Viavictus, that isn’t a pinbar m8…It’s an indecision doji candle. It’s just suggesting that neither buyers nor sellers were left in control. cheers. On the other hand i dont see how it could be an inside bar either…

Konan are you talking about this trade setup?

If it is not a pin bar, then what criteria do you have that qualifies it as a pin bar?

From what I see, it is a pin bar because it broke to a higher high and closed at a lower price.

The only qualification of not being a pin bar is perhaps the pin is not long enough, but how long is enough? that i am interested.

Took trade due to breakout over long term resistance line. SL at 138 pips. Entry 1.5540. TP est, next support line. Turtle Trade

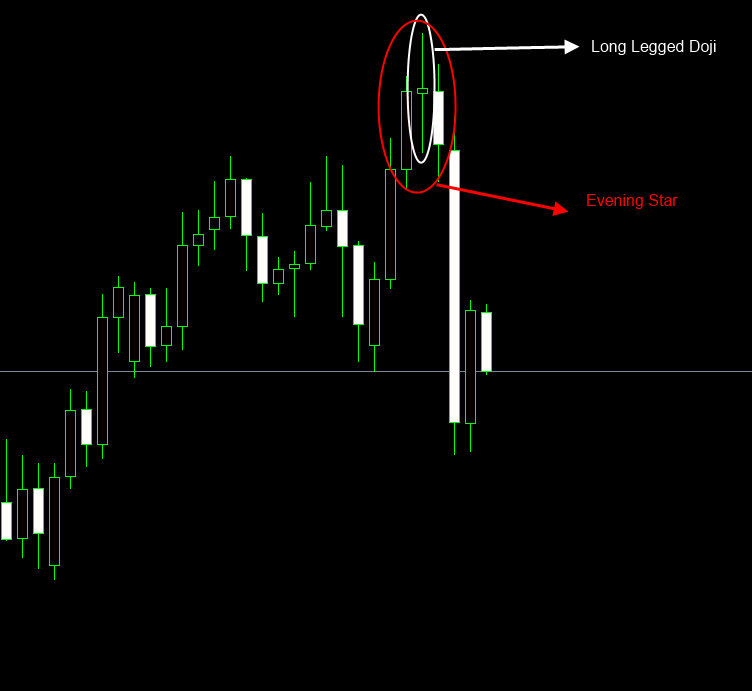

It is a doji, but a long legged doji, meaning there is a significant indecision between buyers and sellers… usually a very good one-day bearish reversal pattern when found in a up trend and at resistance. In my opinion is better to wait another day for confirmation. In the AUD/USD a Evening Star formed, which is even better reversal signal.

“eurgbp short”

Talking about this pic. I dont see an inside bar or a pinbar on it, m8…Pinbar should be at least 2:1 tail to body ratio to call it a pin and its nose shd preferably be insignificant in size compared to the tail. The signal, the bar is telling you a story of the momentum of bulls vs the bears that might define the rest of the trend.

didnt say it was a pin bar. Took the trade short cus of inside bar with confirmation closing below inside bar.

But, which inside bar, where is it?

3rd + 4th last bar

I’m afraid that’s just not an inside bar. For that it would need to be in its entirety immersed by the mother 4th candle…cheers

Just realised it is off my slightly a few pips, tks for the insight!

Been making a couple of mistakes here and there and have been slightly overtrading. Ill be revising my trading by the end of the month.

Equity is still up by 7% this month, have plenty of thoughts on trading. One question I want to ask here is…how quickly do you move your stops to BE? Do you always let your trades “breathe”? or do you always limit your downside by moving to BE quickly?

I’ll give my thoughts on these soon

AUDCHF long

Long entry at 0.9610 of inside bar break on daily. SE moved from BE, to 0.9640 to lock in some profits. Letting this trade run.

AUDCAD Long

Entry at 1.0525 off Pinbar at swing low on H4.

AUDUSD Long

Entry at 1.0262 off Pinbar at H1 and Daily.

EURUSD Short

Entry at 1.30021, off bearish break at bottom of range.

Been a slow week, no real setups.

Trying to be real picky on my setups

EURAUD Long

Entry at 1.2700, on Bullish Engulfing outside bar.

SL from 1.2605 moved to 1.2707 to 1.2780.

Letting trade run.

Equity Growth (month to month): 3.92%

Total Winning Trades: 21 (46%)

Total Losing Trades: 24 (54%)

WinLoss Size Ratio: 1.29

Thoughts:

Good month overall, could have been better if I have not taken too many discretionary trades. Loss over 5% of equity over such discretionary B+++ C+++ trades. Target for this month is to be very picky, and so far it has been a good start to the week with a +2% growth.

Goal 1: Capital preservation achieved for Apr.

Goal 2: Consistency. Yet to be seen. Need more months of results and data.

Will be off for a short holiday soon, no trading for a few days. Still have a couple of trades live, may be shifting them to BE and hope they surprise me after I come back.

Cheers!

Took the trade off bottom of long term support of range.

Zoomed into 1hr for first pin bar for entry.

E – 1.01759, SL 1.0152

Beautiful setup. Hope it goes ranged again. plan is to sit on it and collect money.

Near term wise it is possible to test the support and take off stops again. Plan is to reenter if I witness a fake breakout and support level if this happens.

Despite the fact im not overly confident in this support level right now, on the chance it does hold, it has such a fantastic R:R its worth taking. I bought after it moved back up more, think im in abit of loss at the moment, but felt more comfortable once it had shown a bit of demand.

we can only play S/R with a level of confidence, a probability trade that it would hold. There is no certainty that the support will definitely hold, thus, you need to participate in the market to know.

Would it matter if the trade showed no demand upon entering? would it affect your entry decision? I hope not =)

AUD USD Long, off long term daily support. E – 0.9739, SL 0.9705.

AUD CAD Long, off long term daily support.

1st entry – 0.99709, SL 0.9970 (SL moved to 0.9985)

2nd entry – 1.00042, SL 0.9985

limit order for next entry at 1.0055, SL at 1.0025

Trying to pyramid to 3 entries. Total risk on this trade is now at 1R (1%). Existing paper R:R is 1: 6.

This could be a big runner, so I’m letting this run as far as I can and pyramid aggresively, while moving my stops to BE to maintain risk.