OK, sorry to do marathon posting here but I just have to ask if you guys also see JPY strength in all the weekly charts?

You can combine the two last weekly bars and get a nice “2 weeks” pin bar. But I personally do not like the location cause we are in the middle of a consolidation box (see pic). Usually if you trade those boxes, you would like to take longs from the bottom of it, and shorts from the top of it, whet there are clear PA patterns on these areas. No really obvious where price is heading on the weekly.

Usually all the JPY pairs (USD\JPY, EUR\JPY, etc) look quite the same.

Ben

ben nice conversation. in all truth i havent been keeping up with that thread. too many posts its almost a full time job lol!!!

as for the au. if there is a bearish bar that breaks the low of that beob then i will short it. that would be a trend reversal and they happen frequently. however having said that i am super excited about it either. i watch price and let price tell me when to trade. i don’t get involved with what might happen. i wait and see what does happen and i trade accordingly.

that is why my new style of trading is suiting me so well!!! I took my long term outlook on gu last week and made so much money i don’t even want to post it coz people will say bullsh** But in truth on j16 you can risk 3% and wait days to win, or lose or you can take that long term outlook and trade the crap outta her and earn 1 or 2% per movement!!! several times a day with good accuracy. Anyway I won’t clog this thread but i feel with the j16 material and this approach i will be unstoppable!!!

Do you mean you’re looking at weekly charts now?

WOW I am happy to hear this Johnny…keep it up mate

Ben

Do you mean you’re looking at weekly charts now?

yes and no. i did base alot of weight on that weekly pin we saw in the gu but i also used daily and 4h analysis then i traded off of the 15min selling the rallies.

hello all,

Glad to see you still going strong and having success with this method. I love to read the thread over at FF forum as well but it seems as quck as I can read there, the posts keep mounting up.

I am form my trip away with work but I have some other assignments at home which means time for trading is at a premium, This is really hampering my development and I am going to have to quick work at this rate. Who does my employer think he is assigning me work?

Anyway folks, I wanted to ask your opinion on signing up to J16 site. Have you done it and how do you feel about the content? I get the feeling that this really is work the money, but when I sign up I would like to be able to get some undisturbed time with no distractions to go over the material. Any opinions on this are most welcome.

Cheers all

hi guys, a newbie here,

i have been reading reading reading and i am in admiration of you guys in this thread! I am trying to understand all of the things you are talking about and i am looking at implementing this system as i believe it is simply stunning. If i can ever get to a stage where i am getting 9 out of 10 trades i will be very happy. Even if only 3 make me pips…

I have a couple of questions…

- When you take a trade on the daily chart, do you monitor the PA on the daily also? Or do you take profit and monitor of the 4hr charts?

- What sort of pippage are we looking at for a trade, obviously every trade is very different, but i am unsure are to what to aim for. Especially if i only take 1-3 trades a month looking for the A+ trade.

Many thanks, Scott, from the UK

Quick answer in between drilling teeth

-

I will monitor trades on daily charts, not lower TF as I only trade dailys and weeklies. My view is that if I find the setup on dailys that’s also the time frame I’ll track the trade although I will move SL to BE once the trade is X pips in profit even if it happens intraday.

If I did trade 4H charts then I’d monitor those trades on 4H. As always, no rules without exceptions, but that’s my general view. -

Typically on daily trades I’d say that for most pairs a general figure would be anywhere from 100 up to many hundred pips. The most important thing is to find a reasonable place for your SL and TP resulting in as good a Risk:Reward ratio as possible. I’ll look for at least 1:1 but preferably better than that.

Btw, you’re very welcome to the thread Scott!

thanks for the reply,

I c, so once you enter your are looking for that target then will be looking at break even…

I waited until now to post as i wanted to read every post in the thread, that alone has taken 3 days haha!!

Also, i have just started on JAmes 16s thread on FF, this is confusing me a little already as i though we (here) were doing his method, but his thred begins with the Double lows and highs…?

I fully expect what i am querying will all be explained though!!!

I am so pleased i found such a place, i have so so much to learn. I have a long term plan (2 1/2 years away) And i hope i am good enough in that time to do this seriously (large amounths of invesment) Only time will tell. If i dont put anything into it, i wont get anything out! Research research research!!!

Scott

Anyway folks, I wanted to ask your opinion on signing up to J16 site. Have you done it and how do you feel about the content? I get the feeling that this really is work the money, but when I sign up I would like to be able to get some undisturbed time with no distractions to go over the material. Any opinions on this are most welcome.

hey boca goto there website and check out the free guest videos. the most usefull stuff on that private forum is the videos and webinars. there is som text tutorials but those you can get mostly from the public forum. IMHO it is worth the money to check them out but you can get a sense for the style with the free videos.

Quick answer in between drilling teeth

OMG you are a dentist. I hate the dentist LOL!!!

as long as you don’t get me all hopped up on that nitrous and steal my wallet

obviously you know im kidding

hey scott you can manage your trade via the 4 hour if you like. If I take a trade on the daily gerally i look at the daily for “problem areas” and these are the areas I set my tp from. For me to trade dailys I can’t be around otherwise I would trade lower tf’s. As for pip target that is not as important as %. They would tel you r:r is meaningless but I disagree. I think you should always be looking for trades that have a good expectancy and a greater than 1:1 risk reward. I like to take a trade where I can tuck my stop loss behind a strong ppz area and my trade has space to move netting me a greater gain than risk. There is no set amount, sometimes I will go for 20-30 pips and sometimes I would let it ride for 100+ I would like to get to a confidence level where I would let it run for 100’s and 100’s of pips but I am not there yet. For now I will be happy with break even and if you are new than you should too.

You know what they say: drill, fill, bill

But for me it’s: forex, price action, james16

:D:D:D

Are you lot only searching for pin bars or do you use bullish and bearish bars as well?

I want to try this out on some daily charts…

Would you look at a daily pin bar at 0000GMT and set order accordingly if there is a good setup?

Any thoughts on a LONG at this pin bar on the EURJPY?

Price has reached a long term uptrendline, support line, and short term downtrend support. So trade would be against the short term trend but with the longer term trend.

LONG at 132.61.

I look for two bar reversals as well, not just pin bars. The one thing that I require is that the signal has to be high quality.

I’m glad to see you’re looking into this trading style. May I recommend having a look at the James16 Chart Thread over at FF.

The EURJPY you mention is currently looking more like a spinning top than as a pin bar, plus I don’t have a S/R zone where price is now.

Also, looking at weekly there was a major two bar bearish reversal at the beginning of August.

I do set my orders at around midnight in Sweden, which is London + 1H.

There seems to be a lack of pin bars on any of the daily charts in the last few months, lots of spinning tops and 2 bar reversals as well as bearish or bullish outside bars.

The line I have for support on the EJ is from the bar bounce on 23rd June?

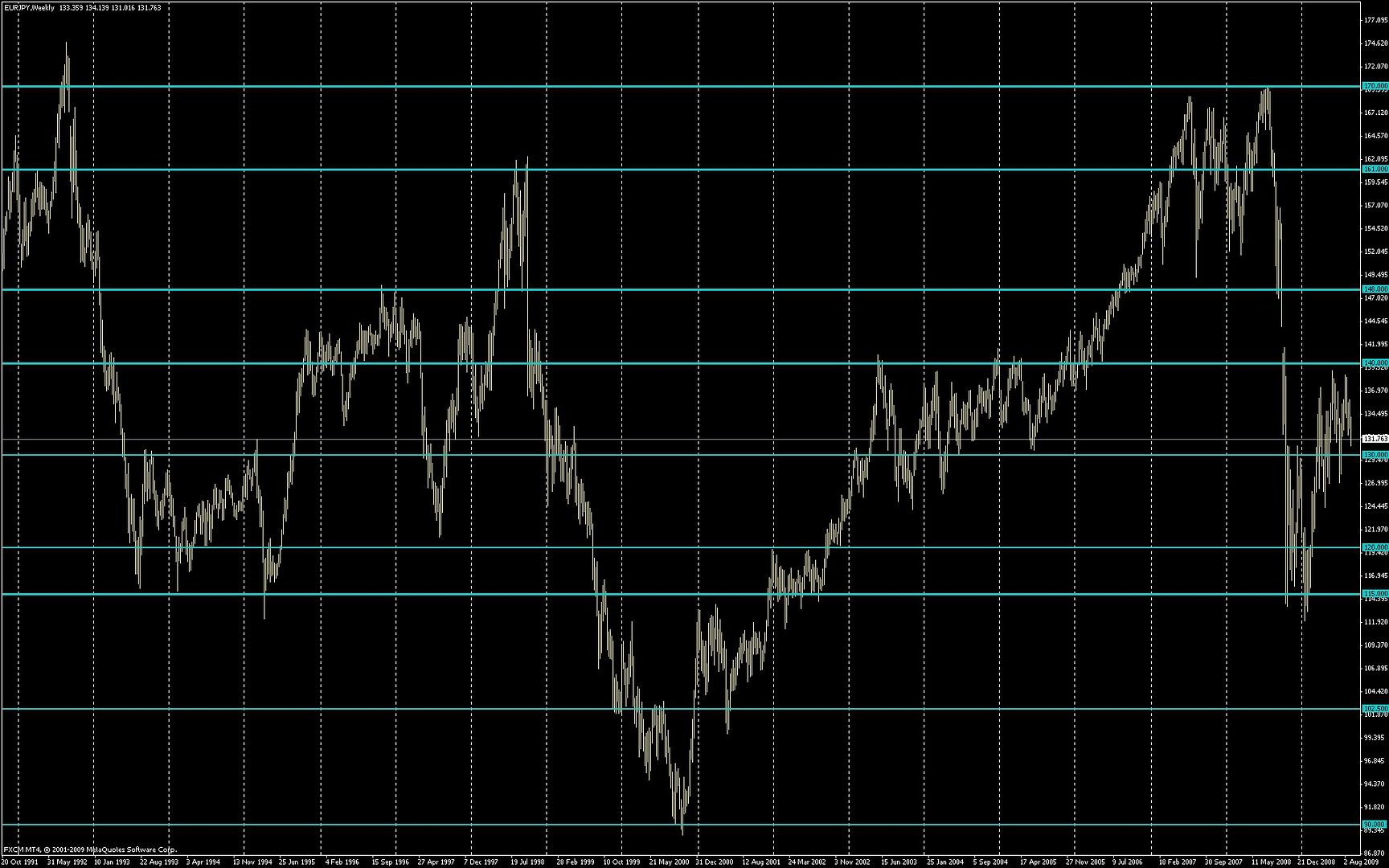

This is where I have my lines (which are more like zones to me) on this pair. The lines were placed on weekly zoomed out. These are levels that have acted as strong S/R over several years. That’s the kind of zones I want to see price react to.

The June 23 low lies in an area with a lot of chopping up and down, which suggests that price does as it pleases, not respecting the minor swing low from the 23rd. 130 has been ill treated lately also, but it’s still such a strong level and it’s also a major round number which in and by itself makes it stronger.

Here are my lines on a weekly zoomed out chart:

Can you when you have an opportunity pu publish plish it here with the chart to help the others

thanks