I didn’t think I was saying that “you could have just moved your original order’s stop up by 10 and achieved the same thing minus the extra spread” was incorrect, as mathamatically it is right. I said it isn’t as efficient as the 5 lot approach.

You can keep moving up your BE, but saving the spread doesn’t equal any gains in this case. Overlapping the trade effectively means you get double the value per pip, whilst keeping the same value = 1 initial risk.

Plus there is the option of keeping the individual lots open and micro trading them, meaning you can have 2,3 4 or 5 lots open at once (in theory) and gain 5x per pip whilst looking for a suitable exit, but where all but the last entry has at least made BE.

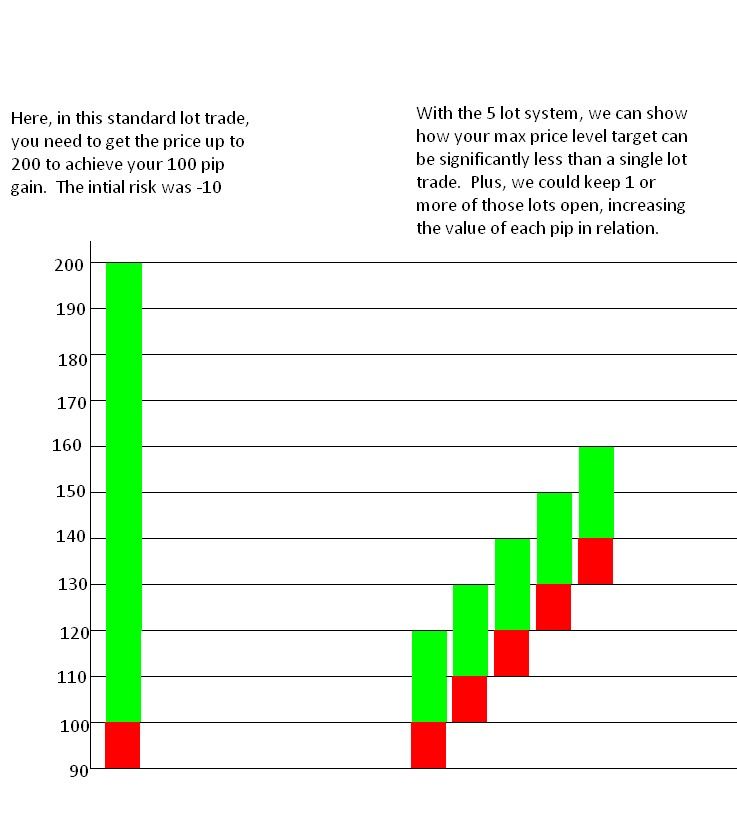

I can’t really explain it any other way than I did in my intial reply, where I showed how your target price can be reduced significantly to achieve the same result. The image doesn’t factor in spreads, but at 2 pips a spread you would just add an additional 10 pips total, meaning a TP of 170 pips final.

So yes, I 100% agree that moving up the BE on a single lot as you go along would mean saving the spread and effectivley having the same risk. I disagree though that it is as efficient, nor do I think that making that 100 pips profit is as likely as making 60 pips profit (or 70 pips if you factor in the spreads, but then you could leave the 2nd, 3rd or fouth lot running for another 10 pips to cancel that spread out).

This is my last post on this also, I hope it’s been helpful. If not, it’s 1am here, so maybe I’ve misread…

Moving on though, how did everyone get on trading today?

EDIT - I’ve enjoyed discussing this. Just noticed in your post where you mention using 2 lots, and moving up BE would effectivley be the same thing.