Hy guys,

New to the forum, decided to share the system I have been testing along the past 2 weeks, which I developed based on two different systems was using before. I thought it would be good if we could share more experiences

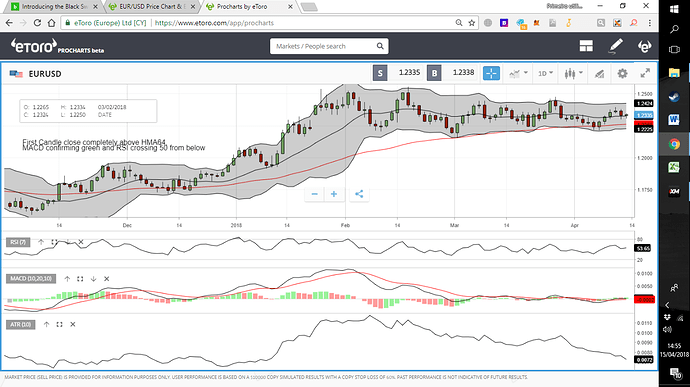

I named it the Black Swan as it is based on smooth soft curves and serves primarily longer time frames. I have tried it with several pairs and so far found it works best on pairs with JPY, NZD and AUD. My favourite are AUDUSD AUDJPY NZDUSD NZDJPY EURJPY. I got 66% success rate in the first two weeks. But tests are really recent so…

Time-frame: 4H

Indicators

HMA 64

Bollinger Bands 16

MACD 10,20,10

ATR 10

Signal Long: when first candle closes bullish and completely (inc wicks) on the other side of the HMA 64 (coming from below before) AND MACD is bullish.

Short: enter short when candle closes bearish and completely (incl wicks) on the otherside of the HMA 64 (coming from above) AND MACD is bearish.

To fine tune entry point go to the 15mn chart and entry when price is close to moving average and BB mouth is widening. Also as a matter of fine tuning as this system is about identifying trend shifts, I also use RSI 7 to identify possible divergence on 4H. Nevertheless, it is not mandatory.

TP x3 ATR

SL x1,5 ATR

Would be cool if anyone is willing to give it a go with me and let me know how it went.

Thanks!