The price has reversed from the weekly up trend line and closed below $1.17200 support level I was mentioning last week.

$1.17200 was a breakpoint for the sellers and now it is resistance for buyers.

Start of the week could have a small test of the $1.17200 before moving further down to $1.16187 which now is the next target.

The price nearly reached $1.17200 two days in a row by retracing back, but it could not stay there for too long.

Same day the price moved higher and closed the day higher than the previous day.

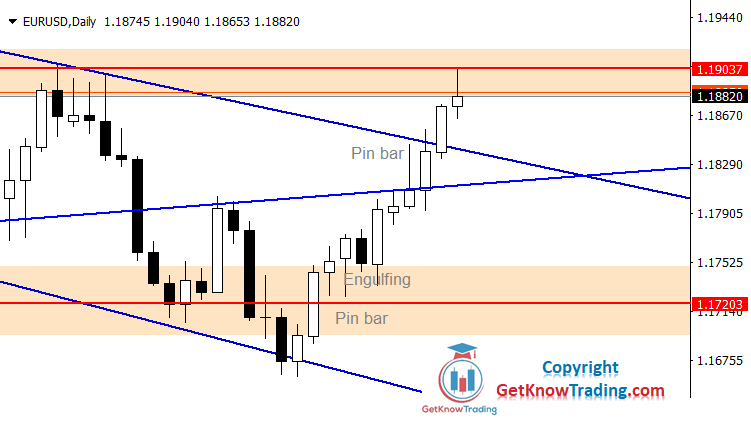

$1.18500 is a confluence of resistance where the sellers could find more strength to push the price back down.

The current market overview shows the $1.17200 as a support that needs to be broken in order to see the price moving down.

On Friday there was a slight pullback from $1.19000 which is a result of buyers exiting from the trades at the end of the week and reaching round level which is known strong resistance.

As it was mentioned in the previous weekly analysis the $1.19000 is a breakpoint for the buyers.

That means we could see price fluctuating around $1.19000 and first strong support below.

From the week beginning the price has changed direction and moved down.

The price is again in the downtrend channel which suggests further move down.

The price could break below $1.18000 and then pullback to $1.18000 to confirm break down before heading down to $1.17200.

On Monday the pair broke down from the confluence of support, but the day ended almost on the price the day started.

The price stopped on the strong support $1.17200 which is well known in the last few weeks.

From this level the price reversed back up on 20.08.2021. so we could see some price confluence here.

But, most likely the price is heading down, below $1.17200 towards $1.16180 which is now a strong confluence of support.

The market did not move too far from the price it started the week which shows indecision in the market.

What we see here on the chart is the price having a hard time to break below $1.17200 which is not nothing strange.

Similar scenario was on 19.08.2021.

When the price broke below support level and returned quickly back above $1.17200.

The whole week was bearish and only Friday was a small bullish candle.

Bears have overtaken the market and for the last three weeks they are dominating.

I am currently outside of the market until I see a better market constellation.

I am waiting for the price to reach $1.17200 for a bearish move with a price action signal or $1.14748 for bullish move.

After breaking below $1.16187 in the previous week, the price made a small pullback to $1.16187.

That pullback was in the form of a small bullish candle which did not close above.

Bullish move could happen on the $1.14748 level which is a strong support.

At that level the sellers could get out from the market and allow the price to make a pullback up.

The small support at $1.15462 was strong enough to stop the price from falling down to $1.14748 which is strong support for the price.

The market formed a bullish engulfing candle which shows bulls strength around $1.15462.

The price is now between two levels which showed strong pressure, $1.15462 with bulls and $1.16187 with bears pushing the price in the opposite direction.

The candles formed from Tuesday to Friday you can see on the chart are all bullish and close price is above this level.

That means the bulls are strong enough to hold the price above.

The currency pair is in the downtrend so being bullish completely is not an option.

For now the price will find resistance on the old resistance at $1.17200 which will now be a confluence of support combined with downtrend channel resistance.

In the last two weeks the price has returned back close to $1.17200 resistance and formed a strong bearish candle.

The price dropped down to $1.15462 which is current support where the price is holding.

If the price breaks above $1.16187 it will be just a first step to see the price changing to a bullish mode.

Only when the price breaks above $1.17200 then it will be the sign of the bulls.

After a bullish Pin bar the price returned back close to $1.16187 and from there turned back down and reached $1.14748.

The week ended below $1.14748 which tells me that the support is not strong here.

The first support is around $1.14000 which was support for the price in the past.

The price could stop for a while and make a retrace back to $1.14748 before finding more sellers to continue with the push down.

The price has reached the previous analysis goal and that is $1.13094 support level.

As said last week the $1.13000 is a strong support where the price could bounce back to $1.14000.

The price has moved outside of the downtrend channel and stopped for a while on the $1.13000 level.

If the next Monday closes below current price then $1.11871 is the next stop for the price.

https://youtu.be/Wjw4AiwaL98

Looking into the past analysis two weeks ago the price reached $1.11871 in the pip.

And then bounced back up to first resistance at $1.13094.

This week I am expecting to see the price close to $1.14000 level and then move down.

The $1.14000 level is a confluence level of resistance we can see on the chart.

Video:https://youtu.be/QC8q9Yl6JE8

This week’s price did not reach the previous analysis predicted level, but the market overview looks like it is preparing to move up.

On Friday we had a small bullish candle whose low price was not below a large bullish candle and that suggests the price has strong support on $1.12650 level.

As the market now looks it seems the price will move higher and reach $1.14000 which is a confluence of resistance.

The EURUSD price was ranging the whole week where we had two strong moves outside the range area.

The week started with two bearish candles where Tuesday’s candle closed below previous daily closes.

The price could find support at $1.11871 and return back up because the price is now in the indecision area.

We have strong buyers at $1.11871 and strong sellers at $1.13600.

Last two weeks the EURUSD price was in the range between $1.12350 on the bottom side and $1.13600 on the upper side.

The price closed the day $1.13466 which is the price above previous days candles close.

The next step is to move above $1.14000 which is now the first resistance.

And then the final resistance is $1.14748.

Week started with the bearish candle and reached a $1.13094 resistance level.

And then on Friday the price moved strongly up and closed again the week above previous daily candles close.

The price is now in the channel where $1,14000 level is highly possible.

The $1.14748 level is the next strong resistance where we can expect the price to stall.

The market broke out to the upside and reached a strong resistance level at $1.14748.

When the strong resistance level at $1.14748 was reached the price formed a small bearish Pin bar and on Friday bearish engulfing bar.

The price is now close to the confluence of resistance where the downtrend channel line and horizontal resistance line are crossing.

From there the next resistance to break is $1.16187 which is a well known level.

1 Like