Paul Robinson of DailyFX Research has identified head-and-shoulders topping potential in SPX500.

[B]SPX500 4-hr Chart: Oct 2014 to Jan 2015[/B]

[ul]

[li]Testing neckline at 2000

[/li][li]Target potential below 1900

[/li][/ul]

Paul Robinson of DailyFX Research has identified head-and-shoulders topping potential in SPX500.

[B]SPX500 4-hr Chart: Oct 2014 to Jan 2015[/B]

[ul]

[li]Testing neckline at 2000

[/li][li]Target potential below 1900

[/li][/ul]

Hey Jason. I finally got around to downloading to new Volume indicators for TS, but after installing and restarting TS I don’t see them available in the indicator list. What I’m I missing? Where do I get some help? Thanks.

The new volume indicators will be available after the latest update to Trading Station Desktop is released on January 24th.

Thanks. Should be pretty interesting.

The Australian Dollar declined over 1.6 percent versus the US Dollar after the Reserve Bank cut rates by 25 basis points. Economists were expecting the bank to keep rates unchanged at 2.50 percent.

Directional Real Volume (DRV) shows that selling volume exceeded buying volume by a factor of 2 to 1 at the time of the announcement. DRV is one of 5 new real volume indicators are available for free on the latest version of Trading Station Desktop.

Yesterday’s key reversal day in AUD/USD on massive volume* (the highest volume day since June of 2013) has brought into question whether it has found some type of bottom or not.

The low of yesterday came at the under-side of a multi-month channel, and dialing in a bit closer (4-hr time-frame) we can see an inverse ‘Head-and-shoulders’ pattern under development.

On a break of yesterday’s high (7852), the next area of significant resistance comes in between 8000-8100 (Pivot low last month/upper-channel line).

_

If you already have this platform on your computer, it will automatically update to the latest version after this weekend. However, you can download the latest version now from our website.

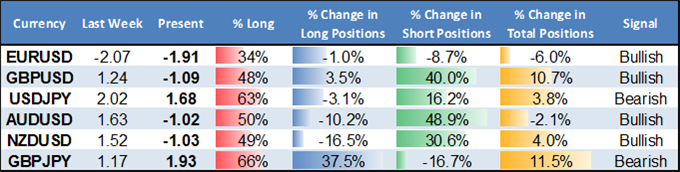

A substantial shift in retail FX trader sentiment warns that the US Dollar may have set an important top.

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

DailyFX Quantitative Strategist David Rodriguez discusses the currencies and potential trades he’s watching.

The Speculative Sentiment Index (SSI) is reported every Thursday at DailyFX.com and twice every trading day inside DailyFXplus.com.

DailyFX Senior Currency Strategist Kristian Kerr uses the new Real Volume* indicator on Trading Station Desktop in his latest Price & Time analysis:

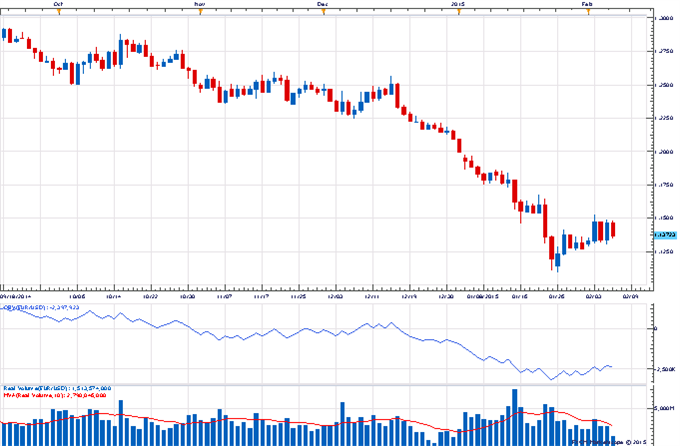

[B]Daily Volume Chart: EUR/USD recovers on weak volume[/B]

[ul]

[li]EUR/USD has rallied steadily from the 11-year low recorded late last month

[/li][li]Declining volume during the recent rise suggests the advance is likely only corrective

[/li][li]A modest push higher in daily OBV levels also favors an eventual downside resumption

[/li][li]A close above 1.1525 on above average volume will keep focus higher

[/li][/ul]

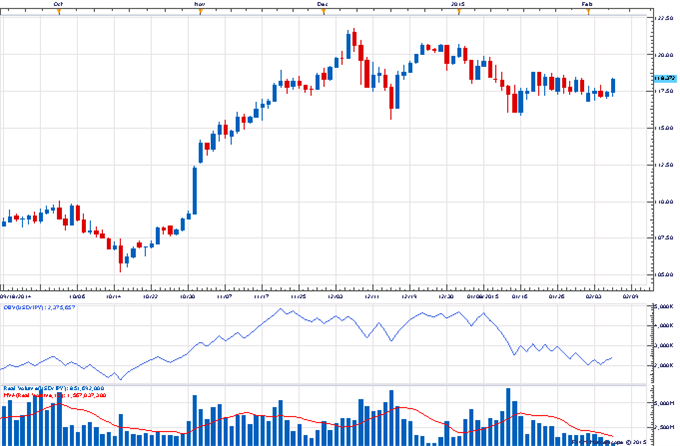

[B]Daily Volume Chart: USD/JPY consolidation sees diminishing turnover[/B]

[ul]

[li]USD/JPY remains in consolidation mode below 122.00

[/li][li]Decline in volume since early December suggests action since then is likely only corrective

[/li][li]However, the persistent decline in daily OBV over past few weeks is a warning sign that a deeper decline may be unfolding

[/li][li]A close under 116.35 on above average volume would turn us negative on the exchange rate

[/li][/ul]

By Paul Robinson of DailyFX

[ul]

[li]EURJPY maintaining an upward bias (trend support) since capitulation lows

[/li][li]Triangle on 4-hr time-frame

[/li][li]Targeting 13700 - 13760 on a break above top-side trend-line

[/li][/ul]

The US Dollar seems to be gaining some momentum as the Dow Jones FXCM US Dollar Index is setting a new 11-year high, and the outcome of today’s EU meeting regarding Greece could prove important to whether we see a break higher.

*Past performance is not indicative of future success

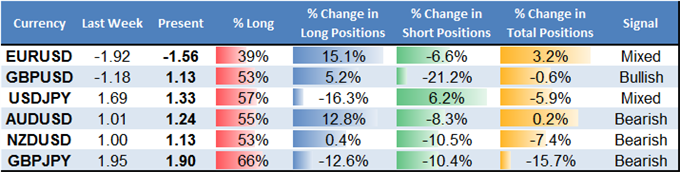

Sharp shifts in forex trader sentiment warn that the US Dollar is likely to offer range-trading opportunities versus the Euro and Yen.

The Speculative Sentiment Index (SSI) is reported every Thursday at DailyFX.com and twice every trading day inside DailyFX PLUS.

FXCM is hosting an Open House for a limited time so that you can test our best products and resources for yourself with no commitment at all. We want you to see the advantages of being with FXCM, and we’re going to do that by letting you test-drive our most popular trading resources for yourself.

For a limited time you will have access to:

FXCM Apps: This limited-time access period includes $500 in App Store credit for FXCM-created applications, strategies and programs at the FXCMApps store. You can use this store credit right now.

Premium products from DailyFX including:

360° Course: The 360° program is a full educational curriculum that emphasizes ‘probability-based trading’ using data from the DailyFX Traits of Successful Traders research series. The course includes a curriculum that teaches traders to simplify fundamental and technical analysis while keeping an eye on the all-important factor of risk management.

DailyFX on Demand – The Ultimate Trading Room: This includes access to four market sessions per day covering the most active periods in the market which an analyst, instructor or strategist will cover economic announcements, data prints and price movements as they happen. DailyFX on Demand also includes access to Real-time SSI and bank research through the live sessions.

DailyFX PLUS: This is the client portal for DailyFX.com where we offer our On-Demand video course, The Live Classroom and the DailyFX PLUS Trading Signals. This portion of the website has grown massively in recent years, and can bring value to traders in a multitude of different ways.

In light of the emergency Eurogroup meeting surrounding Greece’s, please be aware of the risk for gapping over the weekend when trading opens on Sunday. We have seen multiple examples over the years of major market events occurring over the weekend such as the Cyprus bail-in in March of 2013 that caused major volatility at the start of trading. The current bailout arrangement for Greece expires on February 28 giving any rumors or announcements concerning Greece the potential to cause large amounts of volatility.

[B]Be mindful of your Euro positions as we head into the weekend, managing that risk.[/B]

Here’s a strategy video from John Kicklighter discussing EUR/USD and Greek events.

[B]Forex Technical Focus 2/24/2015[/B]

[ul]

[li] USDOLLAR finds slope resistance

[/li][li] Look to USDJPY for a bearish opportunity

[/li][/ul]

AUD/USD Daily

[ul]

[li]AUD/USD breaks weekly/monthly opening range

[/li][li]Now testing confluence resistance into the 79-handle

[/li][li]Breach targets objectives at 7938 / September TL & 8022/38

[/li][/ul]

Full scalping report by Currency Strategist Michael Boutros on DailyFX.com

EUR/USD appears to have broken below it’s month-long range and at the same time SSI is very close to flipping from net short to net long:

[B]SSI Real-Time Positioning Data for EUR/USD[/B]

You can view real-time SSI positioning data in DailyFX on Demand. Access to DailyFX on Demand is now free for a limited time during the 2015 FXCM Open House.