NFP forecasts from 10 major banks

05.06.2020

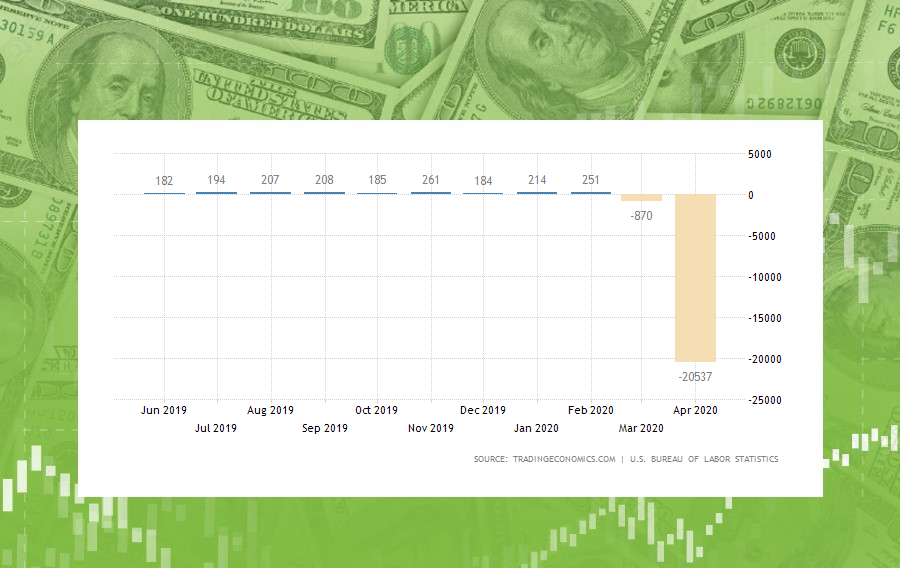

Today is the big day! Investors are waiting for NFP at 15:30 MT time. NFP shows the change in the number of employed people during the previous month, excluding the farming industry. Today it will reveal the employment change in May. It’s one of the most important indicators for all traders as it causes strong market movements. Here below you’ll find predictions from 10 major banks. Their forecasts vary from -2.2 million to -10 million. The most common one is -8 million.

RBC Economics

RBC Economics provides economic analysis and forecasts to the largest bank in Canada - the Royal Bank of Canada and its clients. They anticipate a 2.2 million decline in payrolls after April’s 20.5 million drop and a further increase in the unemployment rate to 20%.

Wells Fargo

It’s the world’s fourth-largest bank, located in San Francisco. Wells Fargo’s analysts believe non-farm payrolls will drop by 8 million and the unemployment rate will climb to 20%.

NBF

NBF is abbreviation for the National Bank of Fujairah in the United Arab Emirates. They expect the US employment to drop by 7.5 million.

CIBC

The Canadian Imperial Bank of Commerce, commonly referred to as CIBC, is one of the “Big Five” banks in Canada. CIBC analysts suggest that around 6 million jobs were shed in May and the unemployment rate will rise by 18.6%.

ING

The ING Group is a Dutch banking and financial services corporation headquartered in Amsterdam. The expect the huge 10 million drop in non-farm payrolls and a rise in unemployment to 20%.

Westpac

Westpac is the Australia’s first bank, located in Sydney. Its economists predict a 7.5 million decline in employment in May and the unemployment rate to peak at 20%.

Deutsche Bank

Deutsche Bank is a multinational investment bank and financial services company headquartered in Frankfurt, Germany. Its analysts forecast a 6.1 million drop in nonfarm payrolls, with the unemployment rate rising to 19.1%.

Danske Bank

Headquartered in Copenhagen, it is the largest bank in Denmark and a major retail bank in the northern European. Danske Bank’s analysts think that employment in the USA has dropped by 10 million. However, they mentioned that we may be too pessimistic.

TDS

TD Securities is a reliable Canadian investment bank. According to economists at TD Securities, the -8 million consensus for payrolls is too weak. Their forecast is -3 million. The TDS expects less weakness than consensus in the unemployment rate as well: a 2.8% rise to 17.5%, versus 19.5% for the consensus.

Goldman Sachs

It’s an American multinational investment bank, headquartered in New York City. Analysts at Goldman Sachs expect a 7.25 million drop in payrolls and a jump to 21.5% in the unemployment rate.

Follow the NFP report at 15:30 MT time today and catch the market movement!