MACFIBO SYSTEM UPDATE 16/4/2012

In my experience trading Macfibo on EURUSD and GBPJPY, there will be months that this system performs not as good as any other months (no surprise there). This shouldn’t be come as a surprise because EVERY system will go through this. In 2009, February was really bad. In 2010, i think it was on November where the winning percentage of that month was around 48% (the pattern was like 2 big-ish win, 3 small-ish losses etc).

I must say so far in April, Macfibo hasn’t performed as well as I would have liked… in terms of number of wins over losses that is. We ended last week with a profitable trade and that atleast gave me a little bit smile. Price slowed down as the signal triggered but eventually hit the 1.618 TP. Harvested 20+ pips. You must be wondering is that the only thing Macfibo could do? harvesting 20+ pips? It has nothing to do with the system rule. Its all down to EURUSD dissapointing low volume/range for the past 30 trading days.

The trading range have been averaging 110 pips only. In 2008-2009 the range was 160+ pips, 2010 and 2011 around 150 pips. So far this year EURUSD averaging around 122 pips only. So the trend now since 2008 is that EURUSD’s range is getting smaller and smaller. I’ve read the reasons for this but I won’t touch it as it is not relevant to this thread (you can ask me though, then i am more happy to tell you my theory… a hint : fundamentals).

Macfibo performance on EURUSD so far in the last 10 trades are :

LLLWWWLWLW (-12 pips… finally a negative… but not enough to break your account obviously)

Due to the shrinking range for EU, obviously the avg loss/win for this pair have shrunk as well… but the ratio between avg loss and win is more or less the same.

So what is the future of Macfibo with EURUSD?

The question itself suggests a ‘knee jerk reaction’ from me isn’t it. Let’s talk fact first. I’d skipped GBPJPY in my macfibo trading before due to it’s increasing choppiness, I skipped EURJPY in my macfibo trading before due it it’s shrinking range (the whole point of trading crosses are the range and it’s volatility). I moved to EURUSD because it provided good range in the last three years… in fact the range between Jan-April for 2008, 2009, 2010 and 2011 is around 145-150 pips… VERY HUGE difference with current Jan-April 2012 range… which I’ve stated earlier in this post.

I will continue trading Macfibo EURUSD. Based on my experience, a bad 1 month or 2 month doesn’t make a ‘trend’. Macfibo have sustained the test of time averaging 65% winning percentage for the last three years and I won’t let 1 or 2 bad month makes me leave EURUSD alone for good. Like what I did with other pairs, I made adaptations, adjustments. I will continue trade EU the way I’ve traded but I will keep a close eye on it (for changes, adapting etc)

On the sidelines, I am in an ongoing backtest and paper trade on XAUUSD… which Macfibo perform better in terms of number of wins ofcourse. It is not considered a good performer if you find reversal up to 80 pips not good for your health. I am also revisiting GBPJPY now as it’s range have steadily increasing but GBPJPY is like an old haunted house that I used to live in… visiting it will bring back bad memories… but this is what forex trading is. ADAPTING to FLUID and RANDOM MARKET CONDITIONS.

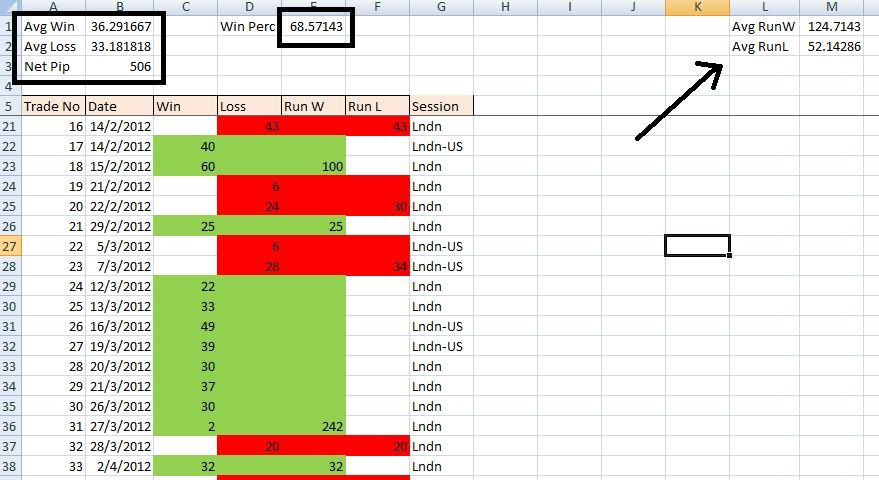

EURUSD MACFIBO STATISTICS 2012 (Updated 16/4/2012)

Average Wins : 33.1 pips

Average Loss : 23.4 pips

Net Pips : 859 pips

Win Percentage : 62.5%

XAUUSD MACFIBO STATISTICS 2012 (Updated 16/4/2012)

Average Wins : 61.1 pips

Average Loss : 50.1 pips

Net Pips : 1361 pips

Win Percentage : 67%

PDF attached in first page

I must say its great anyway!

I must say its great anyway!