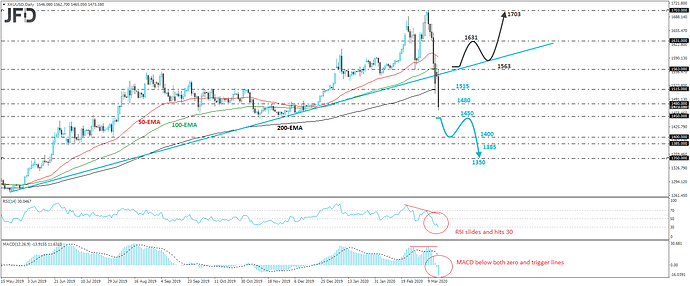

XAU/USD has been in a tumbling mode since March 9th, while today it managed to clearly break below the upside support line drawn from the low of May 5th, last year. What’s more, the precious metal is now trading below all three of our moving averages and looks to be heading towards the key support zone of 1450, which prevented the price from drifting lower between November 12th and 27th. All these technical signs paint a negative near-term picture, but we prefer to wait for a dip below 1450 before we get confident on more bearish extensions.

Such a break may allow the bears to continue driving the metal south and perhaps target the low of August 1st, at around 1400, or the 1385 territory, which acted as a decent support between June 30th and July 9th. If they are not willing to stop there either, a move lower may set the stage for extensions towards the 1350 area, marked by the inside swing high of June 7th, and slightly above the peak of February 20th, 2019.

Looking at our daily oscillators, we see that the RSI slid and hit its 30 line, and continues to point down. It could fall below 30 soon. The MACD lies well below both its zero and trigger lines, pointing south as well. Both indicators point to accelerating downside speed and support the notion for further declines in the yellow metal.

In order to start examining whether the prior uptrend has resumed, we would like to see a strong rebound back above the 1563 barrier, as well as above the pre-mentioned upside support line. This may be the alarm bell for the bulls, who could push towards the 1631 zone, marked by the inside swing low of March 4th. Another break, above 1631, may encourage them to climb towards the peak of March 9th, at around 1703.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.