In his article on DailyFX.com, head forex trading instructor Jeremy Wagner discusses the big week for EUR/USD.

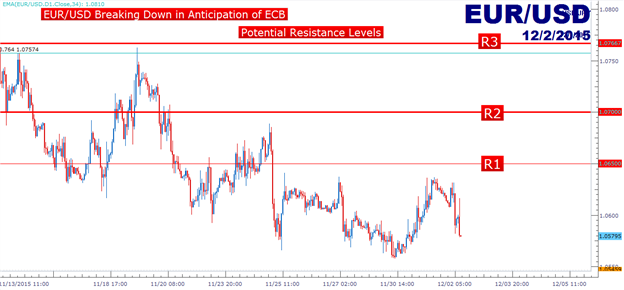

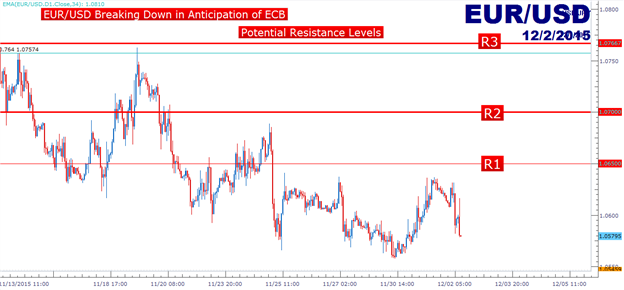

[I]“As we look through the technical patterns, it appears the higher probability move is for a couple hundred pips of US Dollar weakness. This could send the EUR/USD higher towards 1.08-1.09.”[/I]

Tomorrow’s ECB meeting is looking to be one of the more significant European announcements in months, if not years.

Currency analyst James Stanley discusses how to prepare for it in his article today on DailyFX.com.

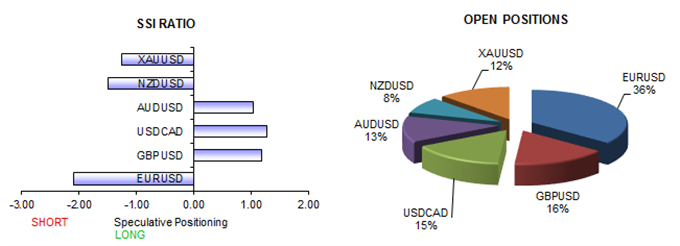

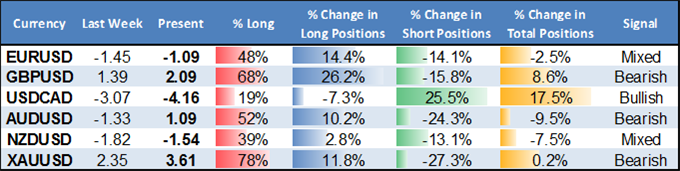

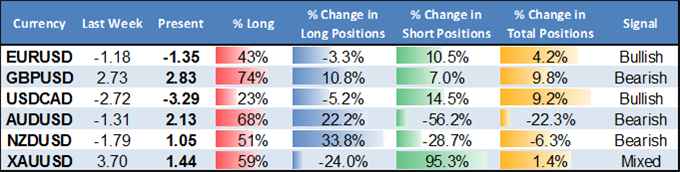

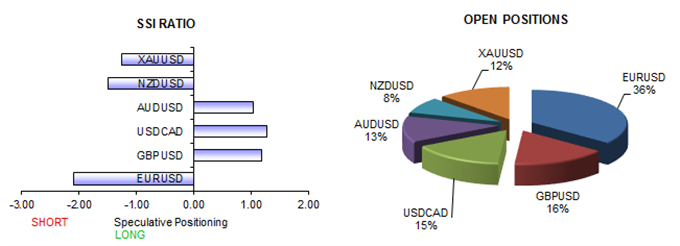

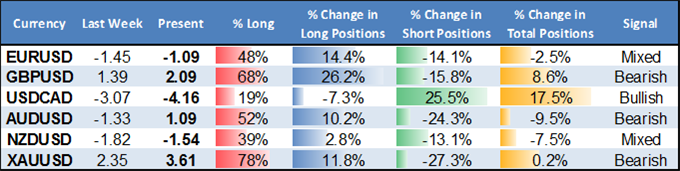

The Speculative Sentiment Index (SSI) has a new format on DailyFX.com and the latest SSI readings show that despite the spike in the EUR/USD exchange rate after today’s ECB rate decision, the retail crowd has flipped net-short EUR/USD.

An SSI value of -1.8956 for EUR/USD means that 65% of retail traders are short the pair. Since SSI is a contrarian indicator, that’s a strong signal that EUR/USD can go even higher.

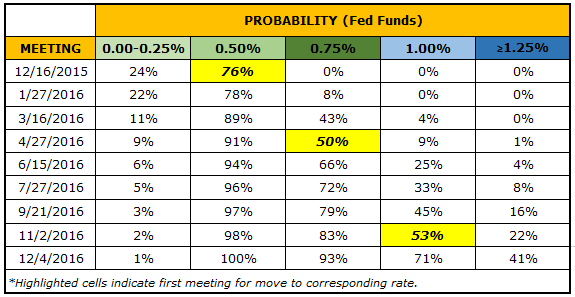

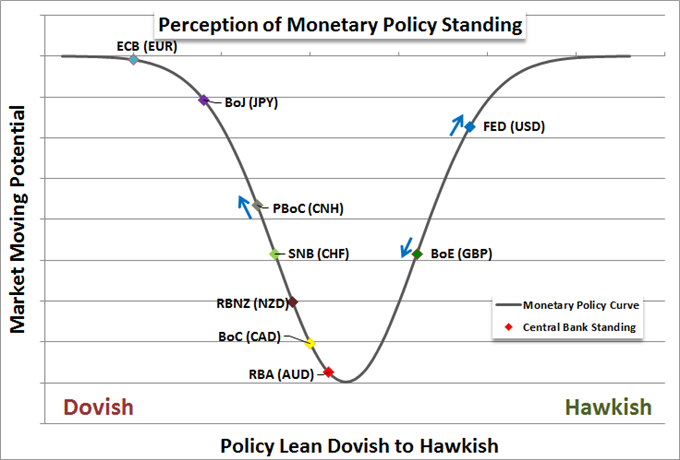

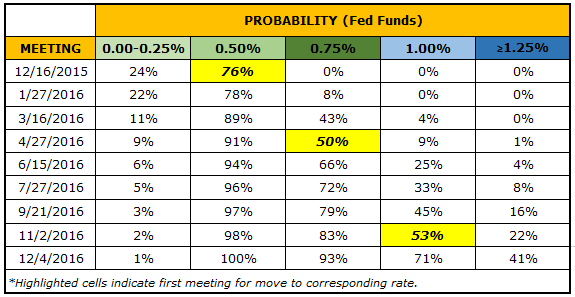

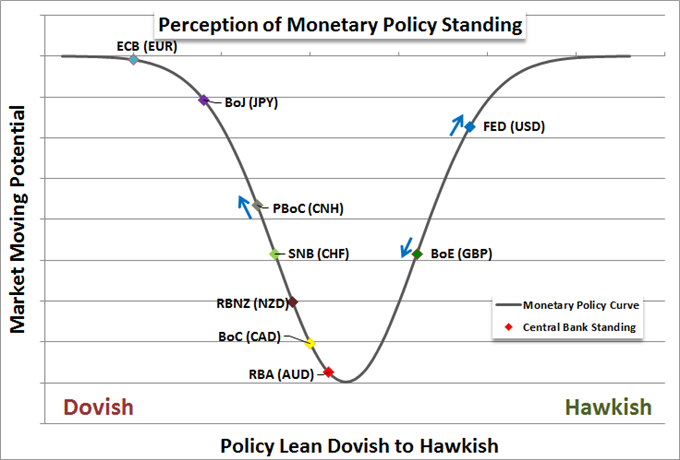

DailyFX currency strategist Christopher Vecchio says, "Mark your calendar for December 16: markets are honing in for the first Federal Reserve rate hike in two weeks after the November US Nonfarm Payrolls report.

“The data, which was truly a ‘Goldilocks’ print – not too hot, not too cold – confirmed recent labor market trends that should keep the Federal Reserve confident enough that the US economy is continuing to heal.”

You can see real-time SSI on the new Sentiment page at DailyFX.com.

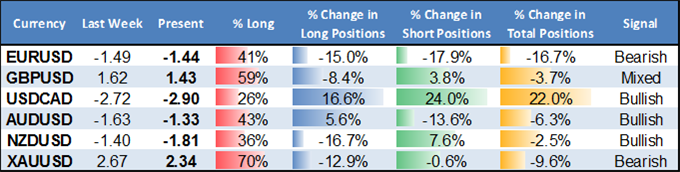

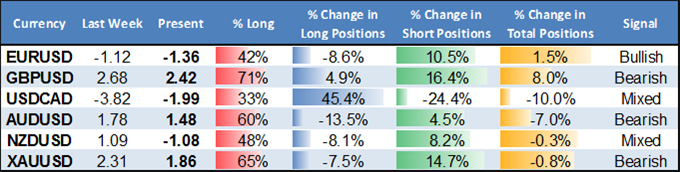

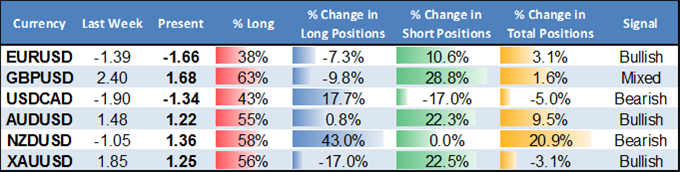

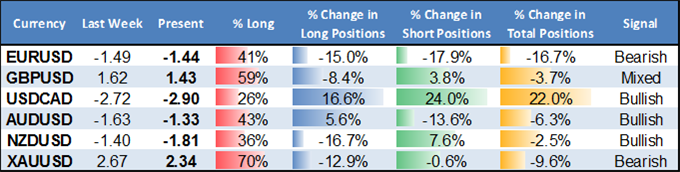

A major turn in retail FX positions warns that the US Dollar may lose further against these major counterparts.

See real time Speculative Sentiment Index (SSI) data on the new retail trader Sentiment page on DailyFX.com

Chief currency strategist John Kicklighter discusses how the upcoming Fed rate decision has the potential to cause big market moves in his article on DailyFX.com.

Talking Points

[ul]

[li]Though there is still some doubt, the market consensus now expects the Fed to hike December 16

[/li][li]Even if a rate hike is realized, the market has priced in far more than what ‘liftoff’ insinuates

[/li][li]We look at a range of visuals that show why this may be a critical event for the global markets

[/li][/ul]

A couple of different scenarios could unfold following the FOMC meeting tomorrow. While it is widely expected the Fed will raise rates, what is not so clear is the path the Fed will take after embarking on a tightening cycle.

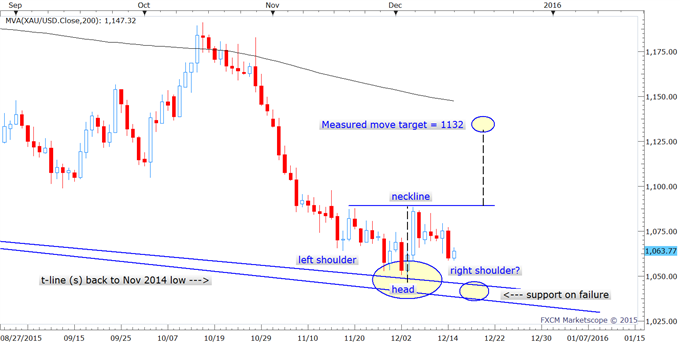

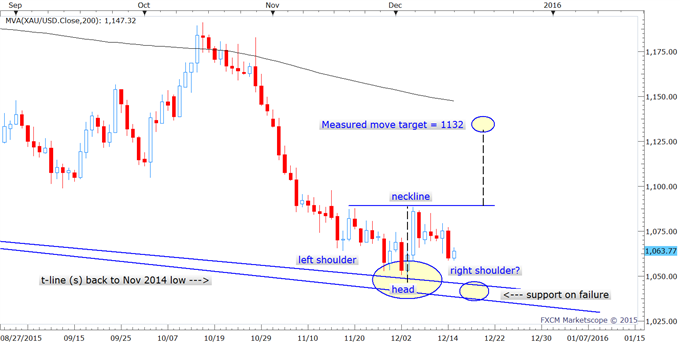

[B]Gold Daily: Aug '15 - Present[/B]

If the Fed signals an even more gradual pace of rate increases than the market expects, we will likely see an immediate sell-off in the dollar and rise in precious metals.

source: The new Sentiment section of DailyFX

Read quantitative strategist David Rodriguez’s full report on DailyFX.com.

[ul]

[li][B]US Dollar:[/B] Greenback Looks in Trouble Heading into New Year

[/li][li][B]International Equities:[/B] S&P 500, World Equities at Risk of Major Correction

[/li][li][B]Gold Price Forecast:[/B] Sell-Off May Accelerate as Fed Likely to Hike Rates

[/li][li][B]Yen Forecast:[/B] Fed Rate Hikes and BoJ Action Points to USD/JPY Gains

[/li][li][B]Oil Price Forecast:[/B] No End in Sight for Oil Price Declines

[/li][/ul]

The forecasts above are all discussed today on DailyFX.com

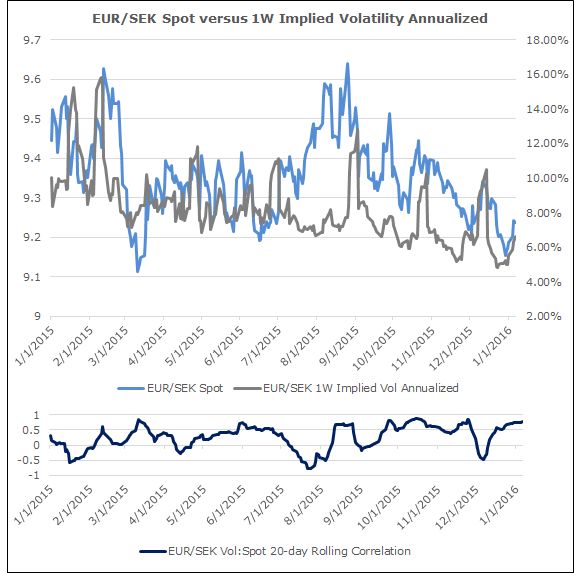

Currency strategist Christopher Vecchio discussion the following in his article today on DailyFX.com:

[ul]

[li]Riksbank has been threatening intervention for the past several months.

[/li][li]Ability to intervene was codified on Monday with this release.

[/li][li]EUR/SEK move below 9.1000 would greatly raise odds of immediate intervention.

[/li][/ul]

DailyFX quantitative strategist David Rodriguez sent me the following alert this morning:

“overnight rollover charges in the USD/CNH have surged as the PBOC has unofficially made it substantially more expensive to hold CNH-short positions. This is consistent with their preference to defend the CNH against speculation, and theres no question that they’re feeling the heat on the surge in the CNH vs CNY spread. (more on that here)”

image source: Bloomberg

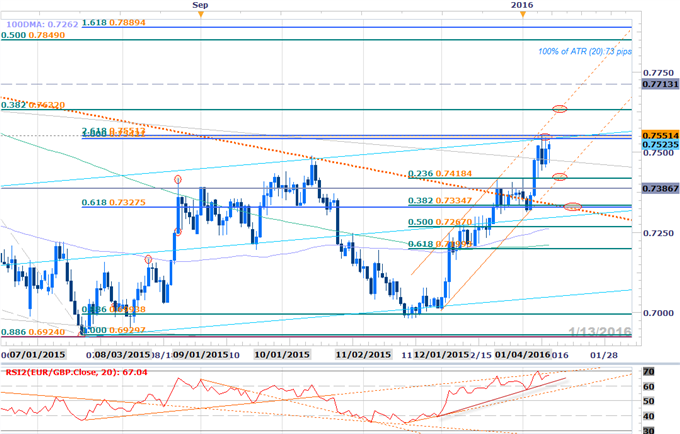

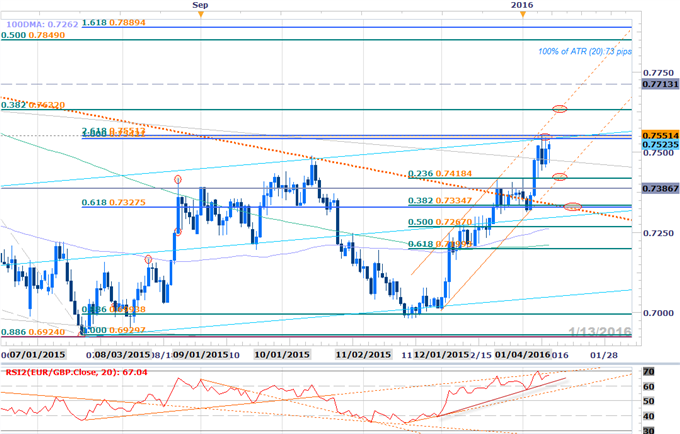

Talking Points from today’s article by Michael Boutros

[ul]

[li]EURGBP testing key resistance confluence- Broader outlook constructive

[/li][li]Updated targets & invalidation levels

[/li][li]Event Risk on Tap This Week

[/li][/ul]

from John Kicklighter’s Twitter feed:

“Strongest $SPX bearish momentum - spot distance from 200-day DMA - since 2011 tumble.”

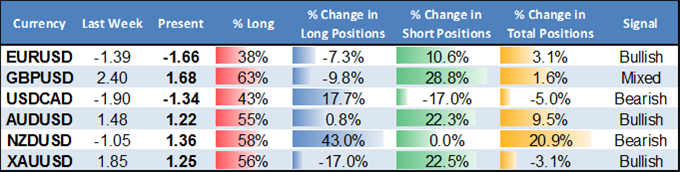

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

For David Rodriguez’s full report on the Speculative Sentiment Index (SSI), visit DailyFX.com

A major turn in price and forex trader positions warns that the US Dollar will likely continue lower versus the Euro, British Pound, Canadian Dollar, and Gold prices. David Rodriguez explains why in his weekly summary of the Speculative Sentiment Index (SSI) on DailyFX.com: