With inflation data to come from both the UK and US this week, the GBP/USD outlook will be put for a big test.

By :Fawad Razaqzada, Market Analyst

The GBP/USD fell over 1% last week, with most of those losses coming in on Friday. Sentiment turned bearish towards the pound as weak UK data raised the probability of further BOE rate cuts this year, with the next one in August being almost a foregone conclusion. Meanwhile, investors warmed towards the dollar on expectations that the US will impose higher tariff rates on several large trading partners when the extended deadline of August 1 passes. On Friday, Donald Trump threatened a 35% tariff on some Canadian goods and raised the prospect of increasing levies on 0most other countries. He followed that up with threats of a 30% tariff rate for Mexico and the European Union, if better terms are not negotiated before the August 1 deadline. With inflation data to come from both the UK and US this week, the GBP/USD outlook will be put for a big test.

Dollar finds much needed support

The US dollar gained ground last week, underpinned in part by unexpectedly strong economic data, but more to the point, because of concerns about inflation. President Trump’s threats of higher tariffs and expansive fiscal plans—described as “big, beautiful” spending and tax initiatives – are among factors that increase the risk of more persistent inflation. While the Federal Reserve is still widely expected to initiate rate cuts in September, the rising inflationary pressures could slow the pace of easing thereafter. This shift would likely provide support for the dollar so long as investors don’t lose trust in US monetary policy.

Week ahead: CPI from both UK and US could set tone for GBP/USD outlook

US CPI

Tuesday, July 15

So far, the inflationary impact of Trump’s tariffs, his spending plans and upcoming tax cuts have not been shown in hard data. But it’s possible that inflation may stick around longer than markets anticipate, delaying or limiting rate cuts.

UK CPI

Wednesday, July 16

Friday’s fresh data dump showed the UK economy contracted for the second consecutive month as the slump in manufacturing continued. Will the weakness in the economy and recent GBP strength reduce imported inflation? If CPI shows weakness, then the market will start to price in more rate cuts towards the end of the year.

US retail sales

Thursday, July 17

Recent data suggests the US economy is holding its own relatively well considering the trade war uncertainty. But are consumers splashing the cash? Core retail sales fell 0.3% m/m in May, but that drop is expected to have been made good in June.

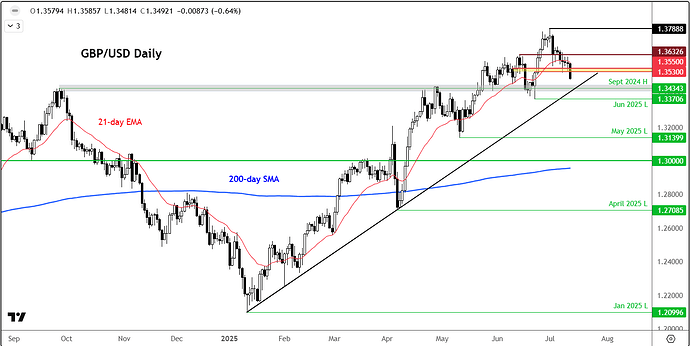

GBP/USD outlook: Technical levels and factors to watch

Source: TradingView.com

The GBP/USD outlook from a technical point of view took a hit after the cable broke a few support levels including 1.3630ish and 1.3530-1.3550 range. These levels were formerly support or resistance and will now be the most important short term hurdles to watch. On the downside, the September high of 1.3434 is the next big level followed by the 1.34 handle. This is where a bullish trend line comes into play, making it a key technical zone.

– Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

https://www.forex.com/en-us/news-and-analysis/gbp-usd-weekly-outlook-cable-topped/

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.