More at: The main events taking place December 9-13 which will affect Forex market.

09.12.2019

The second half of this week is going to be well loaded with big events. All major currencies will be affected, for this reason, brace yourselves and prepare for some price action.

Main events

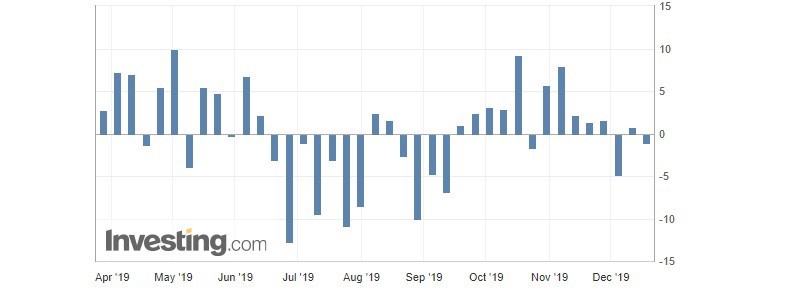

British monthly GDP growth rate (Tue, 11:30 MT time (09:30 GMT))The last two indicators of the monthly GDP growth rate have been at -0.1%. If the monthly GDP growth for October is better than the expected 0.1%, it will make the British pound rise.

Federal Funds Rate (Wed, 21:00 MT time (19:00 GMT)) The American financial authorities will announce the interest rate and release the monetary policy statement. They will also give the economic projections for the nearest future and explain the main issues behind the chosen monetary stance. Steady rate (currently at 1.75%) and positive perspectives will support the US dollar.

The British Parliament elections (Thu, all day)Finally, we will see the resolution of the months-long parliamentary debates and clarification of the coming course of development in Great Britain. Definitely, it is going to be a hard day for the British pound, but the victory of Boris Johnson would boost it.

ECB Main Refinancing Rate and Press Conference (Thu, 15:30 MT time (13:30 GMT))The European Central Bank will announce the interest rate, to which no change is expected (currently at 0%); more importantly, the ECB head Christine Lagarde will give a press conference, which will reveal the economic outlook of the euro area and the intentions of the monetary policy makers. A positive tone of the speech will strengthen the euro.

American monthly retails sales (Fri, 15:30 MT time (13:30 GMT))Although not a major indicator, still the retail sales give a very representative outlook on consumer sentiment. If the picture is more positive than the market expectation, the US dollar will rise.

Background tension

Strong jobs data provided by the Non-Farm Payrolls on December 6 boosted the US dollar. However, the upward movement of the US dollar does not gain full power as there still are serious concerns among the investors on the next stage of the US-China trade war. The deadline of December 15 for imposing new tariffs on the Chinese goods by the US is still in place, while the last comment from the US President Donald Trump was that he liked where the negotiations were going. This means that tensions will keep the market’s optimism in check until next Monday at the very least.

Currency market on December 10

10.12.2019

Clouds are gathering

Today is expected to be a relatively quiet day in terms of economic announcements. The big events start on Wednesday, while at the background the December 15 deadline for imposing new tariffs by the US on the Chinese goods will keep the market dynamics warmed up through the rest of the week. Such a layout represents a future sentiment among many within the financial circles: nothing really disastrous, but a general outlook of uncertainty, misbalance, and slowdown. Essentially, these are the reasons why Goldman Sachs analysts predict the price of gold to rise in 2020.

More specifically, they say it may soar up to $1600, which actually is quite a worrying prediction. The last time gold was in that area were the years 2011-2013, which means crisis and post-crisis period. And the level itself is substantially far away from the current area of $1470 per troy ounce. However, the upward trend is visible since 2016, and it seems that even without any major disappointments in the global economic environment the market would gradually get to the heights of $1600.

Nevertheless, below are some of the noteworthy events of regional impact, which may become the market movers to a certain extent today.

British Balance of Trade (11:30 MT time (09:30 GMT))

German ZEW Economic Sentiment Index (12:00 MT time (10:00 GMT))

You can have a closer look at these events in the economic calendar.

Clear picture for the euro

Since August this year, the euro has been dropping against the British pound and has not made an exception recently. In fact, it may find more reasons to continue the same direction. The pre-election polls show that the Conservative party of Boris Johnson is gaining strength, which in turn supports the GBP. While the questions about the bond purchasing program within the quantitative easing by the ECB keep rising, not leaving much space for positive expectations on the coming press-conference by Christine Lagarde. Altogether, this weakens the EUR/GBP pair. Technically, it is expected to keep falling in any case in the long-term. In the mid-term, however, we may see a surge up to the levels of the 50-period and 100-period Moving Average, to which it came every time before dropping further during the last three weeks. Today, although a recoil up to the resistance of 0.8455 is still a possible scenario, more probably the price will crawl a little further up and then drop. On the H4, we already see that the level of 0.8400 was touched during the trading process previously, and the price is consolidating along the current level in a sideways movement. So watch out for a minor local upswing followed by the continuation of the downtrend.

US news come first

Against the US dollar, the euro has been rising since the end of November, even despite the strong NFP data released by US labor authorities on December 6. On the H1, this marked trend is visible and currently coincides with the 200-period moving average, supporting the price movement. It would be tempting to assume that the price would continue the same direction. However, we have to take into account the news coming. On Wednesday, the Fed will announce the interest rate and give a press conference. That is, after a positive NFP data, showing the resilience of the US economy. On Thursday, the European Central Bank will do the same for the Eurozone, but the expectations are hardly positive. Therefore, it will be safer to price-in the downward reversal later on. But for now, the resistance of 1.1078 is a feasible target for the price to reach.

Opinion polls cast a shadow on the GBP

More at: http://bit.ly/2RO0mw2

11.12.2019

YouGov, the key organization tracking the UK public opinion has released its final report ahead of the vote that will take place on Thursday, December 12. The news made the pound weaken versus most major currencies. Learn more!

Why is it important?

There are three scenarios of the election outcome, which are expected to affect the Brexit process and the GBP as well.

The first one is the victory of the Conservative party. As you may know, this is the party led by Boris Johnson. Analysts expect this scenario to provide certainty in Brexit, and, therefore, to push the GBP up.

The second scenario is a hung Parliament. In that case, the party with most of the votes will form the minority government. At the same time, as the seats will also be taken by the opposition Labour party, the UK will face the risks of having another Brexit deadlock. As a result, the GBP will go down.

Finally, the third scenario is the leadership of Jeremy Corbyn’s Labour party. The opposition leader criticizes the inability of the Conservatives to suggest any clear solution over Brexit and plans a second referendum. No surprise for this outcome to be Brexit-negative.

What do the polls say?

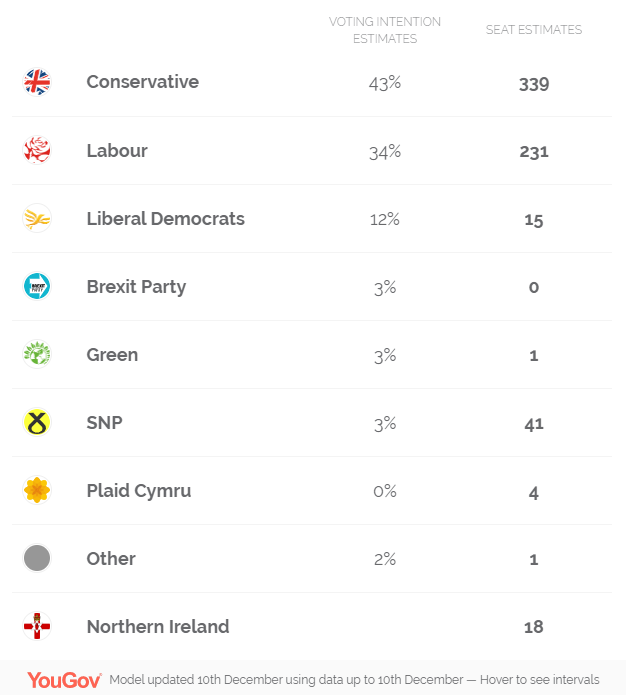

According to YouGov, the Tories (the Conservative party) majority has been shrinking. The final poll shows 43% for the Conservatives and 34% for the Labour. These figures increase the possibility of a hung parliament.

How did the GBP react?

The British pound dropped on the news with the wave of panic selling. The 1.32 cliff appeared to be too tough for GBP/USD and the pair has slid to the 1.31 support level.

Top 4 trading opportunities of December 12

12.12.2019

GBP: the room for surprises

It’s an election day in the UK. Traders will watch exit polls. The results will start arriving after 00:30 MT rime on Friday. The results of the vote will become clear by 4:00-5:00 MT time.

The latest opinion polls showed that the Conservative Party has a small majority. This means that the risk of a hung parliament is substantial and the fate of the GBP is hanging in the balance.

In the meantime, Boris Johnson, Prime Minister and the leader of the Conservatives, was in no mood to talk: he hid in an industrial fridge to avoid journalists’ questions.

EUR: mildly negative risks ahead of the ECB

The first meeting of Christine Lagarde as the President of the European Central Bank. Analysts at UBS expect that she will deal with the divided Government Council and won’t initiate any new policy action. Still, the Lagarde may try to make the news. She may comment on the policy tools available to the central bank. In addition, the ECB may lower growth and inflation forecasts for the euro area.

USD: it’s not so bad

Yesterday, the Federal Reserve kept its interest rate unchanged at a 1.5%-2% range during its meeting. What is more important is that the Fed’s dot plot indicated the federal funds rate at 1.6% in 2020, without any changes. You can read more about the outcome of the meeting here.

Trump’s meeting is ahead

Today, US President Donald Trump plans to meet the top trade advisers to discuss tariffs on China. The meeting will be crucial ahead of the tariffs deadline on December 15. According to an anonymous source, the US administration will raise tariffs on Sunday, but the final word will still belong to Trump. The fresh tariffs will increase uncertainties in the process of the US-China trade deal and be hurtful for the risk-weighted assets, such as the AUD, the NZD, and stocks.

What else happens in the market?

Follow the news and our social networks: Telegram and Facebook to stay up to date with the changes!

Victorious Boris Johnson

Check the charts: http://bit.ly/38DmYW8

13.12.2019

Conservatives win

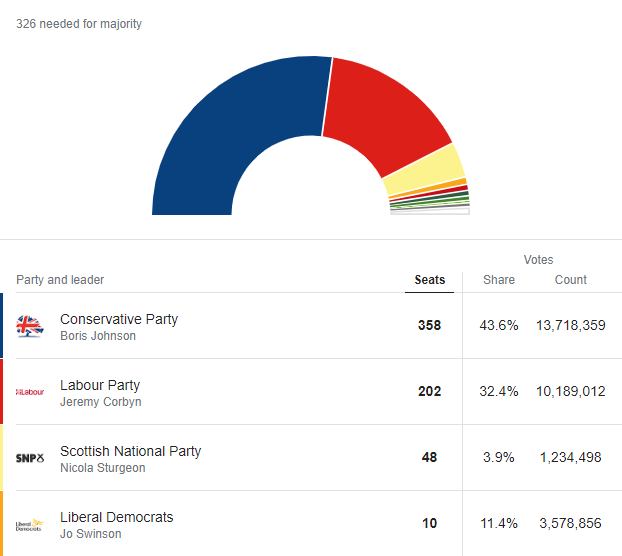

Finally, the victory of the Сonservative party under the leadership of Boris Johnson is confirmed. They have a 43.6% majority, while the Labour party follows with 32.4% and the Liberal Democrats got 11.4%.

The consequences?

Boris Johnson had previously commented he had a strong agenda for the United Kingdom should he win the election. One of the pillars of his plan was to “get Brexit done” at the soonest and in the best interest of the UK.

For the UK, it means higher stability and a better economic outlook with all the consequences.

For the world, it means stronger GBP against the related currencies.

All of that, of course, takes place if Mr. Johnson does not fail on his intentions.

GBP celebrating the victory

In the meantime, the British pound reacted immediately to the victory of Boris Johnson.

On the weekly chart, it is visible that the price of GBP/USD rose to the area of 1.35 – a height it has never been to since May 2018. And it is testing the August-2018-December-2019 resistance currently. Crossing this barrier would confirm the market’s intention to go even higher.

In the short term, however, we are expecting a certain correction downwards, as confirmed by the Awesome Oscillator. In any case, whether it is going further upwards now or later, the price would need to make a stop at the resistance it is testing now. On the hourly chart, the level of 1.3500 is going to be capping the bullish direction for a while, while 1.3450 will be the support. Crossing the support would mean a deeper correction downwards. Otherwise, we will observe a more sideways movement of the price.

Watch the news and stay informed!

Important events this week will bring us

More at: The week December 16-20 is expected to be quiet on Forex market.

16.12.2019

Time to cool down

Last Friday has brought us some good news – the phase-one trade deal between the US and China was sealed. Although the official ceremony of signing the text and shaking hands will take place in January, both sides already confirmed to the public that the step is taken.

According to the deal, the US commits to reducing certain tariffs and expanding tariffs exemption for the Chinese goods, while China commits to purchasing more of the US goods, with the focus on the farm industry. Apart from a few specifics like an advancement in regulating intellectual property rights, there was little more detail provided on the deal struck.

Hence, although the announced content of the deal made a lot of analysts highly skeptical about the actual positive effect the agreement brings, at least we have some confirmation that things are not going worse in the observable future. As the old proverb says, a weak peace is better than a strong war.

A quiet week ahead

As the US-China deal announcement, the ECB monetary press conference and the UK parliamentary elections all took place last week, this week has little to offer in comparison. Nevertheless, below are some of the noteworthy events you may be interested to watch out for.

Monday of PMIs

Today, the industrial expansion indicators will be announced by France (10:15 MT time(08:15 GMT)), Germany (10:30 MT time(08:30 GMT)), the UK (11:30 TM time (09:30 GMT)) and the US (16:45 MT time (14:45 GMT)). Although not a primary indicator like the GDP, the PMI is also an important evaluation of country’s economy and may have an effect on the respective currencies depending on how the actual indicator stands against the market expectation.

Australia

On Tuesday, Australian financial authorities will publish the monetary policy meeting minutes at 02:30 TM time (00:30 GMT). It will provide details of the last monetary policy meeting and the reasons behind keeping the country interest rate at 0.75%. More importantly, it will provide a sense of the economic outlook and the directions to look at in the future. In addition to that, Thursday will be the day when the country employment change and unemployment rates are announced (02:30 MT time (00:30 GMT)). Therefore, by the end of the week, we will have a more or less complete economic picture of how Australia is closing this year. A positive impression from the releases should strengthen the Australian dollar.

Inflation

A central indicator of economic and money mass expansion, the inflation rate will be announced by the UK and Canada on Wednesday at 11:30 MT time (09:30 GMT) and 15:30 MT time (13:30 GMT) respectively, and by Japan on Friday at 01:30 MT time (23:30 GMT).

After election effects on the BOE

17.12.2019

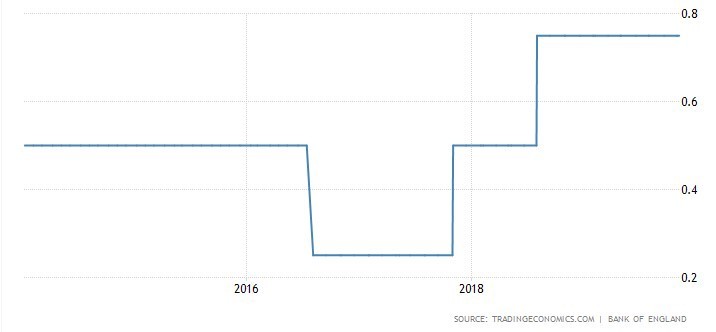

The Bank of England will conduct a meeting and release a monetary policy summary at 14:00 MT time on December 19.

The monetary policy summary is published every month, which helps to keep investors updated with the current economic situation. The summary contains the votes on the interest rate, forecasts, and other policy measures. During the previous meeting, the votes for the rate changes split unexpectedly, as two out of nine members of the bank’s monetary policy committee supported a cut of the interest rate. Let’s see if the result of the UK general election affects the BOE decision this time.

IF the BOE is optimistic, the GBP will rise;

If the BOE is pessimistic, the GBP will fall.

Did Trump impeachment affect the currency market?

More at: Trump impeachment, strong Australian job data and more

19.12.2019

Good Thursday, world! We’ve got plenty of news and important releases since yesterday. Did they have a major impact on the market, though? Let’s see.

Tough time for the US presidency?

During yesterday’s American trading session, the US House of Representatives voted to impeach US President Donald Trump. Trump was charged with abusing of power. That decision made him the third US president in US history to be impeached. However, the support of impeachment in the House does not immediately remove the 45th US president from the office, as the final word still belongs to the Senate. As the Republicans (Donald Trump’s party) have a majority in that chamber, the vote supported by the Democrats will barely change anything.

The currency market was not affected by the impeachment process with no effect on the USD.

Australian labor market gets stronger

During the Asian trading session, the Australian dollar was boosted by the release of Australia’s job data. The employment change showed a solid growth by 39.9K (vs. 14.5K expected), and the unemployment rate declined from 5.3% to 5.2%. AUD/USD has risen by around 35 pips since the start of the day.

Bank of Japan: no hurry needed

The Bank of Japan kept its interest rate unchanged at -0.1% during today’s meeting. The BOJ Governor Haruhiko Kuroda expressed the positive views on the economy but noted that the global uncertainties remain. The bank will continue monetary policy easing until the economic conditions get better.

What is ahead

The main focus will be on the Bank of England monetary policy summary at 14:00 MT. It would be interesting to hear the comments by Governor Mark Carney after the election is over. Follow the news and stay updated.

The undone victory for the GBP

18.12.2019

Yesterday, we were fearing that a strict Brexit deadline announced by the UK PM Boris Johnson and other ministers may put excessive pressure downwards on the GBP in the short-term and the long-term.

Now, we see that all the gains that the GBP won on the Conservatives’ victory are undone. Moreover, the British pound seems to be preparing to continue falling against the major currencies in the observable future.

Against the euro

On the H4, the upsurge of EUR/GBP reached higher than where it dropped from on the day of the UK elections. More so, it crossed the 50-period and 100-period Moving Averages, now testing the resistance of 200-MA. The next big step would be the high of 0.8600, reached in November.

However, we see the consolidation and the slowdown of the current steep rise right at the resistance of the 200-period Moving Average. The Awesome Oscillator also shows that a high may have been reached, and the momentum for this particular upsurge has been exhausted.

Climbing further up requires additional power and most probably additional confirmation from the Conservatives side that they would not back down on their strict agenda. If such news comes in, we may witness the start of a gradual change in the overall trend. In addition, given the context of the situation and the commentaries already provided by the UK PM Mr. Johnson and his colleagues, the absence of any information disproving the rigidity of their plan may also serve as a confirmation of the looming hard Brexit. In this case, it will cause further weakening of the GBP.

Against the USD

Against the USD, the GBP has dropped to the level of 1.3100 where it started its leap on December 12, breaking through the 50-period Moving Average. On the H4, the price is currently testing the support of the 100-period MA, showing signs of consolidation. Same as in the case with the euro, it is likely that the price will stay at the current support level for a while, waiting for additional information to guide the market movement. It may show a slight movement upwards or go sideways. If it does cross the 100-period Moving Average, it would be a sign that the market indeed has little hope for the GBP in the context of hard Brexit.

Against other currencies

Most of the GBP currency pairs show a very similar dynamic, with certain variations. On the H4 of GBP/CHF, the price has crossed the 50-period, 100-period, and 200-period Moving Average on the way down. Currently, it is testing the support of 1.2813, left at the beginning of December. Crossing that line would mean the price aims at the level of 1.2680, along which it has been trading in October-November.

Outcome

The impact of the announced Brexit agenda by the Conservatives is visible at the market. Now, the question is whether it will be a short-term disappointment or a start of a larger trend change.

To answer that, we need to follow the news and keep an eye on the price movement against the mid-term and long-term thresholds.

Will the US crude oil inventories push the USD up?

Check more: http://bit.ly/2QeqoGp

23.12.2019

The American Crude Oil inventories will be announced at 18:00 MT time on December 27.

In view of the OPEC’s last meeting and the ongoing discussions around the world oil production and prices, the American crude oil inventories are an important figure to watch out for. Although it is not a prime indicator like a total US crude oil output, still, it has an impact on the market, especially on the CAD after the USD, due to the robust energy sector of Canada connected with the US. While the USD rises on the expansion of this indicator, the influence on the CAD is inverted; decreasing American oil inventories would put the USD under pressure down and support the CAD.

If the figures are higher than expected, the USD will be supported;

If the figures are lower than expected, the USD will be under pressure down.

Where will EUR/USD head to?

More at: Forecasts for EUR/USD

30.12.2019

Morgan Stanley forecasts EUR/USD at 1.16 at the end of March 2020, ahead of a further rise to 1.18 by the end of June 2020. According to the bank, Eurozone growth will pick up as US growth starts to slow. In addition, the euro will be supported by political factors. A 2020 resolution to Brexit should reduce economic uncertainty for the UK and its major trading partners, including the euro area.

Rabobank reminds, however, that the USD is still the only dominant currency on the global payments system and that the US economy continues to perform well relative to other major countries.” The bank foresees EUR/USD at 1.09 in a three month period and at 1.11 in nine months.

BNP Paribas is somewhere in the middle. Its analysts think that the Fed will cut its official rate twice in the first half of 2020 in reaction to a slowing economy, moderate inflation, and high uncertainty. At the same time, the ECB will also keep the accommodative policy and this won’t let the euro strengthen much against the USD. As a result, there will be little change in EUR/USD even though the euro’s fair value is quite higher than current pricing.

Cautious moods entering the market

06.01.2020

A shattered hope for a quiet start

As we have observed in the previous article, the escalation of the chronic US-Iran conflict put the Middle East unrest into the focus of the world’s political and economic news. Since the death of the Iranian military commander, general Soleimani, the countries only exchanged mutual threats. That pushed the markets away from the outright positive moods to the risk-aversion scenarios with the corresponding currencies and commodities.

Oil

Brent is already trading at $70 per barrel. We mentioned this level as the expected maximum of the price movement for this year in the 2020 forecast for oil. On the daily chart below, the price reached this high with confidence, having now $73 as the next target. If no better news comes from the US-Iran front, there will be a high probability of the price getting there quite soon.

In general, the oil will be the first item to react to any Middle East news. As it is produced in this region, any shaky movement will push its price upwards (to the joy of OPEC+ and other oil-exporting countries, including the US, by the way).

Gold

Gold rose to where it has not been since 2013. On the weekly chart, it broke the August-2019 high of $1530 per ounce to the levels of $1570. The next resistance lies at $1610 at the level of the March-2013 high. The supports may be kept at $1483 and $1453. However, these are likely to stay untouched if the situation in the Middle East keeps evolving in the same direction.

Swiss franc

On the H1, January 3 is where the local downtrend starts – that’s when the news about the Iranian military commander was released. Before that, the USD/CHF was mostly rising. Now, the currency pair is traded at 0.9713, going into consolidation at the 50-period Moving Average level. That reflects the inner logic of the situation: the otherwise positive market mood waiting to see the US-China deal signed tripped at the sudden Middle East tension surge. If things go the same direction, the Swiss franc will keep gaining strength as the primary safe-haven currency, in line with the other ones.

Conclusion

No one expected the US-Iran relations to receive this sudden blow, but this is how things work. However, it would be an overstatement to say that the market seriously trembled. Yes, we saw related currencies and commodities react to the US-Iran worrying news, but nothing extraordinary happened so far. Now, it will be safe to assume that the market shrugs off an openly positive mood and enters a more cautious mode to receive more news about the Middle East situation and weigh them against the US-China trade deal confirmations.

TESLA: up to $500 per share or not so fast?

More at: Tesla seeing its first Model-3 off the Shanghai plant - the consequences?

06.01.2020

What happened

On December 30, Tesla celebrated its first Model-3 vehicle moving off the company’s first overseas plant in Shanghai, China.

What does it mean

Tesla is trying to conquer the Chinese market, being an electric vehicle production pioneer. This goal is pursued because the company sees the strategic importance and vast potential of the Chinese consumer demand. Reaching a success here would mean that Tesla is truly going global.

However, there are various factors against that: a general drop in the Chinese domestic consumer demand as a trade war echo, a mid-term drop in the electric vehicles demand among the population, the vehicles may be affordable for a narrower market segment than what the company expects, the company’s own financial bumps, competitors and others.

Where are we now

The company stock price broke through the previous all-time high of $390 in the middle of December. On the daily chart, $435 per share was reached in one leap, followed by a brief correction down to $403. However, the mentioned first Model-3 appearing from the Tesla Shanghai factory gates pushed the price up again. Consequently, it is now at the current all-time high of $443 per share.

Where is it going

Now, all eyes will be on Tesla’s Chinese sales dynamics. If these go well, eventually, that will prove that the company’s strategic decision to tap into China’s market was the right one. If it happens, the company stock will indeed has all it takes to reach $500 per share as analysts forecast. If not, we will see what else Elon Musk has up his sleeve.

Before you go

You can trade Tesla stock in line with other stocks FBS offers.

To do that, you need to:

Open MT5 account in your FBS personal area.

Make a deposit.

Download MT5.

Log in and start trading.

GOLD: bullish move on US-Iran conflict escalation

Follow the markets: Gold surges to $1600 per ounce on US-Iran escalation.

08.01.2020

Missiles landing, plane crashing

Missiles have landed today at US airbases in Iraq. This was Iranian retaliation for the killing of elite Quds Force commander Qassem Soleimani by American forces. Another piece of news was that a plane bound to Ukraine crashed in Iran with all passengers and staff dying. No surprise, gold rose to $1,600 as investors seek refuge and hedge their risks against market drawdowns.

Broader consequences

$1,600 may not be the end of it. Analysts at Goldman Sachs say that gold may reach $1,625 this quarter if the Middle East crisis persists. Notice though that even this forecast may be too modest: if the price fixes above the Fibonacci level at $1,585, the next one will be as high as at $1,730 – that’s $145 above the current price!

What’s next

The US President Donald Trump did not specify the losses of the US bases. On the contrary, he tweeted “so far, so good!” and promised to give a speech today. Hence, this seems to be the major event to look forward to. At this moment, gold is correcting to the downside a bit, but the situation has all the prerequisites to put further pressure down on the USD and keep pushing the precious metal higher. The medium-term outlook for gold will remain positive as along as the price remains above the 2019 high at $1,557. Therefore, it’s a good moment to buy the precious metal and look forward to what the US president says.

EXCELLENT stuff here ^

Gold is making some bold moves upwards thanks to recent news events i.e Trump lol

this is interesting.t hanks for sharing.

Thank you so much for your interest Zack! Really appreciate it

Main currency pairs: closing the week

Check the charts: Forex market updates for January 10

10.01.2020

Friday rolls in, closing the first market week of the year 2020. Below, we briefly go through the opportunities this day offers for some key currency pairs in view of important events of the previous and coming days.

USD: all set for the NFP

Of course, markets wait for the Non-Farm Payrolls (out at 15:30 MT time). The overall situation for the US dollar looks positive for various reasons. First, the fears of the conflict escalation with Iran have subsided, losing the focus of the audience and letting the risk appetite get back from safe-havens. Second, the US-China deal is on the way, with the Chinese officials planned to visit Washington DC next week and finally sign the deal on January 15. Third, the recent economic indicators released by the US authorities give a good impression, not to mention surprisingly strong data on the previous NFP.

Hence, let’s see if USD manages to break some of the local barriers after the obstacles get removed from its way up. Against the JPY, 109.70 has been the resistance level capping the bullish moods since May 2019. Last, two months show that the currency pair has been testing this line again and again. Will today be the breakthrough?

Against the EUR, the price is testing the support of the 200-period Moving Average. Also, that is where the bottom line of the December uptrend is located – EUR/USD went into consolidation there at 1.1106. Will this trend be broken as well, leading to the reversal upwards? Let’s see what the NFP brings.

EUR/GBP: dotting the “I’s” for Brexit

The future is finally decided. Boris Johnson’s EU Withdrawal Agreement has been approved in the House of Commons and passed to the House of Lords. 31Jan confirming the end of the relationship is now merely a formality. Now, all eyes will be on the course of negotiations between the UK and the EU. The European Commission President Ursula von der Leyen said it will be almost impossible to have all the points negotiated until the end of 2020, so the fears of a bad Brexit are amassing. On the other side, the Eurozone’s own economic indicators are not that good, although there are signing of the European economy picking up the pace. That’s why we see EUR/GBP struggling to decide where to go, right in the crossing area of the Moving Averages at the level of 0.8500. Which direction it will choose? So far, the table is tilted towards the EUR more.

AUD: lands on fire, currency rising

Against all odds, the AUD is rising. While the bushfires keep damaging the Australian economy and the rumors of the RBA going dovish in February are voiced out among the observers, the AUD/NZD grows to 1.038 to test the 50-period Moving Average. If that resistance is broken and the currency manages to climb above 1.0400 to challenge the 100-MA, it will move into the upper part of the downtrend prevailing during the last month and possibly challenging it later on.

Very informative. Thanks !!