Market normality this week only 44%. This doesn’t say much to me - except perhaps the obvious - we’re still falling away from the stunning with-trend price movements of the w/e 10/09. Its hard to see a dramatic resumption of with-trend price action from here, maybe more likely we drift in negative territory, probably drop a little further.

Hi Tommor.

Well, I just got done fixing all my numbers. My normality numbers.

24 hours ago I came in here and was posting away. During the process I discovered that I was dealing with some wrong numbers. I can’t believe it. I’m so embarrassed. So, I spent the next… oh, I don’t know… 8 hours fixing them. I just finished now.

I just cannot trust my source anymore (Barchart). Well, if I want 20 & 50 EMA’s, all I really need is closing prices. Plus my excel of course. And that’s how I fixed everything. Now I got my own, correct, 20 & 50 EMA prices for everybody. So I fixed every day for this year.

I apologize. I won’t accept dealing with wrong numbers. And the thing was…for quite a while now I was wondering why things did seem right with the AUD. Well now I know. But all fixed now. So let me move on.

Finally, my %'s match yours.

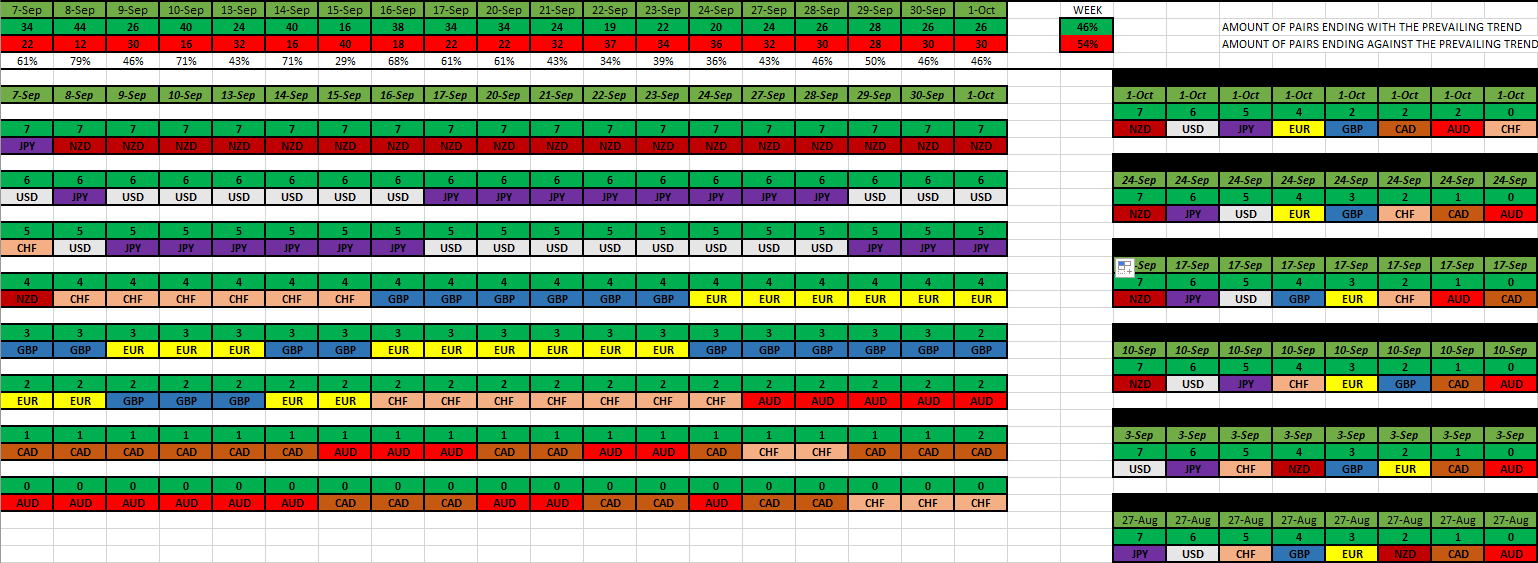

Here’s what I have.

As I was posting yesterday, I’ll make the same point. And that is

What’s considered normal? In the market today?

Look at the line up since Sep. See at the start…How all 3 safe haven currency’s were at the top? But then look at the NZD, how quickly they shot up and arrived up at the top spot. That’s been the mover.

And what does that do for what we consider normal?

We have a risk on currency at the top and whenever they are strong, for a day, that’s considered normal now (has been this month). But we still have the USD and the JPY in the 6 and 5 spots. That’s also considered strong.

The market is quite mixed up. We do not have that easy all-lined-up grouping we had back in August. Where the safe havens all were at the top and the Comms were all on the bottom. We absolutely knew when it was either risk on happening or risk off happening. Right?

That’s not the case anymore.

And to make matters worse, the divergence between the NZD and the AUD is not helping matters. They should be moving in the same direction! But their not, huh.

Well, I just wanted to make the point about what’s normal and what’s not so normal. When we see that it’s 43, 44%, normal, what does that even mean? More risk on occurring? Or more risk off occurring?

We can’t easily call that. The best we can do is see what’s moving.

That’s what I think.

Maybe we can determine which way the market is moving towards. More risk on…or more risk off?

To me it seems like we’re moving more towards risk on.

- The CHF has dropped out quite heavily.

- The NZD has rocketed higher.

- This past week the CAD has moved quite higher. They just might help move the AUD (we’ll have to see about that).

Well, I think there’s a lot to see from those tables above. Maybe we just need to get through this month. I have a feeling October will bring all of the Comms up and together. But we just have to see what happens.

Mike

Bad luck with the bad number data Mike, I feel for you, you do such thorough and deep analysis.

Yes indeed - “normal” - what is normal?

Its difficult to believe the banks would be buying NZD if they also believe AUD is going to go down in the near future. That said, my top D1 trend trade right now would continue to be short AUD/NZD.

Some really smart traders might be accumulating AUD long-side positions… Anyone?

Until recently there was no published plan to end lockdown - Sky Aus report that Melbourne has endured the world’s longest lockdown.

Vac take-up was poor but things have changed (now over half fully vaccinated and 75% 1st dose according to Reuters - there is now a clear road map - a vac rate of either 70% or mentioned today in NY by the PM of 80%

"There comes a time when you just got to move on and get on with it," he was quoted as saying today - Morrison said his message to Australians was “that what I’d like them to have for Christmas is their lives back. And that’s within the gift of governments. And that’s a gift I’d like to see us give them.”

(Reuters today)

Thus the near term outlook for the Aussie economy is much brighter.

Hey Tommor.

I think you got a good idea there.

Why not accumulate some AUD positions…?

If you got the capital to spare, and can hang onto it for a long time, absolutely, why not?

On the other hand, these times that we live in, I think, have changed. It’s the uncertainty. That doesn’t bode well for the market.

I actually think the most lopsided, out of character, currency dynamic that’s been playing out recently is the JPY (moreso than a weak AUD). The depreciation they’ve been going through ever since March of last year has been quite extreme. I’m waiting on a good strong boost higher from the JPY. If that will ever happen, I’ll be in with both feet. And I’m not talking about a couple good days either. I would love to see the strength they used to get. That’s all.

Mike

The idea of buying AUD is from my siblings theory of currencies.

AUD and NZD are siblings and the AUD has by far the larger economy. Almost everything in and out of NZ comes through Aus. Similarly, EUR and CHF are siblings, the EU has the dominant economy and currency over Switzerland in that match-up.

So if the banks are sending CHF up, its because they expect that the EUR will go higher. Likewise if they’re buying NZD, they expect AUD to rise.

Might there be other sibling relationships amongst the minor and exotic currencies?

Let’s just forget about such notion as normality. Market is never normal, it behaves the way it wants. Sometimes your conception works, but as you have mentioned it is far not obligotary for the prices to move according to the principle of normality.

I hope that the theory of normality will at some point prove that this thinking is utterly impoverished.

By “market normality” I mean the tendency of a market price to move in line with its own long-term trend. It is a statistical fact that price in a trend will more often continue the trend than do anything else. It is therefore possible that the reluctance of price to abide by this principle might tell us something about current market conditions.

Which might be an awful lot better than simply throwing up our hands and proclaiming that the market is random.

I agree, I don’t believe it is completely random.

In addition to the siblings theory, I have another one:

On the days when USD is significantly up against all its pairs, trading anything other than USD pairs is more risky. Maybe I am stating the obvious, but IMO it may also be useful to look at the dollar index (that is, tracking USD performance against all its 7 pairs). If it is trending well, only trade USD pairs. And only trade other pairs if the USD index trend is weak.

The above, of course, is in addition to identifying a strong and a weak currency and the appropriate entry rules.

This just a theory, for now.

I think this is a fascinating approach. This might be called something like “currency normality”. I have occasionally looked at individual pairs to see which have been trending most normally over the previous month from time to time but not systematically - and I had not taken it a step further, looking at individual currencies.

Gotta give this some thought. It could well be that the trend behaviour of such a dominant currency as USD might have a lot of influence.

Williams discussed the notion of randomness some years back - i though he put it well, I’ll paraphrase:

To the casual observer price appears to moving in a random direction, first one way and then another, just like a drunk staggering home. But if you can figure where home is then the stagger is no longer random.

Market normality weekly summary -

Very negative, scoring only 38%. Confirming the dramatic strengthening of the USD - I don’t see any obvious signs on the charts of this movement de-railing.

I suppose US political risk is always higher with a Democrat president, though Biden does not seem compelled to act dramatically yet.

Hi Tommor.

Yeah, definitely negative.

This is what I got.

You know…I kept thinking about this, this past week.

It’s the last week of the month.

It’s the last week of the quarter.

All these flows we had were going in such different directions.

We cannot expect to have any idea of where price wants to continue going. Traders place trades with the notion of what it should be doing in the future. We are future looking, acting, agents. Well, that’s why it’s well known to follow what is trending.

But.

Traders, funds, money managers also have a very big priority to manage.

Their accounts!

That’ll explain why mean revision takes place. A lot of exiting out of positions. Taking profits. Readjusting sizes. Just moving their money around for whatever reasons. How about the big money that the international corporations have to exchange in order to take care of their payroll. They want payment in their own currencies. Therefore, these exchanges will take place in our market (although on a slightly different playing field than our spot market). But the idea here is that all of this has nothing to do with what’s going on in the market. Changes take place mostly around the turn of a month.

I say this past week doesn’t mean a whole lot. In talking about direction.

But…I’m in the business of knowing what’s going on. In our market.

I don’t think there’s anything more important than knowing how things have transpired, historical record, and to know how things are, correctly, relating to one another. All of that explains why I do what I do. Which is keeping my own records of the markets movements.

We’ve (me, Peter, and you) have been noting how this month of Sep is historically a risk off type of month. But, I think we kind of believe that the risk on sentiment has been wanting to come back. I think that explains a lot of the changes that’s been taking place this month. It’s been very difficult to see this coming from the perspective of what’s been normal and not so normal. Right?

Well, if I may, can we see what happened this month?

Top table, monthly running %'s. Not counting the CNY, the USD ended up being the most bought currency, ending the month being +8.83% against everyone.

The middle table is the individual daily results. You can see how many days the USD came in on top for that day. 6 days.

The bottom consists of the weekly results. And do you see why I thought that the risk on currency’s would start to take over? You can’t deny the fact that they started the month out being quite bought up.

But then risk off took some shape in the middle of the month. You can see the purple (JPY) quite high. Also the pink (CHF). Just look at the 20th and 21st.

Then the CAD wants in on the action. They lifted up the other 2 Comms.

It’s been so mixed. All we can do is see what’s been happening. But this past week, I think, has been nothing but moving money around for the sake of their accounts.

Moving forward, I think we need to see what we got coming. Both the AUD and the NZD have interest rate decision days coming this week. For the AUD (their Tuesday morning), and then for the NZD (their Wed morning). And the word on the street is that the NZD is supposed to hike up their rates (to .50% from .25%). They would be the world’s first developed country to do so. Well, I think it’s a big deal. Hopefully they’ll go through with it, unlike last time. They were supposed to but someone got COVID and they backed off. We’ll have to see what happens this time.

You guys were talking about the AUD last weekend, at this time. It was very interesting to see that they definitely got a bid this week. Well, just look up above. They ended the week being +5.42%. And what did the NZD end up with? A measly -5.19%. Wow. Talk about a divergence. But remember, it was the end of the month/quarter. I’m sure there’s good reason. We just shouldn’t frame it in any risk on, or risk off type context. But I do got to say, you guys called that.

“Buy up some AUD.”

Needless to say, I kept thinking of you guys this week. That was a sound idea.

Things are gonna fly though, coming up.

And I don’t think we need to wait entirely too long either. Once the open commences, look out.

Mike

Good observations Mike, I had noted it but had not put together a causation why September is such a poor month for returns. What you have posted sounds highly convincing. It would also fit with the fundamentals argument that October’s returns will be better and easier, while on the technicals, a resumption of trend-following normality should be seen after such a negative weekly performance to the month-end.

So this is making good sense from both perspectives.

What I’m going to find hard to resolve will be a bearish trend continuation in EUR/USD, but a bullish risk-on rally in AUD/USD, but we’ll have to wait and see.

I agree. On the daily AUDUSD chart it appears to be a pullback. The weekly is also in a downtrend.

The market will let us know soon.

Not just me - check the red vs the the blue in the graph for an oversight:

Edit; short term China is on holiday - back again next Friday - might obscure the risk element a little especially the Evergrande story.

Normality score for the forex markets this wee continues negative - 44%.

This is slightly up on last week’s 38% score but that’s probably not significant. The week comprised 3 negative days, 1 positive and 1 neutral: so did last week - 3 negative days, 1 positive and 1 neutral.

Perhaps given current geo-political circumstances there isn’t any other answer available.

Hey Tommor.

Yep, same 'ol thing.

Here’s what’s inside the numbers.

Well, the biggest change for what’s normal goes to the CAD. Now they have 5 of their pairs strong. Last week at this time they only had 2 pairs strong. That’s for the 20/50 EMA indicator on all of their 7 pairs.

The USD got strong again. They made a bit of a U turn. See it there? On the weekend results table (right) it seemed like they were heading down lower, along with the other safe haven currency’s. But they go ahead and turn that ship around. Now at the top. Figures. What a mixed up market we have.

Speaking of mixed up.

We also have the AUD and the NZD heading in opposite directions.

The AUD have come up off the floor. But the NZD has dropped. I mean, they (the NZD) even raised their interest rates this week! I don’t get it. Their the highest of all these major players (.50%). Who wouldn’t want to make some money off of the interest rate spreads?

I guess not the big guns.

Oh, and another mover. The GBP. I mean, why did they drop out? Now they do not have any of their 7 GBP pairs being strong Pound (20/50 EMA wise). I guess they had enough for this year. Cause this entire year they’ve been supported and moving nothing but higher and higher.

Are there any fundamentals aligning with that Peter?

Or is this mostly a technical thing?

Well, needless to say, it’s all very interesting.

Things are always moving, bending and twisting.

Can’t really tell which way has the upper hand, between the risk on currencies or the risk off currencies. Well, just yet anyway. I know we just started out on this last quarter. So it is early.

We had NFP on Friday. Came in below expectations. Like, well below. We’ll just have to see if this will make up some minds, moving forward. But it does look like Canada might be more of the favored one, than the US. Cause their employment numbers came in way much more stronger than ours. I mean, all we would need to see is them start to raise their interest rates also. Then it would really get interesting.

Let me give you a visual on how strong they moved this week.

Ok. So in these last couple weeks, they’ve gone straight up.

Mr. Oil…thanks.

Also thanks to the USD. Cause they follow on their heels.

And I’m sure a lot has to do with themselves. The state of their economy.

While I’m at it. Got to see what the USD is doing.

Are they still on a bull trend?

The answer is yes.

Mike

Cheers Mike.

This weekend I have the currencies in this sequence (no surprises I think), most bullish at the top -

CAD

USD

AUD

CHF

GBP

NZD

EUR

JPY

AUD and NZD clearly in opposing directions. Interesting that CHF while not strong is significantly stronger then EUR - German election impact?

These aren’t trending times but I’m still eager to get in on some CAD/JPY action - I’m already short second option, EUR/USD.

Hi Tommor

EURCAD is also in a strong downtrend. Would be a good entry on pullback.