It’s been a big breakout for USD/JPY as the pair has pushed through the 150 handle, and bulls now have an open door to push a larger move.

By :James Stanley, Sr. Strategist

Japanese Yen Talking Points:

- USD/JPY has put in a big breakout beyond the 150.00 level after FOMC and BoJ rate decisions.

- The big question now is whether bulls can continue the fresh trend, and tomorrow’s NFP report represents an important inflection point for the matter.

- The initial breakout in USD/JPY was driven by the Fed but more recently it’s been the JPY-weakness since BoJ that’s been driving matters, as illustrated by both EUR/JPY and GBP/JPY.

It’s been a very weak backdrop for the Japanese Yen since last night’s BoJ rate decision. This is in stark contrast to the Yen just last week, which opened with a strong sell-off in USD/JPY as the results of elections were getting priced-in. As I said in the video at the time, I thought that election results highlighting greater political fragility in Japan were more Yen-weakness than strength-based, and it took a few days for prices to reflect that.

USD/JPY found support at the 145.92 level on Thursday morning and since then it’s been a very bullish backdrop for the pair.

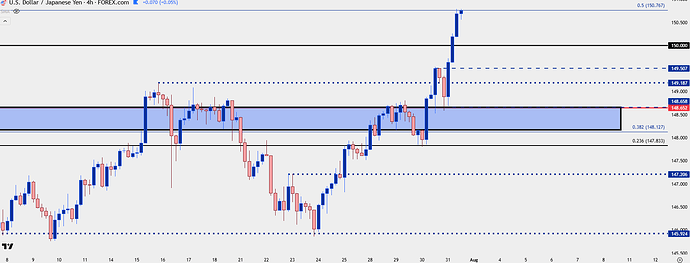

From the four-hour chart, we can see an inverse head and shoulders pattern that had built ahead of the FOMC rate decision yesterday, which has since led to a strong topside breakout.

USD/JPY Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

With USD/JPY at fresh four-month highs, the challenge now is the fact that the market is nearing overbought readings on the daily (and is already there on the four-hour). This doesn’t necessarily preclude continuation, but it does highlight danger in chasing an already developed move trading above a major psychological level for the first time since April.

With NFP on the calendar for tomorrow there’s testing potential. The unemployment rate will probably be the focal point as told by Jerome Powell yesterday, and if we could see that come out a bit higher than expected there would be reason for USD and USD/JPY bulls to pull back a bit, and at that point, we can get a greater read as to what this bullish trend scenario might have going for it.

There’s now support potential at the 150.00 handle, which as I shared in the video has a bit of historical drama around it. Below that, there’s spots at 149.51, 149.19 and then 148.65 that all remain viable for higher-low support in the pair.

Click the website link below to read our exclusive Guide to USD/JPY trading in Q2 2025

https://www.forex.com/en-us/market-outlooks-2025/q2-usd-jpy-outlook/

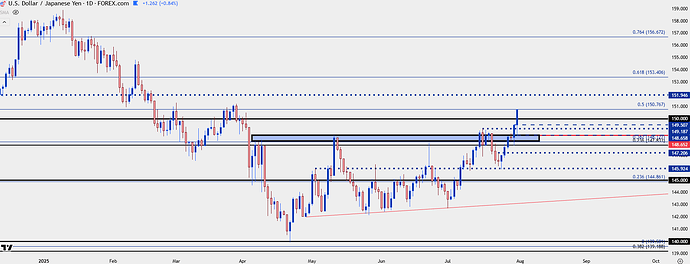

USD/JPY Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

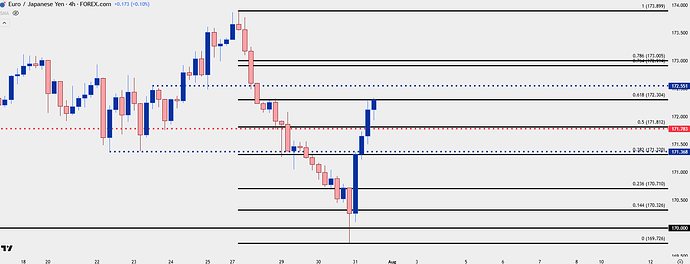

EUR/JPY

EUR/JPY was in a hard sell-off until last night’s Bank of Japan meeting and the pair even tested below the 170.00 handle, albeit temporarily. Bulls have made a large statement since, reversing 61.8% of the sell-off that started from the highs on Monday and there’s now shorter-term support potential at both 171.78 and 171.37, each of which are compatible with Fibonacci retracement levels of the earlier sell-off move.

EUR/JPY Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

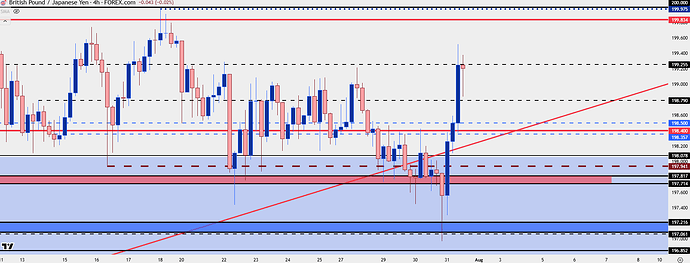

GBP/JPY

On a relative basis GBP/JPY has held a bit better, illustrated by the fact that at the time of this writing the pair is trading above the high from Monday while EUR/JPY has only retraced 61.8% of that sell-off. With that said, the drama in GBP/JPY is about the 200-level which bull shied away from two weeks ago, and buyers may not be ready to push through on that first test of the big figure.

There is support potential here at 198.79 and then a big zone from 198.36-198.50 that’s of interest, as this was resistance earlier in the week and hasn’t yet been tested for support since the breakout.

GBP/JPY Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

— written by James Stanley, Senior Strategist

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.