Hey all!

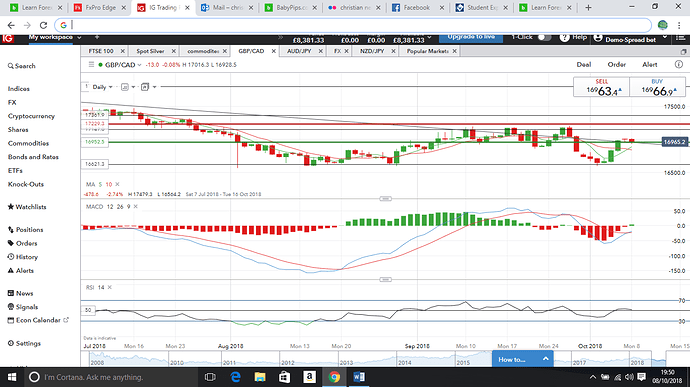

I am currently in GBP/CAD - I got in around the 1.69 level with stop loss at 1.72 just above previous highs on daily chart.

I missed the opportunity to get out at previous lows around 1.66 level, due to brexit woes and Canadian Dollar strength from increased oil prices and NAFTA progress, and from that mistake I am going to alter my strategy in future to get out if price stalls around strong support as below:

Then I would try and get back in if price breaks below support, as long as risk to reward is ok, or if it heads back up to resistance levels look to get back in - however, as it gets towards the end of the wedge the risk to reward becomes worse so may have to wait for a breakout in either direction to get back in.

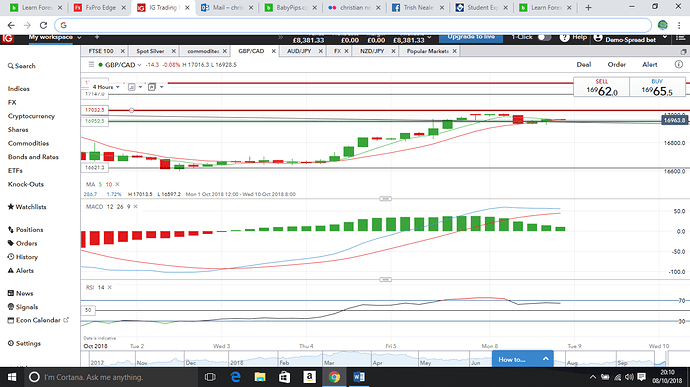

My plan now is to move my stop loss down to around the 1.7033 level - just above previous highs on the 4 hourly chart:

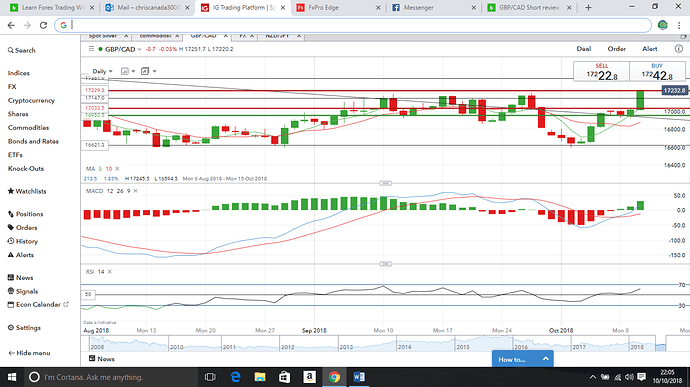

Today’s price action was interesting to see with the majority of GBP pairs showing fairly heavy negative price action due, it seems, to continued Brexit worries. However, CAD was also feeling selling pressure due to, what seems to be, a reversal in oil price action.

I have also noticed that, when looking at other GBP crosses, it appears as if a lot of them could be in the beginnings of a reversal to the positive side of price action, especially if the UK and EU start getting closer to a deal - if this happens I would think that GBP will get heavily bought.

However, in the shark infested Brexit water, anything seems to be able to happen and that is why I am hesitant to jump out straight away at the downtrend resistance level and content to have my stop loss at a level that would see me break even - hopefully price won’t suddenly jump; but time will tell.

Let me know if you are in this at the moment or thinking about getting in - also thoughts and comments always welcome as I am always looking to learn.