Haha , I agree. Also the robo that is also a cop

Ya, some cannot be helped. It will be like a self-weeding garden, those that do not wish to pay attention and learn will leave, and those that would like to hear more will stay. I’ll be glad to help those that listen.

Most traders have found a high win/loss ratio system. The problem is that most of them don´t follow proper money management.

Why is MM the harder part? Maybe it is just me but I find this the easy part, I use a simple fixed stop that is always 2% of my account (updated every 1000$ in my account). I think the harder part is finding a system that works. Took me nearly a year to find one. But, now I got one :). After about another year of LIVE testing I will post it on the forums. Parts of it are scattered already in some of my posts.

I disagree

I agree

For me the hardest part was emotional control. I´ve learned to control greed and fear, but it took me some time…

Then you have overcome the biggest obstacle there is for a trader. Feels nice doesn’t it!

It feels really nice…but i went thru a lot a lot of PAIN!

Lol, I remember going thru that same thing. Glad Im past that now, that really had to be one of the toughest things so far

I don’t buy into your first sentence at all. Your second one, however, I could not agree with you more.

Keep looking mastergunner you will find one I promise!

I don’t trade any system, as I have yet to see one stand the test of time. So I will take a pass on the hunt. I will stick to trading price action where I have the allowance to adapt to the ever changing market.

Is that so! that’s exactly what I trade, purely price action, but with one little twist as it were, I have a certain price action that I’m looking for and trade that, I will wait 2 days for it if I have to, it’s that ever changing thing you refer to, I agree 100% how the heck can you just run a ‘system’ as it were? I don’t know, that is why I have taken the view that I will ignore all that, and just trade when the market does what I want.

That is why I have a high win ratio, my pips may be tiny at times, but my high win ratio lets me employ simple money management.

I had 2 PIPS this morning, first trade of the week.!

If forex can pay my cell phone and internet bill (~$90/mo) with a bit of fundamental and technical analysis each week, and a few clicks on my MT4 platform, then I’m happy. The rest goes to building the equity. I’m not in a rush to get rich, and I’m still learning about forex. It’s all about what you want forex to do for you.

Therein lies a problem with money management.

Have you calculated how much you pay in pips? Scalping is highly inefficient for retail trading as it absorbs up to half of the profits, perhaps even more depending on your currency pair.

Two trades from two traders.

One closed profit with 100 pips and paid 2 pips in spread, the other closed a 2 pip trade and paid 2 pips in spread. Who has a more efficient and sound money management strategy?

I would also question where your risk/reward is. As I highly doubt one would have a 2 pip stop for a 2 pip scalp.

1% per month is never going to make anyone a millionaire.

Work it out, even if you are lucky enough to have a large $50,000 account, which most new traders don’t, 1% of that per month is $500 a month.

Compounding it every month it would take nearly 30 years to turn that $50,000 into a million and then in 30 years time with 30 years inflation that million probably wont seem like a whole lot more than the $50,000 is worth today.

Aside from that, who in their right mind would risk $50,000 to make less per month than they could make stacking shelves in Walmart ?

I think the answer to the original question is, a great return is whatever you are happy with, some people are happy to make just a little more than they would from a regular investment, others are looking to make more than they do at their regular job so they can quit and trade full time others are looking to become overnight millionaires.

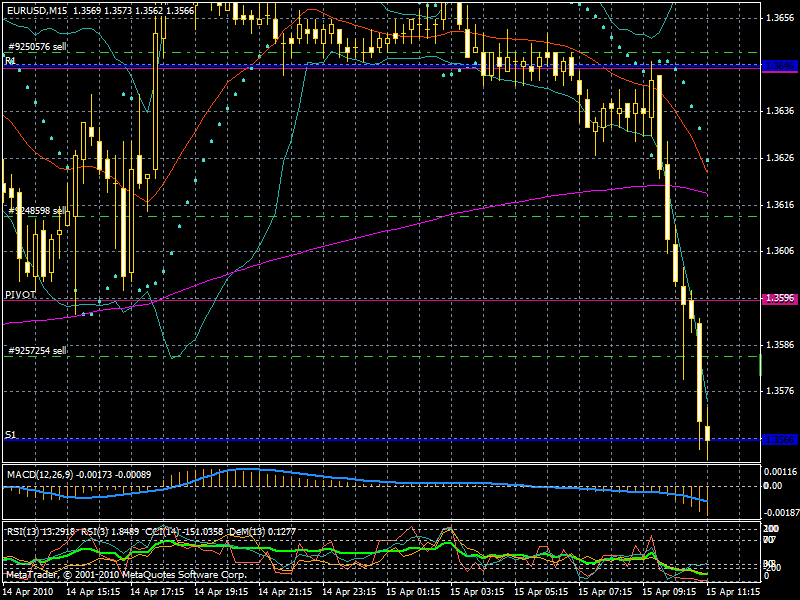

EUR/USD this morning.

See how I open several positions to reduce my risk ?

As you can see I was using pivot points as resistance levels I dont always do this sometimes I stay with trendlines, this time as the PA has been choppy and sideways there was no real intraday trend I used pivot points. I open 1 position then then if the trade goes well I can open further positions as I did here then TP at the S1 support level. As you can see I open my further positions in between resistance levels when I feel sure the resistance is cleanly broken.

This 80 pip move therefore makes for about 140 pip trade and a nice 10% of my account, if I can do that in one day you can make 20% per month you just have to work at it.

Edit: S1 is actually supposed to be S2 I moved it down when PA broke S1 but I didnt rename it. I TP too early at S2, PA actually went on to reach S3, I didnt think it would

You just contradicted yourself. You said you can’t be a millionaire, yet you demonstrate the math on how it’s possible.

But regardless of the folly, it’s clear you missed the point. Read over again what I wrote and try to think about what my point was.

No one would. Even if the return was 1% each month, it’s incredibly unlikely that positions would be open that would assume all of the $50,000 in the account.

The answer is not what people are happy with. Because your happiness will never dictate what you can get from the market.

The true answer is that a great return is what you can get out of the market. Period. You do not get that decision. If it was just a matter of deciding what your return is, then we’d all be wealthy. All we can do is create for ourselves an edge in the market. And with proper risk management and a consistent edge, you will be able to pull a great return.

There it is again. You said “if”. Anyone can take a single winning trade and say, “See, I told you its possible to turn 100 into a million in a only a couple years.”

When I sit down with an advisor to look at what to invest with, I do not jump into a fund where they say it will do well. I invest in one that has shown to do well. There is a significant difference.

Nice trade nonetheless, just don’t fool yourself into thinking that will happen every time to get the success you wish to have over and over again. There will be drawdown along the way.

More exposure cannot create less risk.