Gold still at the bottom very risky to enter at this moment…

Hey Dude,

I just noticed this post and a number of other posts on here from a couple weeks back! There are a few things I have noticed in the past few weeks regarding gold. One is that there was a huge push down in the price of gold in the last trading day of the year. This is me is almost a statement by the big players saying bears are still in control. It’s the same thing you sometimes see a few minutes before a high timeframe candle closes, where price may be bobbing above and below a major price zone as the bulls/bears are establishing the winner for that session. To me this all has bearish implications.

The next thing I noticed is that going into the new year we have a bounce off of this supportive price level. While you have all of the gold bugs screaming double bottom, that is extremely premature to guess. This could just as easily be a descending triangle pattern which as you know starts off as a supposed double bottom. I think where price is sitting right now a short is dangerous, but as you mentioned, if there is a clear break below the horizontal support that is forming and you have price retest it with bearish price action, you could have a great short into the $1000 area. We had another good day for gold again, although I think this is just oscillation of price and price will continue grinding downward throughout the first quarter of this year.

Goodstuff Aaron!

I took the counter-trend BUEB that formed off the weekly two weeks ago, but keeping my eyes peeled for any signs of bearish reversal.

Let’s see how this week plays out

Cheers :)!

Are you shooting for the important number of 1285 for TP? I hope you make big bank on it!

Thanks!

Actually, I’m targeting something a little more crazy… 1400!

Want to see if I can trail it all the way ( if it does go up that far )

Should be interesting

Gold produces gold. When it comes to this, you may also try some Asian countries and you’ll see how you can earn and spend less.

Best of trading to you sir! Have you moved to BE yet? I believe there is a fairly significant trendline and EMA moving into the $1300 area, if price breaks that I have little doubt you will reach your 1400 target

Both Gold and Silver successfully printed Higher High (HH) despite China’s growth concerns and slow production, this has confirmed our bullish bias about bullion prices. However, FOMC January meeting is still keeping precious metals under pressure. Federal Reserve’s forward guidance stance shall be a matter of great interest in forthcoming meeting as unemployment rate sunk to 6.7 percent in December

Gold has clearly been moving higher in the past few weeks and enjoying some bullish momentum. I did find an article and some charts that has moved me to an even more bearish outlook on gold than I previously had. This article showed the extremely high correlation between t-bills and the price of gold. I don’t remember exactly the article but essentially for the past 10 years the price of gold has had this correlated relationship. Using this correlation they were able to call the price of gold to just a few dollar given a certain interest rate. The highest peak of gold directly correlated to the lowest interest rates we have seen. I believe a rise in interest rates is pretty much a certainty as we can’t go much lower than we are right now, which paints a bleak picture for gold, as long as the correlation holds. This also pointed to the fact that the rise in gold after the recession start was believed to be due to people investing in a more “sound” currency, and the uncertainty of the viability of our fiat currency. This may have been illusionary because interest rates were being dropped at the same time. So the spike in gold may have been tied to rates, but the media slapped the “safe haven” stamp on it to explain the rise.

Contributors such as J Murphy, L Williams have for many years drawn attention to the Gold/Bond relationship.

Murphy devotes many pages to this relationship in his book " Trading Intermarket Analysis".

Williams uses the relationship in his short term trading analysis of Bonds, indeed one of his indicators uses Gold as the ‘influence’ on the bond market.

For those of us learning the relationship, since mt4 shows the bond PRICE and not the yield it’s easier to remember the correlation between bond price and gold price as a positive correlation.

One such recent analysis was the bounce in gold at the end of last year at support. The 30yr was similarly at (just below)resistance, but the shorter term 10yr just couldn’t make it down to it’s level - it was following a rising weekly trend line.

(Some would view this divergence between the 30yr and 10yr as a bullish sign for bond prices and then look to gold for confirmation)

It is possible to see why Williams uses the Gold influence on bonds - Bond price jumped on Jan10 this year, then look at Gold , it had already decided a couple of weeks previously that it was heading north, gapped up after the hols, resistance now support (h4) etc etc.

So what gave Bonds the impetus to jump on Jan10, besides a rising Gold price?

A miss on the NFP…

Then Gold’s relationship with USDX…, Jan 23 daily, big fall, Gold Jan23 …opposite.,

Jan 23 - pmi’s greater than expected for Euro Zone.

Here are some quotes relating to Gold from John Murphy:

Since Gold is a “non yielding” asset, the lower yields offered by falling interest rates increases gold’s appeal.

Gold usually benefits from a weak stock market.

A strong upsurge in USD in Sep 2011 finally pushed Gold into a downside correction.

One of the signs of a bull market in Gold is when it rises faster than foreign currencies.

Interesting topic.

although gold is a bit up, but still its getting very difficult to enter this market…

Exactly same divergence on the 1 hr US 10yr and 30yr has been happening - trend line on low from Jan 29 to yesterday’s low on both - see the clear reluctance of the shorter 10yr to follow it’s longer counterpart to support - many traders would take this as bullish, it suggests investors buying 10yr, they were anticipating today’s negative USD numbers.

It was US buying that kicked it off, London were already home at that time.

So what did the London traders do first thing this morning - buy gold, risk off, buy bonds.

See that relationship again today - up goes Gold and down comes USDX

The interesting thing is the timing - all long before the data release - it was just the anticipation of lower numbers that caused the whole thing, now that that is out of the way - back up goes the S&P.

I’ll be careful about chasing the USD down.

Hey Aaron!

I exited around the 1268 area, thinking price had a good chance of reversing…( it did, briefly, even throwing a BEEB on D1 ) but after that it’s been up-up-up! (wish I’d held!)

Cheers

As it was mentioned in the previous technical analysis of Gold dated 2014.02.20 , according to the formed signs, there was a potential for ascending of price which finally happened. Buyers were successful in reaching to the highest price of 1391.908.The price by reaching to the resistance ascending Channel edge has been stopped from more ascend and by forming a Shooting Star candlestick patterns( possibility of formation of a top price and changing price direction)and fixing of it by a descending candle has prepared the field for creating a top price and a descending trend.

Right now the price is under 5-day moving average( Dilay and h4 Time frame) and surmounts the supportive level of 1325.549 that shows the possibility of more descends in this currency pair.Stoch Indicator shows ascending trend of the next candles in this time frame, but because of not being in the same direction of daily(also weekly) time frame it is not so valid. According to the current condition the first warning for descending of price is breaking of the resistance level of 1334.496.

Here’s what I wrote on my facebook trading group today regarding gold.

GOLD

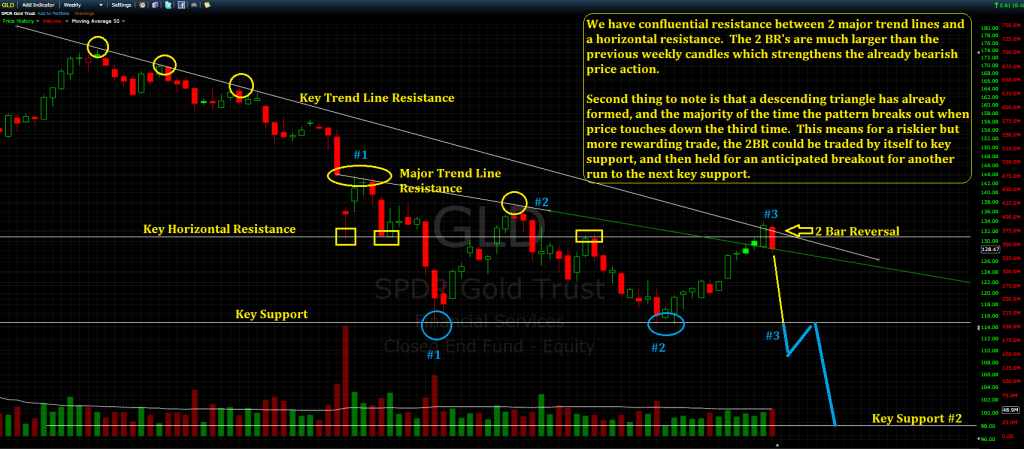

When talking about gold I will be reference to it using the gold ETF “GLD”, just add an extra 0 to the end of my GLD numbers get you pretty close to the price of spot gold.

Gold is much clearer than what I am seeing in the markets. Much of my recent analysis for the SP500 has been using new indicators such as MACD and RSI, but not much price action signals. Given my experience is completely built on price action trading, I have much more confidence in my predictions of gold… Gold has been firing off very large and very clear price action signals as of the past 2 weeks. On the weekly candlesticks we have a large 2 Bar Reversal off of 2 key resistance levels, The horizontal resistance comes in at 133.50-130.50, and trend line resistance is currently slicing through at 133.00. Price made a huge false break through these levels this week and if it can close below 130.00 tomorrow greatly increases the chance of a large movement down. The number of long positions opened in the past 2 weeks has been enormous. This means a break below 129-128 would create a long squeeze and we would see very large and swift movements to the 115 area. This is where my analysis gets a little more general. Depending on how swift the movements are, we may get 1 more bounces off of 115, that may produce a short rally OR if 115 is broken we would see a second long squeeze that would swiftly drop GLD to 97. Summarizing this as spot gold values, I think if tomorrows spot gold closes below 1350-1360 we will see a move to $1180, that may take anywhere for 3-6 weeks to play out. If gold finds support here it’s impossible to tell how long it will hold, but I think we would see a break down to $950 gold by Q4 of this year at the latest.

Silver chart has experienced a strong descending trend during the recent week that could record the bottom price of 18.857. One of the sellers’ targets was the round level of 19.000 that they were successful in reaching to it and the price was not able to descend more by reaching to this level.

As it is obvious in the picture below, price during the descending has touched the Up Trendline (made of 3 bottom prices) and also the round supportive level of 19.000 has created the hammer candlestick pattern. Closing of the bullish candle (Engulfing Pattern) after this pattern will confirm it and warns about ascending of price .Currently price in Daily and H4 time frames is above 5-day moving average that shows ascending of price during the next candles.RSI indicator in Daily time frame is in saturation sell area and with the next cycle warns about ascending of price during the next candles .Generally until the mentioned bottom price is preserved, there is the potential for downtrend reformation.

What the hell happened with Gold during Asia last night? It broke through all the pivot levels 2 hours before London open o.O

gold prices has been feel very steeply and it has become very unpredictable for now, its better to wait for a good opportunity.

Gold was in a strong and consistent downtrend during the recent Days that sellers were successful in obtaining the lowest price of 1241.712.Currently price in long term time frames like weekly and daily time frames is under 5 day moving average which shows a consistent descending trend in long period of time. As it is obvious in the picture below between the top price of 1330.949 and the bottom price of 1241.712, there is a none AB=CD harmonic pattern with the ratios of 76.4 and 161.8 that with completion of the D point (also formation of butterfly pattern), there is a potential for ascending of price.RSI indicator is in saturation sell area and divergence mode with the price chart that confirms the current bottom price and warns about ascending of price during the next candles. According to the current condition of price, the first warning for Ascending of price is breaking of the resistance level of 1250.826.

[B]Technical Analysis of Gold dated 2014.06.03[/B]