Also my tally since starting this thread is now 53.8

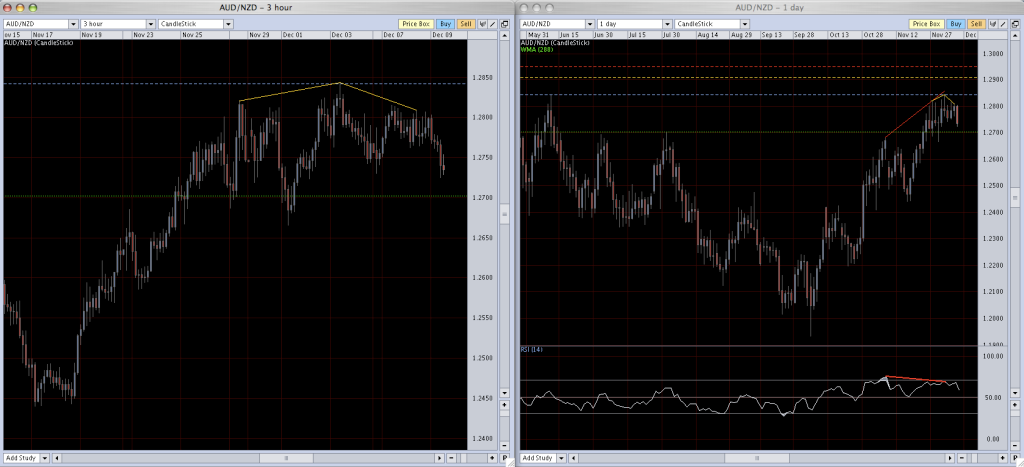

I was wondering if anyone else is looking at the divergence on the AUDNZD daily?

Now fundamentally there are many reasons against going long the NZD. BUT technically speaking, we have not only a series of toppy areas from earlier this year loaded with sell orders, but now there is a head and shoulders pattern forming, topping at 1.2840. There is also a nice convergence on the RSI between the November 6 high and friday’s high. Personally I will be watching closely for the RBNZ’s interest rate decision. I know that no change is expected, and to be honest I don’t see any pressing reason they would need to raise interest rates right now other than to boost the value of their dollar, but why would they want to do that? On the other hand there has been a lot of NZD buying going on today leading up to the interest rate decision, do they know something I don’t? So what to do? Well, if, following the recent head and shoulders there is a continued drop, I will be sadly disappointed because this would leave me out in the cold. If there is overzealous rally proceeding the interest rate decision I would short at 1.2840, otherwise I will be shorting at 1.2900 AND 1.2950 if reached. As per usual I will hold stops quite close, and my eyes will be even closer to the screen trying to determine a longer term trend reversal vs. a short pullback. What are people thoughts on the AUDNZD situation?

damn, another amateur mistake. I left a NZDUSD order open and was totally wiped out when the NZ interest decision was released. -16.5 pips. bugger!

This did not look like it was going to turn around so I closed it at -4.6 pips.

I’ve been looking over trades that I have made and I’ve noted a few things that I really need to work on/not do.

- Change stops. Every time I change the position of a stop I regret it.

- Leave orders unattended. Bad

- Leave orders while high impact news comes out. This has gotten me a

couple of times. What I really need are reminders of news events. It’s easy

to look at the babypips.com event calendar and see what’s happening, But

it’s also easy to let it slip from your mind while doing other things. How do

other people avoid this?

AUDUSD order just hit, not doing so well right now, but i’m looking for a double top to form. will update shortly.

Closed out at brake even.

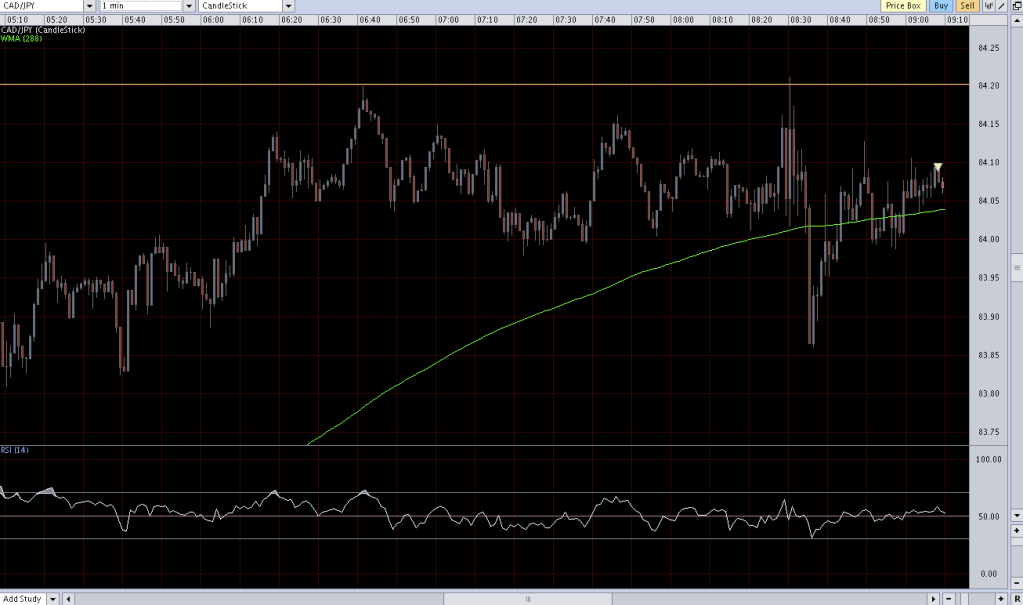

This has started off well, CADJPY has been ranging for a few hours now at what looks like it could be a top, i didn’t quite get in at the top of the range so i will scael in at 84.15 if given the chance.

So i was able to scale in at 84.15 and I’ve taken the safe road and closed my first position at 5.1 pips to avoid a bad loss, because they were both full sized lots. My other trade’s TP is at 83.55.

This came so so close to my take profit and started to retrace so I got out with 48.1 pips for 53.2 pips total. not a bad trade at all.

so some time during the last trade I posted an order was hit for GBPCAD and hit my trailing stop. I was taking a nap at the time, and there was supposed to be an alarm, but my computer was on mute. which is annoying because it would have been a very profitable trade. as it was I only lost 5.3 pips, so nothing to cry about. need to be more careful!

Current tally: +80.6 pips

The trick now is not to get too confident. In my experience after i have a good week or few days i generally get a big head and give a whole bunch of my profits back in risky poor managed trades. Any tips on how people stop themselves from over-confident trading would be appreciated. I want to avoid the phrase “it seemed like a good idea at the time.”

Little bit of ranging action I’m trying to get some pips from here. There’s quite a lot of volatility by the looks of thee ticks so I’m hoping there wont be a breakout here. looking for a conservative 20 pips.

Well the british bulls took over for a minute and stopped me out on that one, along with a GBPCHF order I had total loss -25.3 pips. Again a loss resulting from trading two correlated pairs.

This pair has hit a crucial support area, but momentum is strong and PA is very bearish so i have already moved to BE.

Well this got around 16/17 pips before hitting the support-turned-resistance at .9020 and started to retrace pretty quickly so I jumped out with 11.4 pips profit.

Lots of crazy things happening today. think I’m going to relax.

Total tally: 64.7 pips which is i think around 80 pips just this week. Not bad.

Take care all.

This one kept right on going, however the next resistance at 1.0660 is still within my stop, so hopfully that will see a turn around.

stopped out for a loss of 13 pips. in hindsight 1.0660 would have been a better entry, whether it would have made a difference to the outcome is yet to be seen though.