That Tymen is reading my thread ‘with interest’ gives me quite a thrill…I’m about halfway through “best in trend trading” and honored to have an oracle to the forex gods have interest in these newbie meanderings…

Thanks for info man.

We’re here to learn, there’s noone who knows everything !!

I’m interested knowing this too.

If you’re talking an option straddle then yes because your losses on the losing leg are capped by the cost of that option. If you’re talking simultaneous long/short positions, then it’s no good because either the losing position offsets the winning one or you’re taken out of one side and are left with a naked exposure on the other.

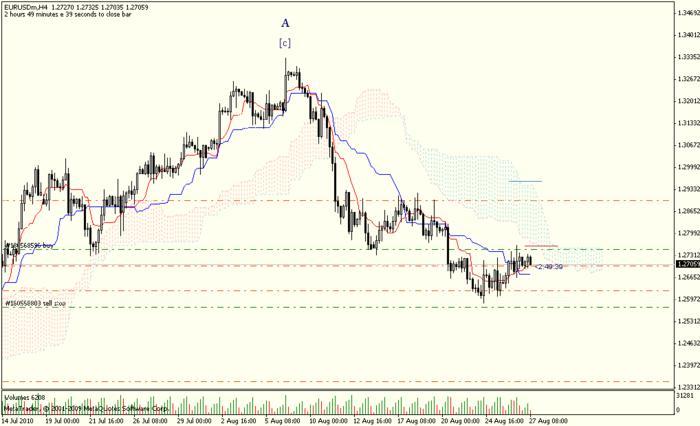

Yes, one’d loose one trade if the gap between the two is too narrow to get both hit? Or if the one that is hit was a looser but we wouldn’t have known and thats trading. If one studied the chart a bit, (did that, realized to move s+r to lessen crowding) see that only one trade gets hit in the direction price decides to take. At worst, I’d get stopped out at 1.2625, I didnt say it was risk-free. Again, timing for setting up the positions has to be right, like London session Thursday morning just before the jumpy candles when one has to go someplace away from screen?

The options straddle, I don’t know that term, please explain. Thanx.

Buy a call and a put with the same strike price.

Phew, I’ll google, thanx again.

place a buy and a sell at the same time on 2 different accounts on same pair a stop at 150 pips a take profit at 500 pips and a trailing stop at 151 pips on both orders… in this way you will catch a trend at some point having the profit exceed the loss

that’s why and how people hedge.