Turnkeyforex.

Coinexx and TurnkeyFx I’m getting my funds in 20 minutes and taking them out in about 6 hrs to 24hrs.

Good to see that some are starting to integrate stablecoins or alternatives to bitcoin. I’ll take a look, cheers.

Mark Cuban’s Dallas Mavericks will give $100 in bitcoin to anyone who downloads the Voyager Digital app in the next 36 hours

Forced? Why? There`s many other opportunities to trade crypto even for the Americans.

Granted, but the point i was making was when Binance banned American citizens from using their main site, they were all migrated to BinanceUS site. The problem with that US site is liquidity is thin af across all pairs. So you get ludicrous PA as posted. Its not the best experience.

Im not sure what you mean by “many other opportunities.” US exchanges offer only a small sliver of assests that are available to the rest of the world.

-Especially when you consider leverage options and volume. US traders have to skirt around regulatory and/or geo-restricted barriers in order to access anything worth considering. Most broker LP’s are still living in a fantasy land when it comes to cryptocurrency.

Have to agree on that. Then when you look at all the different crypto exchanges, US resident are cut off from participating in any ICO’s, Perpetual Futures, Leveraged Tokens, etc. Look at the difference between the main Binance and FTX exchanges vs their separate stand alone US exchanges. US versions only offer spot on a select few.

The various decentralized exchanges show some promise.

It will be interesting to see how things develop.

I am not overly familiar with how it all works, but I suspect that if there existed a solution that enabled a consolidation of such exchanges or an aggregated feed that would solve the volume problem, then that could be pretty exciting. This, assuming that exchanges did not impose unreasonable trading fees.

Uniswap reports to have considerable volume. They have a method to provide what amounts to leverage as well. There is also a REST API. I haven’t had time to dig in, but it certainly looks interesting from what I have read.

One way that BitFinex handled margin (not sure how things are done now) was trader-funded and quite simple. Traders could elect to allocate their account capital to serve as leverage, either in part or in whole and/or only during idle times etc., and could earn income off of the interest while they were sleeping or simply as an investment tool.

The funds were very secure due to how the liquidation/margin stop system worked. I do not remember if they had an insurance fund or not. As volume on the exchange increased, available leverage increased (I believe from 2X to 3X or higher, but I do not recall specifics).

They may also have had outside funding that worked similarly, where investors could earn interest and yield 8%+ a year. I believe that the yield was actually much, much better than that earlier on, but I really cannot remember.

This kind of self-sustaining system is easier to accomplish when your leverage offering is on the small side. Harder to do when you start offering double or triple-digit leverage.

if you look hard enough it look like the U.S. is slowly being left behind, the market is global but the U.S. is making it hard for international companies to accept a U.S. residents. there are so many more markets that U.S. residents don’t have access to. just my opinion

A Coinbase user lost $11.6 million in under 10 minutes after falling for a fake-notification scam, the US Attorneys Office said

-

Federal investigators filed a warrant for 10.2 bitcoin held in a Huobi Global wallet.

-

The crypto was stolen from a Coinbase account in an $11.6 million heist, the government said.

-

Investigators said an unknown person sent a notification to a Coinbase user after a 200 bitcoin buy.

Crypto opposition groups will be jumping all over this to use as justification for more regulation, further-isolating US investors. Meanwhile, millions are lost in casinos everyday where the odds are heavily stacked against you.

oh we know there are more regulation coming, the more we hear bad news about cryptocurrencies the more regulations we will get

Deleted By Me

Unfortunately the crypto space does bear some blame for the crackdown that is happening. It’s kinda like the Wild West to some extent.

Most exchange’s have poor customer support, if you make a mistake, reversing a transaction is impossible.

It’s also rife with bad actors and scam projects that suck people in with hype and then rug pull shortly after. I recall early on there were projects that were heavily “pre-mined” by developers, minted quantities of coin before release and then dump them once value has increased on exchanges.

Then there were ICO projects that enticed people to invest in projects and then the developers ran away with the start up funds.

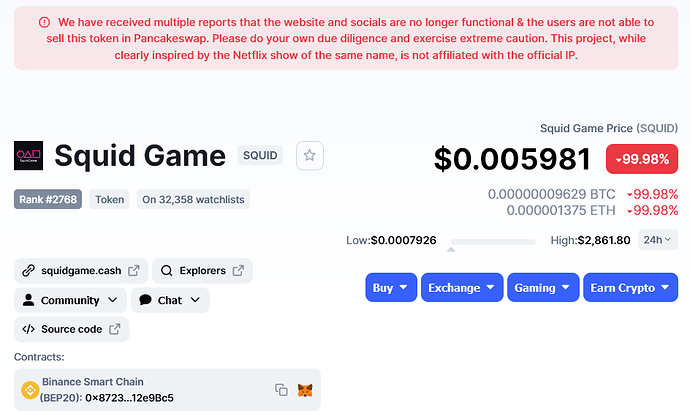

The latest grand rug pull was the “Squid Game” token that peaked at $2500 per coin and then developers rug pulled, deleted all social media accounts and dumped it down to near zero.

I just don’t think regulation is the answer when educating people in correct risk management when it comes to asset allocation would go a lot further. Most of us knew that token was a shitcoin and if we had thought to have a gamble would have done so with negligible change. It is naive of these people to think that regulation will stop these scams. Are they of the opinion that scams using fiat currencies don’t exist?

Honestly I think they do

-Specifically, blanket regulation. Having certain laws in place so that things work as expected, where appropriate departments are assigned to enforce those laws (within their jurisdictional scope) and hold people accountable is one thing, but this blanket regulation just suffocates the industry and prohibits cryptocurrency from being or becoming what it was designed to be - autonomous, anonymous and available to everyone.

Scams surrounding crypto/ICO’s etc. have been rampant since the valuation of BTC and alt-coins exploded. People that were able to invest into ICO’s before regulators stepped in, were often getting scammed and immediately crying foul, running to authorities to complain about their losses. Regulators quickly intervened, and US investors became the lepers of the crypto industry; isolated, excommunicated and restricted from access.

Most people were looking to get in on an ICO early so that they could buy super cheap, then sell it off as soon as it hit the exchange. It was not uncommon to see 100X ROI in some cases. Unfortunately, a lot of the ICO’s ended up being a scam, or, people were too slow and missed their shot.

Whether it be a pump-and-dump scheme, ICO investment or some get-rich ponzi scheme, it should the responsibility of the investor to understand and accept whatever risks may come with that. If illegal activity is happening within the jurisdiction of regulating authorities, then, by all means, shut them down and prosecute. But do not try to force the rest of the world to play by your rules in a supposed effort to ‘protect’ your citizens. Let them be responsible for their own actions and their own money and stop trying to police the world.

Unfortunately, too many amateur investors got involved that did not know what they were doing, US regulators got involved, then the rest of the world followed suit; agreements were made and the war against crypto became easily justifiable.

Everything that crypto represents, its purpose, how it is used and exchanged, the technology that drives it, as well as its autonomous and anonymous nature, are the exact opposite things that governments want.